- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Naphthalate Market Size & Share Report, 2030GVR Report cover

![Polyethylene Naphthalate Market Size, Share & Trends Report]()

Polyethylene Naphthalate Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Beverage Bottling, Electronics, Packaging, Rubber Tyres, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-545-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

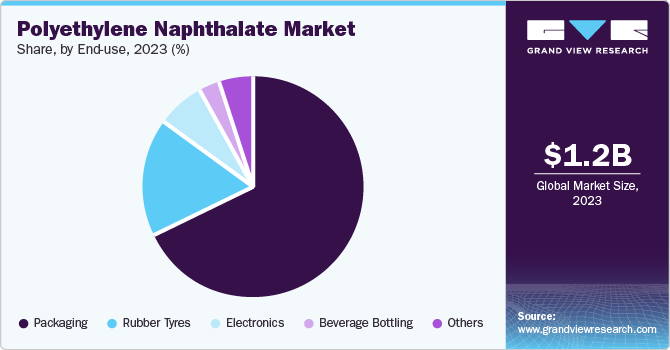

The global polyethylene naphthalate market size was valued at USD 1.21 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Polyethylene naphthalate (PEN) is a high-performance polyester known for its barrier properties, thermal stability, and mechanical strength. These characteristics make it highly demanding in various industries, particularly in the packaging, electronics, and automotive sectors. In the packaging industry, PEN is preferred for its ability to preserve freshness and extend the shelf life of products, especially in food and beverage applications. The growing demand for high-quality, durable packaging materials drives the increased use of PEN, particularly in markets where product safety and longevity are critical.

The growth of the electronics industry is contributing to the rise in demand for PEN, especially in the manufacturing of flexible printed circuits, capacitors, and other electronic components. The material's superior dimensional stability and resistance to hydrolysis make it suitable for high-temperature applications in electronics. Additionally, the automotive industry is adopting PEN for its use in under-the-hood components and other high-performance parts that require materials that can withstand extreme conditions. The shift towards more sustainable and energy-efficient vehicles further boosts the demand for PEN, as it helps in reducing the overall weight of automotive components, leading to improved fuel efficiency.

The increasing awareness and regulatory focus on sustainability also play a significant role in the growing demand for PEN. As industries seek alternatives to traditional plastics that offer better performance and reduced environmental impact, PEN is gaining traction due to its recyclability and lower carbon footprint than other materials. Additionally, ongoing advancements in production technologies make PEN more cost-effective, further driving its adoption across various sectors globally. Overall, its superior performance characteristics, expanding application scope, and alignment with sustainability goals fuel the global rise in demand for polyethylene naphthalate.

End Use Insights

The packaging segment held the largest market revenue share of 67.9% in 2023. The PEN market is driven by the rising need for high-performance materials in the packaging industry. PEN is known for its superior dimensional stability, which makes it suitable for applications that require consistent performance at elevated temperatures, such as in microwaveable or hot-fill packaging. Moreover, the shift towards premium packaging, particularly in sectors such as cosmetics and pharmaceuticals, is pushing the adoption of PEN due to its ability to offer enhanced clarity and resistance to chemicals and UV light. Additionally, the ongoing advancements in packaging technologies, including smart packaging and the integration of barrier films, have amplified the demand for PEN, as it supports the development of innovative packaging solutions.

The electronics segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. The shift towards environmentally sustainable manufacturing practices has highlighted PEN's recyclability and lower environmental impact compared to traditional materials. The expansion of 5G technology and the subsequent need for high-performance materials in telecom equipment also contribute to PEN's increasing adoption. Finally, the surge in demand for flexible electronics and displays further solidifies PEN's role in the electronics segment, as it provides the flexibility and durability required for these advanced applications.

Regional Insights

North America polyethylene naphthalate market is projected to grow significantly over the forecast period. The increasing demand for polyethylene naphthalate (PEN) is primarily driven by the region's focus on advanced packaging solutions and the rapid growth of the electronics sector. Consumers in the U.S. and Canada seek packaging materials that provide superior product protection and meet sustainability goals, pushing manufacturers to adopt PEN for its superior barrier properties and recyclability. Additionally, the expanding automotive and electronics industries in North America are utilizing PEN in components such as high-performance films and capacitors, as the material's thermal stability and durability meet the stringent requirements of these sectors.

U.S. Polyethylene Naphthalate Market Trends

The U.S. polyethylene naphthalate market held the largest market revenue share in 2023. The increasing demand for polyethylene naphthalate (PEN) is attributed to the nation's expanding beverage and food packaging industries, particularly for products requiring enhanced shelf life and freshness. The U.S. is seeing a rise in the consumption of bottled beverages, especially in the sports and energy drink segments, where PEN's superior gas barrier properties help maintain carbonation and flavor over extended periods.

Europe Polyethylene Naphthalate Market Trends

Europe polyethylene naphthalate market has experienced notable expansion. European industries are increasingly adopting PEN because of its superior barrier properties against gases and moisture, which help extend the shelf life of products. Additionally, the shift towards sustainable packaging solutions drives the demand, as PEN can be recycled and reduces the environmental footprint. The electronics sector in Europe is also boosting demand due to PEN's use in flexible displays and advanced electronic components.

The UK Polyethylene Naphthalate (PEN) market is expected to grow in the coming years. As the UK moves towards reducing single-use plastics and improving the recyclability of materials, PEN's superior barrier properties and thermal stability make it a suitable choice for food and beverage packaging that requires longer shelf life and enhanced protection. Furthermore, the UK's strong automotive and electronics sectors are increasingly utilizing PEN for its high-performance characteristics, such as resistance to heat and mechanical stress, which are essential for advanced applications such as flexible printed circuits and automotive components.

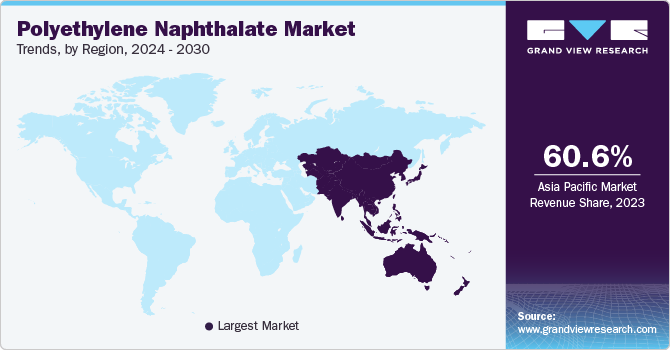

Asia Pacific Polyethylene Naphthalate Market Trends

Asia Pacific polyethylene naphthalate market held the largest market revenue share of 60.6% in 2023. The increasing demand is attributed to the region's growing industrialization, particularly in the packaging and electronics sectors. PEN's superior properties, such as high thermal stability, barrier resistance, and mechanical strength, make it a suitable material for advanced applications in packaging, including food and beverage containers and electronic components such as flexible displays and high-performance capacitors. Additionally, the rising emphasis on sustainable packaging in countries such as China, Japan, and South Korea, coupled with the expansion of the consumer electronics industry, is further driving the demand for PEN in the Asia-Pacific market.

India polyethylene napthalate market is expected to grow at a significant CAGR over the forecast period. The rising demand is due to the expanding food and beverage sector, as there is a growing preference for high-quality packaging solutions. As the middle class in India continues to grow, the consumption of ready-to-eat and packaged foods is also increasing, leading to a greater need for advanced packaging materials such as PEN. PEN's barrier properties help to preserve freshness and extend the shelf life of products.

Polyethylene napthlate market in China held the largest market revenue share regionally in 2023. The growing emphasis on high-quality packaging solutions drives the market, particularly in the food and beverage sector. This is particularly relevant in China's burgeoning e-commerce sector, which requires durable packaging materials for domestic and international shipping. Additionally, China's significant investments in the electronics industry, especially in producing flexible displays and advanced optical films, have fueled the demand for PEN. The Chinese government's focus on environmental sustainability has also encouraged the adoption of recyclable materials like PEN, further boosting its demand in the region.

Latin America Polyethylene Naphthalate Market Trends

Latin America polyethylene naphthalate market is expected to grow at the fastest CAGR over the forecast period. Countries such as Brazil, Argentina, and Mexico are witnessing a shift towards more eco-friendly packaging materials, driven by both consumer preferences and regulatory changes aimed at reducing plastic waste. PEN's superior barrier properties make it a suitable material for packaging carbonated beverages and juices, which are popular in Latin American markets. Additionally, the automotive and electronics industries, particularly in Brazil and Mexico, drive demand for PEN due to its high thermal stability and durability, which are essential for advanced applications in these sectors.

Key Polyethylene Naphthalate Company Insights

Some of the key companies in the polyethylene naphthalate market include DuPont Teijin Films; Sumitomo Chemical; Kolon Plastics; Toray Industries.

-

DuPont, through its joint venture DuPont Teijin Films, offers polyethylene naphthalate (PEN) films under the Kaladex brand. These films are known for their high performance, featuring high glass transition temperatures, excellent dimensional stability, and significant stiffness. They are used in various demanding applications such as electrical insulation, industrial applications, and flexible printed circuitry.

-

Sumitomo Chemical has successfully created Sumicle, a high-strength polyethylene specifically designed for plastic packages and containers. By incorporating Sumicle into the foundational layer of these packages and containers, it becomes feasible to produce single-material packaging made entirely of PE. This breakthrough innovation greatly contributes to the advancement of horizontal recycling, as it enables the transformation of used plastics back into resin that can be utilized in similar applications.

Key Polyethylene Naphthalate Companies:

The following are the leading companies in the polyethylene naphthalate market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- SKC

- Sumitomo Chemical

- Polyonics

- 3M

- KOLON Corp.

- SASA

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED.

Polyethylene Naphthalate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.28 billion

Revenue forecast in 2030

USD 1.83 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, Kuwait, UAE, and South Africa

Key companies profiled

DuPont; SKC; Sumitomo Chemical; Polyonics; 3M; KOLON Corp.; SASA; TORAY INDUSTRIES, INC.; TEIJIN LIMITED.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyethylene Naphthalate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the polyethylene naphthalate market report based on end use and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030), (Volume in Kilotons)

-

Beverage Bottling

-

Electronics

-

Packaging

-

Rubber Tyres

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030), (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.