- Home

- »

- Plastics, Polymers & Resins

- »

-

Polycarbonate Films Market Size And Share Report, 2030GVR Report cover

![Polycarbonate Films Market Size, Share & Trends Report]()

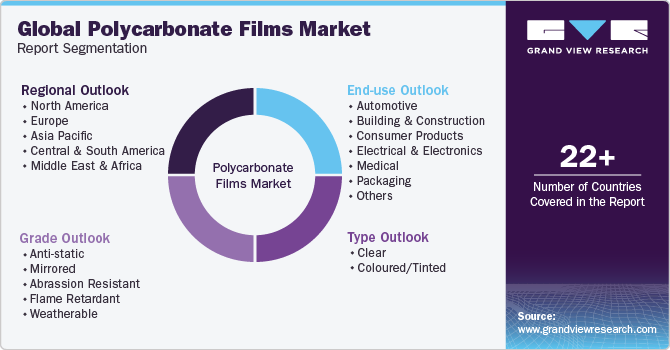

Polycarbonate Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Clear, Coloured/Tinted), By Grade (Flame Retardant, Weatherable), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-8

- Number of Report Pages: 166

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycarbonate Films Market Size & Trends

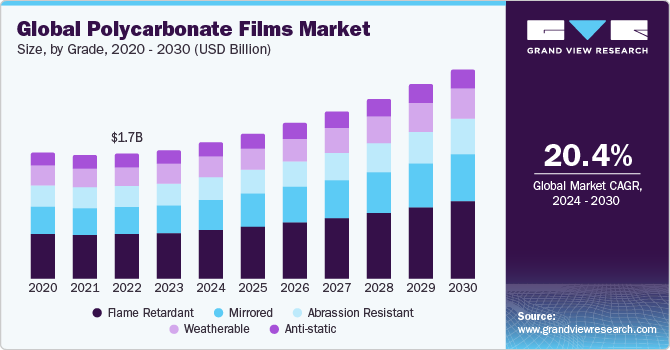

The global polycarbonate films market size was estimated at USD 1.71 billion in 2023 and is expected to grow at a CAGR of 7.5% from 2024 to 2030. Polycarbonate films are increasingly favored for their exceptional properties and versatility in various industries due to factors such as excellent transparency, easy shaping capabilities, high resistance to wear and tear, vibrant printing options, and suitability for diverse sectors like electronics, automotive, medical packaging, safety equipment, optical lenses, consumer products, and aerospace components. The unique combination of these attributes has propelled the growing popularity and utilization of polycarbonate films across different sectors, driving their market demand and innovation.

Technological advancements such as laser cutting, printing, and coating methodologies significantly propel the expansion of the market. These advancements have considerably increased the adaptability and utility of polycarbonate films across diverse industries. Laser-cutting technology facilitates the detailed and elaborate cutting of polycarbonate films, enabling the fabrication of intricate shapes and designs with exceptional precision. This innovation has revolutionized manufacturing processes, rendering them more efficient and cost-effective. Furthermore, printing technologies have empowered the customization and branding of polycarbonate films, enhancing their attractiveness for various applications.

Market Concentration & Characteristics

The market exhibits a significant level of market concentration with key players dominating the industry landscape. Major companies like Covestro AG, General Electric, United States Plastic Corporation, Mitsubishi Chemical Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Regulations substantially influence the market, with factors such as environmental regulations, safety standards, and quality control measures affecting the production, distribution, and usage of these films. Compliance with regulations is essential for market players to ensure product quality, safety, and environmental sustainability.

End-user concentration in the market varies across industries, with sectors like electronics, automotive, medical packaging, and construction being significant consumers of these films. The diverse end-user base contributes to the market's stability and growth, offering opportunities for tailored solutions and applications to meet specific industry requirements.

Type Insights

Based on type, the clear segment dominated the market the market with a revenue share of over 63.0% in 2023. This can be attributed to the need for lightweight materials in vehicles to enhance fuel efficiency and reduce CO2 emissions. Clear polycarbonate films are extensively used in automotive applications such as glazing, windows, sunroofs, and windshields due to their exceptional properties including impact resistance, optical clarity, and weight reduction benefits.

The colored/tinted segment is expected to witness a substantial CAGR over the forecast period. Colored/tinted polycarbonate films present a diverse array of colors and tints, offering extensive aesthetic appeal and customization possibilities for various applications. This characteristic appeals to industries seeking to elevate the visual attractiveness of their products or projects, enhancing their market appeal and customization options.

Grade Insights

Based on grade, the flame retardant segment dominated the market with the largest revenue share in 2023. The increasing occurrences of fire-related accidents have highlighted the critical necessity for fire-resistant materials, consequently fueling the demand for flame retardant polycarbonate films. These films play a pivotal role in enhancing safety measures by effectively inhibiting the spread of flames and minimizing the release of toxic gases. Moreover, ongoing advancements in film manufacturing technologies have resulted in the creation of high-performance flame retardant polycarbonate films that offer superior attributes such as exceptional clarity, impressive impact resistance, and enhanced flame retardancy.

The weatherable segment is anticipated to experience rapid growth during the forecast period due to the escalating need for resilient and environmentally friendly materials. These films are highly valued for their capacity to endure diverse weather conditions while preserving their structural integrity and functionality. This makes them particularly well-suited for outdoor applications where exposure to elements such as sunlight, moisture, and fluctuating temperatures is prevalent.

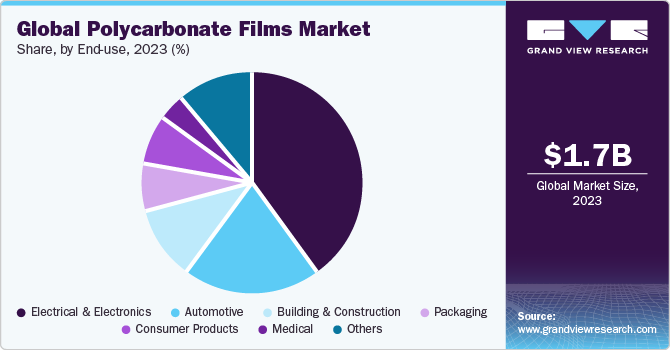

End-use Insights

Based on end-use, the electrical & electronics segment dominated the market with the largest revenue share in 2023. Polycarbonate film is valuable in the electrical and electronics sector due to its excellent properties that meet industry requirements. It is favored for applications like membrane switches, control panels, and packaging material because of its good electrical properties, clarity, stability, heat resistance, and impact strength. Moreover, its durability in harsh environments, chemical resistance, and flame retardancy make it a reliable choice for electronic components and devices, ensuring safety and performance.

The automotive segment is expected to witness the fastest growth over the forecast period. Polycarbonate film is used for various automotive applications such as dashboard components, display panels, and lighting designs. With features like high impact resistance, optical clarity, lightweight nature, and excellent printability, polycarbonate films enhance both the aesthetics and functionality of automotive parts, making them a preferred choice over traditional materials like glass and metals in the automotive sector. The growing trend towards vehicle electrification further drives the demand for polycarbonate films, underscoring their significance in promoting innovation and safety within the automotive industry.

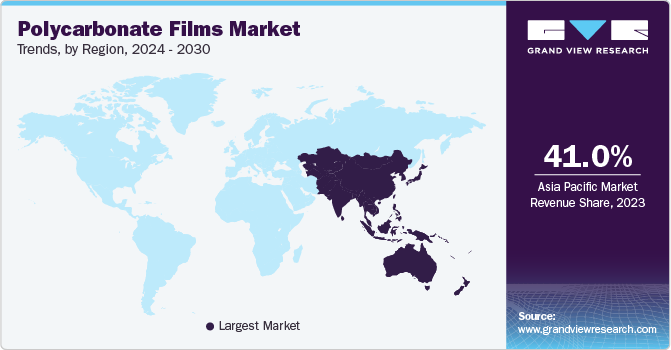

Regional Insights

North America is one of the key regional market and held a revenue share of over 19% in 2023. The strong presence of industries such as electronics, automotive, and construction, which are major consumers of polycarbonate films, are driving the demand. The robust manufacturing sector in North America, particularly in the United States and Canada, drives the demand for high-quality materials like polycarbonate films for various applications.

U.S. Polycarbonate Films Market Trends

The polycarbonate films market in the U.S. is expected to grow at a CAGR of 6.7% from 2024 to 2030, owing to the focus on innovation and research fosters the development of new applications and uses for polycarbonate films. Companies in the region invest significantly in research and development to enhance product performance, introduce new functionalities, and explore novel applications for polycarbonate films. This culture of innovation drives market growth and positions polycarbonate films as a preferred choice for cutting-edge technologies and products.

Europe Polycarbonate Films Market Trends

The polycarbonate films market in Europe is anticipated to grow at a moderate pace of 5.6% during the forecast period. This can be attributed to the strong emphasis on sustainability and environmental regulations. European countries have been at the forefront of promoting eco-friendly practices and materials, making polycarbonate films an attractive choice due to their recyclability, energy efficiency, and low environmental impact.

The UK polycarbonate films market is driven by the emphasis on investments in research and development in the region. The UK has a reputation for fostering a culture of innovation, research, and development.

The polycarbonate films market in Germany is known for its advanced engineering capabilities and high-quality manufacturing standards, which drive the demand for premium materials like polycarbonate films. The emphasis on precision, durability, and performance in German industries such as automotive, electronics, and construction makes polycarbonate films a preferred choice for various applications.

The France polycarbonate films market is witnessing growth driven by the aesthetic appeal, clarity, and versatility of polycarbonate films making them a preferred choice for applications where design plays a crucial role, such as in the luxury goods, cosmetics, and interior design sectors.

Asia Pacific Polycarbonate Films Market Trends

The Asia Pacific market dominated the regional segment by capturing over 41% in 2023, due to the rapid industrialization and urbanization in countries like China, India, Japan, and South Korea. Moreover, the growing middle-class population and rising disposable incomes in countries across the Asia Pacific region drive consumer demand for products using polycarbonate films.

The China polycarbonate films market held the largest share in the Asia Pacific region in 2023 owing to booming economy and extensive manufacturing capabilities drive the demand for high-quality materials like polycarbonate films across various industries such as electronics, automotive, construction, and packaging.

The polycarbonate films market in India is anticipated to grow at a CAGR of 10.7% from 2024 to 2030. The packaging industry in India has been witnessing a surge in demand due to various factors such as the rise in e-commerce, changing consumer preferences, and the growth of the food and beverage sector. Polycarbonate films are being increasingly preferred in packaging due to their exceptional properties such as high impact strength, optical clarity, heat resistance, and flexibility.

Central & South America Polycarbonate Films Market Trends

The construction and architecture sectors in Brazil utilize polycarbonate films for applications such as roofing, skylights, and safety glazing, thus driving the demand of polycarbonate films. The durability, UV resistance, and thermal insulation properties of polycarbonate films make them a preferred choice for architectural projects in Brazil.

Middle East & Africa Polycarbonate Films Market Trends

The Middle East & Africa polycarbonate market is driven by the availability of abundant sunlight, making it an ideal location for solar energy projects. Polycarbonate films are utilized in various components of solar panels and solar energy systems, owing to their excellent properties such as high light transmission, impact resistance, durability, and weatherability.

Key Polycarbonate Films Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In March 2023, Covestro expanded its production capacity for polycarbonate films in Thailand to meet the rising demand in the Asia Pacific and globally. The company is investing in new extrusion lines at the Map Ta Phut Industrial Park, with completion scheduled for 2025. These films, part of the Makrofol range, find applications in identity documents, automotive displays, and electrical and electronic industries. The investment aims to strengthen Covestro's Solutions & Specialties segment and support the growth of future technologies and industries.

-

In November 2023, Röhm GmbH announced the integration of Röhm's Acrylic Products division and SABIC's Functional Forms division marks the establishment of POLYVANTIS, an emerging leader in the global acrylics and polycarbonate film and sheet sector. With a diverse product portfolio encompassing films, sheets, pipes, and rods, POLYVANTIS is poised to serve multiple industries, including building and construction, transportation and aviation, electrical and electronics, automotive, and home and garden.

Key Polycarbonate Films Companies:

The following are the leading companies in the polycarbonate films market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Covestro

- Excelite

- Gallina India

- Işık Plastik

- Koscon Industrial S.A

- MGC Filsheet co. Ltd

- Mitsubishi Chemical Corporation

- Mitsubishi Gas Chemical Company

- Palram Industries Ltd.

- Rowland Technologies, Inc

- SABIC

- Suzhou Omay Optical Materials

- Teijin Limited

- Tüm hakları saklıdır.

- Wiman Corporation

Polycarbonate Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.82 billion

Revenue forecast in 2030

USD 2.81 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, grade, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; and Saudi Arabia

Key companies profiled

3M Company; Covestro; Excelite; Gallina India; Işık Plastik; Koscon Industrial S.A; MGC Filsheet co. Ltd; Mitsubishi Chemical Corporation; Mitsubishi Gas Chemical Company; Palram Industries Ltd.; Rowland Technologies, Inc; SABIC; Suzhou Omay Optical Materials; Teijin Limited; Tüm hakları saklıdır.; Wiman Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polycarbonate Films Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polycarbonate films market report based on type, grade, end-use and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clear

-

Coloured/Tinted

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anti-static

-

Mirrored

-

Abrassion Resistant

-

Flame Retardant

-

Weatherable

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Consumer Products

-

Electrical & Electronics

-

Medical

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polycarbonate films market size was estimated at USD 1.71 billion in 2023 and is expected to reach USD 1.82 billion in 2024.

b. The global polycarbonate films market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 2.81 billion by 2030.

b. The Asia Pacific market dominated the regional segment by capturing over 41% in 2023, due to the rapid industrialization and urbanization in countries like China, India, Japan, and South Korea.

b. Some of the key players operating in the polycarbonate films market include 3M Company; Covestro; Excelite; Gallina India; Işık Plastik; Koscon Industrial S.A; MGC Filsheet co. Ltd; Mitsubishi Chemical Corporation; and Mitsubishi Gas Chemical Company.

b. Polycarbonate films are increasingly favored for their exceptional properties and versatility in various industries due to factors such as excellent transparency, easy shaping capabilities, high resistance to wear and tear, vibrant printing options, and suitability for diverse sectors like electronics, automotive, medical packaging, safety equipment, optical lenses, consumer products, and aerospace components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.