- Home

- »

- Clothing, Footwear & Accessories

- »

-

Pocket Lighter Market Size & Share, Industry Report, 2030GVR Report cover

![Pocket Lighter Market Size, Share & Trends Report]()

Pocket Lighter Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flint Lighter, Electronic Lighter), By Material (Plastic, Metal), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68039-933-6

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pocket Lighter Market Summary

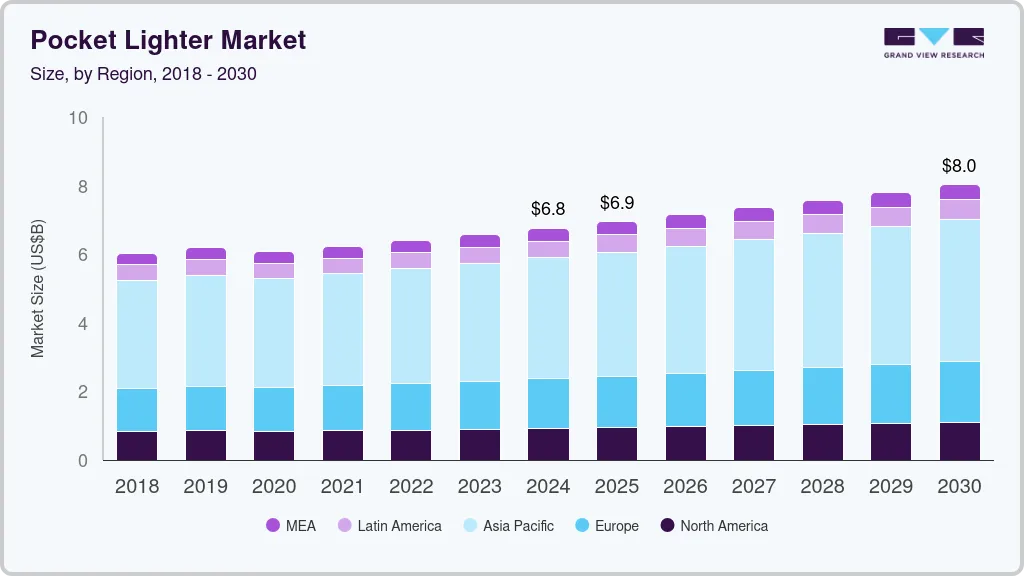

The global pocket lighter market size was estimated at USD 6,755.5 million in 2024 and is projected to reach USD 8,027.0 million by 2030, growing at a CAGR of 2.9% from 2025 to 2030. Modern consumers are increasingly gravitating towards multi-functional lighters that integrate features such as built-in LED lights, safety mechanisms, and ergonomic designs. Moreover, the rise of lighter brands that emphasize eco-friendliness and sustainability is making a significant impact.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, flint lighter accounted for a revenue of USD 4,292.9 million in 2024.

- Electronic Lighter is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6,755.5 Million

- 2030 Projected Market Size: USD 8,027.0 Million

- CAGR (2025-2030): 2.9%

- Asia Pacific: Largest market in 2024

For instance, refillable lighters made from biodegradable materials and those that utilize renewable energy are gaining traction. As consumers become more environmentally conscious, manufacturers are pivoting their efforts towards producing more sustainable alternatives, which reflects a broader societal shift towards greener products.

Another significant demand driver for the pocket lighter industry is the surge in outdoor activities and recreational lifestyles among millennials, and Gen Z. The trend of camping, hiking, and outdoor cooking has stimulated increased demand for versatile tools, including pocket lighters that offer reliability and portability. The advent of lifestyle influencers and social media platforms has further popularized outdoor activities, motivating individuals to invest in high-quality lighters designed for various applications. This growing emphasis on outdoor experiences enhances the market's appeal attributed to the convenience and functionality pocket lighters bring to these activities.

The increasing usage of pocket lighters in the tobacco and cannabis industries is also propelling market growth. The retro and vintage appeal of classic lighter designs has gained traction among collectors and enthusiasts, further driving market demand. As smoking and vaping trends evolve, particularly with the surging popularity of cannabis, reliable and portable lighting devices remain essential for consumers. This connection between pocket lighters and smoking culture drives demand, supported by marketing initiatives that target specific demographics of smokers and vapers. Consequently, brands are diversifying their product lines to attract a wider audience, promoting lighters that cater explicitly to lifestyle preferences among smokers while integrating stylish designs and personalization options.

The ongoing innovations in safety standards and regulations within the pocket lighter industry are shaping the overall market landscape. As countries implement stricter safety measures and promote responsible usage, manufacturers are increasingly focused on producing products that comply with global safety standards. This trend not only emphasizes the importance of consumer safety but also enhances brand reputation and loyalty. With greater emphasis placed on quality assurance and responsible manufacturing practices, stakeholders in the pocket lighter industry are well-positioned to meet the evolving demands of consumers, paving the way for sustained growth and success in the global market.

The growth of online shopping platforms has made pocket lighters more accessible to a wider audience, allowing them to compare products and prices conveniently. As a result, brands that leverage social media and online advertising to showcase their products can effectively reach potential customers and enhance brand loyalty. With the continuous advancement of technology, the integration of smart features into pocket lighters, such as USB charging and Bluetooth connectivity, adds an innovative dimension that appeals to tech-savvy consumers, further propelling the market forward.

Product Insights

The flint lighter segment accounted for a share of 61.8% of the global revenue in 2024, spurred by evolving consumer preferences, environmental regulations, and the resurgence of nostalgic branding. As manufacturers increasingly lean towards retro designs, flint lighters are enjoying a revival among collectors and enthusiasts who seek products that embody a sense of nostalgia and craftsmanship. This trend is further driven by the rising popularity of outdoor activities such as camping, hiking, and fishing, where flint lighters are often viewed as not only practical tools but also stylish accessories for adventure seekers. The simple mechanics and reliability of flint lighters make them appealing to consumers looking for durable options that can withstand various conditions, positioning them as a preferred choice for rugged outdoor lifestyles.

The electronic lighter segment is expected to grow at a CAGR of 3.3% from 2025 to 2030. This segment is witnessing rapid innovation and growing consumer interest as technology enhances user convenience and safety. The advent of plasma lighters, which use electric arcs instead of flame, represents a significant shift in lighting solutions. These lighters have garnered attention due to their windproof and flameless nature, making them ideal for outdoor use. The increasing awareness of the limitations of traditional lighters such as fragility and susceptibility to wind—has led to an uptick in demand for electronic lighters, particularly among tech-savvy consumers and millennials who appreciate their modern design and advanced features. As manufacturers continue to integrate smart technology, such as USB charging capabilities and automatic shut-off features, the allure of electronic lighters is expected to grow further.

Material Insights

Plastic pocket lighters accounted for a share of 65.3% of the global revenue in 2024, driven by factors such as cost-effectiveness, lightweight properties, and versatility in design. Plastic lighters are often favored for their affordable price points, making them an accessible choice for consumers across various demographics. The lightweight nature of plastic also contributes to their popularity, as they are easy to carry and use, making them ideal for outdoor activities such as camping, hiking, and traveling. Furthermore, advancements in plastic manufacturing have enabled brands to produce lighters in an array of colors and designs, appealing to a broad audience and enhancing consumer engagement.

Metal pocket lighter is expected to grow at a CAGR of 3.3% from 2025 to 2030. Metal pocket lighters are recognized for their durability, premium feel, and stylish appeal, contributing to their sustained demand in the global market. With the rising trend in luxury goods and collectibles, many consumers view these lighters as fashion statements or accessories that reflect their identity and personal style. The intricate designs and engravings available on metal lighters attract gifting opportunities, particularly among enthusiasts and collectors. Brands that focus on craftsmanship and limited-edition releases are experiencing a resurgence in popularity, drawing consumers who appreciate the elegance and tactile experience offered by metal materials.

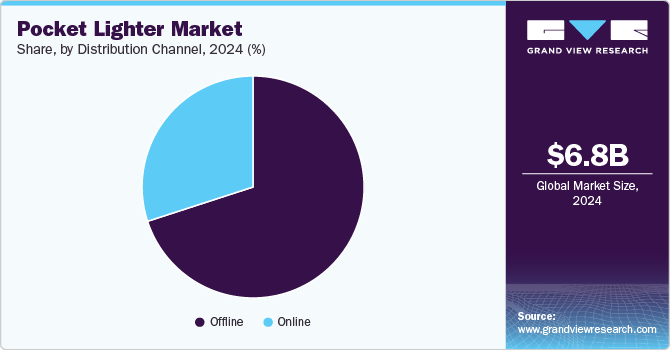

Distribution Channel Insights

The sales of pocket lighters through offline channels accounted for a share of 70.0% of the global revenue in 2024, driven by traditional retail practices that cater to consumer preferences for in-person shopping experiences. Convenience stores, gas stations, tobacco shops, and general merchandise retailers serve as key points of purchase for pocket lighters, providing immediate access to consumers seeking a quick solution for lighting needs. The tactile experience of handling products and the ability to receive instant gratification after a purchase enhance the appeal of offline shopping. Furthermore, promotional strategies, such as in-store discounts or bundled offers, can drive demand, particularly among impulse buyers. Consumer trust in established brick-and-mortar establishments also plays a role in fostering loyalty within this channel, leading to repeat purchases and consistent sales.

The sales of pocket lighters through online channels are expected to grow at a CAGR of 3.2% from 2025 to 2030, driven by the shift in consumer behavior towards e-commerce and the convenience it offers. With the rise of digital marketplaces and dedicated websites, consumers can easily browse a vast array of lighter options from the comfort of their homes. This channel offers the advantage of extensive product variety, including exclusive online designs and limited-edition releases that appeal to collectors and enthusiasts. The ability to compare prices, read reviews, and benefit from online-only promotions also serves to attract tech-savvy consumers who prioritize both convenience and value in their purchasing decisions. Moreover, the recent global trend toward contactless shopping, accelerated by events like the COVID-19 pandemic, has heightened the importance of online shopping as a preferred method for acquiring everyday items, including pocket lighters.

Regional Insights

The pocket lighter market in North America is expected to witness a CAGR of 3.0% from 2025 to 2030, characterized by a mix of innovation and convenience-driven consumption. The demand for pocket lighters in this region is largely propelled by the outdoor recreational activities culture, including camping, hiking, and barbecuing, where disposable and refillable lighters are essential tools. Moreover, the increasing trend of smoking and vaping, despite regulatory challenges, continues to contribute to the market's robustness. Responsiveness to changing consumer preferences, such as eco-friendly and multi-functional lighters, is shaping product development, prompting manufacturers to expand their offerings to include environmentally-conscious materials and designs.

U.S. Pocket Lighter Market Trends

The pocket lighter market in the U.S. is expected to grow at a CAGR of 3.1% from 2025 to 2030, driven by a combination of lifestyle trends and stringent regulatory measures on smoking and tobacco use. Consumer preferences have shifted towards more stylish and multifunctional lighter designs, such as those that feature built-in tools or advanced safety mechanisms. In addition, the rise of outdoor activities, including camping and hiking, has fueled demand for pocket lighters as essential tools for igniting fires in various environments. Amid the increasing awareness of sustainability, manufacturers are also focusing on producing refillable and eco-friendly lighters to appeal to environmentally-conscious consumers.

Europe Pocket Lighter Market Trends

The pocket lighter market in Europe is expected to grow at a CAGR of 3.4% from 2025 to 2030, driven by varying consumer behaviors and distinct regulatory environments across countries. There is a growing trend towards sustainability, with consumers increasingly gravitating towards refillable and reusable lighters. This shift is influenced by stringent regulations aimed at reducing single-use plastics and promoting environmentally friendly products. Consequently, manufacturers are adapting to these trends by innovating designs that not only prioritize functionality but also address consumers' ecological concerns. This is leading to an upsurge in demand for lighters made from recyclable materials or those utilizing alternative technologies, such as electric lighters.

The pocket lighter market in Germany is characterized by a growing demand for premium products driven by high consumer expectations for quality and reliability. As one of the largest tobacco markets in Europe, the demand for pocket lighters is closely tied to trends in smoking and lifestyle choices. With a notable portion of the population moving towards reduced smoking or alternative consumption methods, such as vaping, manufacturers are adapting by diversifying their offerings to include specialized lighters for e-cigarettes and other smoking devices. The focus on innovation is evident, as German brands often prioritize engineering excellence and are known for producing durable, high-quality lighters.

The pocket lighter industry in the UK has been influenced by the strong cultural and social narratives surrounding smoking and outdoor activities. With increased restrictions on tobacco use in public places, consumers are pivoting towards lighters that cater to niche markets such as vaping and herbal products. The demand for versatile lighters—those that can handle various ignition needs, including candles and grills—has also seen a substantial rise. Furthermore, the UK population's interest in wellness and social outdoor gatherings has boosted sales, making pocket lighters a common accessory for social events and camping trips.

Asia Pacific Pocket Lighter Market Trends

The pocket lighter market in the Asia Pacific captured a global revenue share of over 52.1% of the market in 2024, driven by a combination of urbanization, rising disposable incomes, and a burgeoning young population that increasingly engages in outdoor and social activities. Countries like China and India, with their massive populations and increasing rates of smoking and outdoor recreational activities, present substantial opportunities for pocket lighter manufacturers. The demand for both disposable and refillable lighters is robust, reflecting diverse consumer preferences across various socioeconomic strata. Furthermore, the rise of e-commerce in the region is enhancing product accessibility and variety, allowing consumers to explore a wide range of options. Besides, cultural factors also play a significant role in shaping the pocket lighter market in Asia Pacific. For instance, lighters are often exchanged as gifts or used in traditional ceremonies, contributing to their appeal beyond everyday utility.

The pocket lighter market in China is expected to witness a CAGR of 2.7% from 2025 to 2030, propelled by the nation's evolving lifestyle and rapid urbanization. As the world's largest market for tobacco, China's high smoking prevalence significantly drives the demand for pocket lighters. Notably, the younger generation, increasingly engaged in outdoor activities and social events, is leading a trend towards more stylish and functional lighters, which has encouraged manufacturers to innovate and diversify their product lines. This demographic shift is not just confined to smoking; it also includes the use of lighters for culinary purposes, such as lighting barbeques, which further expands the market's scope.

The pocket lighter market in India is experiencing rapid growth, influenced by multiple factors, including social customs, increasing urbanization, and a burgeoning youth population. As smoking norms gradually shift with the emergence of alternative tobacco products, there is a parallel rise in demand for pocket lighters that cater to these new preferences. Lighters are being marketed not just as functional items but also as fashion accessories, particularly among young adults who wish to express their individuality through unique designs and colors. Brands are capitalizing on this trend by offering a variety of customized products that align with contemporary aesthetics.

Latin America Pocket Lighter Market Trends

The pocket lighter market in Latin America is heavily influenced by traditional smoking culture and outdoor lifestyles. The prevalence of both cigarette and cigar smoking, coupled with the region's vibrant social life that often includes barbecues and gatherings, ensures a steady demand for pocket lighters. In addition, economic growth in several countries is increasing consumer spending, leading to a broader range of products available in the market, from basic disposable lighters to premium brands that cater to specific preferences. This expanding middle class is instrumental in driving demand for more stylish, functional, and eco-conscious lighter options.

Middle East & Africa Pocket Lighter Market Trends

The pocket lighter market in the Middle East & Africa is expected to witness a CAGR of 2.5% from 2025 to 2030, characterized by rapid urbanization and a demographic shift toward younger consumers. In many Middle Eastern countries, smoking is a prevalent cultural activity, driving a steady demand for pocket lighters. Moreover, as outdoor activities and social gatherings become increasingly popular, there is a notable rise in disposable and refillable lighter usage for both functional and ceremonial purposes, including grilling and other social events. The dual demand for both aesthetic appeal and functionality positions manufacturers to innovate their offerings, thus fostering market growth.

Key Pocket Lighter Company Insights

The global pocket lighter industry is characterized by the presence of several prominent players that dominate the landscape through strategic initiatives aimed at enhancing their market share and product offerings. Key companies such as BIC Corporation, Zippo Manufacturing Company, Cricket Lighters (Swedish Match), Colibri, BAIDE International Enterprise, Zhuoye Lighters Manufacturing Co., Ltd., and Clipper International S.L. have established themselves as leaders by focusing on innovation and customer engagement. In recent years, BIC has expanded its product portfolio by launching environmentally friendly disposable lighters, catering to the growing demand for sustainable consumer products. Meanwhile, Zippo has capitalized on its iconic brand by introducing limited-edition lighters that appeal to collectors, thereby diversifying its customer base. In addition, Clipper has strengthened its position in the market through strategic partnerships that enhance its distribution networks, allowing it to penetrate emerging markets more effectively.

The competitive landscape of the pocket lighter industry is further shaped by various mergers and acquisitions aimed at consolidating market presence and expanding operational capabilities. For instance, recent acquisitions by larger firms of regional companies have facilitated access to new technologies and distribution channels, allowing for accelerated growth. Investment in research and development also plays a crucial role as companies aim to introduce advanced features such as flameless lighters and multi-functional designs. Furthermore, global market players are investing in expansion efforts to tap into untapped markets in regions such as Asia-Pacific and Latin America, where an increasing number of consumers are driving demand for portable and stylish igniting devices. These strategic maneuvers highlight the dynamic nature of the market, with companies continually adapting to changes in consumer preferences and market conditions to secure their foothold.

Key Pocket Lighter Companies:

The following are the leading companies in the pocket lighter market. These companies collectively hold the largest market share and dictate industry trends.

- BIC Corporation

- Cricket Lighters (Swedish Match)

- CLIPPER (FLAMAGAS, SA)

- Tokai Corporation

- Zippo Manufacturing Company

- Colibri

- S.T. Dupont

- Zhuoye Lighters Manufacturing Co., Ltd.

- BAIDE International Enterprise

- Ningbo Xinhai Electric Co.

Recent Developments

-

In March 2024, Zippo Manufacturing Company joined forces with Seltzer Licensing Group, appointing them as its exclusive licensing agent. This partnership is designed to leverage Zippo’s strong brand identity in fire, heat, cooking, and lighting, facilitating its expansion into new outdoor consumer product categories. The strategy allows Zippo to diversify its product offerings while maintaining its core brand values. By entering the outdoor space, Zippo can tap into a growing market, enhance brand visibility, and create additional revenue streams.

-

In January 2023, BIC Corporation revealed plans for a USD 70 million investment to expand its manufacturing facility in Ramos Arizpe, Coahuila, Mexico. This initiative is projected to generate 700 new jobs while improving production capacity and operational efficiency. This strategic investment will bolster local employment opportunities, enhance production capabilities, streamline operations, and ultimately contribute to BIC's growth in the competitive market. In addition, increased efficiency can lead to cost savings and better product availability, benefiting both the company and its customers.

Pocket Lighter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,945.9 million

Revenue forecast in 2030

USD 8,027.0 million

Growth rate

CAGR of 2.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; France; Germany; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

BIC Corporation, Cricket Lighters (Swedish Match), CLIPPER (FLAMAGAS, SA), Tokai Corporation, Zippo Manufacturing Company, Colibri, S.T. Dupont, Zhuoye Lighters Manufacturing Co., Ltd., BAIDE International Enterprise, and Ningbo Xinhai Electric Co.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pocket Lighter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pocket lighter market report based on product, material, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flint Lighter

-

Electronic Lighter

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pocket lighter market was estimated at USD 6,755.5 million in 2024 and is expected to reach USD 6,945.9 million in 2025.

b. The global pocket lighter market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2030 to reach USD 8,027.0 million by 2030.

b. Asia Pacific dominated the pocket lighter market with a share of 52.1% in 2024, primarily, driven by a combination of urbanization, rising disposable incomes, and a burgeoning young population that increasingly engages in outdoor and social activities. Countries like China and India, with their massive populations and increasing rates of smoking and outdoor recreational activities, present substantial opportunities for pocket lighter manufacturers.

b. Some of the key market players in the pocket lighter market are BIC Corporation, Zippo Manufacturing Company, Cricket Lighters (Swedish Match), Colibri, BAIDE International Enterprise, Zhuoye Lighters Manufacturing Co., Ltd., and Clipper International S.L.

b. The market is driven by the increasing reliance on convenience and portability in modern lifestyles. As urbanization continues to rise, consumers are seeking compact and easy-to-carry solutions for igniting fuels in various scenarios, from lighting cigarettes to camping and outdoor activities. This growing preference for portable products has prompted manufacturers to innovate and refine lighter designs, focusing on enhancing functionality while maintaining a compact size.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.