- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Pipe Market Size And Share Analysis Report, 2030GVR Report cover

![Plastic Pipe Market Size, Share & Trends Report]()

Plastic Pipe Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PVC, PP), By Application (Irrigation, Water Supply), By End-use (Building & Construction, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-233-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2019 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Pipe Market Summary

The global plastic pipe market size was estimated at USD 56.55 billion in 2023 and is projected to reach USD 89.57 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. The rising demand for plastic pipes across several applications including sewage systems, water supply, drainage, and irrigation, owing to the rapid urbanization and industrializations across several economies.

Key Market Trends & Insights

- Asia Pacific dominant the market with the revenue share of 45.0% in 2023.

- China is anticipated to grow at a significant CAGR during the forecast period.

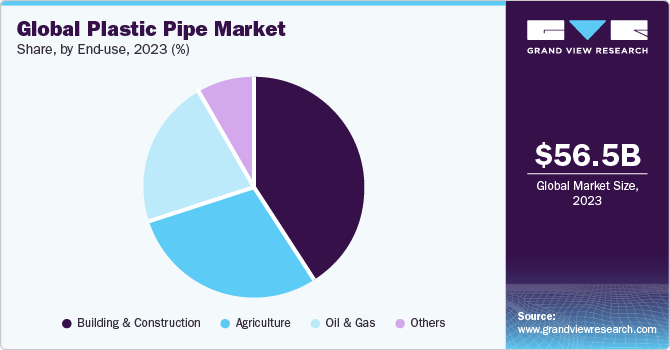

- Based on end-use, the building & construction segment led the market with the largest revenue share of 40.57% in 2023.

- Based on material, the polyvinyl chloride segment dominated the market in 2023.

- Based on application, the water supply segment led the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 56.55 Billion

- 2030 Projected Market Size: USD 89.57 Billion

- CAGR (2024-2030): 6.8%

- Asia Pacific: Largest market in 2023

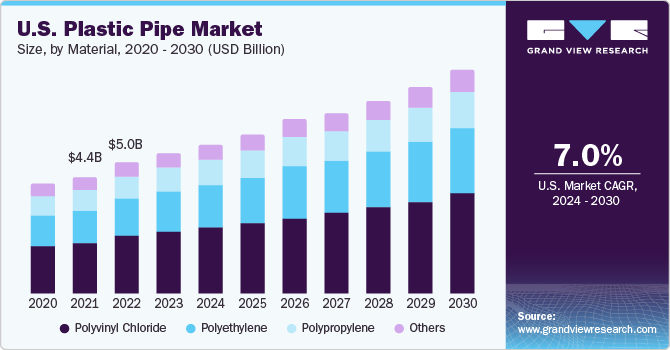

In 2023, the U.S. was the largest market for plastic pipes in North America. The market for plastic pipes is primarily driven by the boom in shale gas exploration and production for several applications in oil and gas extraction, transportation, and distribution.

In addition, water scarcity and the need for efficient water management are significant concerns in the U.S. Plastic pipes play a crucial role in water distribution, irrigation, and drainage systems. The rising focus on infrastructure renewal and development, as highlighted by expansion initiatives like acquisition and merger is expected to propel the construction activities across the country, thus boosting the market growth. For instance, in June 2023, Aliaxis SA announced the completion of its acquisition of Valencia Pipe Company's (Valencia) manufacturing branch in the United States. Valencia's teams will join Aliaxis' North American IPEX division, bolstering the company's position in the U.S.

Moreover, the introduction of innovative technologies for the manufacture of PVC pipes using molecular orientation is also a major trend in the U.S. market. Innovative PVC pipes with IoT technology enable real-time water flow, pressure, and temperature monitoring, assisting in the early detection of leaks or potential problems.

One of the major challenges faced by the market includes the price volatility of plastic pipe raw materials, which is subject to fluctuate according to demand and supply. This can make it difficult for companies to plan for the long term and can also make it challenging to ensure that the price of Plastic Pipes provides a sufficient financial incentive for emissions reductions.

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include Mexichem SAB de CV, Chevron Phillips Chemical Company, Pipe Corporation, Finolex Industries Ltd., among others. Several players are engaged in framework development to improve their market share.

For instance, in March 2023, Finolex Industries introduced a new line of CPVC pipes. CPVC pipes are made of chlorinated polyvinyl chloride, a modified version of PVC that is more resistant to heat and chemicals. Finolex Industries' new line of CPVC pipes is intended for use in hot and cold water applications, as well as industrial applications such as chemical and food processing.

Material Insights

Based on material, the polyvinyl chloride segment dominated the market with the largest revenue share in 2023. Polyvinyl chloride, or PVC, is one of the most widely used materials in the plastic pipe industry. It is a common plastic used across the globe owing to its durability, strength, ease of installation, and low cost. It offers high durability, chemical resistance, and low cost, making it a suitable choice for a wide range of applications such as water supply and distribution, sewage systems, and irrigation.

In the coming years, the demand for PVC pipe is likely to be driven by an increase in pipe demand in the building and construction, as well as irrigation industries.Growing investments in R&D activities are one of the primary drivers of the polyvinyl chloride (PVC) pipes market. The PVC pipe fitting manufacturing sector is rapidly changing to satisfy the growing demand for efficient, safe, and dependable piping systems.

With the ongoing industrialization, the greenhouse emission in the atmosphere has been continuously increasing. Hence, the demand for sustainable building and construction is expected to grow as it provides environmentally friendly PVC pipe fittings that are recyclable, energy efficient, and minimize greenhouse gas emissions.

Application Insights

In terms of application, the water supply segment led the market with the substantial revenue share in 2023. Plastic pipes such as PE, PVC, and CPVC offers lightweight and flexibility, making it suitable for water supply applications in several industries.

The sewage application segment is expected to grow at a significant CAGR during the forecast period, owing to its several usage in industrial and building & construction industries. The rising demand for cost-effective and recyclable products in the construction activities is expected to propel the segment growth in the forecast period. Ongoing R&D developments in the material technology to enhance the efficiency of the product is also likely to contribute to the market growth. For instance, in December 2022, Piping solutions provider and Prince Pipes and Fittings Limited (PPFL) announced the launch of their two drainage and plumbing solutions. The launch is part of the company's growth strategy to bring innovative products to the Indian market and will offer a range of technology-enabled drainage and plumbing solutions segmented under modern vertical plumbing.

End-use Insights

Based on end-use, the building & construction segment led the market with the largest revenue share of 40.57% in 2023. The rising urbanization has led to increased infrastructure development and thus created a demand for modern plastic piping systems across the globe. The growing demand for pipes in the residential sector, large public infrastructure projects, and in places such as hospitals and shopping malls offers lucrative growth prospects for pipe market players.

The agriculture segment is expected to grow at a significant CAGR during the forecast period. The industry relies heavily on irrigation and drainage applications, creating demand for plastic pipes over the forecast period. The market is expanding due to modern irrigation methods and equipment, as well as a growing emphasis on water conservation. a significant amount of research and development work, as well as high crop yields. Factors such as the need for an effective water management system in agriculture and the use of modern irrigation technologies is expected to further boost the market growth.

Regional Insights

The plastic pipe market in North America is expected to grow at a significant CAGR over the forecast period, owing to the presence of advanced manufacturing facilities, along with the rising construction activities across the region. In addition, the growing government spending on infrastructure is likely to create demand for sewer and drinking water supplies, as well as for plastic pipes used as structural supports in bridges and other large structures, thus propelling the market growth.

U.S. Plastic Pipe Market Trends

The plastic pipe market in U.S. dominated the North American market in 2023. The rise in infrastructure activities across residential and commercial sectors is expected to boost the demand for plastic pipe in the country. Strong financial position and technological developments of leading market participants will contribute to the development of the market.

The Canada plastic pipe market held a significant revenue share in the North America in 2023. Rising investment in infrastructure development such as sewer systems, water supply, and transportation. Heavy bilateral trade between U.S. and Canada, coupled with a supportive Canadian trade deal are anticipated to fuel the market growth during the forecast period.

Asia Pacific Plastic Pipe Market Trends

Asia Pacific dominant the market with the revenue share of 45.0% in 2023. This is due to the increase in construction and agriculture activities in the region. The construction and agriculture industry is witnessing a surge in maintenance and repairing activities due to increasing government activities and maintenance initiatives, which is significantly contributing to the market growth.

The plastic pipe market in China is anticipated to grow at a significant CAGR during the forecast period. Rising household incomes, as well as rural-to-urban migration, are expected to continue to drive demand for residential infrastructure. Moreover, government spending on infrastructure affects demand for sewer and drinking water supplies, as well as for plastic pipes used as supports in bridges and other large structures. These factors are likely to propel the China market.

Europe Plastic Pipe Market Trends

The plastic pipe market in Europe is driven by rising spending construction sector. The market is driven by several infrastructural advancements, repair remodeling of existing aged piping systems, and demand for HVAC systems due to extreme weather conditions. High investments in the protection of optic cables and agricultural water pipes from weather fluctuations including long periods of drought are positively influencing the market growth.

The Germany plastic pipe market is anticipated to grow at a steady CAGR during the forecast period, driven by its diverse applications in industries such as domestic, infrastructure, industrial, agriculture, and aqua-cultural. The stability of the market, combined with the constant development of materials and processing technologies, opens up a promising future for the market.

Central & South America Plastic Pipe Market Trends

The plastic pipe market in Central & South America is expected to grow at a substantial CAGRduring the forecast period. The market is driven by the rising adoption of PVC in the construction and water utility industries.

The Brazil plastic pipe market is anticipated to grow at a significant CAGR during the forecast period. The increasing demand for high-performance materials to revamp the aging water transportation system in the country with public-private partnerships contributes to the market growth of Brazil.

Middle East & Africa Plastic Pipe Market Trends

The plastic pipe market in Middle East & Africa region held a prominent global revenue share in 2023, due to the massive infrastructure projects in UAE and Saudi Arabia. Furthermore, the inclination toward environmental sustainability has driven the adoption of PVC in construction activities as they are recyclable.

The UAE plastic pipe market is anticipated to grow at a fastest CAGR during the forecast period, as UAE is observing rapid construction due to high population growth and urbanization. There has been a growing need for cost-effective and durable piping solutions. Besides, emerging trends in the UAE toward water conservation and green construction practices are major growth-inducing factors.

Key Plastic Pipe Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, ISCO announced an agreement to acquire substantially all of the assets of Infinity Plastics, a leading manufacturer of finished high-density polyethylene tubular products.The acquisition of Infinity Plastics is an expansion of ISCO's presence and capacity and is part of the company's overall strategy to support evolving customer needs, backed by quality standards and excellent customer service

-

In June 2023, Aliaxis SA acquired the production division of the American company Valencia Pipe Company (Valencia).With this significant USD 250 million acquisition, Aliaxis SA expands in the key Western US market by adding 2 manufacturing facilities and 1 distribution center in Arizona and Washington

-

In May 2023, SABIC announced the opening of its new European Tube Innovation Center in the Netherlands. The center, located close to SABIC's production site in Geleen, will support the development, evaluation, sampling and testing of customized pipe materials.This will also allow SABIC to work in close coordination with various European pipe manufacturers

Key Plastic Pipe Companies:

The following are the leading companies in the plastic pipe market. These companies collectively hold the largest market share and dictate industry trends.

- Mexichem SAB de CV

- Chevron Phillips Chemical Company

- Pipe Corporation

- Finolex Industries Ltd

- Aliaxis Group S.A.

- Wienerberger AG

- ASTRAL POLYTECHNIK LIMITED

- Tommur Industry (Shanghai) CO.,LTD

- Kubota ChemiX Co., Ltd

- Kotec Corporation

Plastic Pipe Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.39 billion

Revenue forecast in 2030

USD 89.57 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2019 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million/bollion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, capacity forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mexichem SAB de CV; Chevron Phillips Chemical Company; Pipe Corporation; Finolex Industries Ltd; Aliaxis Group S.A.; Wienerberger AG; ASTRAL; POLYTECHNIK LIMITED; Tommur Industry (Shanghai) CO.,LTD; Kubota ChemiX Co., Ltd; Kotec Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Pipe Market Report Segmentation

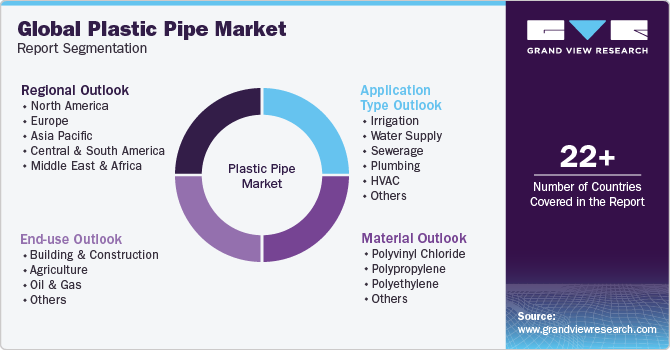

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the plastic pipe market report based on material, application, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyvinyl Chloride

-

Polypropylene

-

Polyethylene

-

Others

-

-

Application Type Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Irrigation

-

Water Supply

-

Sewerage

-

Plumbing

-

HVAC

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Building & Construction

-

Agriculture

-

Oil & Gas

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic pipe market size was estimated at USD 56.55 billion in 2023 and is expected to reach USD 60.39 billion in 2024.

b. The global plastic pipe Market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 89.57 billion by 2030.

b. Asia Pacific emerged as the largest regional segment and accounted for 45.88% of the market in 2023. This is due to the increase in construction and agriculture activities in the region.

b. Some of the key players operating in this industry include Mexichem SAB de CV, Chevron, Phillips Chemical Company, Pipe Corporation, and Finolex Industries Ltd.

b. The demand for plastic pipes has been increasing in recent years owing to the rising demand for plastic pipes across several applications including sewage systems, water supply, drainage, and irrigation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.