- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Dielectric Films Market Size, Industry Report, 2033GVR Report cover

![Plastic Dielectric Films Market Size, Share & Trends Report]()

Plastic Dielectric Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (PTEF, PEN, PET, PP, PPS & PVDF), By Application (Electrical & Electronics, Automobile, Aircraft), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-823-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Dielectric Films Market Summary

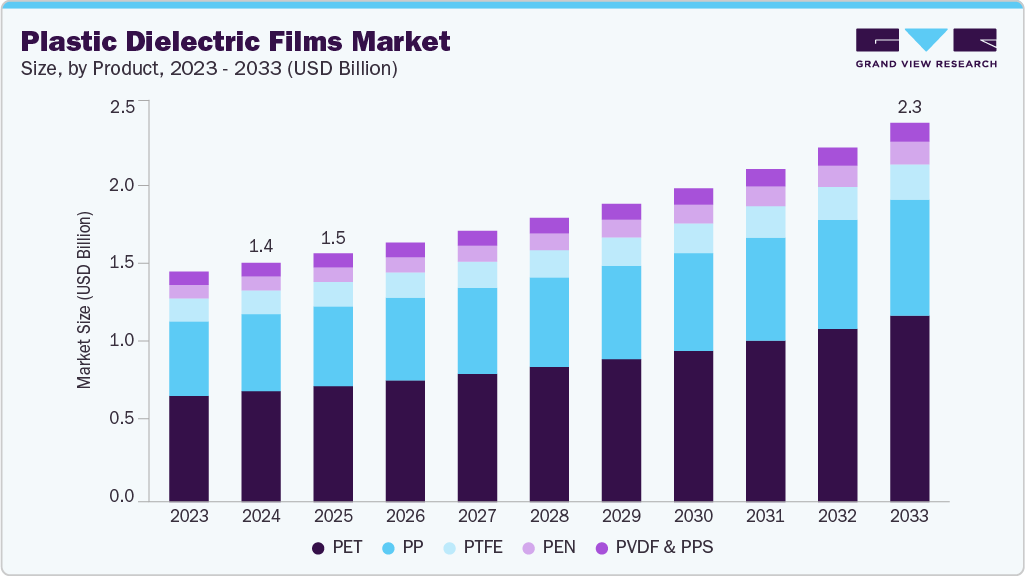

The global plastic dielectric films market size was estimated at USD 1.40 billion in 2024 and is projected to reach USD 2.22 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The increasing demand for electronic goods and the growing food packaging industry drive the market.

Key Market Trends & Insights

- Asia Pacific dominated the Plastic Dielectric Films Market with the largest revenue share of 36.85% in 2024.

- The Plastic Dielectric Films Market in Europe is expected to grow at a substantial CAGR of 4.7% from 2025 to 2033.

- By product, PET segment is expected to grow at the fastest CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By applications, Solar & Wind Energy Systems segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.40 billion

- 2033 Projected Market Size: USD 2.22 billion

- CAGR (2025 - 2033): 5.5%

- Asia Pacific: Largest market in 2024

The demand for plastic films is high globally in sectors such as electrical and electronics, food packaging, automobile, aircraft, and solar and wind energy systems. The market for plastic dielectric films is expected to grow steadily, driven by the rising demand for high-performance capacitors in sectors such as automotive, consumer electronics, renewable energy, and industrial power systems. These films, primarily made of polypropylene, polyethylene terephthalate (PET), and polyphenylene sulfide (PPS), offer benefits like high insulation resistance, thermal stability, and low dielectric loss, which are crucial for achieving energy efficiency and long-term reliability in electronic components.

The trend toward smaller, lighter, and high-voltage electrical systems, especially in electric vehicles (EVs), 5G infrastructure, and solar inverters, is increasing the demand for advanced dielectric film grades. In addition, increased investments in grid modernization and renewable energy projects in developing countries fuel this growth. As various industries prioritize miniaturization, safety, and sustainability, the market is expected to expand steadily in the coming years.

Drivers, Opportunities & Restraints

The market for plastic dielectric films is projected to experience continued growth, driven by rising demand from major sectors such as consumer electronics, electric vehicles, industrial machinery, and renewable energy technologies. These films, predominantly composed of polypropylene, polyethylene naphthalate, and polyphenylene sulfide, possess crucial characteristics like high insulation strength, minimal dielectric loss, thermal stability, and mechanical resilience. The increasing incorporation of sophisticated electronics in vehicles and the ongoing deployment of 5G networks are further propelling the need for high-performance dielectric films.

Emerging prospects in the plastic dielectric films industry are arising as sectors increasingly prioritize enhancing performance, minimizing component size, and achieving sustainability goals. Innovations in recyclable dielectric film compositions, the implementation of eco-friendly manufacturing processes, and the growing utilization of renewable energy technologies are broadening the market opportunities, especially in North America, Europe, and certain regions of Asia. Furthermore, the progression of EV powertrains, heightened demand for rapid charging infrastructure, and advancements in consumer electronics are driving the development of film materials that satisfy both electrical and environmental performance standards.

Nonetheless, the industry could encounter difficulties due to changes in raw material costs and increased regulatory oversight regarding plastic use and its environmental effects. With end-users demanding enhanced thermal resistance, extended operational life, and smaller sizes, the expenses associated with research and development and regulatory compliance might increase. In addition, interruptions in the supply chain and the rise of alternative materials like ceramic-based or hybrid dielectric options might restrict the market share of traditional plastic dielectric films in certain high-performance areas.

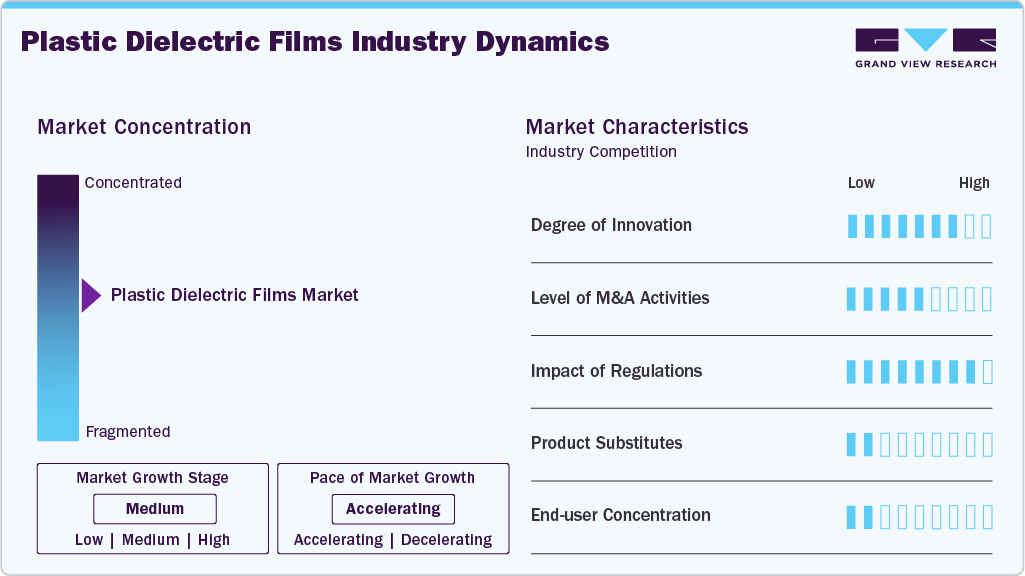

Market Concentration & Characteristics

The plastic dielectric films industry is experiencing moderate growth, with an increase in pace driven by rising demand in key areas such as consumer electronics, electric vehicles, power transmission, and renewable energy systems. Although the market is relatively fragmented, major global players have significant leverage due to their specialized technical knowledge, extensive product ranges, and robust global supply chains. Prominent companies like DuPont Teijin Films U.S. Ltd. Partnership, Steiner GmbH & CO. KG, Jindal Films, Tervakoski Film, Ganapathy Industries, COVEME S.p.A., Jindal Poly Films Ltd., and the Bolloré Group play a crucial role in shaping the competitive landscape by providing advanced dielectric films designed for high-voltage, thermally stable, and energy-efficient uses.

Mergers and acquisitions significantly influence the plastic dielectric films industry, as key players acquire specialized film manufacturers and technology companies to broaden their global presence, diversify their material offerings, and enhance vertical integration throughout the value chain. These strategic initiatives promote the creation of high-performance, recyclable dielectric films that meet increasing regulatory and environmental standards. The escalating costs of regulatory compliance and changing safety and performance standards in electronics and power systems propel investments in cleaner manufacturing methods and advanced polymer technologies that improve dielectric efficiency while achieving sustainability goals.

The market for plastic dielectric films faces moderate competition from alternative materials such as ceramic films, mica, paper-based dielectrics, and new nanocomposites. However, plastic films remain prominent due to their lightweight nature, high dielectric strength, thermal stability, flexibility, and cost-effective mass production. Customers are heavily concentrated in electronics, automotive, energy storage, and power distribution, where major original equipment manufacturers (OEMs), capacitor manufacturers, and component suppliers heavily influence demand. This concentration greatly affects product innovation, material selection, and performance standards, making the market sensitive to changes in industry regulations, energy efficiency targets, and trends toward miniaturization in electrical and electronic systems.

Product Insights

The market has been segmented by product into polyethylene naphthalate (PEN), polyethylene terephthalate (PET), polytetrafluoroethylene, polypropylene, polyphenylene sulfide, and polyvinylidene difluoride. The polyethylene terephthalate segment accounted for the largest revenue share, 46.36% in 2024, and is expected to retain its dominance during the forecast period. The applications driving the market for this segment range from packaging to fabrics and films to molded parts for electronics and automobiles, and others.

The polyethylene naphthalate segment is expected to grow at the fastest CAGR of 5.7% from 2025 to 2033. This is attributed to its wide application in film-based products such as labels, laminates, flexible printed circuits, and optical displays. PEN is a high-performing fiber with enhanced hydrolytic stability and is particularly well-suited for items that are prone to oxidation because of its low oxygen permeability.

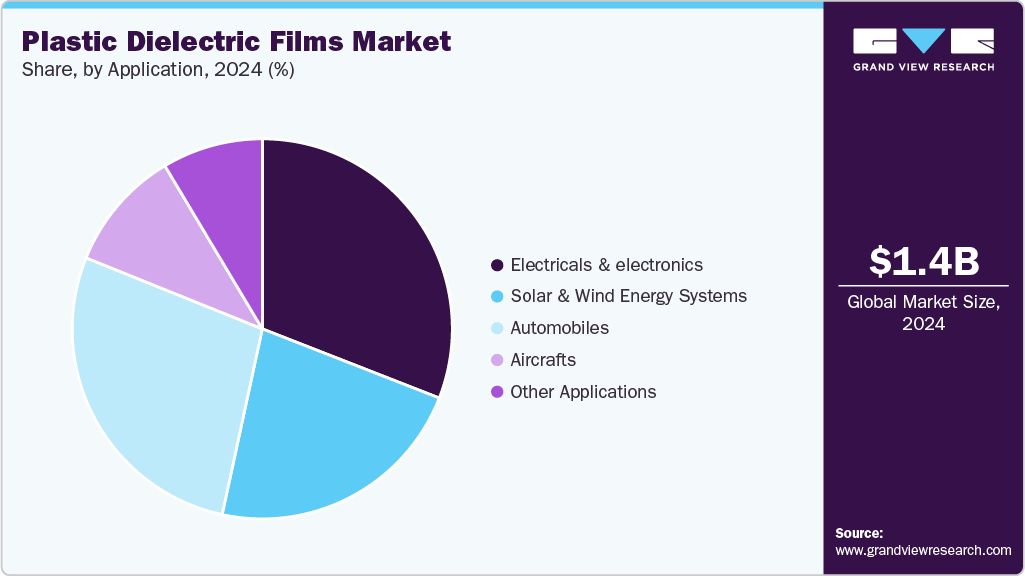

Application Insights

The electricals and electronics segment accounted for the largest market share of 30.93% in 2024 and is expected to retain its position in the market over the forecast period. This is attributed to its wide application in engineering materials such as circuit boards, wire, cable insulation, and others due to its electrical insulation and flame resistance properties. Desai Electronics Pvt. Ltd, a manufacturer of plastic film capacitors, produces metalized and plain polypropylene and polyester film capacitors that are utilized in the electronics industry for DC links, induction cookers, fan speed regulators, power electronics, energy meters, and more.

The solar and wind energy systems segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033. This growth is due to increased demand for solar manufacturers to replace glass with polymers. Organic photovoltaic cells made of polymers are driving new opportunities for solar energy, particularly in transportation. In wind energy systems, the wind turbine's efficiency can be increased by adjusting the blade's length. The capacity to produce power increases with blade size. Polymer composites reinforced with glass, carbon, and aramid fibers lighten the turbine and increase its strength and efficiency.

The automotive and aircraft sector is expected to grow substantially as the demand for dependable, compact, and high-performance components rises in increasingly electrified and lightweight transportation solutions. Plastic dielectric films are extensively used in applications such as DC-link capacitors, EMI filters, and onboard power electronics because of their excellent insulation resistance, thermal endurance, and stability under mechanical stress.

Furthermore, strict safety standards and an increasing focus on component miniaturization and energy efficiency urge manufacturers to adopt advanced dielectric films that can endure varying temperatures, vibrations, and electrical stresses in critical settings.

Regional Insights

In 2024, the Asia Pacific region accounted for the largest plastic dielectric film market revenue share at 36.85%, confirming its position as the leading regional market. This leadership is driven by significant electronics, automotive, and industrial growth and increased investments in renewable energy infrastructure in countries such as China, Japan, South Korea, and India. The region's established electronics manufacturing ecosystem, combined with the rising demand for energy-efficient capacitors and advanced electrical components, is boosting the use of high-performance dielectric films.

China Plastic Dielectric Films Market Trends

The plastic dielectric films market in China is set for significant growth, fueled by the country's expanding electronics manufacturing industry, a strong push towards electric vehicle adoption, and substantial investments in renewable energy infrastructure. Government initiatives encouraging domestic innovation and the localization of critical electronic components drive the demand for high-quality dielectric films used in capacitors, inverters, and power modules. The increasing deployment of 5G technology, smart grid enhancements, and industrial automation progress further boost the requirement for thermally stable films with high dielectric strength.

North America Plastic Dielectric Films Market Trends

The plastic dielectric films market in North America is expected to expand at a CAGR of 5.8%, driven by robust demand from industries like automotive, aerospace, consumer electronics, and renewable energy. This region benefits from a well-established industrial framework, sophisticated research and development capabilities, and a strong commitment to energy-efficient, high-performance electronic systems. The rising adoption of electric vehicles, growth in wind and solar energy projects, and the deployment of 5G infrastructure are increasing the demand for dependable dielectric materials in capacitors and circuit protection components.

U.S. Plastic Dielectric Films Market Trends

The U.S. plastic dielectric films market is projected to grow consistently, fueled by innovations in high-performance electronics, rising adoption of electric vehicles, and an increasing focus on renewable energy solutions. Continuous improvements in power infrastructure and strict regulations regarding electrical safety and energy efficiency are boosting the need for robust, thermally stable, and high-dielectric-strength films used in capacitors and power modules.

Europe Plastic Dielectric Films Market Trends

The plastic dielectric films market in Europe is expected to benefit from stringent environmental regulations, a heightened focus on sustainable manufacturing, and robust commitments to the circular economy. The region has an increasing demand for recyclable, halogen-free, and low-emission dielectric materials, especially in sectors such as power electronics, automotive electrification, and industrial automation. As Europe spearheads the shift toward electric mobility and the adoption of renewable energy, the demand for high-performance, thermally stable dielectric films is rising. Furthermore, regulatory initiatives like RoHS and REACH promote material innovation and facilitate safer, environmentally friendly film technologies throughout electrical and electronic systems.

Key Plastic Dielectric Films Company Insights

The plastic dielectric films industry is experiencing moderate growth, fueled by increasing demand in automotive electronics, renewable energy, and consumer electronics. Although the market is somewhat fragmented, it is influenced by significant players such as DuPont Teijin Films, Jindal Films, SABIC, Mitsubishi Chemical, Toray Industries, and others. These companies are at the forefront of developing recyclable, thermally stable, and regulatory-compliant dielectric films to satisfy changing global performance and sustainability requirements.

Key Plastic Dielectric Films Companies:

The following are the leading companies in the plastic dielectric films market. These companies collectively hold the largest market share and dictate industry trends.

- Dupont Teijin Films U.S. Ltd. Partnership

- Steiner GmbH & CO. KG

- Jindal Films

- Tervakoski Film

- Ganapathy Industries

- COVEME s.p.a.

- Jindal Poly Films Ltd.

- Bolloré Group

- SABIC

- Mitsubishi Chemical Corp.

- Toray Industries, Inc.

- PPI Adhesive Products

- SK geo-centric Co., Ltd.

- Asahi Kasei Corp.

- Maruzen Petrochemical Co., Ltd.

Recent Developments

-

In May 2025, Soteria Flexibles, a specialist in flexible packaging based in the U.S., acquired Hamilton Plastics Inc., known for its high-performance barrier film production capabilities. This acquisition boosts Soteria's production and research and development capabilities in flexible, multi-layered films, allowing it to serve the medical, industrial, and packaging sectors more effectively with innovative film solutions.

-

In March 2025, API Industries, under the Aluf Plastics brand, announced the acquisition of Earthfirst Films, which is recognized as a leader in compostable sealant and barrier film technology. This strategic move expands API’s range of products and strengthens its position in sustainable film solutions for the packaging and medical industries.

Plastic Dielectric Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.45 billion

Revenue forecast in 2033

USD 2.22 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, applications, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Dupont Teijin Films U.S. Ltd. Partnership; Steiner GmbH & CO. KG; Jindal Films; Tervakoski Film; Ganapathy Industries; COVEME s.p.a.; Jindal Poly Films Ltd.; Bolloré Group; SABIC; Mitsubishi Chemical Corp.; Toray Industries, Inc.; PPI Adhesive Products; SK geo-centric Co., Ltd.; Asahi Kasei Corp.; Maruzen Petrochemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Dielectric Films Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global plastic dielectric films market report based on product, applications, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PET

-

PP

-

PTFE

-

PEN

-

PVDF & PPS

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electricals & electronics

-

Solar & Wind Energy Systems

-

Automobiles

-

Aircraft

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.