- Home

- »

- Advanced Interior Materials

- »

-

Plastic Blow Molding Machine Market, Industry Report, 2030GVR Report cover

![Plastic Blow Molding Machine Market Size, Share & Trends Report]()

Plastic Blow Molding Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Injection Stretch, Injection, Extrusion), By End Use (Packaging, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-104-9

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Blow Molding Machine Market Summary

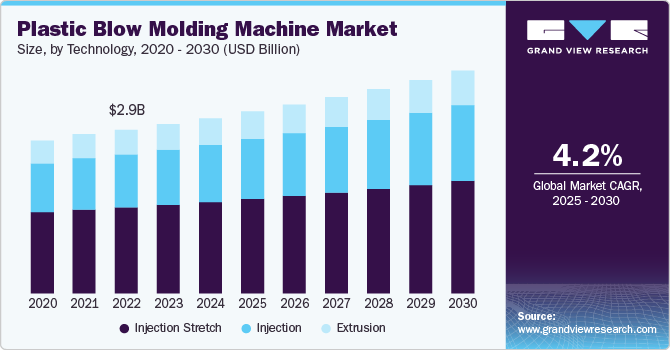

The global plastic blow molding machine market size was estimated at USD 3,182.9 million in 2024 and is projected to reach USD 4,047.7 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The global plastic blow molding machine market is experiencing steady growth, driven by increasing demand across industries such as packaging, construction, automotive, and healthcare.

Key Market Trends & Insights

- Asia Pacific region led the market and accounted for 39.2% of the global plastic blow molding machine market in 2024.

- The plastic blow molding machine market in the India is expected to grow at a CAGR of 5.7% from 2025 to 2030.

- The plastic blow molding machine market in the U.S. is expected to grow at a CAGR of 2.9% from 2025 to 2030.

- Based on technology, the injection stretch technology segment accounted for a revenue share of 52.0% in 2024.

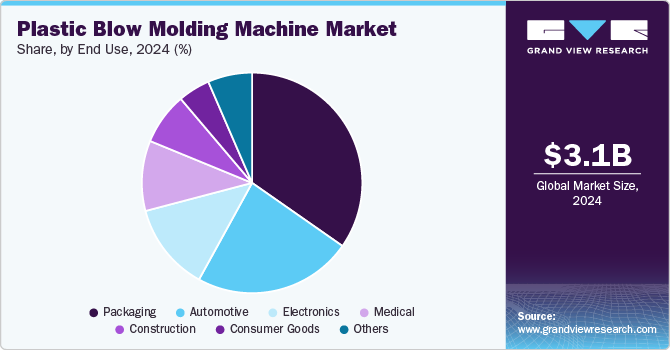

- In terms of end-use, the packaging end use segment accounted for the largest revenue share of 34.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,182.9 Million

- 2030 Projected Market Size: USD 4,047.7 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

These machines play a crucial role in manufacturing hollow plastic products, including bottles, containers, tanks, and industrial components. Technological advancements, such as automation, robotics, and AI integration, are enhancing machine efficiency, reducing operational costs, and improving product quality.

Moreover, as automakers continue to prioritize lightweighting, fuel efficiency, and design flexibility, the demand for advanced plastic components continues to increase. Plastic blow molding, known for its ability to produce lightweight, durable, and complex shapes, has become an essential manufacturing technique for producing automotive parts. In recent years, the automotive industry has focused on reducing the overall weight of vehicles to improve fuel efficiency and lower carbon emissions. Plastic blow molding allows manufacturers to produce large, lightweight components such as bumpers, fuel tanks, and air ducts that contribute to this goal. The ability to create hollow structures with uniform wall thicknesses also adds to the efficiency of these components, providing both strength and reduced weight.

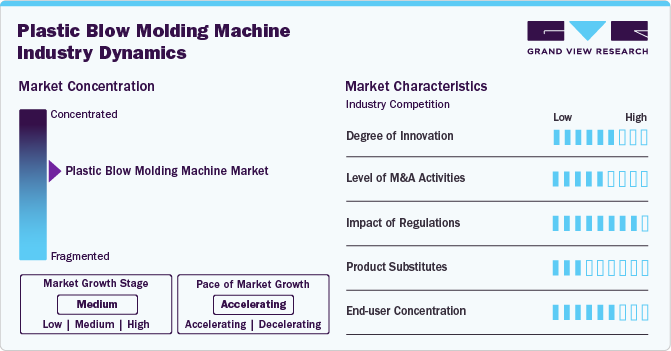

Market Concentration & Characteristics

The plastic blow molding machine industry is moderately concentrated, with a few leading companies dominating global market share. Key players such as Sidel, Krones, and Husky Injection Molding Systems are prominent. However, regional manufacturers also hold significant portions in local markets, especially in Asia Pacific. Smaller companies often offer customized or specialized machines for niche applications, contributing to market diversity.

The market for plastic blow molding machines is characterized by continuous technological advancements, including automation and digitalization. Companies are increasingly focused on improving energy efficiency, reducing cycle times, and enhancing product quality. The growing demand for sustainable production methods has pushed for machines that use less energy and recycled materials. Customization options for machine size, features, and output are available to cater to specific customer needs in various industries, including packaging, automotive, and consumer goods.

Recent innovations in the blow molding industry involve the integration of smart technology, with Industry 4.0 solutions being implemented. Machines are now equipped with sensors and AI-driven systems to monitor production processes and optimize performance. 3D printing is also being explored for creating molds and prototypes. Additionally, there is a strong push towards multi-layer and co-extrusion blow molding machines that enhance material properties, allowing to produce more complex products with different textures and functionalities.

Competition in the plastic blow molding machine industry is driven by the constant need for innovation and cost-efficiency. Leading players have a competitive edge due to their established global networks, extensive service offerings, and strong R&D capabilities. Smaller regional players differentiate themselves by focusing on customer-specific solutions and flexible machine designs. In addition, factors such as after-sales support, machine longevity, and ease of maintenance significantly influence purchasing decisions. As sustainability becomes a major focus, companies that offer eco-friendly and energy-saving solutions are seeing increased demand.

Drivers, Opportunities & Restraints

The growing demand for plastic packaging, especially in industries such as food and beverage, pharmaceuticals, and personal care, is a key driver for the plastic blow molding machine market. As consumer demand for lightweight, durable, and cost-effective packaging increases, manufacturers are investing in advanced blow molding technologies to meet these needs. In addition, the rise of e-commerce and the need for packaging solutions with enhanced shelf appeal further boost market growth, making blow molding machines integral to mass production.

One of the primary restraints facing the plastic blow molding machine market is the increasing focus on sustainability and environmental concerns. The rising awareness of plastic waste and the growing push for more eco-friendly alternatives put pressure on the plastic industry to adopt sustainable practices. This has led to regulatory challenges and shifts in consumer preference towards biodegradable or recyclable packaging, which could impact the demand for traditional plastic blow molding processes and necessitate investments in new, more sustainable production technologies.

The growing trend toward recycling and the use of recycled materials in production processes presents significant opportunities for the plastic blow molding machine market. Manufacturers are increasingly developing machines capable of processing recycled plastics without compromising product quality. In addition, advancements in multi-layer blow molding technology and the development of bio-based plastic alternatives provide new avenues for growth. Companies that adapt to these changes by offering machines compatible with these new materials are likely to see increased demand in the coming years.

Technology Insights

The injection stretch technology segment accounted for a revenue share of 52.0% in 2024. Injection stretch blow molding technology is gaining significant traction in the plastic blow molding machine market due to its ability to produce high-quality, lightweight containers with consistent wall thickness. The trend is primarily driven by the growing demand for PET bottles used in the beverage, food, and personal care industries.

Injection blow molding is a specialized type of blow molding that combines the techniques of injection molding and blow molding in a two-stage process. This method is commonly used for producing hollow items such as bottles, jars, and containers. During the process, plastic is melted and injected into a pre-designed mold. The key benefits of injection molding include reduced waste, minimal need for post production finishing, and recyclability.

End-use Insights

The packaging end use segment accounted for the largest revenue share of 34.7% in 2024, which is expected to continue over the forecast period. Plastic blow molding machines play a crucial role in the packaging industry, particularly for producing bottles, containers, and other packaging products used in various industries such as food, beverages, cosmetics, and pharmaceuticals. The ability of blow molding machines to produce lightweight, durable, and versatile containers makes them an ideal choice for packaging applications.

Plastic blow molding machines play a critical role in the electronics industry by manufacturing custom designed casings for various electronic devices. For instance, plastic housings for items such as routers, printers, and televisions are made using this process. The blow molding technique is particularly valuable here for producing lightweight yet sturdy enclosures that offer both durability and aesthetic appeal, which are essential in modern electronics design.

Regional Insights

North America blow molding machine market shows steady demand for plastic blow molding machines, driven by its established manufacturing base and the growing need for plastic packaging. The market is focused on innovation, with industries emphasizing energy-efficient and sustainable solutions. The U.S. and Canada continue to lead the region, supporting demand across various industries such as automotive, packaging and electronics.

U.S. Plastic Blow Molding Machine Market Trends

The plastic blow molding machine market in the U.S. is expected to grow at a CAGR of 2.9% from 2025 to 2030. The U.S. holds the largest share of the North American market for blow molding machines, primarily due to its extensive packaging and automotive industries. There is increasing demand for high-efficiency, high-speed machines to cater to large-scale production needs.

The plastic blow molding machine market in the Canada is expected to grow at a CAGR of 3.6% from 2025 to 2030. As environmental awareness rises, Canadian manufacturers are seeking more eco-friendly blow molding technologies. The country's focus on innovation and technological advancement also supports the demand for machines that can process biodegradable and recycled materials.

Europe Plastic Blow Molding Machine Market Trends

Europe’s demand for plastic blow molding machines is influenced by its strict environmental regulations and emphasis on sustainable packaging solutions. The market is characterized by a high level of technological innovation, particularly in areas of automation and energy efficiency. Key industries, including automotive, packaging, and healthcare, continue to drive the demand.

Germany's plastic blow molding machine market held 35.2% share in the European market. Germany is one of Europe’s largest markets for blow molding machines, supported by its leading automotive, packaging, and consumer goods industries. As a manufacturing hub, the country demands high-precision and high-performance blow molding machines.

UK’s plastic blow molding machine market is driven by its strong packaging industry, with a growing focus on sustainability. Regulations around plastic waste have pushed manufacturers to adopt machines that enable recycling and use of biodegradable plastics. The post-Brexit market dynamics are encouraging manufacturers to invest in more efficient, cost-effective production technologies.

Asia Pacific Plastic Blow Molding Machine Market Trends

Asia Pacific region led the market and accounted for 39.2% of the global plastic blow molding machine market in 2024. China is a major hub for the plastic blow molding machine market due to its vast manufacturing base and booming packaging industry. The rapid growth of consumer goods and e-commerce has spurred demand for plastic containers, bottles, and packaging solutions.

China plastic blow molding machine market held largest share in the Asia Pacific market. China is a major hub for the plastic blow molding machine market due to its vast manufacturing base and booming packaging industry. The rapid growth of consumer goods and e-commerce has spurred demand for plastic containers, bottles, and packaging solutions.

The plastic blow molding machine market in the India is expected to grow at a CAGR of 5.7% from 2025 to 2030. The growing middle-class population and urbanization are driving packaging needs. India is also focusing on adopting modern manufacturing technologies, such as automation and smart systems, to meet the increasing production demands.

Middle East & Africa Plastic Blow Molding Machine Market Trends

The Middle East & Africa (MEA) region's demand for plastic blow molding machines is increasing, fueled by the growing demand for packaging in sectors such as food and beverage, cosmetics, and pharmaceuticals. Economic diversification in countries like the UAE and Saudi Arabia is driving the demand for advanced production technologies.

In Saudi Arabia, the demand for plastic blow molding machines is largely driven by the expansion of the packaging industry, particularly in the food and beverage sector. The country’s industrial growth, coupled with an emphasis on sustainability, is pushing for advanced blow molding solutions.

Latin America Plastic Blow Molding Machine Market Trends

In Latin America, the demand for plastic blow molding machines is rising due to the growing packaging needs of industries like food and beverage, pharmaceuticals, and personal care. Brazil remains the largest market, with increasing investment in the region’s manufacturing infrastructure.

Brazil is the dominant market for blow molding machines in Latin America, driven by its strong packaging industry. The country's booming consumer goods sector further fuels the need for plastic packaging. Brazil is also witnessing a rise in eco-conscious production, increasing the demand for sustainable blow molding technologies.

Key Plastic Blow Molding Machine Company Insights

Some of the key players operating in the market include Uniloy, Sidel Inc. among others.

-

Uniloy’s technologies include reciprocating blow molding machines, industrial blow molding machines, injection blow molding machines, shuttle-continuous extrusion blow molding machines, and custom molds. In addition, it provides comprehensive aftermarket and service support. Serving a wide range of industries, the company caters to sectors such as automotive, pharmaceuticals, cosmetics, food and beverage, industrial and consumer packaging, and technical parts. With a global presence, the company operates manufacturing facilities in the U.S., Italy, and India, along with sales and service locations in Mexico, Germany, and the Czech Republic.

-

Sidel is a subsidiary of the Tetra Laval Group, a multinational corporation that develops and manufactures packaging and processing systems for food and other products. Sidel offers comprehensive packaging solutions that address the needs of customers and consumers globally, providing products, services, and designs that enhance performance, sustainability, and flexibility. The company is a worldwide leader in packaging solutions for beverages, food, and home & personal care products across materials such as glass, PET, cans, and more.

Key Plastic Blow Molding Machine Companies:

The following are the leading companies in the plastic blow molding machine market. These companies collectively hold the largest market share and dictate industry trends.

- BLOW ENTERPRISES

- Uniloy

- Kautex Maschinenbau System GmbH

- Bekum Maschinenfabriken GmbH

- Sidel Inc.

- Jomar Corp

- NISSEI ASB MACHINE CO., LTD

- Polymechplast Machines Ltd

- Sumitomo Heavy Industries, Ltd

- The Japan Steel Works, LTD

Recent Developments

-

In June 2024, Uniloy introduced a high-cavitation solution designed to increase the output and efficiency of plastic container production. This innovative machine is designed to address rising industry demands, offering customers up to a 40% potential productivity boost.

-

In June 2024, Uniloy acquired shuttle mold making and technical service assets, as well as personnel, from FGH Systems. FGH, a long-time partner of Uniloy, will continue to represent the full range of Uniloy’ s blow molding machines, molds, and services.

Plastic Blow Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,302.7 million

Revenue forecast in 2030

USD 4,047.7 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BLOW ENTERPRISES; Uniloy; Kautex Maschinenbau System GmbH; Bekum Maschinenfabriken GmbH; Sidel Inc.; Jomar Corp; NISSEI ASB MACHINE CO., LTD; Sidel Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Blow Molding Machine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the plastic blow molding machine market on the basis of technology, end use and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Injection Stretch

-

Injection

-

Extrusion

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics

-

Medical

-

Construction

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic blow molding machine market size was estimated at USD 3,182.9 million in 2024 and is expected to reach USD 3,302.7 million in 2025.

b. The global plastic blow molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 and reach USD 4,047.7 million by 2030.

b. The packaging end use segment accounted for the largest revenue share of 34.7% in 2024. which is expected to continue over the forecast period. Plastic blow molding machines play a crucial role in the packaging industry, particularly for producing bottles, containers, and other packaging products used in various industries such as food, beverages, cosmetics, and pharmaceuticals.

b. Some of the key players operating in the plastic blow molding machine market include BLOW ENTERPRISES, Uniloy, Kautex Maschinenbau System GmbH, Bekum Maschinenfabriken GmbH, Sidel Inc., Jomar Corp, NISSEI ASB MACHINE CO., LTD, Uniloy, Sidel Inc. among others.

b. The key factors driving the plastic blow molding machine market include the rising demand for plastic blow-molded products in the medical sector, coupled with the increasing importance of plastic recycling, which is expected to augment the market growth in the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.