- Home

- »

- Consumer F&B

- »

-

Plant-based Yogurt Market Size, Share & Trends Report 2030GVR Report cover

![Plant-based Yogurt Market Size, Share & Trends Report]()

Plant-based Yogurt Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Almond, Oat), By Flavor (Flavored, Non-flavored), By Distribution Channel (B2B, B2C), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-372-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based Yogurt Market Summary

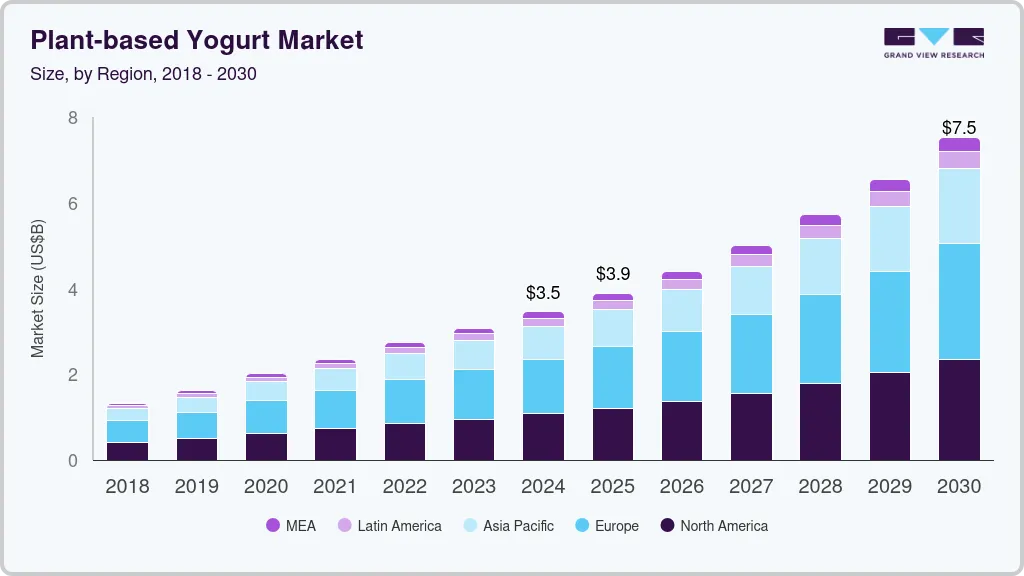

The global plant-based yogurt market size was estimated at USD 3.46 billion in 2024 and is projected to reach USD 7.53 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. Rising lactose intolerance and dairy allergies have spurred demand for non-dairy alternatives, while growing health consciousness has led consumers to seek plant-based options perceived as healthier.

Key Market Trends & Insights

- North America market is expected to grow with a CAGR of 13.8% from 2024 to 2030.

- The market in the U.S. is expected to grow at a CAGR of 13.9% from 2024 to 2030.

- By source, soy yogurt accounted for a revenue share of 36.06% in 2023.

- By flavor, flavored plant-based yogurt accounted for a revenue share of 75.30% in 2023 in the market

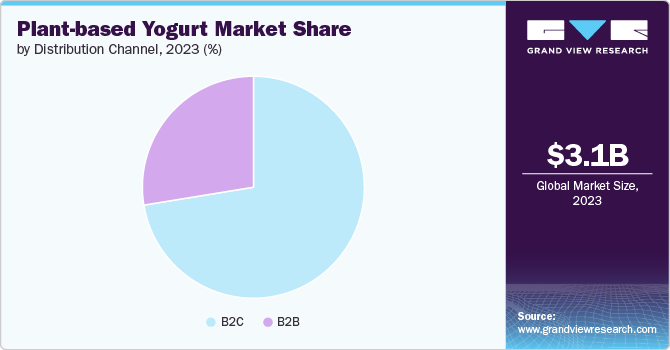

- By distribution channel, sales through Business to Consumers (B2C) accounted for the largest revenue share of 72.62% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 3.46 Billion

- 2030 Projected Market Size: USD 7.53 Billion

- CAGR (2025-2030): 14.1%

- Europe: Largest market in 2023

Environmental sustainability concerns, particularly regarding the carbon footprint of dairy production, have pushed environmentally conscious consumers towards plant-based alternatives. The expanding vegan and flexitarian population have significantly contributed to the market growth. Technological innovations have improved the taste, texture, and nutritional profile of plant-based yogurts, making them more appealing to a broader consumer base. Increased investment in research and development by food companies has resulted in a wider variety of flavors and bases (such as almond, soy, coconut, and oat), catering to diverse preferences.Consumers are increasingly seeking healthier alternatives to traditional dairy products due to concerns about lactose intolerance, dairy allergies, and the desire to reduce cholesterol intake. According to the National Institutes of Health, about 65% of the human population has a reduced ability to digest lactose after infancy, highlighting the need for lactose-free alternatives. Plant-based yogurts cater to these needs, offering a dairy-free option that is often lower in calories and saturated fats.

In addition to being lactose-free, many plant-based yogurts are fortified with probiotics, vitamins, and minerals, making them a nutritious option for consumers. The inclusion of probiotics is particularly appealing as it aligns with the growing awareness of gut health and its impact on overall well-being. Companies are offering probiotic plant-based yogurt. For instance, Lavva, an innovative Indian-inspired brand, crafts a distinctive probiotic-rich yogurt using a special combination of coconut milk and cashews.

Technological advancements in food processing and ingredient sourcing have played a crucial role in the growth of the plant-based yogurt market. Innovations in food technology have enabled manufacturers to improve the texture, taste, and nutritional profile of plant-based yogurts, making them more appealing to a broader audience. The development of advanced fermentation techniques and the use of high-quality plant-based proteins have resulted in products that closely mimic the creamy texture and tangy flavor of traditional dairy yogurt.

Furthermore, advancements in biotechnology have led to the production of novel plant-based ingredients that enhance the nutritional value of these products. For example, the use of pea protein and other plant-derived proteins has improved the protein content of plant-based yogurts, making them a viable option for consumers seeking protein-rich foods.The Coconut Collab, a UK-based brand specializing in coconut yogurt, released a new plant-based protein yogurt with 10g of protein per serving in July 2024. This yogurt is fortified with natural plant proteins from almond and soy and includes live cultures to aid gut health. It is also low in sugar, gluten-free, and made from ethically sourced coconuts.

Source Insights

Soy yogurt accounted for a revenue share of 36.06% in 2023. Soybeans are rich in protein, offering a nutritional profile comparable to dairy yogurt, which appeals to health-conscious consumers. Additionally, soy yogurt has a texture and taste that closely resembles traditional dairy yogurt, making it an easy switch for consumers transitioning to plant-based diets. The extensive availability and relatively low cost of soybeans also contribute to their dominance, allowing manufacturers to produce soy-based yogurt efficiently and economically.

The oat yogurt segment is expected to grow at a significant CAGR from 2024 to 2030, due to its broad appeal and rising popularity as a sustainable and allergen-friendly option. Oat-based products are perceived as more environmentally friendly since oats require less water and fewer resources to cultivate compared to nuts and soy. Additionally, oat yogurt caters to consumers with soy, nut, or dairy allergies, broadening its market reach. The smooth, creamy texture of oat yogurt also closely mimics that of dairy yogurt, enhancing its acceptance among consumers seeking plant-based alternatives without compromising on taste and consistency.

Flavor Insights

Flavored plant-based yogurt accounted for a revenue share of 75.30% in 2023 in the market, due to its immediate appeal to the taste preferences of a broad range of consumers. With a variety of flavors such as strawberry, blueberry, vanilla, and chocolate, these products attract those looking for a tasty and enjoyable alternative to dairy yogurt. The addition of fruit purees, natural sweeteners, and other flavorings enhances the overall sensory experience, making flavored yogurts a popular choice for snacks, breakfasts, and desserts. Furthermore, the convenience of pre-flavored options caters to busy lifestyles, providing a quick and satisfying option without the need for additional ingredients.

The non-flavored segment is expected to grow at a significant CAGR from 2024 to 2030. Health-conscious consumers and those with dietary restrictions often prefer plain yogurt as it typically contains fewer added sugars and artificial ingredients. The neutral taste of non-flavored yogurt allows for endless customization, making it a flexible ingredient in both sweet and savory dishes. Consumers can personalize their yogurt with fresh fruits, honey, nuts, or use it in cooking and baking, catering to a variety of culinary needs and preferences. Additionally, the growing awareness of clean eating and the demand for products with minimal processing and additives have propelled the popularity of non-flavored plant-based yogurt.

Distribution Channel Insights

Sales through Business to Consumers (B2C) accounted for the largest revenue share of 72.62% in 2023, due to the widespread availability of these products in retail outlets such as supermarkets, specialty food stores, and online platforms. B2C channels cater directly to individual consumers who purchase plant-based yogurts for personal use at home. This dominance is bolstered by increasing consumer awareness and accessibility to plant-based alternatives, driven by rising health consciousness, ethical considerations, and dietary preferences such as veganism. The convenience and variety offered through B2C channels make them a preferred choice for consumers seeking plant-based yogurt options that align with their lifestyle choices and dietary needs.

Business to business (B2B) segment is expected to grow at a significant CAGR from 2024 to 2030. This growth is driven by expanding adoption among food service providers, restaurants, bakeries, and institutional buyers who seek plant-based alternatives for use in food preparation and menu offerings. B2B channels offer bulk purchasing options, customized solutions, and partnerships that cater to the specific needs of food industry professionals.

The increasing demand for plant-based ingredients in commercial food production, coupled with efforts to meet consumer preferences for healthier and sustainable options, positions B2B channels for significant growth. As the food service industry continues to embrace plant-based trends and innovation, B2B distribution channels are expected to play a pivotal role in driving the expansion of plant-based yogurt products globally.

Regional Insights

North America market is expected to grow with a CAGR of 13.8% from 2024 to 2030. Consumers are increasingly seeking dairy-free options due to lactose intolerance, dairy allergies, and perceived health benefits of plant-based diets. The strong presence of health and wellness trends, including the rise of veganism and flexitarianism, particularly among millennials and Gen Z, is fueling market growth. Environmental concerns and animal welfare issues are also significant factors, with many consumers viewing plant-based options as more sustainable. The market benefits from continuous product innovation, with companies introducing new flavors, improving textures, and enhancing nutritional profiles to match or exceed dairy yogurts.

U.S. Plant-based Yogurt Market Trends

The market in the U.S. is expected to grow at a CAGR of 13.9% from 2024 to 2030. It's characterized by a diverse range of products, from soy and almond-based yogurts to newer varieties made from oats, coconuts, and cashews. Major dairy companies and specialized plant-based brands compete in this space, driving innovation and expanding consumer choice. The market has seen significant growth in retail presence, moving beyond health food stores to mainstream supermarkets and convenience stores. E-commerce has also played a crucial role in market expansion. Consumer demographics are diverse, but the market particularly appeals to health-conscious millennials, Gen Z, and families with children.

Europe Plant-based Yogurt Market Trends

The Europe market accounted for a revenue share of over 37.26% in 2023. The region has a long-standing tradition of dairy consumption, including yogurt, which has facilitated an easier transition to plant-based alternatives. European consumers are highly health-conscious and environmentally aware, driving demand for sustainable and nutritious options. The region also benefits from a robust regulatory framework supporting plant-based innovations and clear labeling practices. Many European countries, particularly in Northern and Western Europe, have a high percentage of lactose-intolerant individuals, further boosting the market. Additionally, European food companies have been at the forefront of plant-based product development, offering a wide variety of high-quality, innovative plant-based yogurts that cater to local tastes and preferences.

Asia Pacific Plant-based Yogurt Market Trends

The Asia Pacific market is expected to grow at a CAGR of 14.8% from 2024 to 2030. Rapid urbanization, increasing disposable incomes, and growing health awareness are driving consumers towards healthier food options. The region's large population base, particularly in countries like China and India, offers immense market potential. There's a rising prevalence of lactose intolerance among Asian populations, creating a natural demand for dairy alternatives. Additionally, the influence of Western dietary habits, coupled with local food companies innovating with familiar Asian flavors and ingredients, is making plant-based yogurts more appealing to local palates. Government initiatives promoting healthier diets and sustainability in countries like Singapore and China are also contributing to market growth.

Key Plant-based Yogurt Company Insights

The global market is characterized by the presence of numerous well-established and emerging players. Manufacturers are expanding their portfolios to include a wide variety of plant-based yogurts, such as almond, oat, coconut, soy, rice, hemp, and pea yogurt. By offering diverse options, they cater to different taste preferences, dietary needs, and allergy considerations. Furthermore, to compete with dairy yogurt, many plant-based yogurt manufacturers fortify their products with essential nutrients like calcium, vitamin D, vitamin B12, and protein. This ensures that their products meet consumers' nutritional needs and appeal to those looking for dairy yogurt alternatives.

Key Plant-based Yogurt Companies:

The following are the leading companies in the plant-based yogurt market. These companies collectively hold the largest market share and dictate industry trends.

- Danone

- Hain Celestial

- General Mills Inc.

- Stonyfield Farm, Inc.

- Kite Hill

- Daiya Foods Inc

- Chobani, LLC

- Hudson River Foods

- Good Karma Foods, Inc.

- NANCY’S

Recent Developments

-

In February 2024, Danone Canada's Silk brand introduced its new protein-rich plant-based yogurt, which incorporates Canadian pea protein. Each 175g serving contains 12g of protein and boasts a thick, Greek-style texture. The new product is available in Key Lime and Vanilla flavors, offering excellent taste, consistency, and nutritional value. Additionally, Silk has updated the recipe for its existing coconut-based yogurts and introduced new flavors and sizes to the line.

-

In October 2023, Marvelous Foods introduced its new Yeyo plant-based coconut yogurt products at Ole supermarkets. Ole, a boutique supermarket brand owned by China Resources Vanguard, is China's largest premium supermarket chain, operating 100 stores in 31 major cities and boasting more than 10 million registered members. Yeyo yogurt will initially be available at Ole stores in Beijing.

-

In April 2022, MISTA, an innovation platform headquartered in San Francisco, launched its inaugural member-co-created product: a high-performance plant-based yogurt base. This yogurt base is the result of collaboration among AAK, Givaudan, Chr. Hansen, and Ingredion, Inc. It integrates various technologies, including plant-based fava and pea proteins from Ingredion, flavor masking and protein binder solutions from Givaudan, and texturizing cultures from Chr. Hansen that enhance the performance of proteins and starches, resulting in a pleasing mouthfeel. Additionally, AAK contributes a functional blend of fats that imparts a dairy-like taste to the yogurt.

Plant-based Yogurt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.89 billion

Revenue forecast in 2030

USD 7.53 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

7.6Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Danone; Hain Celestial; General Mills Inc.; Stonyfield Farm, Inc.; Kite Hill; Daiya Foods Inc; Chobani, LLC; Hudson River Foods; Good Karma Foods, Inc.; NANCY’S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Yogurt Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plant-based yogurt market report based on source, flavor, distribution channel, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Almond

-

Oat

-

Soy

-

Coconut

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored Yogurt

-

Non-Flavored Yogurt

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Frequently Asked Questions About This Report

b. The global plant-based yogurt market size was estimated at USD 3.08 billion in 2023 and is expected to reach USD 3.46 billion in 2024.

b. The global plant-based yogurt market is expected to grow at a compounded growth rate of 13.9% from 2024 to 2030 to reach USD 7.53 billion by 2030.

b. Soy yogurt accounted for a largest revenue share of 36.1% in 2023. Soybeans are rich in protein, offering a nutritional profile comparable to dairy yogurt, which appeals to health-conscious consumers. Additionally, soy yogurt has a texture and taste that closely resembles traditional dairy yogurt, making it an easy switch for consumers transitioning to plant-based diets. The extensive availability and relatively low cost of soybeans also contribute to their dominance, allowing manufacturers to produce soy-based yogurt efficiently and economically.

b. Some key players operating in plant-based yogurt market include Danone; Hain Celestial; General Mills Inc.; Stonyfield Farm, Inc.; Kite Hill; Daiya Foods Inc; Chobani, LLC; Hudson River Foods; Good Karma Foods, Inc.; NANCY’S

b. The plant-based yogurt market is primarily driven by increasing health consciousness among consumers, growing awareness of environmental sustainability, and rising prevalence of lactose intolerance and dairy allergies. Technological innovations have improved the taste, texture, and nutritional profile of plant-based yogurts, making them more appealing to a broader consumer base.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.