- Home

- »

- Medical Imaging

- »

-

Photoacoustic Imaging Market Size, Industry Report, 2030GVR Report cover

![Photoacoustic Imaging Market Size, Share & Trends Report]()

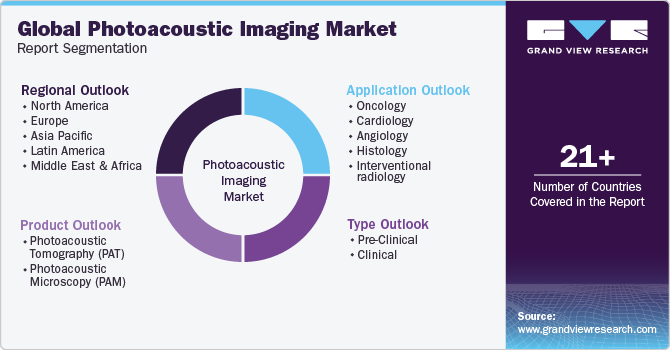

Photoacoustic Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Photoacoustic Tomography (PAT), Photoacoustic Microscopy (PAM)), By Imaging Type (Pre-clinical, Clinical), By Application (Oncology, Cardiology), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-804-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Photoacoustic Imaging Market Summary

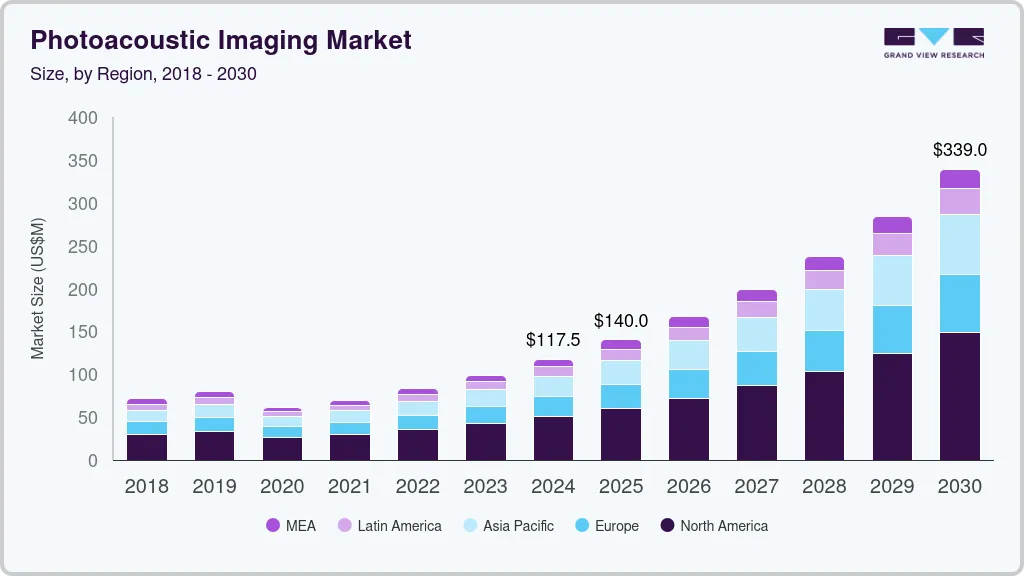

The global photoacoustic imaging market size was estimated at USD 117.5 million in 2024 and is projected to reach USD 339.0 million by 2030, growing at a CAGR of 19.4% from 2025 to 2030. The growth of the market is driven by the increasing incidence of cancer, primarily breast cancer, and rising research studies in non-ionizing radiation for imaging.

Key Market Trends & Insights

- North America photoacoustic imaging market dominated the global market with the largest revenue share of 35.7% in 2024.

- The photoacoustic imaging market in the U.S. led North America and held the largest revenue share in 2024.

- By imaging type, the pre-clinical segment led the global photoacoustic imaging industry and held the largest revenue share of 78.2% in 2024.

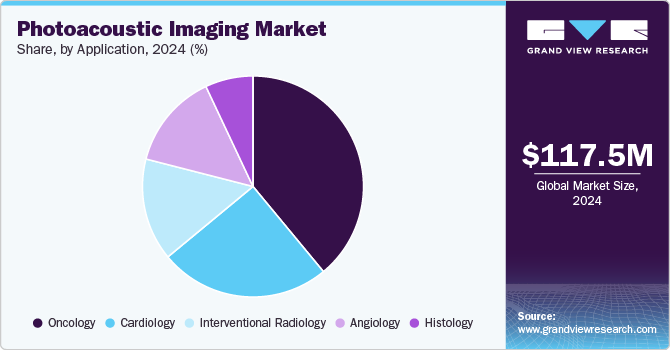

- By application, the oncology segment held the dominant position in the market, with the highest revenue share of 39.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 117.5 Million

- 2030 Projected Market Size: USD 339.0 Million

- CAGR (2025-2030): 19.4%

- North America: Largest market in 2024

In addition, the growing scope of applications is equally contributing to the market expansion. Furthermore, photoacoustic imaging (PAI) is superior to other diagnostic imaging systems as it uses non-ionizing radiation to examine tissues in real-time with high resolution and contrast at long penetration depths, allowing morphological, functional, and molecular imaging of living subjects. Photoacoustic imaging (PAI) represents a sophisticated technique in biomedical imaging that operates without invasive procedures. This method generates ultrasonic waves when pulsed laser light is directed at the tissue, allowing for the reconstruction of images based on how light energy is absorbed within the tissue. The market for photoacoustic imaging is currently experiencing substantial growth, largely due to the rising incidence of chronic illnesses, including cancer, cardiovascular diseases, and neurological disorders. For example, projections from the American Cancer Society indicate that breast cancer will remain a critical health issue in the U.S., with an estimated 310,720 new cases of invasive breast cancer and 56,500 cases of ductal carcinoma in situ (DCIS) anticipated in 2024. This alarming statistic highlights the need for precise and timely diagnostic methods to enhance patient outcomes. Photoacoustic imaging stands out by delivering high-resolution, real-time images that merge the advantages of optical imaging with ultrasound's depth penetration capabilities.

Technological innovations such as research and development in photoacoustic imaging systems aim to enhance their resolution, sensitivity, and clinical utility, which are anticipated to boost product demand over the forecast period. Optical and ultrasonic imaging advantages are combined in near-infrared photoacoustic imaging (NIR-PAI), which delivers high-resolution anatomical and functional information about tissues. PAI offers a unique combination of structural and functional information, making it valuable for early disease detection and monitoring.

Furthermore, the growth of the photoacoustic imaging market is also fueled by increasing investments in healthcare infrastructure. Both government and private sectors are channeling significant resources into improving healthcare facilities, especially in emerging markets. These investments cover many healthcare needs, from building new medical facilities to acquiring cutting-edge diagnostic technologies such as photoacoustic imaging systems. In many developing regions, there is a concentrated effort to enhance medical infrastructure to meet the rising demand for superior healthcare services and advanced diagnostic capabilities.

Product Insights

The photoacoustic tomography (PAT) segment dominated the market and accounted for the largest revenue share of 65.0% in 2024. PAT is the most adaptable and open-ended photoacoustic imaging method since it has the fewest real-world limitations on picture performance. In addition, PAT technology has improved quickly in terms of spatial resolution, frame rates, and detection sensitivity. PAT has had several potential clinical uses, and its use in primary biological sciences has substantially increased. Furthermore, due to its unique combination of optical absorption contrast and scalable depth and resolution ultrasound imaging, PAT is also projected to have more useful applications in biological research and clinical practice.

The photoacoustic microscopy (PAM) segment is expected to grow at a CAGR of 18.3% over the forecast period. PAM provides anatomical, functional, and molecular information and has become a more common biomedical technique. Unlike pure optical microscopic methods, PAM uses tissue’s weak acoustic scattering to overcome the optical diffusion limit. In addition, PAM’s scalability allows it to produce high-resolution images at specified maximum imaging depths of a few millimeters. Even though PAM has been commercialized for preclinical applications, the future commercialization of clinical applications will significantly accelerate PAM’s translation from laboratory technology to mainstream imaging modality.

Imaging Type Insights

The pre-clinical segment led the global photoacoustic imaging industry and held the largest revenue share of 78.2% in 2024. PAI is an efficient, non-invasive, non-ionizing tool used in pre-clinical studies to characterize small animals, such as mice or rats, without harming them. Characterization of small-animal models of brain damage and disease processes, especially those requiring the study of vascular anatomy and function, such as stroke, epilepsy, and traumatic brain injury, is possible. Furthermore, the widespread use of PAI in the research platform to investigate human disease processes and develop new therapies is expected to promote market growth.

The clinical segment is expected to grow at a CAGR of 20.6% over the forecast period, due to the growing scope of applications in clinical studies. The PAI modality can be used in diagnostic imaging using endogenous contrast between different tissues; also, it is well-suited for visualizing foreign objects, such as stent needles, as metals or composite materials have a high absorption coefficient. The rate of advancement toward clinical application in oncology, dermatology, cardiovascular medicine, and other specialties is anticipated to accelerate the market growth.

Application Insights

The oncology segment held the dominant position in the market, with the highest revenue share of 39.3% in 2024. In oncology, breast cancer imaging is a potentially significant clinical application for PAI. In addition, breast imaging is the most advanced PAI technique in terms of clinical use, with benefits such as non-contrast imaging of the neo-vasculature around a tumor and oxygen saturation mapping. Furthermore, the increasing prevalence of cancer, advancements in imaging technology that enhance diagnostic capabilities, and the ability of photoacoustic imaging to provide high-resolution, real-time insights into tumor characteristics. Moreover, its integration with existing imaging modalities supports improved patient outcomes and personalized treatment strategies.

The cardiology segment is expected to grow at a CAGR of 20.3% from 2025 to 2030, owing to an increased burden on cardiovascular disorders globally. Accurate diagnosis and real-time interventional guidance are essential for effective management and treatment of CVDs. In addition, PA imaging is a promising novel imaging technology with therapeutic applications in cardiology since it is intrinsically bonded to and complementary to ultrasound imaging. Furthermore, deep learning (DL) techniques have become more popular as GPU capacity increases.

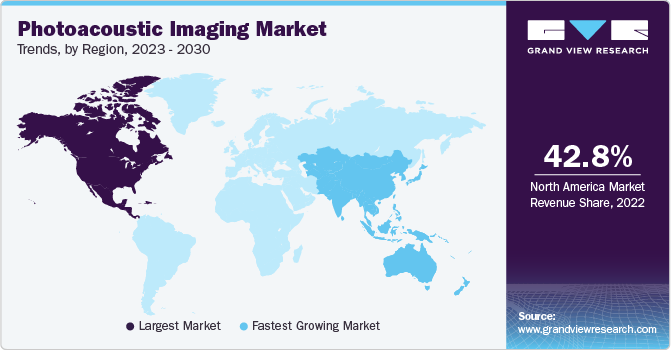

Regional Insights

North America photoacoustic imaging market dominated the global market with the largest revenue share of 35.7% in 2024. This growth can be attributed to the existence of several market competitors in the region and the increasing number of cancer cases. For instance, as per the National Cancer Institute, an estimated 1,958,310 new cancer cases in the U.S. will be diagnosed in 2023. In addition, improved funding has boosted the region’s research activities. The U.S. spends the most per capita on healthcare and has the largest funds and grants available for research through government agencies, such as the National Institutes of Health (NIH).

U.S. Photoacoustic Imaging Market Trends

The photoacoustic imaging market in the U.S. led North America and held the largest revenue share in 2024, driven by a robust research and development ecosystem. Increasing adoption of advanced imaging technologies, particularly in oncology and neurology, enhances diagnostic capabilities. Furthermore, the presence of well-established regulatory frameworks supports innovation and market entry. In addition, rising funding for biomedical imaging research, coupled with strategic collaborations between academic institutions and industry leaders, fosters advancements. Moreover, the growing prevalence of chronic diseases and heightened demand for early disease detection further propel the market's expansion.

Asia Pacific Photoacoustic Imaging Market Trends

Asia Pacific photoacoustic imaging market is expected to grow at a CAGR of 20.4% over the forecast period, owing to improvements in healthcare infrastructure and continuous regulatory advancements create a favorable environment for technological adoption. In addition, the increasing demand for minimally invasive surgical procedures drives innovation in imaging techniques. Furthermore, rising investments from both public and private sectors enhance research capabilities and manufacturing activities. Moreover, the growing focus on early diagnosis and treatment of diseases contributes significantly to the expansion of the photoacoustic imaging market in this diverse region.

The photoacoustic imaging market in China led the Asia Pacific market and held the largest revenue share in 2024, primarily driven as it capitalized on emerging opportunities within the healthcare sector. In addition, the government’s increased investment in research and development plays a pivotal role in advancing medical technologies. Furthermore, a rising focus on healthcare improvements and growing awareness of early disease detection drives demand for innovative imaging solutions. Moreover, collaborations between domestic companies and international firms enhance technological capabilities.

Europe Photoacoustic Imaging Market Trends

Europe photoacoustic imaging market is expected to grow significantly over the forecast period, owing to the increasing demand for non-invasive, high-resolution imaging techniques enhances patient care and diagnostic accuracy. In addition, technological advancements in laser and ultrasound technologies contribute to improved imaging capabilities. Furthermore, the rising prevalence of chronic diseases necessitates innovative diagnostic tools. The integration of artificial intelligence into imaging processes further enhances efficiency and accuracy. Moreover, ongoing research in molecular imaging also supports the growth of photoacoustic applications across various clinical fields within Europe.

The growth of the photoacoustic imaging market in Germany is expected to be driven by a strong emphasis on advanced medical technologies. The country's commitment to healthcare infrastructure development supports the adoption of innovative imaging solutions. In addition, increasing demand for precise diagnostics drives investment in research and development initiatives. Furthermore, strategic partnerships between universities and industry players foster collaboration and innovation within the sector. Rising awareness of the benefits of early disease detection contributes to market expansion.

Key Photoacoustic Imaging Company Insights

The key players in the global photoacoustic imaging industry include Advantest Corp., TomoWave, Kibero GmbH, and others. These companies are improving their offerings by upgrading their products, leveraging important cooperative drives, and considering acquisitions and government approvals to increase their client base and gain a larger global industry share.

-

TomoWave Laboratories manufactures optoacoustic tomography and laser ultrasound systems for functional, molecular, and anatomical imaging. Primarily focused on cancer detection, TomoWave operates in both preclinical research and clinical applications, emphasizing non-invasive breast imaging and monitoring thermal therapies.

-

Kibero GmbH manufactures advanced systems for photoacoustic tomography, which are utilized in various medical applications, including oncology and vascular imaging. Kibero's focus on integrating cutting-edge technology positions it prominently within the biomedical imaging market, catering to research and clinical environments.

Key Photoacoustic Imaging Companies:

The following are the leading companies in the photoacoustic imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Advantest Corp.

- TomoWave

- Kibero GmbH

- FUJIFILM VisualSonics Inc.

- Seno Medical Instruments

- iThera Medical GmbH

- Aspectus GmbH

- Vibronix Inc.

Recent Developments

-

In November 2024, Seno Medical's Imagio Breast Imaging System, utilizing photoacoustic imaging, secured an Innovative Technology contract from Vizient, Inc. The Imagio system, which integrates ultrasound, opto-acoustic technology, and AI, aids in differentiating between benign and malignant breast lesions. This non-invasive system doesn't require radiation or breast compression. CEO Tom Umbel expressed honor at the designation, emphasizing the system's potential to improve patient care. Vizient's program recognizes technologies poised to enhance clinical outcomes and healthcare operations, highlighting the promise of photoacoustic imaging in breast cancer diagnostics.

-

In August 2023, TomoWave introduced the LOIS-3D, a Laser Optoacoustic Imaging System, marking a leap in small animal imaging for preclinical research. This system offers detailed images with high resolution. Unlike traditional methods such as X-ray and MRI, LOIS-3D integrates photoacoustic imaging to provide functional information about blood content and tissue composition. This technology combines light and sound to enable researchers to "see" through the body, enhancing the accuracy of disease diagnosis and treatment monitoring through photoacoustic imaging.

Photoacoustic Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.0 million

Revenue forecast in 2030

USD 339.0 million

Growth rate

CAGR of 19.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, imaging type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Advantest Corp.; TomoWave; Kibero GmbH; FUJIFILM VisualSonics Inc.; Seno Medical Instruments; iThera Medical GmbH; Aspectus GmbH; Vibronix Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Photoacoustic Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global photoacoustic imaging market report based on product, imaging type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Photoacoustic Tomography (PAT)

-

Photoacoustic Microscopy (PAM)

-

-

Imaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Clinical

-

Clinical

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Angiology

-

Histology

-

Interventional Radiology

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.