- Home

- »

- Healthcare IT

- »

-

Pharmacovigilance Market Size, Share, Industry Report 2030GVR Report cover

![Pharmacovigilance Market Size, Share & Trends Report]()

Pharmacovigilance Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Life Cycle, By Service Provider (In-house, Contract Outsourcing), By Type, By Therapeutic Area, By Process Flow, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-327-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacovigilance Market Summary

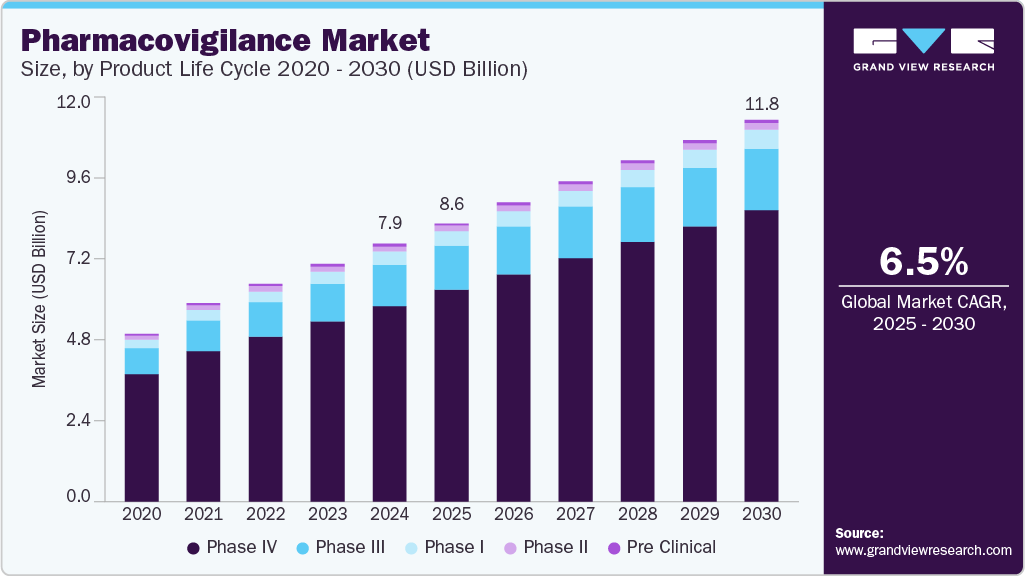

The global pharmacovigilance market size was estimated at USD 7.95 billion in 2024 and is projected to reach USD 11.78 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The rising incidence of Adverse Drug Reactions (ADRs) owing to drug abuse and the prevalence of diseases that require a combination of drugs are the major growth drivers for the market.

Key Market Trends & Insights

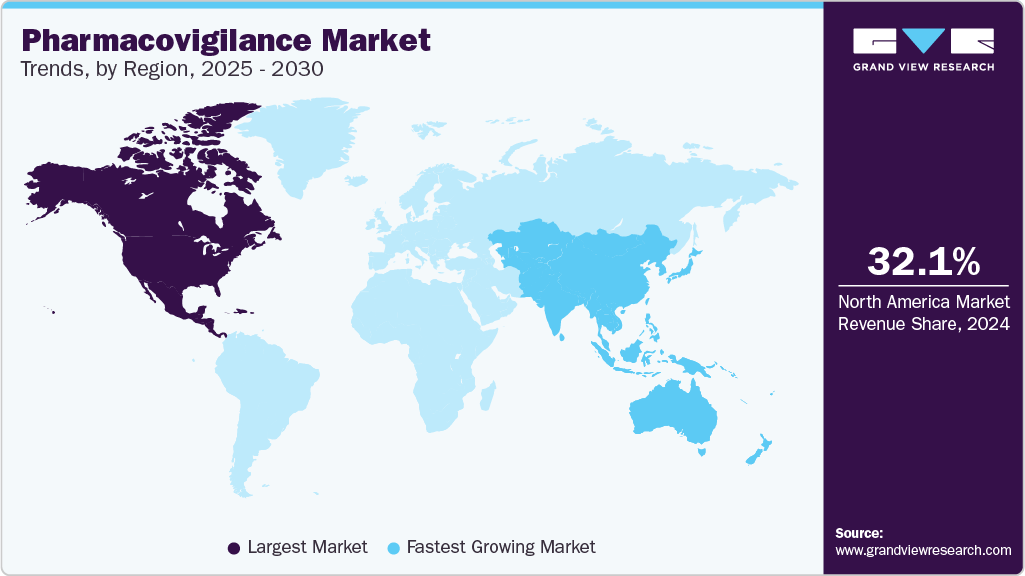

- North America dominated the pharmacovigilance market in 2024 and held the largest revenue share of over 32.11%.

- The pharmacovigilance industry in the U.S. held the dominant share owing to a high incidence of Adverse Drug Reactions (ADRs) in this region due to high drug consumption.

- By product, the phase IV (post-marketing) segment dominated the overall pharmacovigilance market in the product life cycle segment with over 75.90% revenue share in 2024.

- By service provider the contract outsourcing segment held the largest market share in 2024.

- By installation, the spontaneous reporting segment dominated the pharmacovigilance market in 2024 with the largest share.

Market Size & Forecast

- 2024 Market Size: USD 7.95 Billion

- 2030 Projected Market Size: USD 11.78 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, an upward shift in the production of novel drugs and the presence of stringent government regulatory frameworks for drug safety are significantly boosting the market growth. For instance, the U.S. FDA and the EU’s European Medicines Agency (EMA) formulate regulatory guidelines for all phases of clinical trials. Moreover, advancements in the development of ADR databases and information systems have enabled accurate reporting of information, which can be further utilized by research professionals for prospective clinical studies, thereby fueling overall growth. Drug consumption has increased substantially owing to the growing prevalence of diseases. The rising incidence of chronic diseases, such as cancers, diabetes, and cardiovascular & respiratory disorders, has increased drug consumption worldwide. According to a WHO report on pharmaceutical consumption, medicines to treat chronic diseases accounted for a larger proportion of the total volume of drug consumption in nonhospital settings. In addition, the global use of medicines has increased by 414 billion defined daily doses (DDD) over the past five years and is projected to rise by another 400 billion DDD by 2028. This surge in medication consumption highlights the growing need for robust pharmacovigilance systems to monitor drug safety and efficacy across diverse populations and therapeutic areas.

The increasing incidence of ADR and drug toxicity is fueling the growth of the pharmacovigilance industry. According to the National Center for Biotechnology Information (NCBI), approximately 5% of total hospitalizations in a year are due to ADR in Europe. Furthermore, a February 2022 article published in the Journal of Current Medicine Research and Practice titled "Characterization of Seriousness and Outcome of Adverse Drug Reactions in Patients Receiving Cancer Chemotherapy Drugs - A Prospective Observational Study" revealed that serious Adverse Drug Reactions (ADRs) in the U.S. result in over 100,000 deaths annually and have been a major health concern since the past decade.

Furthermore, an increasing trend of outsourcing PV services is observed in the pharmaceutical industry. Some of the services that are outsourced are medical writing, clinical trial data collection, medical reporting, and other PV services. Manufacturers are now striving to identify various ways to reduce costs and minimize operational expenses by gradually shifting from being fully integrated pharmaceutical companies to sharing costs by collaborating with other service providers.

Outsourcing can improve internal resource flexibility, timelines, and short- & long-term- term outcomes. It also helps achieve better pharmacovigilance through regulatory compliance, higher quality, improved productivity, and strategic outcomes. According to a blog by Veeva Systems published in February 2021, small biotech and pharma companies often lack in-house safety knowledge and capabilities. Modern PV applications allow companies to outsource safety services without losing control or visibility of the data, providing greater transparency & collaboration between pharma companies and service providers or CROs.

The COVID-19 pandemic had a significant impact on the pharmacovigilance (PV) market. While it introduced significant uncertainty and volatility across the pharmaceutical, biotechnology, and medical device industries, prompting companies to optimize resource allocation, it also brought certain opportunities for the pharmacovigilance sector. On the negative side, the pandemic disrupted clinical trial operations, particularly in medical device R&D, due to social distancing measures, delayed or cancelled trials, and challenges in patient recruitment.

However, the heightened public health emergency stimulated a shift toward decentralized clinical trials and amplified the importance of robust adverse event reporting. Regulatory bodies such as the U.S. FDA, UK MHRA, and EMA issued guidelines emphasizing the need for vigilant post-marketing surveillance, especially in COVID-19 vaccines. This increased the demand for advanced PV solutions. In addition, the urgency of vaccine development catalyzed R&D investments in the biotech sector, with the OECD noting continued growth in life sciences R&D even in broader economic disruption. Overall, while the pandemic posed operational challenges, it also elevated the strategic importance of pharmacovigilance in ensuring patient safety and regulatory compliance.

Artificial Intelligence (AI) in Pharmacovigilance Market

Artificial Intelligence (AI) is transforming pharmacovigilance by enhancing safety monitoring processes' efficiency, accuracy, and scalability. Traditionally, labor-intensive tasks such as adverse event (AE) case intake, triage, coding, assessment, and reporting are being automated using AI-driven tools. Natural language processing (NLP) enables the extraction of relevant safety information from unstructured data sources like clinical notes, social media, and literature, while machine learning (ML) models help detect patterns and predict potential safety signals earlier than conventional methods. Such advantages of AI in pharmacovigilance are driving key players to offer AI-based pharmacovigilance solutions.

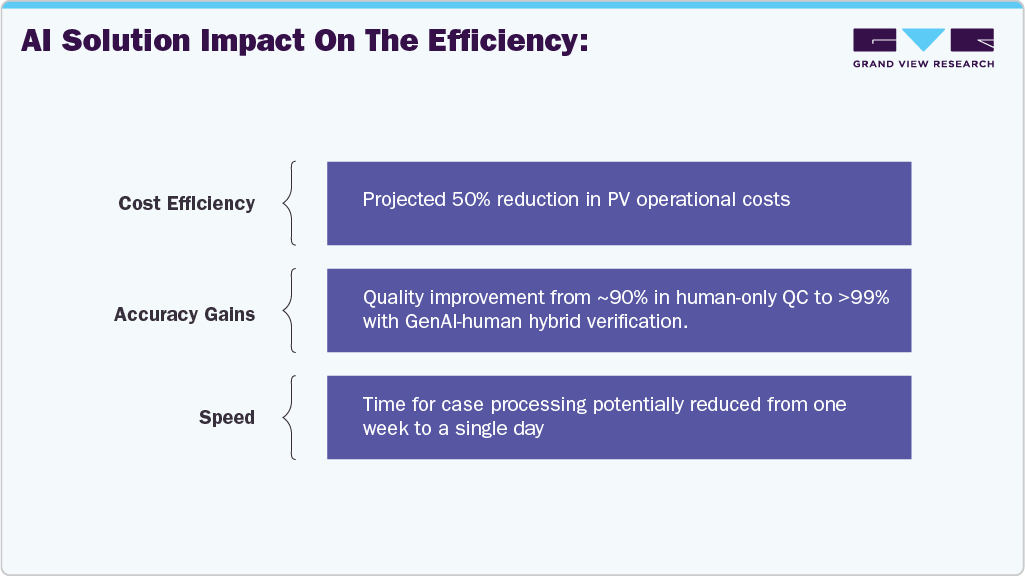

For instance, in March 2025, Tech Mahindra launched an agentic AI-powered pharmacovigilance solution in collaboration with NVIDIA. This solution leverages the TENO framework and NVIDIA’s AI Enterprise suite to automate core PV functions, including case processing, quality control, and regulatory compliance. The system uses LLM-powered agents to classify and prioritize AE reports, delivering a 40% reduction in turnaround time, 30% improvement in data accuracy, and 25% cost savings, demonstrating the real-world impact of AI in advancing drug safety.

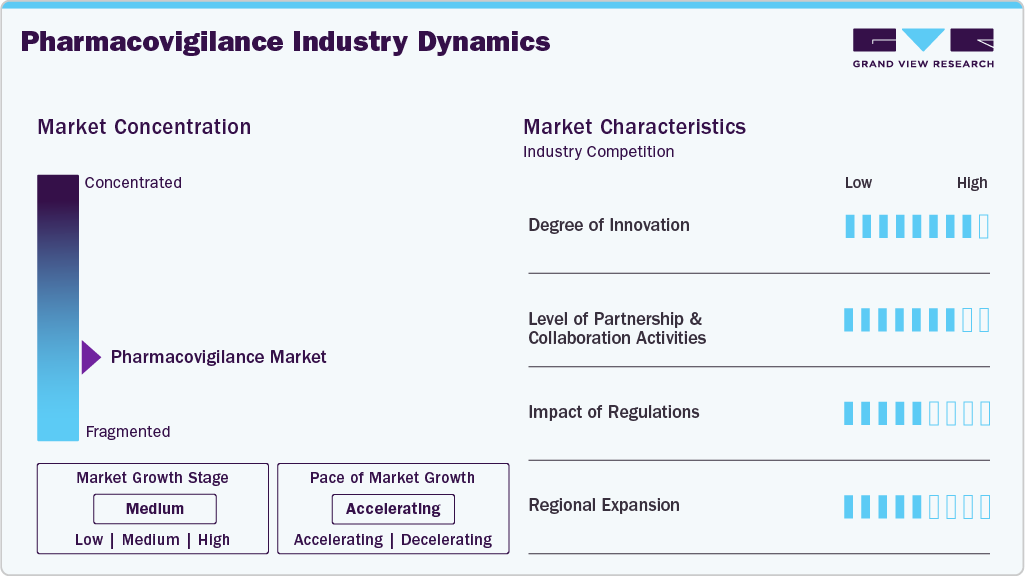

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the pharmacovigilance market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the pharmacovigilance industry is high. The market is witnessing increased innovation, incorporating big data analytics, cloud-based solutions, artificial intelligence, automation, and digitalized medicines. Integrating analytical techniques and big data is poised to propel traditional pharmacovigilance practices forward. Future developments include the creation of algorithms for signal detection from various sources, with AI technologies revolutionizing PV science through intelligent signal evaluation.

The level of partnerships & collaboration activities by key players in the pharmacovigilance market is medium to high to increase their capabilities, expand product portfolios, and improve competencies. For instance, in January 2023, IQVIA announced a collaboration with Alibaba Cloud, an intelligence and digital technology arm of Alibaba Group. This collaboration aims to deliver commercial clinical solutions in the Chinese market.

"Through this new partnership between IQVIA and Alibaba Cloud, Salesforce life sciences customers will be able to better serve their customers, and patients, in China.”

-LaShonda Anderson-Williams, Executive Vice President & Chief Revenue Officer, Healthcare & Life Sciences, Salesforce.

The impact of regulations on the market is high. In the U.S., regulatory oversight is managed by the U.S. Department of Health and Human Services and the FDA. The U.S. FDA, in conjunction with the Center for Biologics Evaluation and Research (CBER) and Center for Drug Evaluation and Research (CDER), monitors pharmacovigilance activities. The escalating demand for pharmacovigilance solutions for adverse drug reaction (ADR) reporting is anticipated to intensify regulatory compliance pressures on healthcare providers throughout the forecast period.

The industry's level of regional expansion is moderate. Regional expansion has become a key growth strategy for pharmaceutical and biotechnology companies in the pharmacovigilance market, significantly broadening patient access, driving revenue, and diversifying product portfolios. For instance, inSeptember 2022Parexel announced opening of clinical trials logistics and supplies depot in China.

Case Study: IQVIA's AI-Driven Transformation In Pharmacovigilance

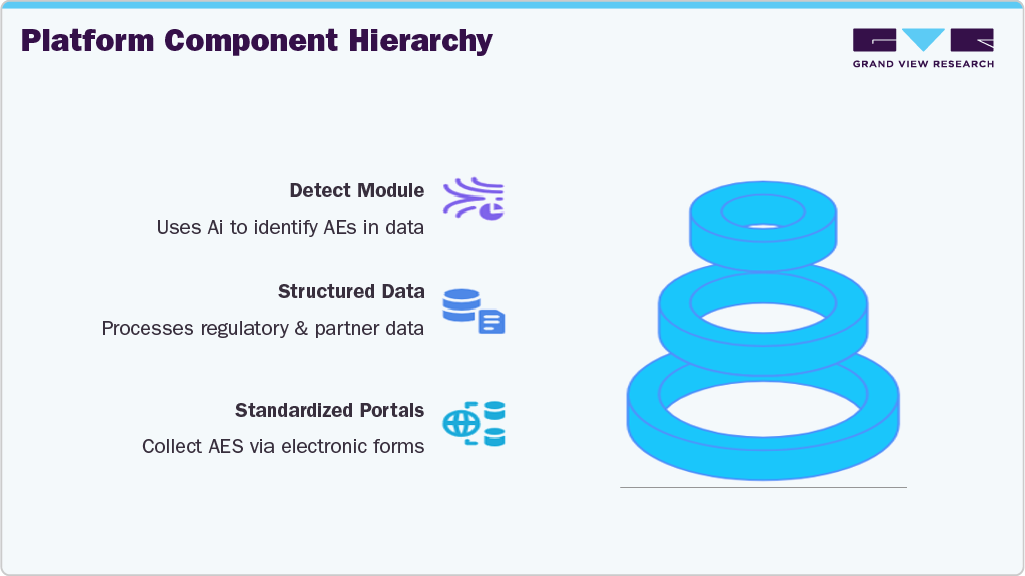

Background: Pharmacovigilance (PV), the practice of monitoring the effects of medical drugs after they have been licensed for use, is a critical and highly regulated function in the pharmaceutical industry. Traditional PV processes are labor-intensive, costly, and often hindered by the variability in data quality and format. IQVIA, a global leader in health information technologies and clinical research, is redefining this landscape through the strategic integration of generative AI and modular automation.

Challenge: Pharmaceutical companies typically face significant bottlenecks in adverse event (AE) case processing. Despite advancements in techniques like natural language processing, manual workflows still dominate and can take up to a week per case. Compounding the issue are disparate data sources, including socials media, medical call centers, structured reports from partners, and digital forms - all of which must be processed under strict regulatory scrutiny. Large pharma firms often navigate thousands of reporting rules across hundreds of global partners.

Solution: IQVIA's AI-Powered Vigilance Platform

IQVIA’s vision, led by Uwe Trinks, Ph.D., is to reduce PV costs by 50% while improving data quality to above 99%. The cornerstone of this transformation is the IQVIA Vigilance Platform - a closed, secure ecosystem modularized into AI- and code-driven components (“bubbles”) that efficiently handle data collection, detection, and reporting.

AI Integration Strategy: IQVIA has adopted a hybrid AI model, applying generative AI where it adds the most value - such as in unstructured data extraction and multilingual translation - while continuing to use traditional coded logic for standardized, repetitive tasks like regulatory reporting. The platform incorporates multiple international data standards including MedDRA, SNOMED, and the FDA Drug Database. A confidence scoring system (color-coded) helps prioritize human review based on AI certainty, focusing manual oversight only on ambiguous or complex cases.

Ongoing Development and Vision While some components like the 'Detect' module are already operational, others - such as modules for case assessment, validity checking, and causality - are under pilot testing. IQVIA is pursuing a phased rollout strategy to ensure continuous system improvement and robust governance.

Product Life Cycle Insights

Phase IV (post-marketing) segment dominated the overall pharmacovigilance market in the product life cycle segment with over % revenue share in 2024. The phase IV trial is crucial in the entire clinical trial process, as unsuspected ADRs can be detected in this stage. This can be attributed to intensive drug testing on a large patient demographic of the highest relevance post the drug commercialization. A phase IV study is conducted on a nonmedicated population. Some examples of phase clinical studies are:

-

Investigation of subsets of drugs indicated for approved patient groups.

-

Market research studies of competitor drugs

-

Demographically specific studies in comparison to another drug or treatment

-

Investigation of a specific AE that has occurred after commercialization

The Phase III segment is projected to witness growth at a lucrative CAGR during the forecast period. Phase III trials are conducted to specify and establish drug efficacy. These trials provide supplementary information about drug safety, possible drug interactions, and pre-commercialization effectiveness. In addition, players operating in the segment are undertaking strategic initiatives to integrate effective trial management practices in drug development and trials. For instance, in June 2022, Florence Healthcare raised USD 27 million to support the expansion of its technology platform to integrate the growing demand for clinical trials. These factors are anticipated to drive the segment over the forecast period.

Service Provider Insights

The contract outsourcing segment held the largest market share in 2024. The segment dominated the pharmacovigilance industry owing to the rapid entry of multiple Contract Research Organizations (CROs), which provide end-to-end clinical trial solutions, especially in key Asia Pacific economies of India, China, & Japan. The segment is anticipated to grow at the fastest CAGR over the forecast period, as contract outsourcing partners offer a balanced and flexible solution within cost-contained models, ensuring overall quality. Pharmacovigilance outsourcing now encompasses intricate tasks, including benefit-risk management, signal detection, pharmacoeconomics, and comprehensive risk management planning.

Type Insights

Spontaneous reporting segment dominated the pharmacovigilance market in 2024 with the largest share, owing to its wide-scale usage in detecting new, serious, and rare ADRs efficiently & affordably. The growing use of surveillance reports developed through this procedure by regulatory authorities and pharmaceutical industries is responsible for the significant market share of spontaneous reporting.

The targeted spontaneous reporting segment is anticipated to witness a lucrative CAGR during the forecast period, owing to the rising government initiatives to incorporate reporting methodologies other than spontaneous reporting by the European Network of Centers for Pharmacoepidemiology and Pharmacovigilance (ENCePP). Associated benefits such as greater affordability, lower labor costs, feasibility in poor resource settings, and usage in routine monitoring are expected to drive the demand over the forecast period. These factors are contributing to the steady growth of this segment.

Therapeutic Area Insights

The oncology segment dominated the pharmacovigilance market, with a share of 27.14% in 2024. It is also expected to be the fastest-growing segment over the forecast period. Pharmacovigilance in oncology refers to the specialized monitoring and assessment of safety data related to anticancer drugs and therapies. It involves the systematic collection and analysis of adverse events specific to oncology patients, identification of potential drug-related risks, and proactive risk management strategies to ensure cancer treatments' safe and effective use.

An increasing number of research activities undertaken by various biopharmaceutical firms for cancer treatments and the rising government support to improve the living conditions of people living with cancer are propelling the research activities is anticipated to accelerate the need for pharmacovigilance in clinical research activities. For instance, the White House in 2023 announced an ambitious project to reduce the death rate of Cancer by at least 50.0% in the next 25 years. In addition, USD 2 billion was granted for R&D purposes in the Cancer Moonshot initiative, which will support clinical, laboratory, public health, and other areas for cancer treatment. These factors are responsible for the growth and dominance of the segment during the forecast period.

The cardiology segment is expected to grow significantly in the pharmacovigilance industry over the forecast period, owing to the increasing incidence of cardiac disorders and continuous developments in designing new treatment options. According to the CDC, heart disease is a leading cause of death in the U.S., with about 702,880 deaths attributed to CVD in 2022, of which Coronary Heart Disease (CHD) caused the highest number of deaths (371,506). CHD accounts for a major economic burden on the U.S. economy. As per the CDC, the impact of the disease is expected to be greater than USD 818 billion by 2030.

Process Flow Insights

The signal detection segment held the largest revenue share in 2024. Signal detection refers to identifying various safety signals and actively searching for such signals across registries and plausible healthcare data sources. Regulators require biopharmaceutical firms to maintain spontaneous reporting systems, and most commonly, signals are generated from such systems. Furthermore, data for processes can be stored in databases maintained by the pharmaceutical firm, a technology partner, or a contract research organization. The signal source may vary from spontaneous reporting, interventional studies, and clinical & non-clinical studies to literature, social media, free text, etc.; thus, effective signal detection is important.

The as adverse event information can be produced from diverse modes such as spontaneous reports, clinical trials, post-marketing programs, and literature. In addition, emerging technologies such as artificial intelligence (AI) and machine learning are widely used for case data management. Some data management software includes repClinical, PvNET, Siebel Clinical, ClinSource, Oracle, and more.

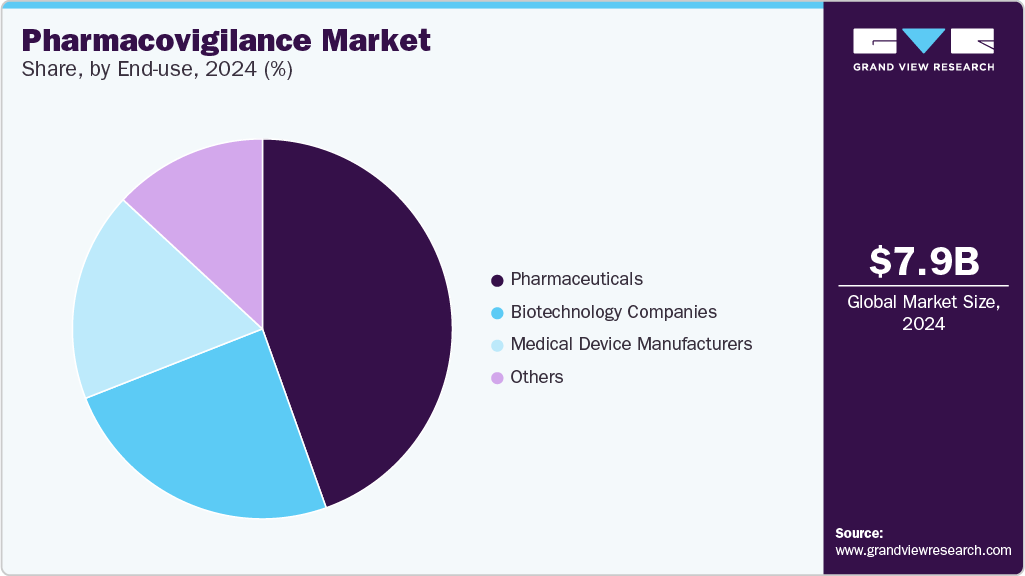

End Use Insights

The pharmaceuticals segment dominated the market with a revenue share in 2024. Pharmacovigilance enables pharmaceutical firms to limit drug development costs, as it provides an early warning system. In addition, noncompliance with PV practices for patients in clinical trials can lead to financial troubles. For instance, as per an article published by Octalsoft in December 2023, nearly 15 to 40% of participants in a clinical trial drop out, creating heavy financial losses. In addition, the average cost to recruit a new candidate in a clinical trial due to noncompliance is estimated at USD 19,500.

The biotechnology companies segment is expected to grow at the fastest CAGR during the forecast period. Biotechnology firms prioritize the development of innovative products, such as novel therapies, biologics, and gene therapies. These products often leverage cutting-edge technologies and may target rare diseases or feature unique mechanisms of action. For instance, in December 2022, the U.S. FDA approved ADSTILADRIN biologic manufactured by Ferring Pharmaceuticals A/S. This biologic is indicated for use in adult patients with high-risk BCG-unresponsive non-muscle invasive bladder cancer. Such advancements are expected to propel the segment's growth over the forecast period.

Regional Insights

North America dominated the pharmacovigilance market in 2024 and held the largest revenue share of over 32.11%. This can be attributed to the presence of key pharmaceutical players in this region, which significantly contributes to the overall revenue generated by this region. The rise in drug abuse and associated ADRs is a leading cause of morbidity and mortality. The abovementioned elements act as high-growth rendering factors for North America's Pharmacovigilance (PV) market. Furthermore, growing patient awareness and concerns related to the safety of drugs are expected to impact the market positively.

U.S. Pharmacovigilance Market Trends

The pharmacovigilance industry in the U.S. held the dominant share owing to a high incidence of Adverse Drug Reactions(ADRs) in this region due to high drug consumption. The U.S. FDA implemented the Risk Evaluation and Mitigation Strategy (REMS) Act to unveil the potential risks associated with a drug following a series of drug safety-related events. After the implementation of this act, all manufacturers of drugs were required to submit REMS to the FDA. Drugs that fail to follow the REMS provision could be considered misbranded. Moreover, the U.S. FDA launched Sentinel Initiative in 2008, a national electronic system that tracks the safety of drugs and medical devices. Such factors are expected to fuel the market growth.

Europe Pharmacovigilance Market Trends

The pharmacovigilance industry in Europe is driven by stringent regulatory requirements, increasing drug development, and growing awareness of drug safety. According to WHO, in 2024, 7,152 clinical trials were registered, in Europe registering a decline compared to the previous year. In 2024, EudraVigilance implemented significant updates aimed at improving data quality and operational efficiency. These included stricter validation rules and clearer guidelines for report submissions, which likely led to reduced duplicate or erroneous reports and discouraged improper submissions. Furthermore, the growing demand for clinical trials and the need for novel drug development due to the geriatric population and an increasing number of pharmaceutical and biotechnology firms are the factors driving the market growth in the region.

The pharmacovigilance market in the UK is expected to grow over the forecast period due to the well-established healthcare system and increasing incidence of medication errors and ADRs. The increasing number of clinical trials and the Yellow Card Scheme by the UK government also contribute to market growth. The Medicines and Healthcare Products Regulatory Agency (MHRA) inspects MAHs and verifies compliance with UK PV regulations, conducting Good Pharmacovigilance Practice (GPvP) inspections.

The Germany pharmacovigilance marketheld the largest revenue share in 2024. The presence of government bodies, such as Deutsche Forschungsgemeinschaft (DFG), which is a German research funding organization that offers funds for clinical trials, is expected to further propel the market growth. The Federal Institute for Drug and Medical Devices (BfArM) has also launched a database UAW-DB, which publishes the suspected adverse effects of all drugs and active substances along with suspected cases of ADRs in Germany since 1995. This initiative is in line with BfArM’s plan to streamline the regulatory process in Germany. Such initiatives are expected to propel the industry growth in the coming years.

Asia Pacific Pharmacovigilance Market Trends

Asia Pacific is expected to witness lucrative growth in the pharmacovigilance industry over the forecast period. Asia offers a substantial cost-saving advantage, with savings ranging from 50% to 80% of the cost compared to developed nations, thus leading to an increase in the number of clinical trials being conducted in this region. Hence, the rise in demand for clinical trials has led to an increasing focus on PV and drug safety in the region. Along with India and China, Singapore, South Korea, and Taiwan are recognized as outsourcing hubs in Asia Pacific.

The pharmacovigilance market in China is the largest in the Asia Pacific region due to the increasing incidence of ADRs, rising healthcare expenditure, and favorable government initiatives. According to NMPA, around 97% of country-level regions reported ADR. Moreover, the presence of various nonprofit organizations, such as the Chinese Clinical Trial Registry (ChiCTR), which provides consultation for trial design, peer review for draft articles, etc., is contributing to the market growth in this region.

The India pharmacovigilance market is the fastest-growing market for PV services in Asia Pacific. The rising incidence of adverse drug reactions (ADRs) and heightened awareness among healthcare professionals contribute to market growth. For instance, in June 2024, India's Central Drugs Standard Control Organization (CDSCO) issued a draft guidance document for the industry on pharmacovigilance requirements for human vaccines. This guidance outlines the responsibilities of all stakeholders, including Marketing Authorization Holders, in vaccine safety monitoring, developing risk management plans, conducting audits and inspections, and periodically submitting a Risk Benefit Evaluation Report (PSUR) to the Licensing Authority. It highlights the necessity of continuous vigilance over vaccine products to ensure their safety and efficacy.

Latin America Pharmacovigilance Market Trends

The Latin America pharmacovigilance industry is growing significantly. The rising demand for PV centers in the Latin American region is expected to impact the market positively. About 16 countries in the region have set modalities for immediate adverse event reporting, and 10 countries are involved in developing stringent regulations and PV programs for periodic adverse event reporting. Increasing sponsorship and outsourcing by local companies for phase III and late-phase trials are also anticipated to contribute to growth prospects, resulting in cost-effectiveness.

Middle East & Africa Pharmacovigilance Market Trends

The pharmacovigilance industry in Middle East &Africais anticipated to witness steady growth over the forecast period, owing to the growing biopharmaceutical market, untapped opportunities pertinent to the entire clinical trial cycle, and a rise in supportive government initiatives. The lack of coordinated PV systems and the increasing need for efficient ADR reporting systems are positively impacting the overall market in this region. This is a result of illicit drug consumption, lack of a stringent regulatory framework, and low awareness.

Key Pharmacovigilance Company Insights

The pharmacovigilance market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling the market growth. For instance, In November 2022, Linical Americas (a U.S. subsidiary of The Linical Group) and Science 37 Holdings, Inc. announced a partnership to enable the deployment of hybrid and fully decentralized trials. This partnership will provide enhanced access to Linical’s offerings.

Key Pharmacovigilance Companies:

The following are the leading companies in the pharmacovigilance market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- IQVIA Inc.

- Cognizant

- Clinquest Group B.V. (Linical Americas)

- IBM

- Laboratory Corporation of America Holdings

- ArisGlobal

- Capgemini

- ITClinical

- ICON plc.

- TAKE Solutions Limited

- Parexel International (MA) Corporation

- Wipro

- United BioSource LLC

- BioClinica Inc. (Clario)

- ClinChoice (formerly FMD K&L)

Recent Developments

-

In April 2025, Parexel collaborated with Palantir to enhance clinical trial delivery. With this collaboration, Parexel will integrate Palantir’s Foundry and Artificial Intelligence Platform (AIP) into its clinical data systems to improve trial efficiency, data transparency, and accelerate time-to-market for new therapies.

“We're thrilled to expand our collaboration with Palantir - a leader in artificial intelligence technology - as we build on our application of AI to further improve clinical trial execution and advance our offerings in Real World Evidence, advanced analytics and Health Outcomes.”

- Jonathan Shough, Chief Information Officer for Parexel.

-

In March 2023, ICON plc and LEO Pharma announced partnerships to accelerate the execution of clinical trials in the medical dermatology space.

“We’ve been exploring several outsourcing models but found a hybrid sourcing model to be the most efficient. Partnering with ICON supports our 2030 strategy as it will help us to bring innovative treatments to patients faster while also supporting a more sustainable business through scalability and flexibility. “ICON’s wealth of services and leading position in clinical development will support LEO Pharma’s R&D strategy building on driving innovation through partnerships and support staying competitive.”

- Jörg Möller, Executive Vice President and head of Global R&D at LEO Pharma

-

In February 2023, Parexel International Corporation announced the launch of Expert Series-New Medicines, Novel Insights. The series features the latest insights from the company’s cross-functional experts postanalysis of trends that impact drug development and evidence-based guidance for the biopharmaceutical industry.

“Cutting-edge medicines are becoming more personalized and precise across the therapeutic landscape, while the process to develop those therapies is reaching new heights of complexity. “Parexel’s New Medicines, Novel Insights research series offers expert-led guidance to deliver on the promise of patient-focused drug development and bring impactful treatments to patients more rapidly.”

- Amy McKee, MD, Chief Medical Officer and Head of Oncology Center of Excellence

Pharmacovigilance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.58 billion

Revenue forecast in 2030

USD 11.78 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report Updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, device/product, technology/software, indication, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Accenture; IQVIA; Cognizant; Clinquest Group B.V. (Linical Americas); IBM; Laboratory Corporation of America Holdings; ArisGlobal; Capgemini; ITClinical; ICON plc.; TAKE Solutions Ltd.; PAREXEL International Corporation.; Wipro; United BioSource LLC; BioClinica Inc. (Clario); ClinChoice (formerly FMD K&L)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmacovigilance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmacovigilance market report based on service provider, product life cycle, type, process flow, therapeutic area, end use, and region:

-

Product Life Cycle Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Contract Outsourcing

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Spontaneous Reporting

-

Intensified ADR Reporting

-

Targeted Spontaneous Reporting

-

Cohort Event Monitoring

-

EHR Mining

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Biotechnology Companies

-

Medical Device Manufacturers

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Respiratory Systems

-

Others

-

-

Process Flow Outlook (Revenue, USD Million, 2018 - 2030)

-

Case Data Management

-

Case Logging

-

Case Data Analysis

-

-

Medical Reviewing & Reporting

-

Signal Detection

-

Adverse Event Logging

-

Adverse Event Analysis

-

Adverse Event Review & Reporting

-

-

Risk Management System

-

Risk Evaluation System

-

Risk Mitigation System

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Latin America

-

-

Frequently Asked Questions About This Report

b. The global pharmacovigilance market size was estimated at USD 7.95 billion in 2024 and is expected to reach USD 8.58 billion in 2025.

b. The global pharmacovigilance market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 11.78 billion by 2030.

b. North America dominated the pharmacovigilance market with a share of over 32.11% in 2024. This is attributable to rising drug abuse and related Adverse Drug Reactions (ADRs), increasing patient awareness and safety concerns, and rising strategic initiatives by key market players in the region.

b. Some key players operating in the pharmacovigilance market include Accenture; IQVIA; Cognizant; Clinquest Group B.V. (Linical Americas); IBM; Laboratory Corporation of America Holdings; ArisGlobal; Capgemini; ITClinical; ICON plc.; TAKE Solutions Ltd.; PAREXEL International Corporation.; Wipro; United BioSource LLC; BioClinica Inc (Clario).; ClinChoice (formerly FMD K&L)

b. Key factors that are driving the pharmacovigilance market growth include growing drug consumption and drug development rates, increasing incidence of ADR and drug toxicity, rising trend of outsourcing pharmacovigilance services, increased externalization of clinical trial studies by large pharmaceutical and biopharmaceutical companies, the growing regulatory burden on manufacturers and introduction of advanced software services, constantly rising investment in R&D by healthcare companies and increasing partnerships and collaborations between market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.