- Home

- »

- Medical Devices

- »

-

Pharmaceutical Regulatory Affairs Market Size Report, 2030GVR Report cover

![Pharmaceutical Regulatory Affairs Market Size, Share & Trends Report]()

Pharmaceutical Regulatory Affairs Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Provider (In-house, Outsourcing), By Service, By Category, By Indication, By Development Stage, By Company Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-107-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Regulatory Affairs Market Summary

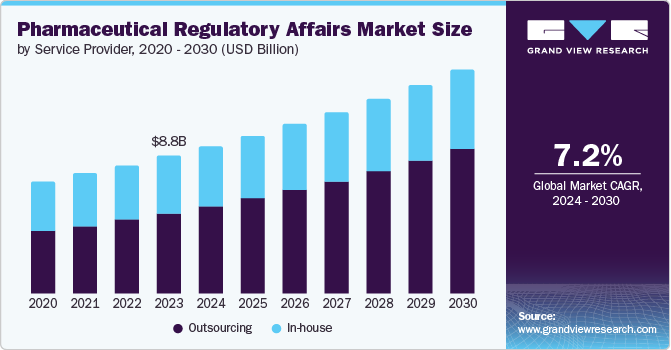

The global pharmaceutical regulatory affairs market size was estimated at USD 9.47 billion in 2024 and is projected to reach USD 14.34 billion by 2030, growing at a CAGR of 7.17% from 2025 to 2030. The changing regulatory landscape, the increasing need for companies to focus on core business activities, and economic & competitive pressures are the key drivers responsible for market growth.

Key Market Trends & Insights

- Asia Pacific pharmaceutical regulatory affairs market dominated with a revenue share of over 37.9% in 2024.

- The U.S. pharmaceutical regulatory affairs market held the largest revenue share in the North America region in 2024.

- By service provider, the outsourcing segment dominated the market with the largest revenue share of 59.07% in 2024.

- By service, the regulatory writing & publishing segment dominated the market in 2024.

- By category, the drugs segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.47 Billion

- 2030 Projected Market Size: USD 14.34 Billion

- CAGR (2025-2030): 7.17%

- Asia Pacific: Largest market in 2024

Entry of life sciences companies in global markets and the evolution of new areas, such as orphan drugs, biosimilars, ATMPs, and personalized medicine, are further anticipated to contribute to the market growth, as new areas would require advanced technical expertise for compliance with regulatory requirements.

Life sciences companies deal with constant modifications in regulatory requirements, which can vary based on geographies and business activities. Noncompliance with the changing regulatory requirement can result in penalizations & suspensions, which may lead to loss of revenue. A Genpact-sponsored survey found that 72.0% of life sciences executives in the life sciences sector identified regulatory compliance as one of their top three challenges. Regulatory departments often face the burden of handling multiple tasks simultaneously and must always ensure compliance with stringent regulatory standards by companies to expand their geographical reach & gain rapid approvals in global markets, which is expected to further contribute to the adoption of outsourcing models for regulatory services. Regulatory approval procedures are becoming increasingly stringent, and market players aim to receive product approvals in the first attempt to gain market share.

Companies outsource their regulatory affairs due to complex regulatory requirements in developed economies and changing regulations in developing ones. Establishing an in-house regulatory affairs department in offshore countries is only sometimes feasible. Thus, companies are inclined to implement distinct outsourcing models based on the priority and size of projects, thereby contributing to market growth. In addition, regulatory authorities across the globe are actively involved in updating existing regulations and introducing new reforms, thus prompting the companies to adopt a dedicated regulatory affairs team to track these changes. For instance, The Drugs (Prices Control) Amendment Order, 2022, dated November 11, 2022 ("Amendment Order"), was released by the Department of Pharmaceuticals. The Drugs (the Price Control) Order 2013 ("DPCO"), issued under the Essential Commodities Act, 1955, to control drug costs in India, is amended to include the NLEM 2022 in Schedule I. A list of medications ("Scheduled Formulations") subject to price restriction in India can be found in Schedule I of the DPCO. Moreover, the regulatory changes due to Brexit in 2020 and the Russian pharmaceutical serialization regulations effective from January 2020 have been anticipated to negatively affect the healthcare market in these regions. In April 2020, the national regulatory authorities in Africa and national ethics committees across the region agreed to accelerate the clinical trial review process, which is anticipated to propel the market growth.

The pressure to reduce costs by life sciences companies is very high. A shift toward outcome-based models, an increase in the use of generics, patient demand for low-cost drugs owing to increased out-of-pocket expenses, irregular economic growth across regions, and measures taken by various governments to curtail drug pricing are expected to contribute to the economic & competitive pressure on these companies. For instance, Japan’s Central Social Insurance Medical Council approved a drug repricing system that is anticipated to result in an average price reduction of nearly 4.38%. This system includes nearly 17 top-selling products, such as Vyndaqel, Samsca, Revlimid, Lynparza, Stelara, and Dupixent. In April 2023, the average price of over 2,000 drugs in Japan was reduced by 9.4%. Thus, the aforementioned factors are anticipated to influence pharmaceutical regulatory affairs outsourcing services in the near future.

Globalization of biopharmaceuticals & medical device companies is likely one of the major market drivers. Emerging markets from Asia Pacific, Latin America, Middle East, and Africa regions offer tax benefits, low product development & manufacturing costs, and availability of skilled labor at relatively affordable costs with favorable regulations. The aforementioned factors offer attractive possibilities to the regional markets in terms of outsourcing & expansion for biopharmaceutical companies, thus stimulating the demand for regulatory services. For instance, in June 2023, Novo Nordisk announced that it had invested around USD 2.3 billion to expand Danish production facilities. Such initiatives are anticipated to fuel the demand for regulatory services in the countries, especially for GMP and product development.

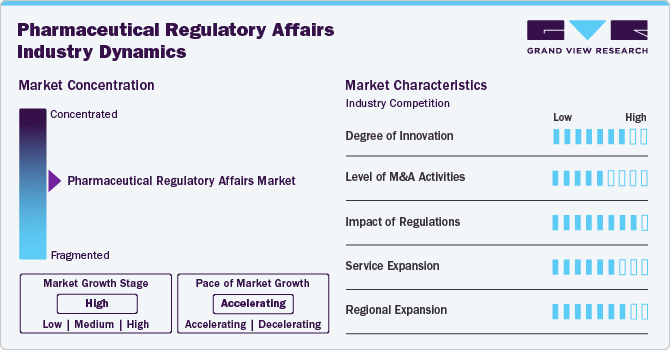

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. The pharmaceutical regulatory affairs industry is characterized by increasing demand for regulatory services, expanding market presence of regulatory consulting firms, and significant investment by pharmaceutical and biotech companies in compliance and regulatory strategies. Moreover, the increasing complexity of regulatory requirements, the globalization of pharmaceutical markets, and the need for efficient regulatory processes to ensure timely product approvals and market entry are key factors driving market growth.

The pharmaceutical regulatory affairs industry witnesses a high degree of innovation. Advances in digital health technologies, personalized medicine, and novel drug delivery systems are driving the need for updated regulatory frameworks and specialized regulatory expertise. This innovation requires constant adaptation and compliance with new regulatory standards, fueling demand for pharmaceutical regulatory affairs services

The pharmaceutical regulatory affairs industry is witnessing a moderate level of M&A activities. Large pharmaceutical companies and specialized regulatory affairs firms are engaging in strategic acquisitions to enhance their regulatory capabilities, expand their service offerings, and enter new markets. These M&A activities consolidate expertise and resources, leading to more comprehensive and efficient regulatory services.

Stringent and evolving regulatory requirements significantly impact the pharmaceutical regulatory affairs industry. The need to comply with complex and diverse regulations across different regions drives the demand for specialized regulatory services. Regulatory updates and increased scrutiny from authorities such as the U.S. FDA and EMA ensure that companies continuously seek expert regulatory support to maintain compliance and avoid market delays.

The pharmaceutical regulatory affairs industry is experiencing moderate service expansion. Regulatory firms are broadening their service portfolios to include comprehensive solutions such as regulatory strategy development, clinical trial support, market authorization, and post-market surveillance. This expansion caters to the growing needs of pharmaceutical companies pursuing end-to-end regulatory support, thereby driving market growth.

The market is also growing due to regional expansions by several regulatory affairs firms. Companies are establishing and strengthening their presence in emerging markets like Asia-Pacific and Latin America, where regulatory environments are rapidly evolving. This regional expansion allows regulatory firms to offer localized expertise and support, meeting the specific regulatory needs of these regions and contributing to overall industry growth.

Service Provider Insights

The outsourcing segment dominated the market with the largest revenue share of 59.07% in 2024 and is anticipated to witness the fastest growth over the analysis timeframe. This can be attributed to the increasing popularity of these services as outsourcing enables healthcare companies to reduce costs, prioritize strategic projects, reduce staff training time, and improve overall efficiency as well as provide greater flexibility. The availability of various outsourcing models suitable for different company sizes is also anticipated to boost the outsourcing market. For instance, the Functional Service Provider (FSP) model is suitable for large biotechnology & pharmaceutical companies. In contrast, the hybrid model is generally suitable for medium-sized companies, and the end-to-end service model is suitable for small-sized companies. The different models cater to the customized needs of the clients, thereby boosting the adoption of outsourcing by pharmaceutical and biotechnology firms.

The in-house segment is expected to grow at a considerable CAGR over the forecast period. Large pharmaceutical and biotechnology firms have strong in-house teams for regulatory affairs due to their varied product portfolios and pipelines and the ability to attract skilled and experienced professionals, which makes it a feasible and practical option. However, these firms are also shifting toward outsourcing to focus on their core competencies and address capacity issues.

Service Insights

The regulatory writing & publishing segment dominated the market in 2024. The high segmental growth is attributed to the increasing outsourcing of these services by large- and mid-size biopharmaceutical and medical device companies. The rising complexity and volume of regulatory documentation required by global health authorities, such as the U.S. FDA and EMA, require specialized expertise in regulatory writing and publishing. In addition, the growing number of drug approvals, clinical trials, and post-marketing surveillance activities require thorough documentation and timely submissions. The trend towards outsourcing these functions to specialized firms for efficiency and compliance is also fueling demand. Furthermore, advancements in digital tools and electronic Common Technical Document (eCTD) submissions are streamlining processes, managing regulatory writing and publishing more efficiently and crucial for a timely market.

The legal representation segment is anticipated to grow at the fastest CAGR over the anticipated time period. The segment growth potential is owing to complex and changing healthcare regulations across the globe. Legal representatives handle regulatory requirements in a specific country where the manufacturing facility of the company is not present. The changing regulatory landscape in regions such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and customs clearance.

Category Insights

The drugs segment held the largest market share in 2024. Some of the key factors contributing to segment growth are the increasing complexity of drug regulations, particularly for novel and high-risk therapies, requiring specialized regulatory expertise to ensure compliance and accelerate approvals. In addition, the globalization of the pharmaceutical industry requires navigating diverse regulatory landscapes, driving companies to seek expert guidance for international market penetration. Thus, the abovementioned factors, coupled with continuous reforms in regulatory frameworks, significantly propel the growth of the market within the drugs segment.

On the other hand, the biologics segment is anticipated to witness lucrative growth potential over the forecast period. The segment growth is owing to increasing development of complex biologic drugs, such as monoclonal antibodies, gene therapies, and vaccines, requiring specialized regulatory expertise due to their unique manufacturing processes and stringent regulatory requirements. Continuous advancements in biotechnology and personalized medicine are accelerating the innovation of biologics, requiring continuous regulatory updates and compliance. In addition, the rising prevalence of chronic diseases and the growing demand for targeted therapies boost the need for regulatory support in biologics. Evolving guidelines and expedited approval pathways among several regulatory authorities for biologics further drive the demand for comprehensive regulatory affairs services in this segment.

Indication Insights

The oncology segment dominated the market in 2024. This can be attributed to the high prevalence of cancer, which is boosting the need for safe and effective treatment options. According to data published by GLOBOCAN 2022, the number of cancer incidence cases was over 19.9 million worldwide. Among these, Asia region witnessed the highest number of cancer patients over 9.8 million followed by Europe with 4.4 million and North America with 2.6 million cancer patients. Furthermore, oncology is one of the most profitable markets for pharmaceutical & biotechnology companies, thereby increasing the R&D projects undertaken by these players. Thus, the factors above are estimated to positively influence overall industry growth.

On the other hand, the immunology segment is anticipated to project highest growth potential over the estimated timeframe. The segment growth is owing to a robust immunology pipeline of pharmaceutical and biopharmaceutical companies that is anticipated to further boost segment growth. For instance, as of 2022, Novartis had nearly 26 drugs in the pipeline for treating immunological conditions. The high number of drugs in the pipeline for immunological drugs is expected to support the demand for specialized regulatory services during the forecast period.

Development Stage Insights

The clinical studies segment held the largest market share in 2024. This can be attributed to the increasing number of clinical trial registrations over the past few years. The COVID-19 pandemic has increased the number of clinical trials across the globe due to the urgency to identify and commercialize an effective cure and vaccine for the disease. Furthermore, supportive regulatory actions, such as shortening trial approval time, waiving the waiting period, release of industry guidance documents, and funding clinical trials undertaken by regulatory authorities, are anticipated to boost this segment in the market.

The preclinical segment is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing demand for novel disease treatments, such as COVID-19, Zika virus, & Ebola, and the increasing prevalence of existing diseases such as CVDs, cancer, & neurological diseases. Moreover, the increasing complexity of preclinical study requirements, including detailed toxicology, pharmacokinetics, and pharmacodynamics studies, necessitates specialized regulatory expertise to ensure compliance with stringent guidelines. Advancements in preclinical testing technologies, such as in vitro and in vivo models, require updated regulatory frameworks, driving demand for specialized regulatory services.

Company Size Insights

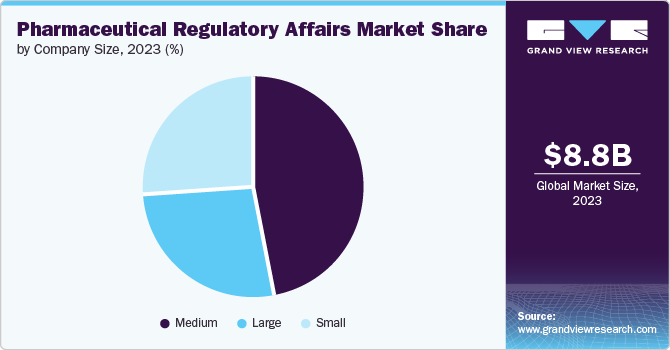

The medium size companies segment dominated the market in 2024. Medium-sized companies have more resources and capabilities compared to small companies, enabling them to navigate the complex regulatory landscape more effectively. These companies have a broader product portfolio and a wider geographic presence, allowing them to serve a larger customer base. They can invest in R&D, clinical trials, and regulatory compliance, ensuring that their products meet the necessary standards and regulations. Moreover, medium-sized companies can establish strategic partnerships with local stakeholders, including regulatory authorities and healthcare providers, to streamline the regulatory process & enhance market access.

The large size companies’ segment in the market is poised for significant growth, primarily fueled by financial strength to invest in extensive clinical trials, advanced manufacturing facilities, and robust regulatory compliance systems. This allows them to bring innovative and high-quality pharmaceutical products to the market while meeting stringent regulatory requirements. Moreover, their strong distribution networks and supply chain capabilities ensure the widespread availability of essential

Regional Insights

The North America pharmaceutical regulatory affairs market held a significant global revenue share of 31.97% in 2024. This can be attributed to the growing complexity and stringency of regulations from agencies such as the FDA that demand specialized expertise to navigate and comply with these standards. The region's robust pharmaceutical and biotechnology sectors, marked by significant R&D investments and numerous drug development projects, further fuel the need for comprehensive regulatory support. In addition, the trend towards outsourcing regulatory affairs to specialized firms for cost efficiency and access to advanced regulatory knowledge is accelerating market growth. Advances in digital health and personalized medicine also require continuous regulatory updates, creating sustained demand for regulatory affairs services in North America.

U.S. Pharmaceutical Regulatory Affairs Market Trends

The U.S. pharmaceutical regulatory affairs market held the largest revenue share in the North America region in 2024. Along with branded and patented products, there is a strong demand for cost-effective generic and biosimilar products in the U.S. In addition, there has been a significant increase in the import of generic and biosimilar products from emerging countries, thereby increasing the demand for regulatory service providers in the country. Leading biopharmaceutical and medical device companies are outsourcing part of their regulatory functions, such as report writing & publishing and clinical trial application services, to regulatory service providers, thereby contributing to the overall market growth in the U.S.

Europe Pharmaceutical Regulatory Affairs Market Trends

The pharmaceutical regulatory affairs market in Europe is expected to grow significantly owing to strong presence of small- and mid-size biopharmaceutical companies lack a regulatory affairs department that generally hire a regulatory consultant or a legal representative to assist them through various stages of regulatory approval processes required for commercializing their product in Europe.

The UK pharmaceutical regulatory affairs market is anticipated to witness the highest growth potential in Europe. The demand for generic products has also increased owing to the government’s support for generics over branded drugs. This trend attracts small—and mid-sized biopharmaceutical and medical device companies to enter the UK market, thereby improving the demand for regulatory support services.

In 2024, the pharmaceutical regulatory affairs market in Germany held the highest revenue share in Europe. Increasing complexity in drug development and approval processes, driven by advancements in biotechnology and personalized medicine, further fuels the demand for expert regulatory guidance. The growing emphasis on patient safety and transparent clinical trials also intensifies the need for robust regulatory frameworks. The presence of a skilled and experienced workforce is another factor expected to drive the pharmaceutical regulatory affairs market in Germany.

Asia Pacific Pharmaceutical Regulatory Affairs Market Trends

Asia Pacific pharmaceutical regulatory affairs market is expected to grow at the fastest CAGR over the forecast period. The high market growth is attributed to the improved regulatory landscape, cost savings, growing number of clinical trials conducted in the region, and increasing number of biopharmaceutical companies in the region. Furthermore, the availability of a skilled workforce at a lower cost than in the U.S. is another factor expected to propel growth. Similarly, the expansion of established biopharmaceutical companies may increase the demand for regulatory service providers. This is owing to the heterogeneous and complex regulatory environment fueling the growth of the pharmaceutical regulatory affairs industry.

The pharmaceutical regulatory affairs market in Japan held the largest share in 2024 in the Asia Pacific region due to rising demand for new and cost-effective medicines that may attract investments from biopharmaceutical companies. Rising demand for generics due to government support and improvement in regulatory approval processes are expected to increase the number of market entrants, propelling the demand for regulatory services.

The China pharmaceutical regulatory affairs market is expected to grow over the forecast period. The growing geriatric population and a large pool of middle-income group population are increasing the demand for innovative and cost-effective medicines, which is expected to attract major biopharmaceutical and medical device companies.

The pharmaceutical regulatory affairs market in India is anticipated to grow at the fastest CAGR over the forecast period. The cost benefits, improved infrastructure facilities, and a large pool of technical expertise are some of the major factors propelling the market growth in India. Global biopharmaceutical companies outsource the manufacturing of biopharmaceutical products for clinical trials or sales in emerging countries such as India.

Latin America Pharmaceutical Regulatory Affairs Market Trends

The pharmaceutical regulatory affairs market in Latin America is anticipated to grow at a substantial rate over the forecast period owing to the increasing number of biopharmaceutical companies venturing into this region. This is anticipated to drive the demand for regulatory services, contributing to pharmaceutical regulatory affairs market growth. In addition, its geographic placement, in being strategically close to the U.S. market, is another factor attracting outsourcing in this region. The presence of CROs and regulatory service providers is also expected to increase considerably, which is further driving the growth of market.

The Brazil pharmaceutical regulatory affairs market is anticipated to grow at a significant CAGR over the forecast period. Presence of restrictive pricing policies, complex regulatory framework, and a well-established generic industry are factors that may restrict the growth of market during the forecast period.

Middle East Pharmaceutical Regulatory Affairs Market Trends

The pharmaceutical regulatory affairs market in Middle East is expected to grow substantially over the forecast period. Technological advancements, increasing prevalence of chronic diseases, and quicker regulatory approvals compared to China, India, & Brazil are expected to contribute to the growth in the number of clinical trials conducted in Saudi Arabia, increasing the demand for pharmaceutical regulatory services.

Africa Pharmaceutical Regulatory Affairs Market Trends

The pharmaceutical regulatory affairs market in Africa is anticipated to grow at the considerable CAGR over the forecast period owing to the demand in the market is driven by the growth of the pharmaceutical industry, increasing demand for quality healthcare, and the need to ensure patient safety. The regulatory landscape varies across countries, ranging from well-established regulatory bodies to those in the early stages of development.

The pharmaceutical regulatory affairs market in South Africa held the largest revenue share in Africa region in 2024. Growing investment in regulatory capacity, increasing pharmaceutical markets, development of the local industry, establishment of regulatory bodies, and a focus on continent-specific diseases are expected to boost the South Africa pharmaceutical regulatory affairs market.

The pharmaceutical regulatory affairs market in Nigeria is anticipated to grow at the significant CAGR over the forecast period. Increasing demand for pharmaceuticals due to population growth and rising health concerns is fueling regulatory activities.

Key Pharmaceutical Regulatory Affairs Company Insights

The eminent market players operating across the pharmaceutical regulatory affairs industry focus on implementing several strategic initiatives such as acquisitions, mergers, service launches, partnerships, expansions, and collaborations, among others, to broaden the geographical reach and gain a competitive edge in the overall market. For instance, in January 2023, PharmaLex Holding GmbH was acquired by AmerisourceBergen Corporation. The acquisition aimed to enhance its specialty services and expand its global platform of pharmaceutical manufacturer services capabilities. PharmaLex 's expertise in development consulting, regulatory affairs, pharmacovigilance, quality management & compliance services, and scientific affairs will further strengthen AmerisourceBergen’s position as a preferred partner for biopharmaceutical companies throughout the pharmaceutical development and commercialization process.

Key Pharmaceutical Regulatory Affairs Companies:

The following are the leading companies in the pharmaceutical regulatory affairs market. These companies collectively hold the largest market share and dictate industry trends.

- Freyr

- IQVIA Inc

- ICON plc

- WuXi AppTec (WAI)

- Charles River Laboratories International, Inc.

- Labcorp Drug Development

- Parexel International Corporation

- Pharmalex GmbH

- Pharmexon

- Genpact

Recent Developments

-

In April 2023, PharmaLex Group announced to expand its footprint in Australia by entering into a collaboration agreement with Cpharm, a provider of pharmacovigilance and medical services.

-

In May 2023, Freyr announced its first regulatory support initiative. The company partnered with a prominent consumer products company based in the U.S. to facilitate the voluntary recall of over 50 consumer products across more than 60 global markets.

Pharmaceutical Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.14 billion

Revenue forecast in 2030

USD 14.34 billion

Growth rate

CAGR of 7.17% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service provider, service, category, indication, development stage, company size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East, Africa

Country scope

U.S.; Canada; Mexico; UK, Germany, France, Italy, Spain, Denmark, Norway, The Netherlands, Switzerland, Sweden, Japan, China, India, Australia, South Korea, Indonesia, Malaysia, Singapore, Thailand, Taiwan, Brazil, Argentina, Colombia, Chile, Saudi Arabia, UAE, Kuwait, Egypt, Israel, South Africa, Botswana, Namibia, Zimbabwe, Zambia, Tanzania, Rwanda, Ghana, Nigeria, Uganda, Mauritius, Kenya

Key companies profiled

Freyr, IQVIA Inc, ICON plc, WuXi AppTec (WAI), Charles River Laboratories International, Inc., Labcorp Drug Development, Parexel International Corporation, Pharmalex GmbH, Pharmexon, Genpact

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical regulatory affairs market report based on service provider, service, category, indication, development stage, company size, and region:

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

Generics

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Development Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

Post Market Approval (PMA)

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

The Netherlands

-

Switzerland

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Egypt

-

Israel

-

-

Africa

-

South Africa

-

Botswana

-

Namibia

-

Zimbabwe

-

Zambia

-

Tanzania

-

Rwanda

-

Ghana

-

Nigeria

-

Uganda

-

Mauritius

-

Kenya

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical regulatory affairs market size was estimated at USD 9.47 billion in 2024 and is expected to reach USD 10.14 billion in 2025.

b. The global pharmaceutical regulatory affairs market is expected to grow at a compound annual growth rate of 7.17% from 2025 to 2030 to reach USD 14.34 billion by 2030.

b. Asia Pacific dominated the pharmaceutical regulatory affairs market with a share of 37.89% in 2024. This is attributable to cost savings, improved regulatory landscape, and a growing number of clinical trials conducted in the region. Furthermore, the expansion of established biopharmaceutical companies may increase the demand for regulatory service providers.

b. Some key players operating in the pharmaceutical regulatory affairs market include Freyr, IQVIA Inc., ICON plc, WuXi AppTec, Charles River Laboratories, Labcorp Drug Development, Parexel International Corporation, Pharmalex GmbH, Pharmexon, Genpact.

b. Key factors that are driving the market growth include increasing focus on patient safety and pharmacovigilance, accelerated drug development and approval processes, and increasing regulatory requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.