- Home

- »

- Advanced Interior Materials

- »

-

Pharmaceutical Processing Seals Market Size Report, 2030GVR Report cover

![Pharmaceutical Processing Seals Market Size, Share & Trends Report]()

Pharmaceutical Processing Seals Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Metal, Rubber), By Product (O-rings, Gaskets), By Region (North America, Europe), And By Segment Forecasts

- Report ID: GVR-4-68040-375-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Processing Seals Market Summary

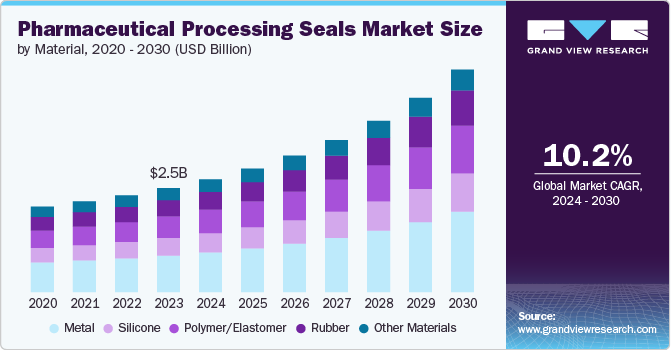

The global pharmaceutical processing seals market size was estimated at USD 2.52 billion in 2023 and is projected to reach USD 5.40 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030. This growth is attributed to the presence of stringent regulations relating to pharmaceutical manufacturing.

Key Market Trends & Insights

- The Asia Pacific dominated the market in 2023 with a revenue share of 47.7%.

- The market in the U.S. is expected to grow at a CAGR of 9.4% over the forecast period.

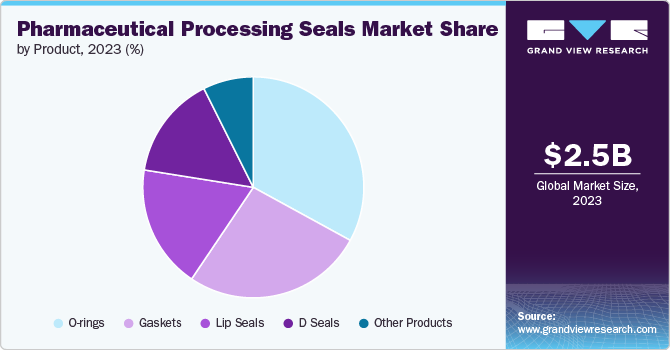

- Based on product, the O-rings segment accounted for the largest revenue share of 33.0% in 2023 and is further expected to grow at the fastest CAGR of 10.8% over forecast period.

- Based on material, the metal dominated the market and accounted for a revenue share of 35.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.52 Billion

- 2030 Projected Market USD 5.40 Billion

- CAGR (2024-2030): 10.2%

- Asia Pacific: Largest market in 2023

For instance, regulatory agencies such as the FDA (in the U.S.), EMA (in Europe), and similar bodies worldwide enforce stringent standards for pharmaceutical manufacturing. This drives the demand for seals that comply with these regulations to ensure product safety and quality, thereby, positively impacting market growth.

The global demand for pharmaceutical products continues to rise due to population growth, aging demographics, and increasing prevalence of chronic diseases. This drives expansion in pharmaceutical manufacturing facilities, boosting the demand for sealing solutions to maintain hygienic and sterile conditions. Furthermore, shift towards biopharmaceuticals, including vaccines, antibodies, and gene therapies, requires specialized sealing solutions due to the sensitive nature of biologics. Seals play a crucial role in maintaining the integrity and efficacy of these products, thereby driving the pharmaceutical processing seals market growth.

Continuous advancements in sealing technologies, such as the development of materials with improved chemical resistance, durability, and sealing performance, enhance the efficiency and reliability of pharmaceutical manufacturing processes. This encourages adoption and drives market expansion. Moreover, there is a growing emphasis on patient safety and product quality in pharmaceutical manufacturing. Seals prevent contamination and ensure product sterility, contributing to enhanced safety standards and reducing the risk of adverse events.

Seals made from advanced materials such as PTFE (Polytetrafluoroethylene), Viton (fluoroelastomer), and silicone can be expensive. This cost factor may prevent smaller pharmaceutical companies from investing in high-performance sealing solutions. In addition to this, seals must be compatible with a wide range of pharmaceutical formulations, including liquids, powders, and biologics. This further provides rules for pharmaceutical processing seals manufacturers.

Material Insights

Metal dominated the market and accounted for a revenue share of 35.2% in 2023. Metals are primarily used in pharmaceutical processing seals for their durability, strength, and resistance to corrosion. Common metals used for manufacturing sealing solutions include stainless steel, aluminum, and titanium. They are commonly used for seals in pumps, valves, and fittings where robust sealing is required.

Rubber materials are elastomers known for their flexibility, resilience, and sealing properties. Common rubber materials used in product manufacturing include EPDM and silicone rubber. It is used in seals for outdoor equipment and steam sterilization applications in pharmaceutical processing. Furthermore, silicone materials offer unique properties that make them suitable for this product manufacturing such as high temperature resistance, flexibility, elasticity, and biocompatibility.

Product Insights

The O-rings segment accounted for the largest revenue share of 33.0% in 2023 and is further expected to grow at the fastest CAGR of 10.8% over forecast period. O-rings are used in pharmaceutical processing equipment for sealing static and dynamic applications where relative motion occurs, such as pumps, valves, and connectors. They offer excellent sealing properties, resilience, and resistance to a wide range of chemicals and temperatures, ensuring reliable performance in pharmaceutical environments.

Gaskets are expected to witness growth at second fastest rate over the forecast period. Gaskets are flat seals used to create a static seal between two surfaces, often made from flexible materials like silicone rubber, EPDM, Viton, and PTFE (Polytetrafluoroethylene). They provide reliable sealing under compression, resist chemicals, and maintain their integrity over a wide range of temperatures and pressures. On the other hand, lip seals offer effective sealing against liquids and gases, even at high speeds and pressures, ensuring operational reliability in pharmaceutical manufacturing.

Regional Insights

North America is expected to grow at a significant rate over the forecast period. Rising healthcare expenditure in North America supports continuous investment in pharmaceutical manufacturing infrastructure, including sealing solutions. This expenditure is driven by an aging population, higher prevalence of chronic diseases, and increasing demand for pharmaceutical products.

U.S. Pharmaceutical Processing Seals Market Trends

The market in the U.S. is expected to grow at a CAGR of 9.4% over the forecast period. Country is at the forefront of technological advancements in pharmaceutical processing. This includes the adoption of advanced sealing technologies that enhance efficiency, reduce contamination risks, and comply with stringent regulatory requirements. Furthermore, country has stringent regulatory standards for pharmaceutical manufacturing, including the use of seals that comply with FDA (Food and Drug Administration) and Health Canada guidelines. This drives the demand for high-quality, compliant sealing solutions.

Europe Pharmaceutical Processing Seals Market Trends

Europe has a well-established pharmaceutical industry known for its high standards of manufacturing and compliance with regulatory requirements. This demands reliable sealing solutions to ensure product safety, integrity, and adherence to EU regulations. In addition to this, Europe has stringent environmental regulations that impact pharmaceutical manufacturing processes, including the choice of sealing materials. Sustainable and compliant sealing solutions are gaining traction in region.

Asia Pacific Pharmaceutical Processing Seals Market Trends

Asia Pacific dominated the market in 2023 with a revenue share of 47.7%. Asia Pacific is witnessing rapid growth in pharmaceutical manufacturing, driven by increasing healthcare expenditure, rising population, and expanding middle-class population with higher healthcare expectations. Countries like China, India, and Japan are key contributors in growth of pharmaceutical manufacturing, thereby, positively affecting product growth. Furthermore, Asia Pacific countries are increasingly focusing on pharmaceutical research and development, including the development of generic drugs and biopharmaceuticals. This drives demand for seals that support advanced manufacturing processes and product innovation.

Key Pharmaceutical Processing Seals Company Insights

Some of the key players operating in the market include Flowserve Corporation and Saint-Gobain S.A. among others:

-

Flowserve Corporation, founded in 1997 and headquartered in Irving, Texas, USA, is a manufacturers of fluid motion and control products and services. The company specializes in designing, manufacturing, and servicing of pumps, valves, seals, and related equipment for various industrial applications.

-

Saint-Gobain S.A. is a France based company established in 1665. It is engaged in the design, manufacturing, and distribution of high-performance materials and building materials. In addition, it provides solutions for energy efficiency, growth challenges, and protection of the environment.

IDEX Corporation and Parker Hannifin Corporation are some of the emerging participants in the market.

-

IDEX Corporation was established in 1988 and its business segments includes fluid & metering technologies, health & science technologies, and fire & safety/diversified products. It operates manufacturing facilities in around 20 countries serving various industries such as aerospace, agriculture, automotive, dispensing, medical, life science, food & pharma, energy, industrial, among others.

-

Parker Hannifin Corporation is involved in manufacturing of sealing solutions and high performance materials. Its products find applications in many industries such as diabetes care, surgical, respiratory, pharmaceutical, drug delivery, thermal management, and shielding management.

Key Pharmaceutical Processing Seals Companies:

The following are the leading companies in the pharmaceutical processing seals market. These companies collectively hold the largest market share and dictate industry trends.

- Flowserve Corporation

- Morgan Advanced Materials PLC

- Trelleborg AB

- Garlock

- Saint-Gobain S.A.

- Parker Hannifin Corporation

- IDEX Corporation

- James Walker

- Freudenberg Group

- John Crane

Recent Developments

-

In November 2023, Pharmaceutical Services, Inc. (West), a company involved in manufacturing of healthcare and injectable drug products, launched its Gamma Irradiated Flip-Off seals product in India and other Asia pacific countries. This product is developed and designed to deliver safe and convenient user experience while maintaining consistency and container closure integrity. It will help biopharmaceutical and pharmaceutical manufacturers to protect their products and maintain drug quality.

Pharmaceutical Processing Seals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.74 billion

Revenue forecast in 2030

USD 5.40 billion

Growth rate

CAGR of 10.2% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Flowserve Corporation; Morgan Advanced Materials PLC; Trelleborg AB; Garlock; Saint-Gobain S.A.; Parker Hannifin Corporation; IDEX Corporation; James Walker; Freudenberg Group; John Crane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Processing Seals Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical processing seals market report based on material, product, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Rubber

-

Silicone

-

Polymer/Elastomer

-

Other Materials

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

O-rings

-

Gaskets

-

Lip Seals

-

D Seals

-

Other Products

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pharmaceutical processing seals market size was estimated at USD 2.52 billion in 2023 and is expected to reach USD 2.74 billion in 2024.

b. The global pharmaceutical processing seals market is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2030 to reach USD 5.40 billion by 2030.

b. O-rings accounted for the largest pharmaceutical processing seals market share of 33.0% in 2023 as they offer excellent sealing properties, resilience, and resistance to a wide range of chemicals and temperatures, ensuring reliable performance in pharmaceutical environments.

b. Some key players operating in the pharmaceutical processing seals market include Flowserve Corporation, Morgan Advanced Materials PLC, Trelleborg AB, Garlock, Saint-Gobain S.A., Parker Hannifin Corporation, IDEX Corporation, James Walker, Freudenberg Group, and John Crane.

b. The key factors that are driving the pharmaceutical processing seals market growth is the presence of stringent regulations relating to pharmaceutical manufacturing driving demand for high quality sealing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.