- Home

- »

- Medical Devices

- »

-

Pharmaceutical Inspection Machines Market Report, 2030GVR Report cover

![Pharmaceutical Inspection Machines Market Size, Share & Trends Report]()

Pharmaceutical Inspection Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Inspection System, Software), By Type (Semi-automated, Fully-automated), By Packaging, By Formulation, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-453-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Inspection Machines Market Summary

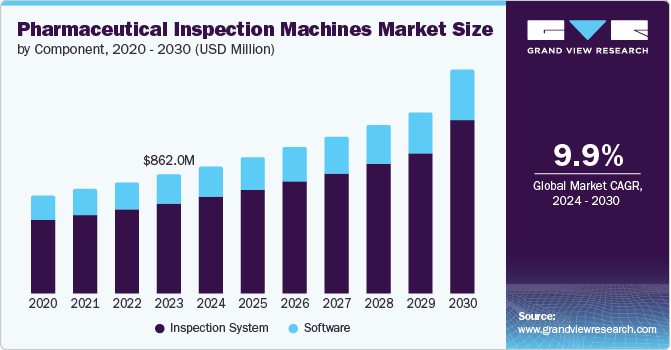

The global pharmaceutical inspection machines market size was estimated at USD 862.0 million in 2023 and is projected to reach USD 1.62 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030.This growth is fueled by pharmaceutical and biotechnology companies' rising adoption of inspection systems, stringent regulatory requirements, and increasing outsourcing to emerging markets.

Key Market Trends & Insights

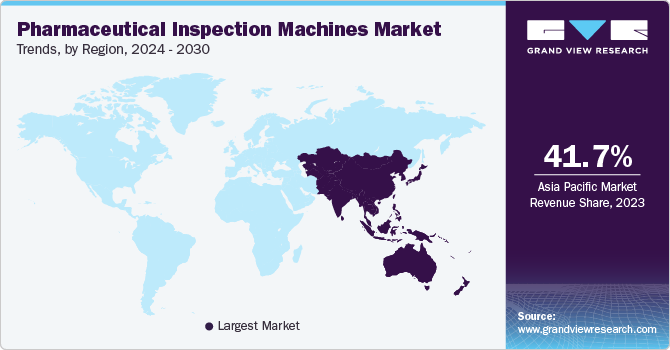

- The Asia Pacific region is expanding rapidly due to increasing pharmaceutical production, rising regulatory standards, and advancements in inspection technology.

- The U.S. pharmaceutical inspection machines market is notable for its significant size and dynamic growth.

- Based on type, the fully automated segment was identified as the most significant revenue contributor, with more than 40.0% in 2023.

- Based on packaging, the syringes segment dominated the global pharmaceutical inspection machines industry, capturing a substantial revenue share of 35.8% in 2023.

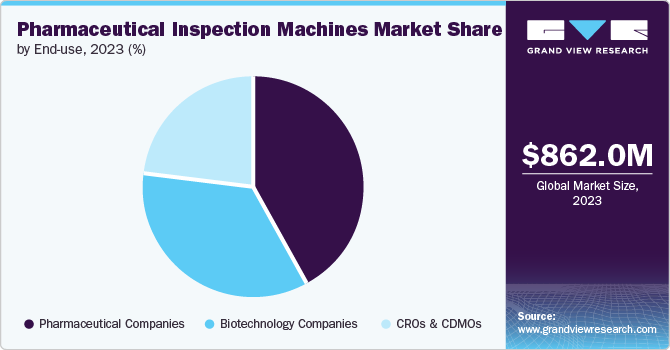

- Based on end-use, the pharmaceutical companies dominated the global market, capturing a substantial revenue share of over 40.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 862.0 Million

- 2030 Projected Market Size: USD 1.62 Billion

- CAGR (2024-2030): 9.9%

- Asia Pacific: Largest market in 2023

High-quality, compliant pharmaceutical products demand sophisticated inspection technologies to meet evolving industry standards and regulatory requirements. As the market expands, industry stakeholders invest more in sophisticated systems to ensure product integrity, boost operational efficiency, and adhere to global quality standards.

The surge in complex drug formulations and biologics, including large molecules such as monoclonal antibodies and gene therapies, demands sophisticated inspection technologies to maintain product integrity and efficacy. These advanced systems are essential for identifying minute defects in packaging, labeling, and product composition, which helps prevent costly recalls and ensures adherence to stringent regulatory standards. As biologics and complex drugs become more prevalent, the need for high-precision inspection technologies grows, making them indispensable for safeguarding product quality and compliance in an increasingly complex pharmaceutical landscape.

Regulatory mandates are another significant driver for market growth. Regulatory bodies including the U.S. FDA, the European Medicines Agency (EMA), and the WHO enforce stringent quality control requirements that pharmaceutical companies must adhere to. For instance, the FDA's regulations under the Code of Federal Regulations (CFR) Title 21 outline detailed standards for pharmaceutical manufacturing, including the inspection of finished products. The EMA's guidelines on Good Manufacturing Practices (GMP) also emphasize the need for rigorous inspection processes to ensure the safety & efficacy of medicinal products. Compliance with these regulations necessitates using advanced inspection systems to meet the detailed requirements and avoid potential legal and financial repercussions.

The rise in pharmaceutical outsourcing to emerging markets is another crucial factor driving market growth. As pharmaceutical companies seek to reduce production costs and expand their market reach, many outsource manufacturing to emerging countries with cost-efficient labor and advanced production capabilities. This trend is particularly prevalent in India and China, which are significant hubs for pharmaceutical manufacturing. Outsourcing requires adherence to international quality standards, which drives the demand for sophisticated inspection systems to ensure that products manufactured in these regions meet the stringent quality and regulatory requirements of developed markets. This need for compliance and quality control in outsourced manufacturing processes fuels the adoption of advanced inspection technologies. For instance, Brevetti CEA provides a wide array of automatic inspection machines designed for injectable pharmaceuticals in ampoules, syringes, vials, cartridges, and bottles, highlighting the growing need for advanced inspection technologies in outsourced manufacturing.

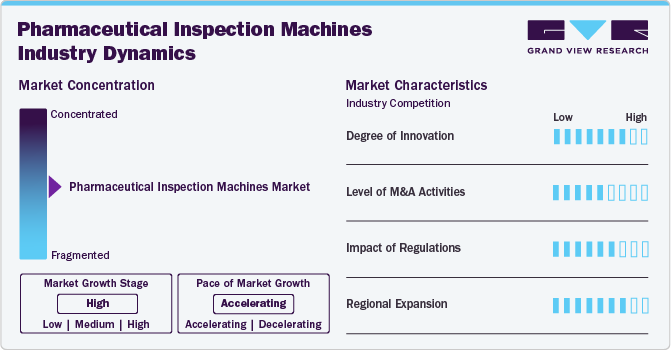

Market Concentration & Characteristics

The market is rapidly evolving owing to technological advancements & shifting industry demands. Key innovations include the integration of Artificial Intelligence (AI) and Machine Learning (ML), which significantly enhance the accuracy and efficiency of inspection systems. AI-powered vision systems provide high-resolution imaging and real-time defect detection, which are essential for complex drug formulations and biologics. For instance, in February 2021, Syntegon Technology installed the first fully validated AI-driven visual inspection system, marking a significant advancement in automated inspection. AI applications, including Deep Learning algorithms, improve detection rates and reduce false rejects, particularly in challenging products such as highly viscous parenteral solutions with air bubbles. These developments are crucial as the industry moves towards personalized medicine and biologics, necessitating sophisticated inspection technologies to comply with rigorous regulatory standards.

M&A activities in the market for pharmaceutical inspection machines reflect the sector's consolidation and strategic expansion. Companies are acquiring or merging with technology firms to enhance their capabilities and product portfolios. These M&A activities aim to expand market reach, integrate advanced technologies, and leverage synergies to drive growth. Consolidation also helps companies streamline operations, reduce costs, and accelerate innovation, positioning themselves more competitively in the global market.

Regulatory requirements significantly impact the market, ensuring product safety and quality. Regulatory bodies such as the EMA & the U.S. FDA enforce stringent guidelines that mandate rigorous inspection processes. For instance, the FDA's guidelines under the Code of Federal Regulations (CFR) Title 21 outline specific pharmaceutical manufacturing and inspection requirements, including real-time monitoring and defect detection. The EMA's GMP guidelines also require thorough inspection of finished products to ensure compliance with safety standards. These regulations drive the adoption of advanced inspection technologies to meet compliance standards, reduce the risk of regulatory fines, and avoid product recalls. The continuous evolution of regulatory standards necessitates ongoing innovation and adaptation in inspection technologies.

Regional expansion in the market is driven by increasing pharmaceutical production and regulatory requirements in emerging markets. Countries such as India and China are becoming significant hubs for pharmaceutical manufacturing due to lower production costs and growing market demand. According to the India Brand Equity Foundation, the country's pharmaceutical industry is anticipated to grow at a CAGR of over 10.0% to reach USD 130.0 billion by 2030. Similarly, China's significant investment in its pharmaceutical sector and regulatory framework is spurring the adoption of sophisticated inspection technologies. Government initiatives, such as China's 13th Five-Year Plan, support advancements in pharmaceutical manufacturing, including quality control. This regional growth drives the demand for inspection machines that ensure compliance with local and international regulations, fostering market expansion and technological adoption.

Component Insights

In 2023, the inspection systems segment dominated the market with a substantial share of 76.0% and is also expected to grow at the fastest CAGR of 10.2% during the forecast period. This segment's substantial market share and rapid growth is attributed to the increasing complexity of pharmaceutical products, stringent regulatory requirements, and ongoing technological advancements. The rising sophistication of pharmaceutical offerings, such as biologics and personalized medicines, requires advanced inspection technologies capable of meeting the rigorous standards for product quality and safety. These products often involve complex formulations and packaging, making detecting even minute defects crucial. Regulatory bodies worldwide impose strict guidelines to ensure that these products meet high standards, further driving down the demand for sophisticated inspection systems. For instance, the Accura Pharmaquip Tablet Inspection Machine uses advanced vision technology to detect defects and efficiently processes 75,000 to 100,000 tablets per hour. This technology underscores the segment's critical role in meeting the continuous evolving demands of the pharmaceutical industry.

The software segment is also anticipated to grow significantly during the forecast period. Pharmaceutical companies are generating vast amounts of data from inspection processes, including information on product defects, production efficiency, and compliance with regulatory standards. Advanced inspection software is essential for analyzing this data to ensure high-quality standards and regulatory compliance. For instance, software platforms integrating with inspection systems can provide real-time analytics and reporting, which is critical for maintaining quality control and optimizing production processes.

Type Insights

The fully automated segment was identified as the most significant revenue contributor, with more than 40.0% in 2023, and is expected to grow at the fastest CAGR of over 10.5% during the forecast period. This robust growth is driven by the need for increased operational efficiency, advancements in automation technology, and the rising complexity of pharmaceutical products. Fully automated inspection systems significantly reduce the need for manual intervention, minimizing human error and ensuring consistent quality control. This is crucial in the pharmaceutical industry, where maintaining high standards of product quality and regulatory compliance is essential. Automated systems streamline the inspection process, enabling faster and more accurate detection of defects, which is critical for meeting stringent regulatory requirements.

The semi-automated inspection systems segment is also projected to grow significantly due to their cost-effectiveness and versatility. These systems balance automation and manual operation, offering a more affordable solution for many pharmaceutical manufacturers and are modifiable to various product types & packaging, making them ideal for companies with diverse product lines or those producing small batches. For instance, Industrial Vision System’s semi-automatic inspection machines are designed for GMP compliance and provide complete validation documentation. They handle a range of containers, from ampoules and vials to syringes of different volumes, and feature continuous motion technology with an inverter unit. This setup ensures syringes are correctly oriented during inspection, improving the robustness of the process and maintaining high-quality standards.

Formulation Insights

In 2023, the oral segment dominated the global market for pharmaceutical inspection machines, capturing a substantial revenue share, and is also expected to grow at the fastest CAGR during the forecast period. The high demand for oral medications and stringent regulatory standards drives this prominence.

Oral medications are the most prevalent and convenient form of drug delivery, dominating the global pharmaceutical market due to their ease of administration and patient preference. This widespread reliance on oral dosage forms, such as tablets and capsules, necessitates deploying robust inspection systems. These systems are crucial for ensuring oral drugs' quality, safety, and efficacy, given their substantial market presence and the rigorous standards they must meet.

Packaging Insights

In 2023, the syringes segment dominated the global pharmaceutical inspection machines industry, capturing a substantial revenue share of 35.8%. This dominant position is primarily attributed to the growing adoption of prefilled syringes, the rising incidence of chronic diseases, advancements in syringe technology, and stringent regulatory requirements. Prefilled syringes have become increasingly popular due to their convenience, accuracy, and reduced risk of contamination compared to traditional vial-and-syringe methods. Their use is particularly prevalent in chronic disease management, where patients require regular medication. This shift towards prefilled syringes necessitates advanced inspection systems to ensure their integrity and efficacy. These systems must detect minute defects such as particulate contamination, seal integrity issues, and dosage accuracy, all of which are critical for maintaining patient safety and meeting regulatory standards.

Bottles are anticipated to achieve the fastest CAGR of 11.0% during the forecast period. This growth is driven by the rising use of bottle packaging for pharmaceuticals, including vaccines and biologics, due to its secure containment and contamination prevention. Technological advancements in inspection systems, such as sophisticated vision technology and automation, enhance the detection of defects such as particulate contamination and seal integrity. Increased consumer demand for safety and convenience and stringent regulatory standards for tamper-evident and child-resistant packaging further fuel this growth. These factors collectively ensure that bottle packaging remains a preferred and expanding choice in the pharmaceutical industry.

End-use Insights

In 2023, pharmaceutical companies dominated the global market, capturing a substantial revenue share of over 40.0%. The pharmaceutical industry increasingly focuses on developing complex drug formulations and personalized medicines. These advanced therapies, such as biologics, gene therapies, and novel drug delivery systems, require precise and reliable inspection systems to ensure their safety, efficacy, and compliance with stringent regulatory standards. These products often involve intricate manufacturing processes, so they demand high-resolution and advanced inspection technologies to detect minute defects and ensure product integrity. Pharmaceutical companies invest heavily in advanced inspection technologies to maintain competitive advantage and meet evolving industry standards.

CROs & CDMOs are anticipated to achieve the fastest CAGR of 10.2% during the forecast period. Pharmaceutical and biotechnology companies increasingly outsource research, development, and manufacturing processes to CROs and CDMOs. This trend is fueled by the need to reduce costs, expedite time-to-market, and leverage specialized expertise. CROs and CDMOs offer valuable services that allow pharmaceutical companies to divert their focus on core competencies while managing complex projects more efficiently. The increasing complexity of drug development, including the rise of biologics, personalized medicine, and complex formulations, has heightened the demand for specialized expertise and sophisticated technologies. CROs and CDMOs are well-positioned to handle these complexities due to their specialized knowledge and advanced equipment.

Regional Insights

The North America market for pharmaceutical inspection machines is experiencing robust growth. The U.S. and Canada are home to some of the most stringent pharmaceutical regulations in the world. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada enforce rigorous quality standards for pharmaceutical products. Compliance with these standards requires advanced inspection systems to ensure products meet high-quality and safety benchmarks. The need to adhere to these stringent regulations drives the demand for sophisticated inspection machines.

U.S. Pharmaceutical Inspection Machines Market Trends

The U.S. pharmaceutical inspection machines market is notable for its significant size and dynamic growth, driven by high regulatory standards, technological advancements, and the extensive presence of pharmaceutical and biotechnology companies. The FDA imposes rigorous inspection and quality control standards, necessitating advanced inspection machines to ensure compliance. The growing focus on providing drug safety and efficacy, coupled with the increasing complexity of drug formulations, further drives the demand for sophisticated inspection technologies in the U.S. market.

Europe Pharmaceutical Inspection Machines Market Trends

The European global pharmaceutical inspection machines market is witnessing substantial growth driven by stringent regulatory requirements. The European Medicines Agency (EMA) enforces strict guidelines for pharmaceutical inspections, including quality control and compliance with Good Manufacturing Practices (GMP). This regulatory environment drives the need for advanced inspection systems. Additionally, Europe's emphasis on high-quality and safe pharmaceuticals, coupled with innovations in inspection technology such as advanced imaging systems and automation, contributes to the market's expansion.

The country's strong pharmaceutical industry bolsters the UK global pharmaceutical inspection machines market, stringent regulatory standards, and technological innovations. The UK Medicines & Healthcare Products Regulatory Agency (MHRA) enforces rigorous quality standards for pharmaceuticals, driving the need for advanced inspection technologies. The growing emphasis on high-quality pharmaceuticals and the increasing complexity of drug formulations contribute to the market's growth as pharmaceutical companies invest in advanced inspection systems to meet regulatory requirements and enhance operational efficiency.

An established pharmaceutical industry and technological advancements fuel the pharmaceutical inspection machines market in Germany. The Federal Institute for Drugs & Medical Devices (BfArM) enforces strict pharmaceutical quality and safety regulations, driving the demand for sophisticated inspection systems. The country is a central hub for pharmaceutical and biotechnology companies, which require advanced inspection technologies to comply with regulatory standards and ensure product integrity.

Asia Pacific Pharmaceutical Inspection Machines Market Trends

The pharmaceutical inspection machines market in the Asia Pacific region is expanding rapidly due to increasing pharmaceutical production, rising regulatory standards, and advancements in inspection technology. The region is experiencing significant growth in pharmaceutical manufacturing, driven by increasing demand for affordable medications and advancements in drug development. Regulatory bodies in countries such as China and India are implementing stricter quality control measures, necessitating the adoption of advanced inspection systems. Additionally, technological advancements in automation and AI are enhancing the capabilities of inspection machines, improving their efficiency and accuracy.

The pharmaceutical inspection machines market in India is experiencing rapid growth, fueled by a combination of factors, including increasing pharmaceutical manufacturing and technological advancements. India is a significant player in the global pharmaceutical industry, with a growing emphasis on producing high-quality medications to meet domestic and international demand. The Indian Ministry of Health and Family Welfare is enhancing regulatory standards, including stricter quality control measures, which drives the need for advanced inspection technologies.

The China pharmaceutical inspection machines market is experiencing robust growth due to the country's expanding pharmaceutical sector, stringent regulatory standards, and technological advancements. The National Medical Products Administration (NMPA) has enforced stricter quality and safety regulations, increasing the demand for advanced inspection systems. China's rapid pharmaceutical manufacturing growth and focus on improving product quality and compliance drive this demand. However, recent revisions to China's State Secrets and Data Security laws have raised concerns, particularly for international companies, such as those from Germany, which depend heavily on Chinese suppliers. These new regulations create uncertainties and challenges in maintaining compliance with Good Manufacturing Practice (GMP) standards, potentially disrupting the pharmaceutical supply chain.

Latin America Pharmaceutical Inspection Machines Market Trends

The pharmaceutical inspection machines market in Latin America is expanding due to increasing pharmaceutical production, rising regulatory standards, and technological advancements. The region is seeing growth in pharmaceutical manufacturing as countries seek to meet the growing demand for medications and improve local production capabilities. Regulatory bodies in Latin American countries are implementing stricter quality control measures, driving the need for advanced inspection systems.

The pharmaceutical inspection machines market is driven by increasing pharmaceutical production and technological advancements in Brazil. Brazil is a critical player in the Latin American pharmaceutical industry, with a growing emphasis on enhancing local manufacturing capabilities and meeting international standards. The Brazilian Health Regulatory Agency (ANVISA) has implemented stricter quality control and regulatory requirements, driving demand for advanced inspection technologies.

Middle East & Africa Pharmaceutical Inspection Machines Market Trends

The pharmaceutical inspection machines market in the Middle East and Africa is expanding significantly due to increasing pharmaceutical production. The region is experiencing growth in pharmaceutical manufacturing as countries seek to enhance local production capabilities and meet the growing demand for medications. Regulatory bodies are implementing stricter quality control measures, necessitating the adoption of advanced inspection systems.

The pharmaceutical inspection machines market in Saudi Arabia is rapidly growing due to the country’s expanding pharmaceutical industry and the technological advancements. Saudi Arabia is investing in enhancing its local pharmaceutical manufacturing capabilities to meet domestic and international demand. The Saudi Food & Drug Authority (SFDA) has implemented stricter quality control regulations, driving the need for advanced inspection systems.

Key Pharmaceutical Inspection Machines Company Insights

The global market is dominated by several major pharmaceutical companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative options. They also expanded their machines portfolios through strategic collaborations, mergers, and acquisitions.

Key Pharmaceutical Inspection Machines Companies:

The following are the leading companies in the pharmaceutical inspection machines market. These companies collectively hold the largest market share and dictate industry trends.

- Anritsu Corporation

- ACG Group

- ANTERAS VISION

- Cognex Corporation

- HEUFT Systemtechnik GmbH

- Ishida Co., Ltd.

- Körber AG

- Keyence Corporation

- Mettler-Toledo International Inc.

- Omron Corporation

- Optel Group

- Robert Bosch GmbH

- Sartorius AG

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

Recent Developments

-

In May 2024, Antares Vision Group announced to showcase its latest innovations at ACHEMA in Germany, including its first automatic inspection machine for blow-fill-seal (BFS) cards. This new system, showcased at Stand B4, Hall 3.0, provides 100% inspection at speeds up to 100 pieces per minute. It addresses the unique challenges of BFS containers by performing thorough inspections, such as cosmetic checks, particle detection, fill level measurement, and tab verification. Advanced algorithms enable effective detection of foreign particles in low-fill containers, surpassing traditional methods.

Global Pharmaceutical Inspection Machines Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 922.3 million

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, packaging type, formulation, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Anritsu Corporation; ACG Group; ANTERAS VISION; Cognex Corporation; HEUFT Systemtechnik GmbH; Ishida Co., Ltd.; Körber AG; Keyence Corporation; Mettler-Toledo International Inc.; Omron Corporation; Optel Group; Robert Bosch GmbH; Sartorius AG; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Inspection Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical inspection machines market report based on component, type, formulation, packaging type, end-use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Inspection System

-

Vision Inspection System

-

Multifunctional

-

Specialized

-

-

Leak Detection System

-

Metal Detectors

-

X-ray Inspection System

-

Check weighing System

-

Combination System

-

Others

-

-

Software

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-automated

-

Fully-automated

-

Manual

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Syringes

-

Bottles

-

Blisters

-

Ampoules/Vials

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Tablets/Capsules

-

Oral Solutions/Syrups

-

Others

-

-

Parenteral

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

CROs & CDMOs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical inspection machines market size was valued at USD 862.0 million in 2023 and is projected to reach USD 922.3 million in 2024.

b. The global pharmaceutical inspection machines market is projected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2030 to reach USD 1.62 billion by 2030.

b. In 2023, the inspection systems segment dominated the market with a substantial share of 76.0% and is also expected to grow at the fastest CAGR of 10.2% during the forecast period.

b. Some of the key market participants operating in this market include Anritsu Corporation; ACG Group; ANTERAS VISION; Cognex Corporation; HEUFT Systemtechnik GmbH; Ishida Co., Ltd.; Körber AG; Keyence Corporation; Mettler-Toledo International Inc.; Omron Corporation; Optel Group; Robert Bosch GmbH; Sartorius AG; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc.

b. The growth is fueled by pharmaceutical and biotechnology companies' rising adoption of inspection systems, stringent regulatory requirements, and increasing outsourcing to emerging markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.