- Home

- »

- Consumer F&B

- »

-

Pet Supplements Market Size, Share & Trends Report, 2030GVR Report cover

![Pet Supplements Market Size, Share & Trends Report]()

Pet Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Over-the-counter (OTC), Prescription), By Pet Type (Dogs, Cats), By Form, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-400-0

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Supplements Market Summary

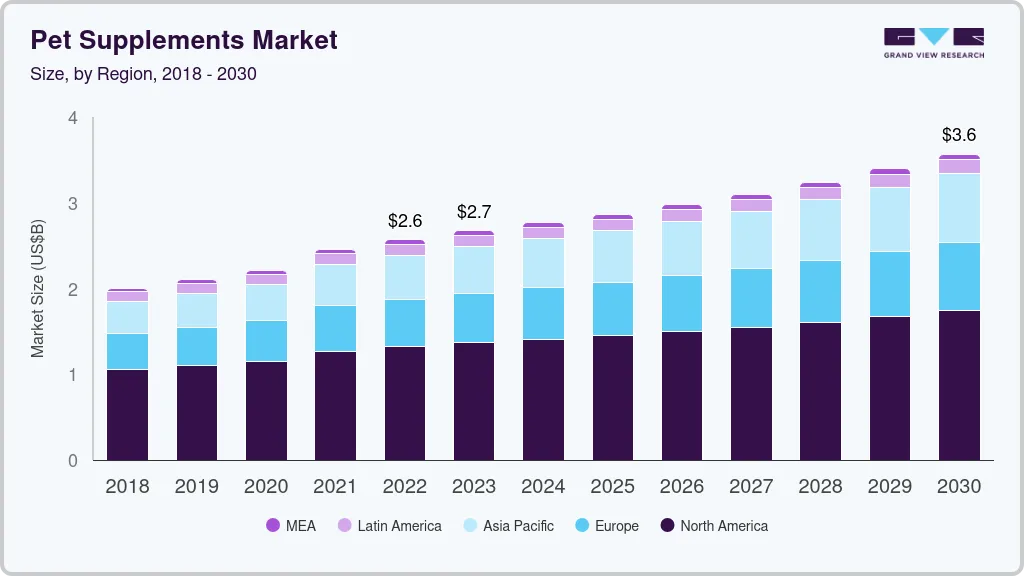

The global pet supplements market size was estimated at USD 2.26 billion in 2024 and is projected to reach USD 3.19 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The rising demand for the market can be attributed to rise in pet humanization, leading to significant expenditure on pet food, supplements, and other related products to keep them active and healthy.

Key Market Trends & Insights

- North America big data market dominated the market with a revenue share of 36.8% in 2023.

- The U.S. big data market dominated the regional industry in 2023.

- By type, over-the-counter (OTC) pet supplements dominated the market and held the largest revenue share of 86.6% in 2023.

- By pet type, dog supplements dominated the market for pet supplements and held the largest revenue share of 41.4% in 2023.

- By form, chewables are one of the most preferred forms of supplements, accounting for approximately 70.0% of global revenue in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2.26 Billion

- 2030 Projected Market Size: USD 3.19 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Supplements enhance pets’ concentration, focus, and energy levels, strengthen their immune system, and improve heart health. Anti-stress, anti-anxiety, or calming supplements are also in high demand and are anticipated to gain further traction among pet owners.

Pet owners across the globe have been spending significantly on their pets’ well-being and nutrition. According to an article published by the Insurance Information Institute, Inc., the total pet industry expenditure in the U.S. was USD 123.6 billion in 2023, up 19% from USD 103.6 billion in 2020. In addition, owing to various health issues such as arthritis, canine parvovirus, diabetes mellitus, and distemper among pets, pet owners are increasingly using calming supplements, which primarily contain ingredients such as hemp oil and cannabis, supporting the market growth.

Private-label pet supplement companies have been experiencing a notable trend in recent years. As more pet owners seek specialized and personalized products for their furry companions, private-label brands have emerged to meet this demand.

The increasing number of pets across the globe is driving the demand for pet supplements. For instance, according to the U.S. Pet Food Industry’s 2020 pet ownership study, pet ownership rose from 67% of households to an all-time high of 70%, as confirmed by the American Pet Product Association APPA. These statistics foretell high market growth over the forecast period.

Increased spending on pet care across the globally is one of the key factors propelling market growth. Pet owners are willing to spend a lot of money to ensure the health of their pets, which has led to an increase in the health expenditure of pets. A study by the Consumer Expenditure Survey of the Bureau of Labor Statistics estimates that from 1996 to 2012, spending on pets increased by 60%. For instance, according to the 2020 statistics report by the American Pet Products Association, a total of USD 103.6 billion was spent on pets in the U.S. in 2020, where the majority sales breakdown was as follows: pet food & treats USD 42.0 billion.

During COVID-19, most services and stores for dogs, cats, and birds were shut owing to government advisories against frequent trips to the supermarket and other physical stores. As a result, a number of people began looking for food delivery options for these animals. The emergence of such innovative avenues is one of the few winners in an otherwise devastating COVID-19 crisis. Online shopping for food increased by 20% during the pandemic in the U.S., as reported by the American Pet Products Association (APPA) in June 2023. Prior to the COVID-19 crisis, 60% of animal owners in the country bought supplies such as food and medicines from offline brick-and-mortar stores.

Pet supplements provide essential nutrients that help improve the immune system and reduce the risk of heart disease, cancer, inflammation, and diabetes. In addition, supplements such as fish oil, biotin, and amino acids improve skin health and enhance the ability to fight common problems, such as bacterial infection, itchy skin, and environmental allergies. They also improve cognitive development by providing antioxidants such as vitamin E, vitamin C, L-Carnitine, and Coenzyme Q-10.

Moreover, according to a June 2023 statistics report by the American Pet Products Association (APPA), spending on dogs and cats increased during the COVID-19 pandemic, with 35% of pet owners stating they spent more on supplies—including food, wellness-related products, and other body care items compared to 2019. These statistics show that the market for pet supplements has great potential across the region as well as the globe. Moreover, the products beneficial for different health problems are available in the market.

Type Insights

Over-the-counter (OTC) pet dietary supplements market held the largest revenue share of 86.6% in 2023. The segment is expected to maintain dominance over the forecast period as there are supplements to either support a particular aspect of pet's health or provide specific nutrients. Moreover, these supplements are popular and readily & easily available at a relatively affordable price. Additionally, a wide range of pet supplements is available through various distribution channels, including online retailers, supermarkets & hypermarkets, and pet stores. Some of the most popular over-the-counter supplements consumer purchase for their pets include joint supplements, omega-3 supplements, multivitamins, probiotics, and others.

The prescribed pet supplements are expected to register the fastest CAGR during the forecast period from 2024-2030. Prescription pet supplements are formulated to target specific health concerns. This approach enables the treatment of complex medical conditions in pets, thus resulting in increased adoption and market growth. Prescription supplements are safe, effective, and backed by clinical trials and scientific research. Moreover, prescription supplements go through rigorous quality control standards, ensuring the efficacy and safety of these supplements. Zoetis and Elanco are the two largest supplement companies that provide prescription pet supplements.

Pet Type Insights

Dog supplements dominated the market for pet supplements and held the largest revenue share of 41.4% in 2023. The dog supplements are also expected to maintain dominance over the forecast period. Dogs are the most popular pets with high adoption rate around the world. According to the National Pet Owners Survey conducted by the American Pet Products Association, 69.0 million households in the U.S. own a dog. Companies have been introducing new dog supplements, further propelling market growth. For instance, in October 2023, Greenies, a brand of Mars and Affiliates, launched a line of dog supplements targeting mobility, immune system support, and skin and coat health. These products are free from artificial flavors, artificial preservatives, and fillers and are formulated with high-quality ingredients.

However, the cats segment is projected to expand at the fastest CAGR from 2024 to 2030. It is observed that cats provide greater comfort and companionship to their owners, which in turn has increased the demand for cat food products and supplements. According to an article published in CNN Health in November 2023, approximately 30% of the American public suffers from insomnia and at least 25 million adults suffer from obstructive sleep apnea, and sleeping with cats might help perpetuate insomnia. Thus, the benefits of owning a cat have boosted their adoption and hence, creating opportunities for the segment.

Form Insights

Chewables are one of the most preferred forms of supplements, accounting for approximately 70.0% of global revenue in 2023. Various pet animals including cats and dogs, find it difficult to swallow tablets/capsules or do not like the sensation. In such cases, chewable supplements are ideal as animals are bound to chew food intuitively, consequently driving this segment’s growth. A vital benefit of chewable products is their ability to be absorbed in the stomach like food. Chewing exposes the food to saliva containing digestive enzymes that break it down as they are chewed, and the more opportunity these enzymes have to deconstruct it. Hence, chewable supplements offer complete absorption and allow the absorption of nutrients.

The powder form is anticipated to register the highest CAGR from 2024 to 2030. Supplements in powder form are absorbed more quickly than tablets or pills, are easy to consume, and can be easily mixed into foods and beverages. Such factors are expected to increase product visibility among animal owners, resulting in the growth of powder-based products over the forecast period. Key players offer a wide range of powder-based products. For instance, NOW Foods offers powdered pet supplements that support cardiovascular system health in both cats and dogs.

Distribution Channel Insights

The offline distribution channel dominated the market for pet supplements and accounted for the largest revenue share of around 77.8% in 2023. Offline channel includes supermarkets/hypermarkets, convenience stores, and local shops. The increasing availability of a wide range of supplements such as multivitamins, omega-3, and skin and coat care products in such stores also plays a key role in driving segment’s growth. For instance, in July 2020, Carrefour, the French supermarket chain, launched a new concept pet store in Paris in collaboration with Invivo Retail’s pet care brand Noa. The concept retail store offers a broad selection of full-body care products including supplements.

The online distribution channel is anticipated to register the fastest CAGR of 8.7% from 2024 to 2030. The availability of a wide range of domesticated animal food and necessities and the increasing customer loyalty through “Subscribe and Save” programs are expected to drive the online channel segment. For instance, Chewy, Petco Animal Supplies, Inc., BestVetCare.com, and Amazon are major trusted online suppliers of supplements for animals such as dogs, cats, fish, and birds.

Application Insights

The hip and joint segment dominated the market for pet supplements and held the largest revenue share of more than 21.49% in 2023 and is expected to maintain its dominance over the forecast period. Excessive joint pains can lead to limping, stiffness, reluctance to do things, stress, and anxiety in pets, which can be serious health problems related to overall health. Many of the supplements for joints come with soothing ingredients such as glucosamine and chondroitin that help protect the joints from severe wear and tear and prevent arthritis. Several dogs and cats are given supplements containing omega-3 fatty acids that offer anti-inflammatory benefits. These factors are expected to drive the demand for supplements that address hip and joint issues.

The skin and coat segment is projected to register the highest CAGR during the forecast period from 2024 to 2030. Pet supplements for skin and coat are gaining momentum as several owners have reported skin issues such as hair loss, dry skin, self-inflicted wounds, inflammation, and dandruff, which can result from constant itching and scratching. Skin supplements offer nourishment to the pet’s skin and relieve dryness. Ingredients such as omega-3 and omega-6 fatty acids, coconut oil, zinc, vitamins, minerals, and other powerful antioxidants offer regular nourishment to skin. Increasing concerns among the owner towards overall well-being of their pet are driving the demand for these products in the market.

The multivitamins segment is projected to register a lucrative growth rate during the forecast period from 2024 to 2030. The increasing inclination toward purchasing multivitamin pet supplements among pet owners can be attributed to various health and wellness-related factors. One of the primary factors is the utility of multivitamins to fill any nutritional gaps in a pet diet when pets are on a homemade or nutritionally imbalanced diet. Multivitamins are perceived to maintain optimal health and potentially extend the pets' lifespan, thus promising the prospect of a longer, healthier life.

Regional Insights

North America dominated the pet supplements market and accounted for the largest revenue share of 48.4% in 2023. The rising number of pet owners, the growing concerns for pets, and the increasing awareness among pet owners about various health risks are the major factors driving the growth of the North America market. According to the National Pet Owners Survey 2019-2020, 67% of U.S. households owned a pet, which has increased from 56% in 1988. The rising tendency of pet owners to improve the immune systems of their pets, strengthen their bones, improve digestion, and treat various skin allergies of their pets is also driving the demand for pet supplements in North America.

The U.S. pet supplements market is expected to grow at a CAGR of 5.3% from 2024 to 2030. The growth of the U.S. market can be attributed to the increasing pet ownership. According to statistics published by the American Veterinary Medical Association (AVMA) in October 2022, 44.5% of U.S. households had at least one pet dog, and around 29% had at least one pet cat; this increased from 38.4% and 25%, respectively, in 2016.

In Asia Pacific, the market is expected to witness at the fastest CAGR from 2024 to 2030. The increasing perception among owners that food alone might not meet all the health requirements of their pets and supplements can address any deficiencies in their daily diet is favoring the growth of these products for animals. Additionally, the growing population of domesticated dogs, fish, birds, and cats in the region, particularly in China and Australia, is expected to enhance the market growth.

China is one of the major producers as well as exporters of pet food items and related products and, therefore, has an established distribution channel for these products across the country. The popularity of dogs, cats, and birds as pets has increased in recent years. The presence of several manufacturers of supplements for various animals, such as cats, dogs, fish, and birds, has resulted in the availability of a variety of product options for consumers in the country. In recent years, China is influenced by Western culture, particularly in the trend of owning pets. According to a white paper by the China Pet Industry Association, the number of dogs and cats, the most commonly kept pets in Chinese cities, stood at 100.8 million in 2020.

India has a high acceptance of dogs as pets, a trend increasingly popular among the young generations. According to the article published by Pawsome Advice in August 2023, India has one of the highest dog population of 10.2 million. This high rate of pet adoption and the growing willingness to spend money on pets is expected to benefit the market. Consumers are contemplating giving their pets supplemental nutrition, along with home-cooked meals.

Europe held a significant market share of in 2023 and is projected to showcase a lucrative growth rate during the forecast period from 2024 -2030. Europe is one of the largest regions in terms of pet owners, which favors the market growth for pet supplements. Europe houses a significant number of manufacturing facilities that are apt for the pet food industry, which, in turn, has increased the availability of pet supplements in the European market.

The growing millennial and Gen Z population in Germany is expected to generate a noteworthy growth in pet ownership, thereby driving the growth of the Germany market. Most millennials in the country own either a cat or a dog and look at them as the first step in forming a family and easing into parenthood. Such behavioral patterns among consumers have been gradually increasing pet ownership, which is driving the Germany pet supplements industry growth.

Increasing awareness of pet dietary supplements to enhance the nutritive balance for pets is the key factor driving their demand. The U.K. is known as a country of pet lovers. Government regulations and animal rescue organizations working toward preventing animal cruelty, promoting kindness toward animals, and alleviating the suffering of animals have increased the pet welfare and adoption rate in the country, which favors the market growth of pet supplements in the U.K.

Key Companies & Market Share Insights

Key companies undertake various strategies to gain a competitive advantage over others. For instance,

-

In March 2023, Mars Petcare is entering the supplements category by introducing Pedigree Multivitamins. This new product line consists of three types of soft chews specifically designed to meet the essential needs of pets. The Pedigree Multivitamins aims to support immunity, promote healthy digestion, and provide joint care for pets.

-

In March 2022, Virbac launched two new Veterinary HPM wet diets formulated to help prevent and manage feline lower urinary tract disease (FLUTD), a health concern in cats.

-

In February 2022, Virbac announced the launch of its first line of pet food- Veterinary HPM Pet Nutrition, formulated for spayed and neutered animals. The product line includes two cat foods and four dog foods, available in six different formulas and customized to fit pet needs based on age and size.

-

In October 2023, Zesty Paws was launched in Canada in partnership with PetSmart and Amazon. This move marked Zesty Paws’ international expansion.

-

In July 2020, Virbac launched Tramvetol, an injectable solution for treating acute and chronic pain in dogs.

-

In April 2020, Virbac launched an internal and external selamectin-based parasiticide for domestic dogs and cats in North America and Australia.

-

In April 2020, Nestlé Purina Petcare acquired Lily's Kitchen, a U.K.-based natural pet food brand, to expand its product portfolio and offering in the U.K. market.

Key Pet Supplements Companies:

- FoodScience Corporation

- Ark Naturals

- NOW Foods

- Virbac

- Zoetis, Inc.

- Mars, Incorporated

- Pet Honesty

- Nutramax Laboratories, Inc.

- Zesty Paws

Pet Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.39 billion

Revenue forecast in 2030

USD 3.19 billion

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, pet type, form, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K; France, Spain; Italy; China; Japan; India; Brazil; South Africa

Key companies profiled

Nestlé S.A.; FoodScience Corporation; Ark Naturals; NOW Foods; Virbac; Zoetis, Inc.; Mars, Incorporated; Pet Honesty; Nutramax Laboratories, Inc.;, Zesty Paws

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Supplements Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet supplements market report based on type, pet type, form, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Over-the-counter (OTC)

-

Prescription

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Pills/Tablets

-

Chewables

-

Powders

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin & Coat

-

Hip & Joint

-

Digestive Health

-

Immune Support

-

Weight Management

-

Oral/Dental Health

-

Heart Health

-

Cognitive Function

-

Calming/Anxiety & Stress Relief

-

Muscle & Performance

-

Eye Health

-

Kidney & Liver Support

-

Multivitamins

-

Allergy Relief

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Pet Specialty Stores

-

Pharmacy & Drug Stores

-

Convenience Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the pet supplements market growth include changes in socio-economic aspects and inclination towards the humanization of animals.

b. The global pet supplements market size was estimated at USD 2.49 billion in 2023 and is expected to reach USD 2.62 billion in 2024.

b. The global pet supplements market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 and reach USD 3.73 billion by 2030.

b. North America dominated the pet supplements market with a share of 48.4% in 2023. This is attributed to the high adoption of pets and growing pet humanization in the U.S.

b. Some key players operating in the pet supplements market include Nestle Purina Petcare, VetriScience Laboratories, Ark Naturals, NOW Food, Virbac, Kemin Industries, Novotech Nutraceuticals, Zoetis, and Bayer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.