- Home

- »

- Beauty & Personal Care

- »

-

Pet Calming Products Market Size, Industry Report, 2030GVR Report cover

![Pet Calming Products Market Size, Share & Trends Report]()

Pet Calming Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet (Dog, Cat), By Product (Food & Supplements, Snacks & Treats, Gel & Ointment, Spray & Mist), By Type, By Ingredient, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-046-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Calming Products Market Summary

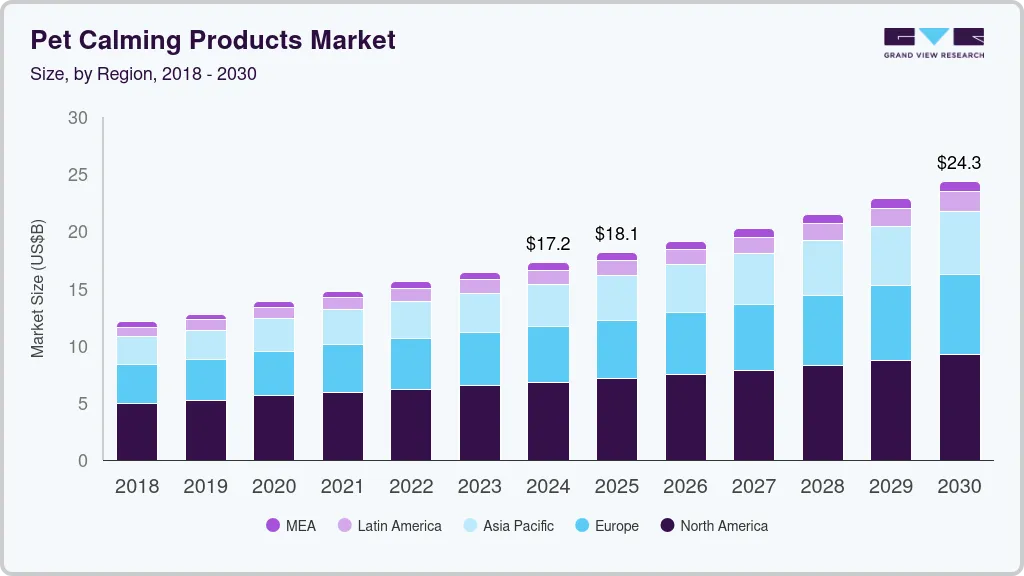

The global pet calming products market size was estimated at USD 17,235.1 million in 2024 and is projected to reach USD 24,341.1 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. In recent years, there has been a significant surge in pet adoption, particularly in the U.S.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Africa is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, dog accounted for a revenue of USD 8,246.3 million in 2024.

- Cat is the most lucrative pet type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: 17,235.1 million

- 2030 Projected Market Size: USD 24,341.1 million

- CAGR (2025-2030): 6.1%

- North America : Largest market in 2024

The preference for dogs and cats as pets remains steadfast in different regions in the U.S. According to the American Society for the Prevention of Cruelty to Animals, one in five Americans acquired a pet during the pandemic. In 2020, 90.5 million families in the U.S. adopted pets, spending a combined total of USD 103.6 billion on pet care. Pet calming is an essential aspect of pet care, as it directly addresses the emotional and behavioral well-being of pets. Just as physical health and hygiene are integral to overall pet care, mental health plays a crucial role in ensuring that pets live happy, healthy lives. Many pets experience stress and anxiety from various triggers, such as separation from their owners, unfamiliar environments, loud noises, or changes in routine.

The global pet calming products industry has seen significant growth driven by increasing awareness of pet mental health and a surge in pet ownership worldwide. Pet owners are increasingly seeking solutions to manage their pets' anxiety, stress, and behavioral issues, which has led to the popularity of calming products. As pet anxiety disorders, including separation anxiety, noise phobia, and fear-related behaviors, become more recognized, the demand for calming solutions such as pheromone-based sprays, collars, diffusers, and other calming aids has expanded.

For instance, brands like Adaptil and Feliway, which specialize in calming products, have seen increased sales globally due to the growing demand for effective, natural solutions to pet anxiety. In addition to pheromone-based products, supplements, calming chews, and anxiety wraps have gained traction in the market.

There is a growing awareness among pet owners about the importance of pet health and well-being. This increased awareness results in an increased focus on calming routines as an essential aspect of pet care. Pet owners look for calming products that not only help with the anxiety but also contribute to the overall well-being of their pets.

Pet calming products are one of the niche categories in the pet care market. The global rise in pet adoption and the high demand for pet products, as well as grooming & therapy services, are some of the major factors anticipated to drive the market through 2030. Pheromone-based pet calming products encompass a diverse range of products, including sprays, diffusers, collars, gels & ointment among others designed to address various pet calming needs.

Consumer spending on pet-related requirements has significantly increased due to pet humanization. Pets are increasingly viewed as integral members of the family. This shift in perception prompts pet owners to invest in calming products that prioritize their pets' comfort, health, and aesthetics, echoing the care they provide for themselves and their human family members.

Pet Insights

The dog pet calming products segment accounted for a share of about 52% in the overall pet calming products industry in 2024. Dog calming products are becoming increasingly popular among dog owners looking for ways to reduce their pets' anxiety and stress. According to the article “Prevalence, comorbidity, and breed differences in canine anxiety in 13,700 Finnish pet dogs,” published in Scientific Reports in March 2020,” a study done on 264 dog breeds in Finland, found that more than 70% of dogs exhibited some anxiousness or stress-related behavior, with noise sensitivity being the most prevalent. Dogs, like humans, can experience stress and anxiety, which can lead to behavioral issues and health problems if left untreated. Calming products can help alleviate these symptoms and improve the dog's overall well-being.

Usage of pet calming products among cats is expected to increase at a CAGR of 6.8% from 2025 to 2030. Cats can experience stress and anxiety in response to various situations such as travel, grooming, and veterinary visits. Such stress can lead to behavioral problems like hiding, aggression, and inappropriate elimination. To help cats deal with these issues, cat owners are increasingly adopting cat-calming products like chews, snacks, and treats. Several brands have been operating in this segment with a focus toward innovation and novelty to offer pet owners with easy-to-use products. For instance, in June 2022, Animal Science Labs launched a new product to treat cat anxiety using the owner's natural scent. Kitty Comfort Spray combines therapeutic-grade essential oils with the cat owner's scent molecules in a highly concentrated composition. The spray would remind a cat of their owner, even if the owner is not physically present, and comfort them.

Product Insights

Pet calming snacks and treats industry accounted for a revenue share of about 38% in the overall market. Pet calming snacks and treats are natural supplements designed to help soothe and relax pets. They can be given to pets as treats or chews and are intended to be used as a supplement to other anxiety-reducing techniques, such as exercise, training, and environmental enrichment. In recent years CBD and hemp-derived dog treats are gaining traction because they offer a natural and non-toxic way to help soothe and relax pets. These treats are typically made with high-quality ingredients and are free from harmful chemicals and additives, making them a safer and more effective option for pets with sensitive stomachs or allergies. In April 2021, U.S.-based YUP PUP launched its all-natural hemp-derived CBD dog treat. The products are available in three variants and are formulated with all-natural and human-grade ingredients.

The pet calming gel & ointment industry is expected to grow at a CAGR of 8.1% from 2025 to 2030. Several brands have been entering this segment and releasing products. The Anxious Pet, for instance, offers Soothe Move CBD Soothing Balm. It relieves anxiety in dogs as well as cats while protecting, healing, and moisturizing areas like elbows, paw pads, and snouts. The product contains 500 mg of CBD, 100% natural ingredients and is tested by an independent third party.

Type Insights

Over-the-counter pet calming products accounted for about 63% in the global market. Recent investment moves, especially mergers & acquisitions, have resulted in resource availability to develop new and innovative OTC pet calming products that are safe, effective, and meet the evolving needs of pet owners. For instance, in July 2020, NXMH, a Belgian investment firm, acquired Whitebridge Pet Brands. NXMH focuses on expanding its product portfolio through acquisitions and product development. Investors are targeting market players with strong, sustainable growth and robust & improving margins and that have demonstrated performance over time. Moreover, they are also looking for companies with a strong e-commerce presence. Investments in the pet industry could lead to the expansion of distribution channels for OTC pet calming products, making them more widely available to pet owners.

The prescription pet calming products industry is projected to grow at a CAGR of 6.8% from 2025 to 2030. Prescription-based pet calming products are formulated with ingredients that are safe for pets with the appropriate dose for their size and weight. These are prescribed by a veterinarian who has evaluated the pet's health and determined that the benefits of the medication outweigh any potential risks. This ensures that the pet is receiving safe and appropriate treatment. Nowadays, pet owners treat their pets as family members, taking every measure to improve their quality of life. This has led to an increased demand for prescription-based pet calming products.

Ingredient Insights

Melatonin based pet calming products had a revenue share of approximately 27% in the market. These are gaining popularity due to their natural and non-addictive properties, appealing to pet owners seeking gentle solutions for stress and anxiety in pets. Melatonin helps regulate sleep and relaxation in animals, making it effective for situations like travel, storms, or separation anxiety. Its widespread use in humans for similar purposes adds to consumer trust. Additionally, these products are available in various forms, such as chews and sprays, increasing accessibility and convenience.

Demand for pet calming products made of herbal ingredients is set to expand at a CAGR of 6.7% from 2025 to 2030. Such products are gaining popularity as pet owners increasingly prefer natural, holistic solutions for anxiety and stress. Ingredients like chamomile, valerian root, and passionflower appeal to consumers seeking safe, chemical-free options. This trend aligns with growing awareness of pet wellness and the desire for eco-friendly, sustainable products.

In April 2024, Cymbiotika launched its pet line, Cymbiotika Pets, featuring high-quality supplements for dogs. The line included "Dog’s Calm," a duck-flavored soft chew formulated with natural ingredients like chamomile, valerian root, GABA, and L-theanine. Designed to alleviate stress and anxiety caused by environmental factors, it aimed to promote relaxation and overall well-being in dogs.

Distribution Channel Insights

The offline sales channel accounted for a major revenue share of over 63% in 2024. Amidst the continued boom in the pet industry, several market players have been expanding their reach to tap consumers in an offline setting. Bunnings, an Australian household hardware and garden center chain, released its first range of pet products in March 2023. The retailer introduced more than 700 items in its wide selection of pet care goods, and it also sells products by brands like Happy Tails, Baxter & Bone, and PetZone.

Sales through the online sales channel is expected to expand at a CAGR of 6.5% from 2025 to 2030. The online and e-commerce platforms in pet calming products industry are expected to grow significantly during the forecast period, owing to the diverse product offerings, ease of shopping, and hefty discounts offered. Moreover, the pandemic paved a way for the development of online and e-commerce platforms.

Recognizing the e-commerce and digitalization revolution, key players in the market are collaborating with companies to strengthen their online presence. For instance, in April 2021, Central Garden & Pet Company collaborated with Profitero, Inc. to strengthen its online presence and accelerate e-commerce growth as pet purchases through online shopping surge. Such instances coupled with factors driving online shopping are expected to grow the pheromone-based market.

Regional Insights

The pet calming products market in North America accounted for a market share of around 39% in 2024 in the global market. The market here is growing primarily due to the rise in pet adoption. According to data published by Forever Vets in February 2022, pet ownership in the U.S. is on the rise. The number of pets, including dogs and cats, rose from 140 million in 2019 to 149 million in 2020. Moreover, many of these new pet owners are more aware of their pets' emotional and behavioral needs, contributing to increased demand for calming solutions.

U.S. Pet Calming Products Market Trends

The pet calming products market in the U.S. accounted for a market share of around 81% in 2024 in the North American market. There is a growing trend of treating pets as family members and are willing to invest in products that improve their pets' well-being, including pheromone-based calming solutions. North America experiences monsoon lighting and a countless number of storms. According to the NOAA National Severe Storms Laboratory data, the U.S. alone experiences approximately 100,000 thunderstorms each year. These environmental changes cause anxiety and stress among pets, and they need calming procedures to soothe them.

Europe Pet Calming Products Market Trends

The pet calming products market in Europe accounted for a market share of around 28% in 2024 in the global pet calming products industry. According to FEDIAF EuropeanPetFood in 2022, 90 million European families (46%) owned pets, which led to an increase in the sales of pet products and services worth over USD 20 billion. With an increasing demand for safe and effective pet calming products, regional manufacturers are developing products with natural ingredients. Zylkene, for instance, offers a capsule containing a natural ingredient called alpha-casozepine, derived from milk protein. The capsule is designed to help calm dogs and cats in stressful situations. Also, Camex offers a chewable tablet made from the natural ingredient L-tryptophan, an amino acid that helps reduce anxiety and promote relaxation in pets.

Asia Pacific Pet Calming Products Market Trends

The pet calming products market in Asia Pacific is anticipated to rise at a CAGR of about 7.1% from 2025 to 2030. As more people move to cities, pets are living in smaller spaces and being exposed to more stressors such as traffic and noise pollution. With the rise in pet ownership in this region, there is a growing demand for products that can help pets cope with anxiety and stress. This has led to collaborations among the players in the pet calming products industry. For instance, in December 2022, JD Pet Health announced its partnership with the U.S. manufacturer Zesty Paws. Through this collaboration, Zesty Paws entered the Chinese market, with JD Pet Health as its first Chinese retail partner.

Key Pet Calming Products Company Insights

The market is fragmented in nature. The industry is highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key Pet Calming Products Companies:

The following are the leading companies in the pet calming products market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé Purina Petcare

- Virbac

- NOWFoods

- Zoetis Inc.

- PetHonesty

- Zesty Paws

- THUNDERWORKS

- PetIQ, LLC.

- CEVA (ADAPTIL)

- GARMON CORP. (NaturVet)

Recent Developments

-

In November 2024, PetFriendly introduced Mellow, a line of pheromone-based pet calming products designed to reduce stress and anxiety in cats and dogs. The line included a diffuser and spray, offering solutions for common triggers like fireworks, thunderstorms, and separation anxiety. The diffuser, using Passive Evaporation Technology, provided 30 days of calming effects in spaces up to 700 square feet, while the spray offered portable relief for travel and vet visits.

-

In December 2023, PetIQ, Inc. launched the SENTRY Portable Calming Diffuser for dogs and cats, designed to ease pet stress during the holiday season and beyond. The diffuser used patented pheromone technology to lower pets’ heart rates and promote relaxation for up to 30 days without electricity. Ideal for areas pets frequent, and it helped address stress-related behaviors like barking, marking, and scratching. Pet parents could easily replace cartridges for continuous calming support.

-

For instance, in September 2022, Zesty Paws expanded its portfolio with the launch of three cat-specific products. The Hemp Elements Plus Calming Bites in the collection include broad-spectrum hemp extract, ashwagandha, melatonin, and similar ingredients to promote a feeling of calmness in cats.

Pet Calming Products Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.14 billion

Revenue forecast in 2030

USD 24.34 billion

Growth Rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet, product, type, ingredient, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; South Africa

Key companies profiled

Nestlé Purina Petcare; Virbac; NOWFoods; Zoetis Inc.; PetHonesty; Zesty Paws; THUNDERWORKS; PetIQ, LLC.; CEVA (ADAPTIL); GARMON CORP. (NaturVet)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Pet Calming Products Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet calming products report on the basis of pet, product, type, ingredient, distribution channel, and region.

-

Pet Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dog

-

Cat

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Supplements

-

Snack & Treats

-

Gel & Ointment

-

Spray & Mist

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

Over-the-counter (OTC)

-

-

Ingredient Outlook (Revenue, USD Billion, 2018 - 2030)

-

Melatonin

-

L-theanine

-

Vitamin B1

-

Herbal Ingredients

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet calming products market was estimated at USD 17.24 billion in 2024 and is expected to reach USD 18.14 billion in 2025.

b. The global pet calming products market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 24.34 billion by 2030.

b. North America region dominated the pet calming products market with a share of around 39% in 2024. This is owing to the increasing pet ownership in the region, and hectic schedules motivating consumers to use these products to relieve anxiousness and agitation in pets.

b. Some key players operating in the pet calming products market include Nestlé Purina Petcare; Virbac; NOW Foods; Zoetis Inc.; PetHonesty; Zesty Paws; THUNDERWORKS; PetIQ, LLC.; CEVA (ADAPTIL); GARMON CORP. (NaturVet).

b. Key factors that are driving the pet calming products market growth includes the humanization of pets, impact of COVID-19 pandemic on human-pet relations, and increasing studies proving the efficacy of such products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.