- Home

- »

- Biotechnology

- »

-

Personalized Nutrition and Supplements Market Report, 2033GVR Report cover

![Personalized Nutrition And Supplements Market Size, Share & Trends Report]()

Personalized Nutrition And Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Ingredient (Proteins & Amino Acid, Vitamins), By Dosage Form (Tablets/Capsules, Liquids), By Distribution Channel, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-015-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personalized Nutrition And Supplements Market Summary

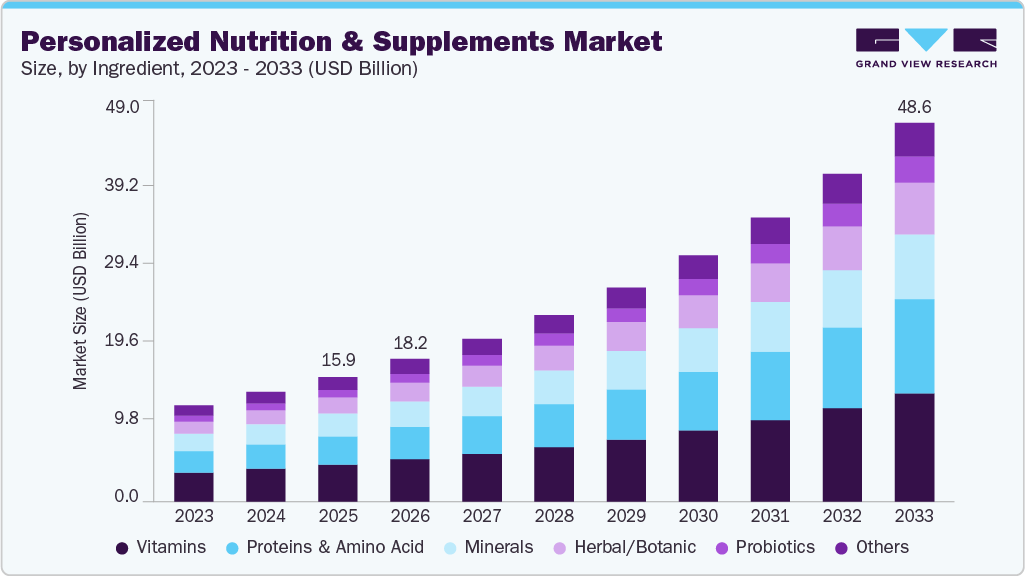

The global personalized nutrition and supplements market size was estimated at USD 15.97 billion in 2025 and is projected to reach USD 48.57 billion by 2033, growing at a CAGR of 15.03% from 2026 to 2033. Increasing consumer health awareness and growing demand for retail nutrition products are expected to drive the global industry's growth.

Key Market Trends & Insights

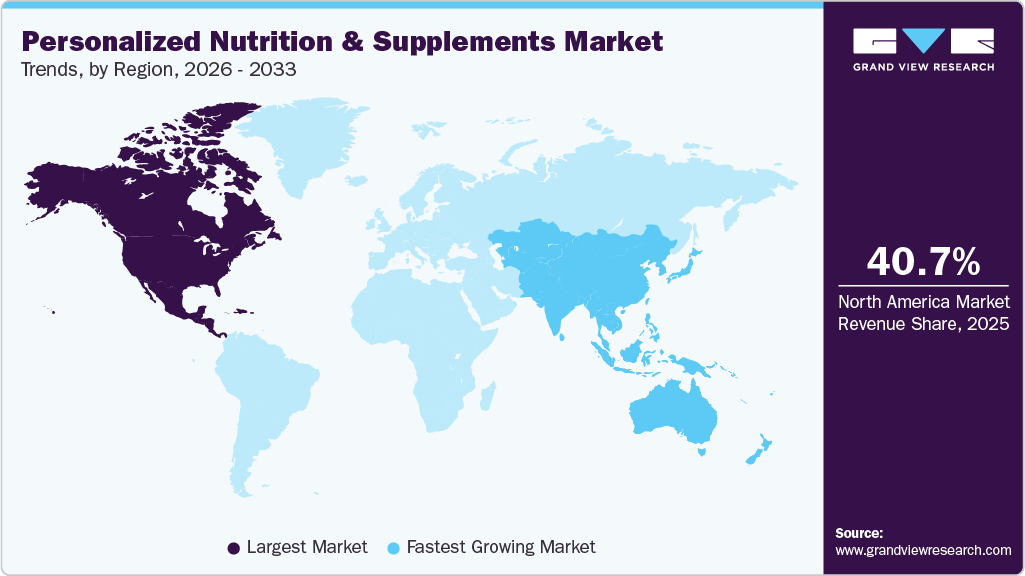

- The North America personalized nutrition and supplements market held the largest share of 40.69% of the global market in 2025.

- The personalized nutrition and supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By ingredient, the vitamins segment held the largest market share of 29.68% in 2025.

- Based on dosage form, the tablets/capsules segment held the largest market share in 2025.

- By distribution channel, the online pharmacies & e-commerce sites segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.97 Billion

- 2033 Projected Market Size: USD 48.57 Billion

- CAGR (2026-2033): 15.03%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing market

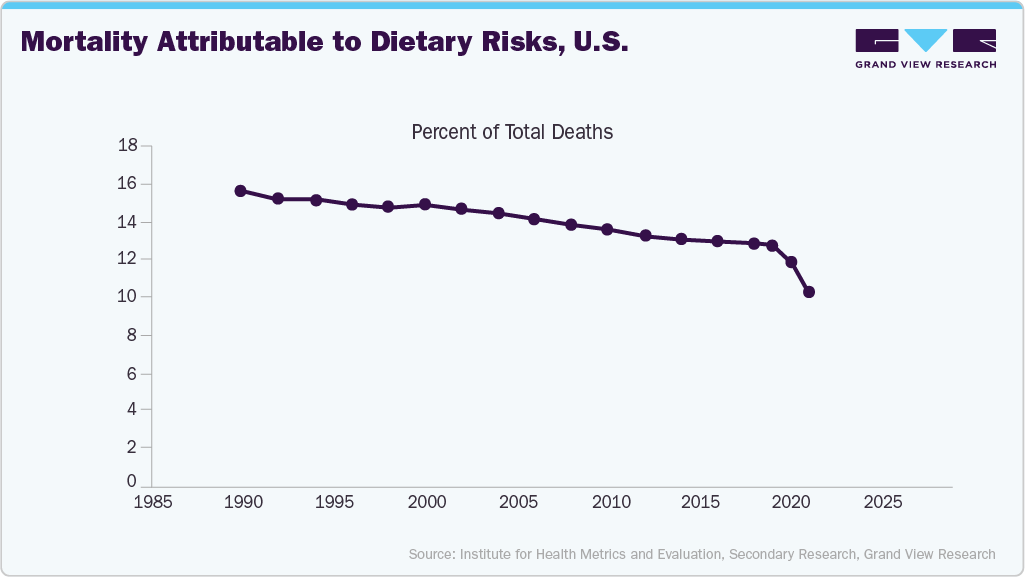

Prevalence of diet-related diseases

A key factor driving the growth of the personalized nutrition and supplements industry is the increasing prevalence of diet-related diseases. Exceptional diet-related diseases such as obesity, type 2 diabetes, cardiovascular disease, and metabolic syndrome continue to rise globally. People are seeking ways to take control of their health through personalized dietary solutions. The main reason for these diseases is mainly unhealthy diets, which consist of eating a lot of processed and unhealthy foods, taking in too much sugar, and not getting enough of the essential vitamins and minerals. As a result, very few people are still unaware of the fact that superficial and universal diet recommendations don't meet the requirements of even one person, let alone a whole population.

Furthermore, healthcare providers and nutritionists have slowly but steadily started to accept personalized nutrition as part of the treatment protocols for patients suffering from chronic diseases. Digital health and telehealth platforms are allowing remote access to customized solutions that are specific to the patients. Furthermore, insurance companies and wellness programs are increasingly recognizing the benefits of preventive health strategies, such as customized nutrition, as cost-cutting in long-term healthcare is now a widely accepted policy. This backing from institutions is one of the key factors driving the market's upward trend.

Wide range of program options with respect to type and price

There are numerous program options for companies to extend their messages to a broad audience, from value-based consumers to premium health and wellness consumers, increasing the overall market reach and customer opportunities. Technology has facilitated the adaptation of personalized nutrition brands to provide their services at varying levels of cost and sophistication.

Flexible pricing structures, such as monthly subscriptions, tiered plans, and pay-as-you-go or one-time purchase options, make it easy for customers to choose a program that suits their personal and financial needs. Rootine, for example, provides precision multivitamins designed to meet an individual's unique needs through a DNA test and blood nutrient analysis, and they are personalized to achieve the desired body composition. Evaluation involves administering the basic body composition test and offering pricing plans/options based on additional testing and personalization. Similarly, Baze develops personalized supplement kits based on blood nutrient levels. With Baze, the same concept as Rootine, but the customer determines the plan that meets their health goals and financial desires.

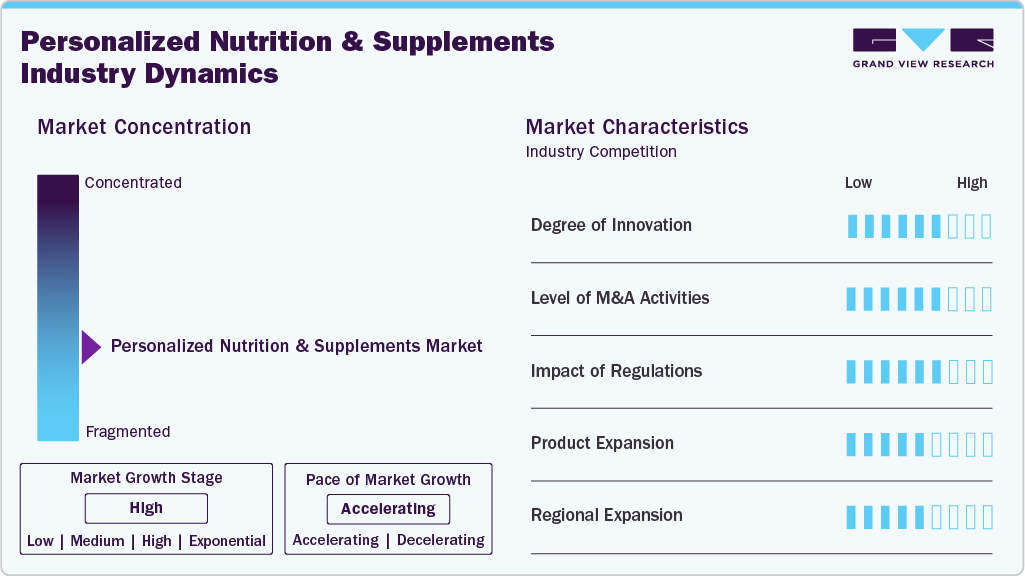

Market Concentration & Characteristics

The personalized nutrition and supplement industry is full of innovations and techniques powered by genetics, AI, and e-health platforms. DNA testing, microbiome analysis, and AI-enabled lifestyle data analytics are the primary strategies employed by companies to offer personalized supplement products. For instance, in September 2025, Joi + Blokes launched a Smart Supplement program offering personalized daily supplements based on symptoms, lab results, and clinician review.

The market is witnessing increasing mergers and acquisitions as companies aim to enhance their capabilities and expand their market presence. Notable examples include Nestlé’s acquisition of Persona Nutrition and Bayer’s purchase of Care/of, highlighting the strategic focus on personalized health. Such activities consolidate market share and accelerate innovation by leveraging acquired expertise and technologies.

Regulatory frameworks significantly impact the industry for personalized nutrition and supplements, with a growing emphasis on transparency, safety, and labeling standards. Governments and organizations implement stricter regulations to ensure consumer safety and product efficacy. For example, compliance with FDA and EFSA guidelines has become critical for market players, shaping product formulations and marketing strategies.

Product expansion in the market is focused on tailored formulations based on genetics, lifestyle, and health goals. Companies are introducing customizable vitamins, targeted functional blends, and condition-specific products, supported by digital platforms, data analytics, and direct-to-consumer models to address diverse and evolving consumer needs.

Regional expansion is a major factor in market development, with companies aiming at the high-growth areas of the Asia Pacific and the Middle East. The factors, such as an increase in disposable incomes, migrations to cities, and rising knowledge of personalized health in these areas, are opening very profitable opportunities. The firms are utilizing marketing tactics and distribution networks specifically designed for the local market to create a powerful presence in these new markets.

Ingredient Insights

The vitamins segment dominated the industry in 2025, accounting for the largest share of 29.68% of the overall revenue. Advances in digital health tools, at-home testing, and subscription models supported this shift, making customized vitamin programs more accessible and scalable. Strategic partnerships also played a key role in accelerating adoption. For instance, in January 2025, Optum Now launched a collaboration with personalized nutrition company Vous Vitamin, enabling group-level savings for subscribers purchasing through the Optum Now store. The partnership offered a recurring 20% discount on personalized vitamin subscriptions, promoting long-term engagement over one-time purchases. Such initiatives are expected to fuel growth in the vitamins segment.

The probiotics segment is expected to grow at the fastest rate over the forecast period, driven by rising consumer awareness of gut health, increasing prevalence of digestive disorders, and scientific evidence supporting immunity and wellness benefits. As consumer focus shifts toward preventive and holistic health management, the personalized probiotics segment is expected to continue its strong upward trajectory.

Dosage Form Insights

The tablets/capsules segment dominated the industry and accounted for the largest share of 60.40% of the overall revenue in 2025. Tablets/capsules are the most common form of supplement. They are safe to consume, inexpensive to produce, and effective at delivering nutrients. Tablets can be made in various shapes and sizes. These are developed by adding powdered ingredients to create a solid tablet that can easily break down inside the digestive tract. Furthermore, most tablets and capsules have additives that enhance their texture, appearance, or taste. At the same time, others have a coating to avoid breakdown before going through the small intestine, where the major nutrients are absorbed.

The powders segment is projected to register the fastest CAGR, driven by demand for customizable and easy-to-mix nutrition. Key applications include weight management, digestive health, immunity, sports nutrition, and wellness, while online retail is rapidly emerging as a major distribution channel alongside pharmacies and stores.

Distribution Channel Insights

The online pharmacies & e-commerce site segment dominated the industry and accounted for 40.69% of the overall revenue in 2025. The convenience of online shopping, coupled with advancements in digital health tools such as AI-driven recommendations, DNA testing kits, and mobile apps for dietary tracking, empowers consumers to make informed decisions about their health. These platforms often provide a wider product variety, detailed ingredient transparency, and subscription models, enhancing customer loyalty and further driving the segment demand.

The specialty stores segment is expected to grow significantly over the forecast period, driven by demand for customizable, easy-to-mix solutions. Personalized service, expert guidance, and curated product offerings that cater to health-conscious consumers further boost the demand for specialty stores in the industry.

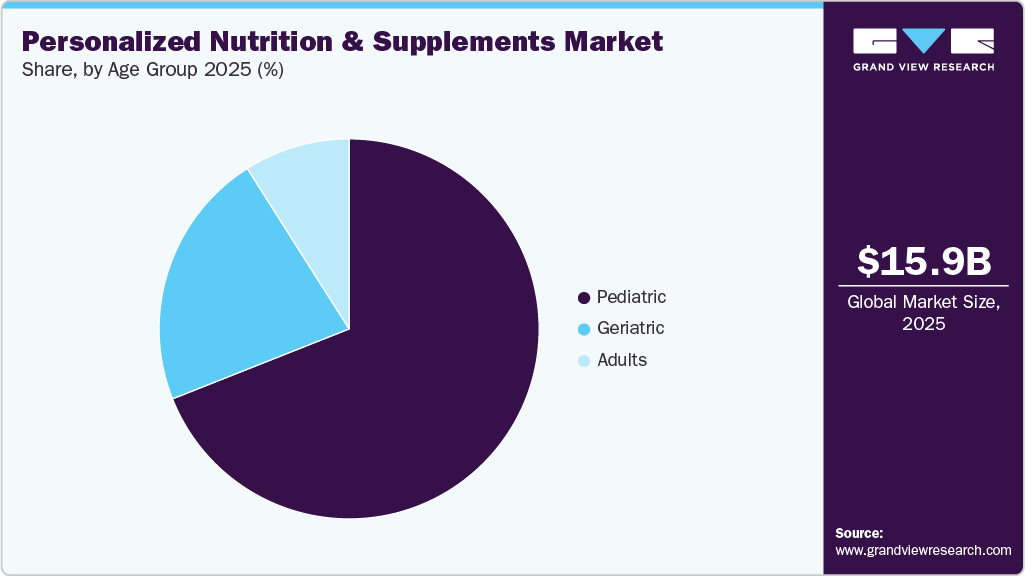

Age Group Insights

The adult segment accounted for the largest revenue share of 69.99% in 2025. A large proportion of consumers of personalized nutrition & supplements are adults. An unhealthy lifestyle at the age of 21 to 55 years increases the risk of diet-related issues. The acceleration of stress levels, coupled with alcohol intake and a lack of nutritional foods, increases dietary deficiencies. The segment is also driven by an increasing supply of personalized, science-backed health and performance solutions. For instance, in July 2025, Eternal launched Foundations, a USD 499/year membership providing lab-driven, personalized nutrition guidance for active adults. This initiative reflects a broader trend of adults investing in personalized, data-informed solutions to enhance lifelong health, demonstrating how subscription models and specialized services can support the growth of the adult segment.

The geriatric segment is expected to grow strongly, driven by rising adoption of personalized nutrition to support healthy aging, immunity, bone and joint health, and chronic disease management increased preventive healthcare awareness, higher disposable incomes, and improved healthcare access further support this growth.

Regional Insights

The personalized nutrition and supplements industry in North America led the global market with a 40.69% share in 2025, driven by major industry players, government funding, and strong research activity. Increasing investments in key companies are also expected to boost regional growth. For example, in July 2024, Bioniq, which specialized in AI-driven personalized supplements based on blood marker data, closed a USD 15 million Series B funding round led by HV Capital and Unbound.

U.S. Personalized Nutrition And Supplements Market Trends

The U.S. personalized nutrition and supplements industry leads the North American market due to high consumer awareness, advanced healthcare infrastructure, and adoption of genetic testing and AI-based solutions. One of the reasons market growth is still on the rise is the subscription-based services provided by companies like Persona Nutrition and Care/of, coupled with the growing emphasis on preventive and life-stage-specific nutrition.

Europe Personalized Nutrition And Supplements Market Trends

The personalized nutrition and supplements industry in Europe is growing due to increasing health consciousness, an aging population, and a strong emphasis on preventive care. Advancements in nutritional science and genetic testing are enabling tailored supplement solutions. Countries like Germany and France are key contributors due to their high disposable incomes and the adoption of innovative health products.

The UK personalized nutrition and supplements industry is supported by strong health and wellness awareness, growing interest in personalized nutrition, and the use of online platforms and in-store kiosks for customized assessments. Favorable regulatory support for dietary supplements further strengthens market growth opportunities.

The personalized nutrition and supplements industry in Germany is growing steadily. This growth stems from its robust biotechnology ecosystem, established pharmaceutical industry, and well-developed research infrastructure.

Asia Pacific Personalized Nutrition And Supplements Market Trends

The personalized nutrition & supplements industry in the Asia Pacific is expected to grow at the fastest CAGR of 16.14% during the forecast period, owing to robust product pipelines in personalized nutrition & supplements and a large patient population. The market is expanding rapidly due to increasing disposable incomes, urbanization, and growing health awareness. Countries such as China, Japan, and India are emerging as key markets, driven by the adoption of personalized healthcare technologies and the increasing prevalence of lifestyle-related diseases.

The China personalized nutrition and supplements industry is fueled by the growing middle class and rising awareness of preventive healthcare. Integrating AI and big data in health assessments has accelerated adoption, with e-commerce giants playing a pivotal role in distribution.

The personalized nutrition and supplements industry in Japan growth is driven by an aging population seeking tailored health solutions and the cultural emphasis on holistic wellness. Advanced technologies and government support for healthcare innovation further boost the adoption of personalized supplements.

Middle East And Africa Personalized Nutrition and Supplements Market Trends

The personalized nutrition & supplements industry in the Middle East is driven by the rising awareness of preventive healthcare and increasing disposable incomes. The demand for customized solutions is rising, particularly in urban centers, supported by the adoption of advanced diagnostic tools.

The Kuwait personalized nutrition and supplements industry is driven by high healthcare spending and growing consumer interest in personalized nutrition. Adopting online health assessments and e-commerce platforms further enables access to tailored supplement solutions.

Key Personalized Nutrition And Supplements Company Insights

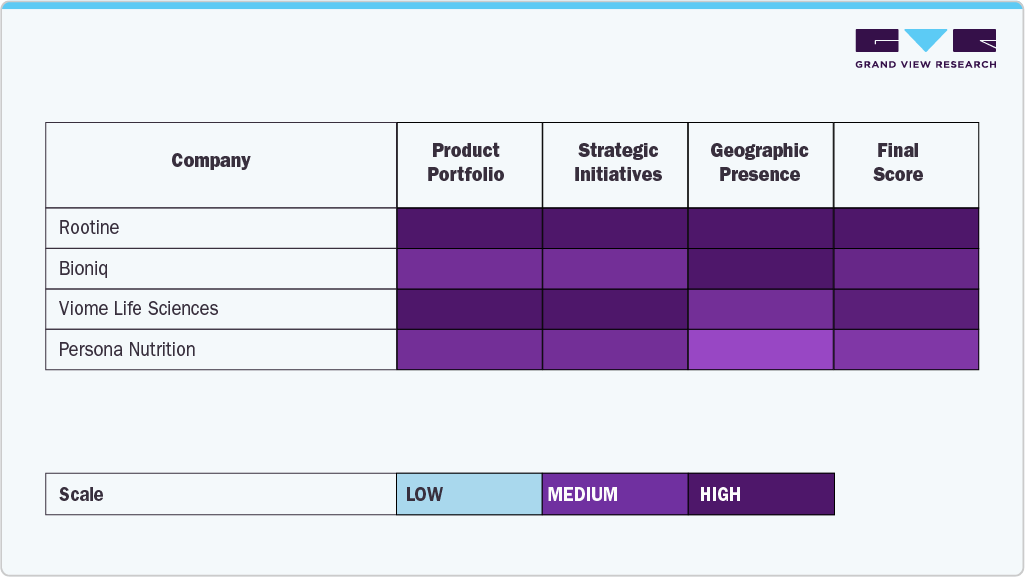

Key players in the industry, including Rootine, Bioniq, Viome Life Sciences, Persona Nutrition, and Metagenics, Inc., command significant market shares due to their comprehensive product offerings, extensive distribution capabilities, and ability to offer high-quality, evidence-based nutritional products.

Emerging competitors, including LifeNome, DNAfit, and others, are broadening their reach by offering innovative, individualized solutions based on an individual's unique genetics and lifestyle. These companies represent a growing trend involving health-focused consumers, exercise enthusiasts, and the aging population seeking personalized interventions regarding general wellness, immunity, and health-related quality of life.

Key Personalized Nutrition And Supplements Companies:

The following are the leading companies in the personalized nutrition and supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Rootine

- Bioniq

- Viome Life Sciences

- Persona Nutrition

- Metagenics, Inc.

- Fagron Genomics S.L.U.

- DNAfit

- GenoPalate

- Nutrigenomix

- LifeNome

Recent Developments

-

In June 2025, The Vitamin Shoppe and GenoPalate partnered to launch an at-home DNA collection kit that analyzes over 400 genetic markers to deliver tailored nutrition insights, personalized supplement formulas, and diet guidance to consumers.

-

In November 2024, Persona Nutrition, one of the leaders in subscription-based personalized vitamins and supplements, announced the launch of its white-labeling service, designed to support emerging and established businesses or individuals aiming to enter the personalized nutrition industry.

Personalized Nutrition And Supplements Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 18.22 billion

Revenue forecast in 2033

USD 48.57 billion

Growth rate

CAGR of 15.03% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, dosage form, distribution channel, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Rootine; Bioniq; Viome Life Sciences; Persona Nutrition; Metagenics, Inc.; Fagron Genomics S.L.U.; DNAfit; GenoPalate; Nutrigenomix; LifeNome

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Personalized Nutrition And Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global personalized nutrition and supplements market report on the basis of ingredient, dosage form, distribution channel, age group, and region:

-

Ingredient Outlook (Revenue, USD Million, 2021 - 2033)

-

Proteins & Amino Acid

-

Probiotics

-

Herbal/Botanic

-

Vitamins

-

Minerals

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets/Capsules

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Specialty Stores

-

Online pharmacies & E-commerce sites

-

Supermarkets/Hypermarkets

-

Retail Pharmacies

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Pediatric

-

Geriatric

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized nutrition and supplements market size was estimated at USD 15.97 billion in 2025 and is expected to reach USD 18.22 billion in 2026.

b. The global personalized nutrition and supplements market is expected to grow at a compound annual growth rate of 15.03% from 2026 to 2033 to reach USD 48.57 billion by 2033.

b. North America dominated the personalized nutrition and supplements market with a share of 40.69% in 2025. This is attributable to rising product awareness and increased spending on health and wellness across the U.S., Canada, and Mexico.

b. Some key players operating in the personalized nutrition and supplements market include Amway Corporation, Abbott, Superior Supplement Manufacturing, Herbalife International of America, Inc., Metagenics, Inc., GX Sciences, LLC, Nutralliance, DNAfit, Archer Daniels Midland Company (ADM), Viome Life Sciences, Inc.

b. Key factors that are driving the market growth include increasing consumer health awareness and growing demand for retail nutrition products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.