- Home

- »

- Medical Devices

- »

-

Personalized Medicine Outsourcing Market Report, 2030GVR Report cover

![Personalized Medicine Outsourcing Market Size, Share & Trends Report]()

Personalized Medicine Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Phase (Preclinical, Clinical), By Application (Oncology, Rare Diseases), By Service, By Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-350-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

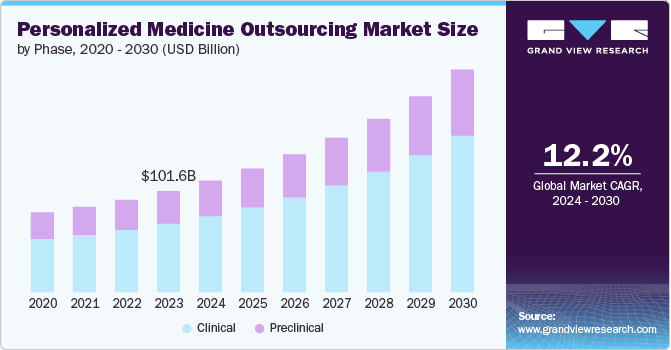

The global personalized medicine outsourcing market size was estimated at USD 112.08 billion in 2024 and is projected to grow at a CAGR of 12.47% from 2025 to 2030. The increasing awareness regarding benefits of personalized medicine, increasing application of personalized medicine in various diseases, such as rare diseases, cancer, infectious diseases, and others, the requirement of specialized expertise, and the benefits of outsourcing the services are some of the major factors driving the market growth. The increasing prevalence of diseases such as chronic diseases, rare diseases and infectious diseases is further increasing the demand for these medicines as it offers enhanced patient outcomes. According to the American Cancer Society report, Cancer Facts & Figures 2023, cancer was expected to cause around 609,820 deaths in the U.S. in 2023 and was expected to diagnose over 1.9 people in the same year.

The applications of personalized medicine have significantly increased in cancer care, which is one of the major factors contributing to the market growth. Personalized medicine or precision medicine is utilized for several indications in oncology such as early detection of certain cancers, identifying people with higher cancer risk, evaluation of treatment alternatives, and effect of treatment on patient’s health. As the burden of these diseases increase, the demand for personalized medicine is also anticipated to witness growth.

Furthermore, CROs and CDMOs have witnessed significant growth during the past few years as most of the pharmaceutical companies are opting to outsource their drug development and manufacturing activities to these outsourcing companies. Building and maintaining internal capabilities for all aspects of personalized medicine, from development to manufacturing, requires several resources and investments. Therefore, outsourcing these activities can allow companies to access specialized expertise, infrastructure, and resources according to their needs, thereby offering a cost-effective solution. Moreover, the complexity and risk associated with the development of personalized solutions, such as failures in the preclinical and clinical phases, offer a significant risk factor, while CROs can handle the complexities of later-stage development and manufacturing, allowing companies to streamline their operations and enhance their efficiency.

The awareness about personalized medicine has significantly increased in recent years owing to its several benefits, such as reducing trial and error prescribing, helping in avoiding adverse drug reactions, and shifting the medical importance from prevention to reaction. Personalized medicine offers the ability to use molecular markers that can indicate disease risk or presence even before clinical signs and symptoms appear, allowing for early treatments of diseases and thereby improving patient outcomes. Similarly, the patient’s non-compliance with offered treatment and medication can lead to adverse health effects such as Adverse Drug Reactions (ADR), which have been on a significant rise in past years. Thus, increasing cases of ADRs would boost the demand for better treatment options among people further driving the demand for personalized medicine. For instance, according to an article published by the National Institute of Health (NIH) in January 2024, there were around 1.25 million serious adverse effects and approximately 175,000 deaths were recorded in the U.S. in 2022.

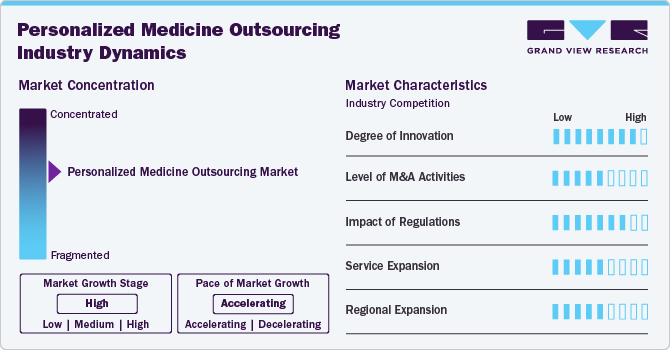

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

The market is experiencing significant degree of innovation, particularly in the development of advanced technologies such as next-generation sequencing and proteomics. These advancements are enhancing biomarker discovery and diagnostic accuracy, enabling more personalized treatment methods.

Regulatory frameworks play a fundamental role in influencing the market. Compliance with stringent guidelines enhances the safety and efficacy of personalized therapies, accelerating outsourcing strategies and partnerships.

The level of M&A activity in the market is moderate as companies seek to expand their technological capabilities, scale, and global footprint. Furthermore, larger firms acquire smaller, specialized manufacturers to enhance service portfolios. These strategic acquisitions majorly focus on expanding capabilities in personalized medicine solutions and gain a competitive edge in the market.

There is a significant expansion in services offered by CMOs, including flexible production systems that can quickly adapt to the unique demands of individualized therapies. This allows pharmaceutical companies to produce customized treatments for a wide range of patients.

The market is witnessing regional growth, with North America leading in revenue share. Emerging markets, particularly in Asia Pacific, are also experiencing rapid expansion due to increased R&D investments and favorable government initiatives.

Phase Insights

The clinical segment dominated the personalized medicine outsourcing industry with the largest revenue share of 67.19% in 2024. Clinical trials, especially in later phases, require significantly more resources, a large patient population, long durations, and extensive monitoring. The increasing complexity and expenses associated with the clinical trials. Therefore, outsourcing these trials to CROs with specialized expertise and infrastructure helps pharmaceutical companies optimize costs and timelines and improves their regulatory compliance. Moreover, the CROs offering clinical trials utilize advanced solutions such as machine learning for patient identification and enrolment, which further improves the efficiency and effectiveness of clinical trials. These attributes of outsourcing clinical trials are expected to drive the segment’s growth over the forecast period.

The preclinical segment is projected to witness the fastest growth rate over the forecast period. The developing field of personalized medicine is the growing importance of optimizing drug candidates in the preclinical phase. This allows for better selection of candidates and reduces the risk of expensive clinical trial failures. Moreover, identifying these ineffective drug candidates in early development process can save time and resources of the company. Similarly, outsourcing preclinical personalized medicine activities can allow these companies to access specialized expertise and infrastructure without the upfront investment required for in-house capabilities.

Application Insights

The oncology segment dominated the personalized medicine outsourcing industry in 2024 and is anticipated to witness the fastest growth over the forecast period. This can be attributed to the rising prevalence of cancer globally coupled with increasing applicability of personalized medicines in cancer treatments. Moreover, the increasing preference of companies developing personalized medicine to outsource complex clinical research is further driving the segment growth. For instance, in February 2022, Tempus, a precision medicine solution company, partnered with the Highline Sciences, an oncology-focused full-service CRO, to enhance its capabilities of complex clinical research.

The rare diseases segment is expected to witness significant growth over the forecast period. This can be attributed to increasing prevalence of rare diseases, and supportive government regulation are some of the factors which are driving the segment’s growth. For instance, the U.S. government launched an Orphan Drug Act in the U.S., which offers incentives for companies developing treatments for rare diseases. Outsourcing allows companies to navigate the complexities of applying for and complying with these regulations, further enhancing the development process.

Service Insights

Contract manufacturing dominated the personalized medicine outsourcing industry in 2024. CMOs offers several customized services to the companies and can adapt their production lines to handle smaller batch sizes, complex formulations, and stringent quality control measures. Moreover, CMOs often have the necessary regulatory approvals and quality management systems, which ensure compliance with stringent regulations for personalized medicines, reducing the regulatory threat for companies. Thus, these are some of the factors contributing to the segment's growth.

Contract development is expected to witness the fastest growth over the forecast period. This can be attributed to companies' increasing focus on cost-effectiveness, the complexity of personalized medicine development, and the growing emphasis on risk reduction. The development process of personalized medicine from the preclinical to clinical phase is unsafe, and outsourcing these services can help companies mitigate risk and improve cost-effectiveness. Similarly, outsourcing development activities to a single CDMO can streamline the entire process, leading to improved efficiency and faster development timelines.

Type Insights

The inhibitor drugs segment dominated the personalized medicine outsourcing industry in 2024 owing to the presence of several approved inhibitor drugs which can be used for the treatment of diseases such as cancer, rare diseases, among others. Inhibitor drugs, which block specific molecules involved in disease processes which are utilized as a crucial component in personalized medicine to develop patient-specific solutions. Developing safe and effective inhibitor drugs often requires expertise in complex areas such as protein-protein interactions and targeted delivery mechanisms. Outsourcing these components with experience in these areas allows companies to leverage this expertise and accelerate the development process, increasing the trend of outsourcing inhibitor drug service, thereby driving the segment growth.

Cell and gene therapy is expected to witness the fastest growth over the forecast period owing to growing product pipeline of these drugs and their subsequent approval in the forthcoming years. Cell and Gene therapy development and manufacturing involve several complex procedures, such as extracting genetic material (DNA) from a patient, altering it to develop a personalized therapy, and injecting it back into the patient. Such therapies are based on state-of-the-art technology and can require specialized expertise to manufacture. Moreover, outsourcing these complex activities can streamline the therapy development process, thereby improving its efficiency and accelerating path to market.

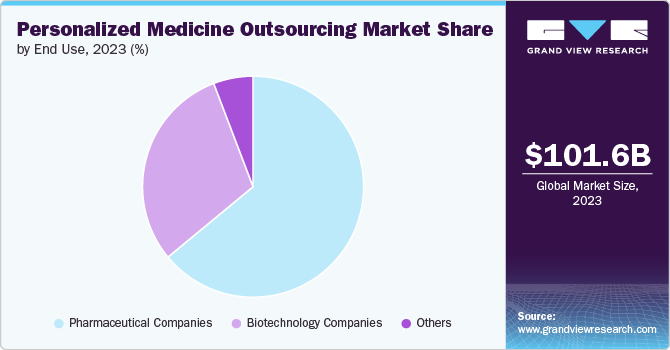

End Use Insights

The pharmaceutical companies segment dominated the personalized medicine outsourcing industry with the largest share in 2024 as most of the companies prefer to outsource its drug development and manufacturing activities to CROs/CDMOs. Moreover, increasing partnerships and collaboration between pharmaceutical companies and outsourcing partners to utilize advanced technologies for enhancing the development of personalized medicines would further contribute to the segment growth. For instance, in March 2024, Teva UK entered in a strategic partnership with Closed Loop Medicines to advance personalized medicine development. The partnership aims to collectively utilize Closed Loop Medicine’s software as a medical device (SaMD) technology platform to improve patient outcomes with certain chronic disorders.

Biotechnology companies are expected to witness the fastest growth over the forecast period. The complexity of developing personalized medicines, regulatory compliance, growing investments in R&D, and increasing partnerships and collaborations between biotechnology and outsourcing companies are some of the major factors driving segment growth. For instance, in April 2024, Miltenyi Biotec entered into a strategic partnership with MiLaboratories to develop next-generation therapies. According to the partnership, Miltenyi Biotec. Gets the rights of MiLaboratories’s RNA kits immune sequencing technology, which is to be utilized to make an impact in the fields of personalized medicine and genomics.

Regional Insights

North America personalized medicine outsourcing market dominated the market and accounted for a 33.15% share in 2024, owing to the presence of a large number of pharmaceutical companies, a supportive regulatory environment, better access to advanced technologies, and increasing investments in R&D activities. Moreover, increasing adoption of advanced technologies such as next-generation sequencing, big data analytics, and artificial intelligence (AI) are some of the factors driving the development for personalized medicine development in the region. Furthermore, the increasing prevalence of various diseases, such as chronic diseases and rare diseases, is further expected to drive the demand for personalized medicines in the region. For instance, according to the Canadian Cancer Society, around 247,100 cancer cases and around 88,100 cancer mortalities are expected in 2024.

U.S. Personalized Medicine Outsourcing Market Trends

The U.S. personalized medicine outsourcing market is anticipated to witness lucrative growth over the forecast period. This can be attributed to the presence of key market players, supportive regulatory framework and increasing R&D efforts by pharmaceutical and biotechnology companies. The US Food and Drug Administration (FDA) has implemented initiatives to accelerate the development and approval of precision medicine therapies, such as offering funding and guidance for the development of targeted therapies. Moreover, there is a significant rise in focus on developing personalized solutions. For instance, according to the Personalized Medicine Coalition (PMC) report 2022, around 12 personalized medicines were approved by the FDA in 2022, representing around 34% of all therapeutic molecular entities approved in the same year.

Europe Personalized Medicine Outsourcing Market Trends

Europe personalized medicine outsourcing market is projected to witness significant growth over the forecast period. Several technological advancements, such as next-generation sequencing, bioinformatics, and other pioneering technologies, are significantly accelerating biomarker discovery, which allows outsourcing providers to offer innovative solutions to their clients. According to the European Commission data, out of the region’s total population of approximately 448.8 million, around 21.3% were aged above 65 years in January 2023. Thus, growing aging population in the region is expected to boost the demand for personalized medicines as there is a growing demand for more targeted and effective treatments for the geriatric population base suffering from chronic and rare diseases. Thus, the aforementioned aspects are driving the region’s market growth.

The UK personalized medicine outsourcing market is influenced by the increasing demand for precision medicine, presence of robust biotechnology industry, advancements in genomics and bioinformatics, and expertise gap in the development and manufacturing of personalized medicine, leading to the increasing trend towards personalized medicine outsourcing.

The France personalized medicine outsourcing market is influenced by the increasing focus on innovation and research, developments in the regulatory framework, such as the implementation of the 2025 France Genomic Medicine Initiative, the increasing geriatric population, and the rising prevalence of chronic diseases.

The Germany personalized medicine outsourcing market is observed to be a lucrative market in the region owing to the growing pipeline of innovative therapies, partnerships and collaborations between pharmaceutical and biotechnology companies and outsourcing partners, coupled with increasing investments in R&D for the development of advanced treatments and therapies.

Asia Personalized Medicine Outsourcing Market Trends

Asia Pacific personalized medicine outsourcing market is anticipated to witness the fastest growth from 2025 to 2030. This can be attributed to the growing healthcare infrastructure, increasing presence of outsourcing companies, increasing clinical trials, and high prevalence of chronic diseases such as cancer and diabetes. For instance, according to the WHO, around 2.3 million people are diagnosed, and around 1.4 million die each year due to cancer in the Southeast Asia region. This high prevalence of chronic diseases, coupled with the growing pharmaceutical and biotechnology industry, is expected to drive the market in the region.

The market for personalized medicine outsourcing in China is experiencing significant growth owing to the presence of diverse genetical data, growing demand for innovation in country’s healthcare sector, increasing government initiatives and funding.

The Japan personalized medicine outsourcing market is expected to witness lucrative growth over the forecast period owing to the growing geriatric population base, increasing prevalence of chronic diseases, and growing emphasis on R&D initiatives in the country’s healthcare sector are driving the market growth. According to the World Bank, 30% of Japan’s population is aged 65 years and above. This geriatric population base is expected to increase the demand for personalized medicine in the country, thereby driving market growth.

The India personalized medicine outsourcing market is experiencing growth due to factors such as the significant presence of pharmaceutical companies in the country, rising investments in healthcare infrastructure, growing focus on R&D activities and increasing prevalence of chronic diseases. According to the National Centre for Disease Informatics and Research, the cancer incidence rate in India was expected to be 100.4 per 100,000, with a total of 1,461,427 cancer cases. Such high prevalence of cancer in the country is expected to increase the demand for precision medicine, thereby driving the market growth.

The personalized medicine outsourcing industry in the Middle East and Africa is projected to grow in the near future due to the increasing applications of biotechnology in healthcare and increasing efforts by government bodies to develop region’s healthcare sector. The continuous advancements in technology have enabled researchers to be able to isolate primary cells from individual patients, which allows the development of more advanced personalized treatment approaches. This development is expected to drive their demand in the region as healthcare professionals are focused on developing more effective and targeted therapies.

Saudi Arabia personalized medicine outsourcing market is expected to witness growth owing to the increasing government initiatives such as National Biotechnology Strategy, increasing investment and collaborations, and supportive regulatory framework and policies such as research incentives.

The UAE personalized medicine outsourcing market is driven by growing emphasis on innovation in healthcare, the focus of pharmaceutical and biotechnology companies on improving cost-effectiveness, and rising trend of accessing specialized expertise and advanced technology to manage complex reimbursement processes.

Key Personalized Medicine Outsourcing Company Insights

Key players operating in the personalized medicine outsourcing market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities, acquisitions and partnerships play a key role in propelling market growth.

Key Personalized Medicine Outsourcing Companies:

The following are the leading companies in the personalized medicine outsourcing market. These companies collectively hold the largest market share and dictate industry trends:

- Parexel International (MA) Corporation

- Syneos Health

- Catalent, Inc

- ICON plc

- Lonza

- Syngene International Limited

- HCL Technologies Limited

- Infosys Limited

- Fujirebio

- Aurigene Pharmaceutical Services Ltd.

Recent Developments

-

In February 2024, Standard BioTools Inc. entered into a collaboration agreement with Navignostics AG to integrate Hyperion XTi Imaging System with personalized medicine service offerings and clinical research applications to offer crucial biological insights and guide treatment decisions.

-

In August 2021, Precision for Medicine and Trialbee, a patient enrollment platform, entered into a partnership that aims to utilize Trialbee’s advanced analytics to recruit and match patients to Precision for Medicine's trials, which can lead to the development of advanced, personalized medicine.

Personalized Medicine Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 124.30 billion

Revenue forecast in 2030

USD 223.69 billion

Growth rate

CAGR of 12.47% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, application, service, type, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Parexel International (MA) Corporation; Syneos Health; Catalent, Inc; ICON plc; Lonza; Syngene International Limited; HCL Technologies Limited; Infosys Limited; Fujirebio; Aurigene Pharmaceutical Services Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Medicine Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personalized medicine outsourcing market report based on phase, application, service, type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Preclinical

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Rare Diseases

-

Infectious Diseases

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Manufacturing

-

Contact Development

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhibitor Drugs

-

Monoclonal Antibodies

-

Cell & Gene Therapy

-

Other Therapeutic Products

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized medicine outsourcing market size was estimated at USD 112.08 billion in 2024 and is expected to reach USD 124.30 billion in 2025.

b. The global personalized medicine outsourcing market is expected to grow at a compound annual growth rate of 12.47% from 2025 to 2030 to reach USD 223.69 billion by 2030

b. The clinical accounted for largest revenue share of 66.9% in 2024 and is also anticipated to witness the fastest growth over the forecast period. Several companies are outsourcing their research and development activities to CROs as they offer advanced solutions such as machine learning for patient identification and enrolment, which further improves the efficiency and effectiveness of clinical trials. These factors are contributing to the segment growth.

b. Some key players operating in personalized medicine outsourcing market include Parexel International (MA) Corporation, Syneos Health, Catalent, Inc, ICON, Lonza, Syngene International Limited, HCL Technologies Limited, and Infosys Limited among others.

b. Increasing prevalence of chronic diseases coupled with growing demand for effective treatment options to meet the growing need of patients is driving the growth of the market. Moreover, constant technological advancements in the field of personalized medicines is also contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.