- Home

- »

- Advanced Interior Materials

- »

-

Personal Protective Equipment In Construction Market Report, 2030GVR Report cover

![Personal Protective Equipment In Construction Market Size, Share & Trends Report]()

Personal Protective Equipment In Construction Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Protective Clothing, Protective Footwear, Head Protection, Respiratory Protection, Face Protection), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-553-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Protective Equipment In Construction Market Summary

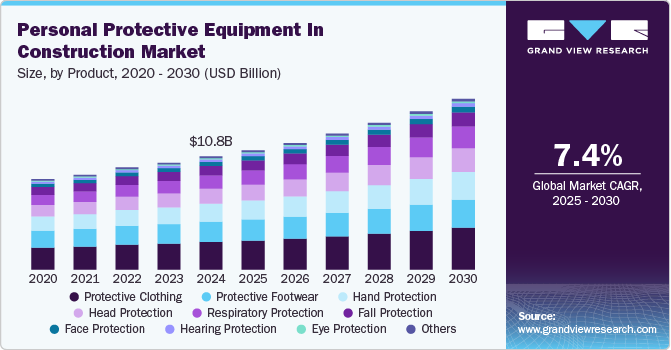

The global personal protective equipment in construction market size was estimated at USD 10.82 billion in 2024 and is projected to reach USD 16.30 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The PPE market in the construction industry is experiencing robust growth, driven by increasing regulatory enforcement, heightened awareness of workplace safety, and the rising complexity of construction projects.

Key Market Trends & Insights

- The personal protective equipment in construction market in Europe led the market and accounted for 30.9% globally in 2024.

- The personal protective equipment in construction market in the U.S. is expected to grow at a CAGR of 7.3% from 2025 to 2030.

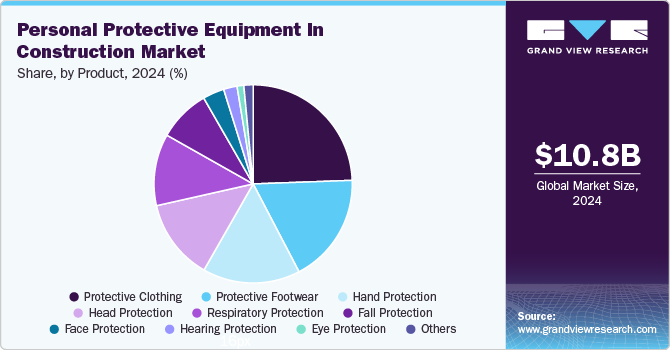

- By product, protective clothing held a significant market share and accounted for a share of 24.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.82 Billion

- 2030 Projected Market Size: USD 16.30 Billion

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2024

Governments and safety organizations across regions are tightening safety regulations and inspection protocols, pushing construction companies to adopt more comprehensive PPE solutions to mitigate risks.

There is a growing emphasis on worker safety amid rising incidents related to falls, head injuries, and respiratory hazards, particularly in high-rise construction, demolition, and infrastructure development. This has led to an uptick in demand for advanced personal protective equipment, including smart helmets, high-visibility clothing, cut-resistant gloves, and integrated fall arrest systems designed to provide higher safety standards while maintaining worker comfort and mobility.

Market Concentration & Characteristics

The market is moderately concentrated, with a mix of global giants and regional players competing for market share. Major multinational companies like Honeywell, 3M, and MSA Safety dominate due to their extensive product portfolios and strong distribution networks. However, local and niche manufacturers are gaining ground by offering specialized, cost-effective solutions tailored to regional safety regulations. This dynamic creates a competitive landscape where innovation and compliance drive differentiation.

One of the defining market characteristics is the high level of regulation influencing product design and usage. ConstructionPersonal Protective Equipment (PPE) must adhere to stringent safety standards such as OSHA in the U.S. or EN standards in Europe, leading to consistent demand for certified and tested products. These regulations vary by region but generally require employers to provide appropriate PPE for tasks involving head, eye, respiratory, and fall hazards. As safety compliance becomes non-negotiable, especially in large-scale projects, demand for premium PPE products is rising.

Another notable market feature is the growing emphasis on worker comfort and ergonomic design. Modern construction PPE is being developed with lightweight materials, better ventilation, and customizable fittings to ensure long-term wearability and reduce fatigue. This shift is crucial as companies aim to balance compliance with employee satisfaction and productivity. Adopting user-friendly and wearable technologies also enhances the usability and effectiveness of traditional safety gear.

Moreover, the industry is increasingly shaped by digitization and sustainability trends. Smart PPE, which integrates sensors and connectivity for real-time monitoring, is gaining traction among safety-conscious firms. At the same time, there's a push toward environmentally responsible production, with companies investing in recyclable or biodegradable materials. These trends are helping reduce the environmental footprint of PPE manufacturing and appealing to contractors seeking to align with ESG goals.

Drivers, Opportunities & Restraints

The market is primarily driven by stringent occupational safety regulations, increasing awareness of workplace hazards, and rising construction-related injuries and fatalities. With governments and international bodies enforcing strict safety compliance across job sites, there is consistent demand for protective equipment such as helmets, gloves, safety harnesses, and respiratory gear. In addition, the expansion of infrastructure and urban development projects, especially in emerging markets, continues to fuel the adoption of PPE as companies strive to ensure worker safety and minimize legal liabilities.

There is significant growth potential in integrating technology into personal protective equipment, with smart wearables and connected devices offering real-time hazard detection, health monitoring, and compliance tracking. This opens new opportunities for innovation, particularly in data-driven safety management systems. Emerging markets present further opportunities as construction activities surge and safety standards become more aligned with global norms. Moreover, the growing demand for eco-friendly and reusable PPE products encourages manufacturers to explore sustainable materials and production methods, adding a new dimension to product development.

Despite its growth, the personal protective equipment (PPE) market in construction faces several restraints, including high costs associated with advanced and smart PPE solutions, which can be a barrier for small to mid-sized construction firms. There is also a lack of awareness and enforcement in certain developing regions, where informal labor markets dominate, and safety practices are often overlooked. Moreover, discomfort or inconvenience associated with prolonged PPE usage can lead to non-compliance among workers, undermining its effectiveness and slowing widespread adoption.

Product Insights

Protective clothing held a significant market share and accounted for a share of 24.4% in 2024. Demand for protective clothing in the construction industry is steadily increasing, driven by the growing emphasis on worker safety, regulatory compliance, and extreme working conditions. High-visibility vests, flame-resistant garments, and weather-adaptive clothing are increasingly required across various construction environments, particularly in roadwork, high-rise projects, and industrial sites. As job sites become more diverse and complex, there is a stronger push for multi-functional protective clothing that combines safety features with comfort, durability, and flexibility.

The demand for respiratory protection in the construction industry is increasing due to heightened awareness of airborne hazards, such as silica dust, asbestos, and fumes from welding or paint, which pose serious health risks to workers. Stricter regulatory standards, including those from OSHA and EU safety directives, are driving construction companies to invest in advanced respiratory protection, such as powered air-purifying respirators (PAPRs) and half/full-face masks with improved filtration systems. With the growing complexity of construction projects, especially those involving demolition, tunneling, or heavy industrial work, workers are more exposed to hazardous airborne particles, pushing the need for effective respiratory PPE.

Regional Insights

The North American personal protective equipment market in construction is driven by rigorous safety standards and increasing construction activity. In both the U.S. and Canada, heightened safety regulations push demand for advanced personal protective equipment, such as smart helmets, high-visibility clothing, and respiratory protection. Urbanization, large infrastructure projects, and a focus on worker health are significant factors driving growth. Sustainability and eco-friendly PPE solutions are becoming more common, further influencing the market.

U.S. Personal Protective Equipment in Construction Market Trends

The personal protective equipment in construction market in the U.S. is expected to grow at a CAGR of 7.3% from 2025 to 2030. In the U.S., the demand for construction PPE is fueled by the ongoing expansion in commercial, residential, and infrastructure projects. The rise of smart PPE and wearable technology, such as connected devices for real-time safety monitoring, is boosting market growth. In addition, increasing awareness of health risks like respiratory diseases, particularly in high-risk environments, is driving the demand for advanced respiratory protection. Ongoing construction activities in cities and the regulatory push for stricter safety standards are key contributors to the market's growth.

Canada personal protective equipment in construction market is expected to grow at a CAGR of 6.3% from 2025 to 2030. Canada’s construction PPE market is seeing growth driven by rapid urbanization, extreme weather conditions, and a rising number of large-scale projects. There is a notable demand for protective clothing tailored to the unique climate conditions, such as insulated and weather-resistant gear. Safety standards set by organizations like CCOHS drive the continuous need for personal protection equipment.

Europe Personal Protective Equipment in Construction Market Trends

The personal protective equipment in construction market in Europe led the market and accounted for 30.9% globally in 2024.In Europe, the PPE market for construction is expanding due to stringent safety regulations and an increasing focus on worker well-being. The demand for multi-functional PPE, including high-visibility clothing, respiratory protection, and fall arrest systems, is particularly strong across infrastructure and renovation projects. Countries such as Germany, France, and the UK, with their high standards for safety, contribute significantly to market demand. The growing emphasis on sustainability is prompting the development of eco-friendly PPE solutions within the region.

Germany personal protective equipment in construction market held a 23.5% share in the European market. The country's robust industrial and infrastructure development drives its market. With strict occupational safety regulations and a growing emphasis on sustainability, German companies are adopting innovative and environmentally friendly PPE products. Demand is particularly high for respiratory protection and high-performance protective clothing suited for heavy industrial construction.

The personal protective equipment market in the construction industry in the U.S. is driven by thecountry's expanding infrastructure projects and stringent safety requirements. The increasing adoption of advanced protective gear, such as wearable safety devices and high-visibility clothing, is in response to regulatory pressures from bodies like the Health and Safety Executive (HSE). The trend towards eco-friendly and sustainable materials is also growing in the UK, as private and public sector projects focus more on environmental responsibility.

Asia Pacific Personal Protective Equipment in Construction Market Trends

The personal protective equipment in construction market in Asia Pacific is seeing rapid market growth, driven by increased urbanization and infrastructure development, particularly in emerging markets like China and India. Construction activities, such as large-scale residential, commercial, and industrial projects, are pushing demand for a wide range of PPE, including protective clothing, headgear, and respiratory equipment. Furthermore, rising safety awareness and stricter regulations contribute to a shift towards higher-quality, reliable protective gear.

China Personal Protective Equipment in Construction Market held a significant shareof the Asia Pacific market. In China, the demand for PPE in the construction industry is surging due to rapid urbanization and an expanding construction sector. The government’s stringent safety regulations and focus on worker welfare have led to a rising need for high-quality personal protective equipment, especially in high-risk areas like heavy industrial construction. With the adoption of advanced construction technologies, there is a growing demand for smart PPE, such as helmets with integrated sensors and real-time health monitoring devices.

The personal protective equipment in construction market in India is expected to grow at a CAGR of 10.4% from 2025 to 2030. India's PPE market in the construction sector is growing rapidly as the country witnesses a boom in infrastructure development and urban expansion. The need for reliable safety equipment, such as fall protection gear, helmets, and respiratory protection, is increasing in response to the rise in construction accidents and regulatory enforcement. There is also a growing trend toward adopting more durable and comfortable PPE to address the challenges of working in extreme weather conditions.

Middle East & Africa Personal Protective Equipment in Construction Market Trends

The personal protective equipment in construction market in the Middle East and Africa is witnessing rapid growth, driven by large-scale projects in countries like the UAE, Saudi Arabia, and South Africa. Harsh working conditions, such as extreme heat, dust, and hazardous materials, push demand for protective clothing, respiratory protection, and heat-resistant gear.

Saudi Arabia Personal Protective Equipment in Construction Market is being driven by the country’s ambitious Vision 2030 development plan, which includes large-scale infrastructure projects such as NEOM and the Red Sea development. The need for high-quality, durable PPE to protect workers from the harsh desert environment is growing, particularly in terms of heat-resistant clothing, respiratory protection, and protective eyewear.

Latin America Personal Protective Equipment in Construction Market Trends

The personal protective equipment in construction market in Latin America is growing due to the rising number of large infrastructure projects and heightened safety concerns. Countries like Brazil invest heavily in urban development, driving the need for advanced safety equipment. However, there are regional differences, with some countries adopting stricter safety regulations while others are still working to improve enforcement.

Brazil personal protective equipment market in the construction industry is accelerating due to expanding urbanization and large-scale infrastructure projects. Safety standards are improving, which increases the need for protective gear such as helmets, gloves, and respiratory protection. Due to Brazil's diverse weather conditions, the market is also shifting toward more durable and climate-adapted PPE. Moreover, as Brazil continues to focus on sustainable development, there is an increasing preference for eco-friendly and reusable PPE solutions in the construction sector.

Key Personal Protective Equipment In Construction Company Insights

Some key players operating in the market include 3M, Honeywell International Inc., and DuPont.

-

3M has a robust distribution network, and its products are distributed globally through a wide distribution network that includes retailers, wholesalers, dealers, distributors, and jobbers. It is publicly traded on the New York Stock Exchange. The products are mainly aimed at industries such as construction, healthcare, manufacturing, transportation, and consumer. The company operates through four business segments, including safety & industrial, healthcare, consumer, and transportation & electronics. The company operates a total of 61 manufacturing facilities across 29 states in the U.S.

-

Honeywell International Inc. operates through four reportable business segments, namely aerospace, building technologies, performance materials & technologies, and safety & productivity solutions. The personal protective equipment business comes under the safety & productivity solutions segment. It provides a wide range of safety equipment, including personal protective equipment, to various end-use industries such as construction, healthcare & life sciences, distribution centers, manufacturing, aerospace, and defense. Honeywell has a global presence in North America, Asia, Europe, South America, Australia, and Africa. The company has a presence in over 80 countries and is located at 750 sites.

Key Personal Protective Equipment In Construction Companies:

The following are the leading companies in the personal protective equipment in construction market. These companies collectively hold the largest market share and dictate industry trends.

- FallTech

- 3M

- Honeywell International Inc.

- Lakeland Industries, Inc.

- DuPont

- ANSELL LTD.

- uvex group

- COFRA S.r.l.

- MSA

- DELTA PLUS

- Safetec Direct Ltd

- Radians, Inc

- MALLCOM INDIA LIMITED

- ALPHAPROTECH

- Polison Corp

Recent Developments

-

In March 2024, FallTech launched the FT-Lineman Pro Body Belt. The latest utility belt breaks away from the conventional design and offers unmatched comfort, versatility, and lasting support. This new launch is likely to help the company strengthen its position in the market.

-

In March 2024, uvex announced the launch of the ‘uvex profi pure HG’ safety glove, which has been designed to offer workers optimum grip in damp or wet environments. The product uses a novel ‘Hydro Grip’ polymer coating that improves gripping and maintains traction. The coating also has waterproof properties and has a cotton fiber lining to ensure wearer comfort for longer periods.

Personal Protective Equipment In Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.39 billion

Revenue forecast in 2030

USD 16.30 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

FallTech; 3M;, Honeywell International Inc.; Lakeland Industries, Inc.; DuPont; ANSELL LTD.; uvex group; COFRA S.r.l., MSA; DELTA PLUS; Safetec Direct Ltd; Radians, Inc.; MALLCOM INDIA LIMITED; ALPHAPROTECH; Polison Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Protective Equipment In Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal protective equipment in construction market report based on product and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Head Protection

-

Face Protection

-

Eye Protection

-

Hearing Protection

-

Protective Clothing

-

Heat & flame protection

-

Thermal Insulation & Waterproof Clothing

-

General Use

-

His-Vis clothing

-

Others

-

-

Respiratory Protection

-

Air-purifying respirator

-

Supplied air respirators

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Individual Protection

-

Collective Protection

-

Access Equipment

-

-

Hand Protection

-

Disposable Gloves

-

Durable Gloves

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global personal protective equipment in construction market size was estimated at USD 10.82 billion in 2024 and is expected to be USD 11.39 billion in 2025.

b. The global personal protective equipment in construction market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 16.30 billion by 2030.

b. Protective clothing held a significant share of the market and accounted for a share of 24.4% in 2024. Demand for protective clothing in the construction industry is on a steady rise, driven by the growing emphasis on worker safety, regulatory compliance, and extreme working conditions.

b. Some of the key players operating in the personal protective equipment in construction market include FallTech, 3M, Honeywell International Inc., Lakeland Industries, Inc., DuPont, ANSELL LTD., uvex group, COFRA S.r.l., MSA, DELTA PLUS, Safetec Direct Ltd, Radians, Inc, MALLCOM INDIA LIMITED, ALPHAPROTECH, Polison Corp.

b. The personal protective equipment in construction market is experiencing robust growth, driven by increasing regulatory enforcement, heightened awareness of workplace safety, and the rising complexity of construction projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.