- Home

- »

- Medical Devices

- »

-

Personal Lubricants Market Size, Share, Growth Report 2030GVR Report cover

![Personal Lubricants Market Size, Share & Trends Report]()

Personal Lubricants Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Silicone-based, Oil-based, Water-based), By Distribution Channel (E-commerce, Drug Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-627-1

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Lubricants Market Summary

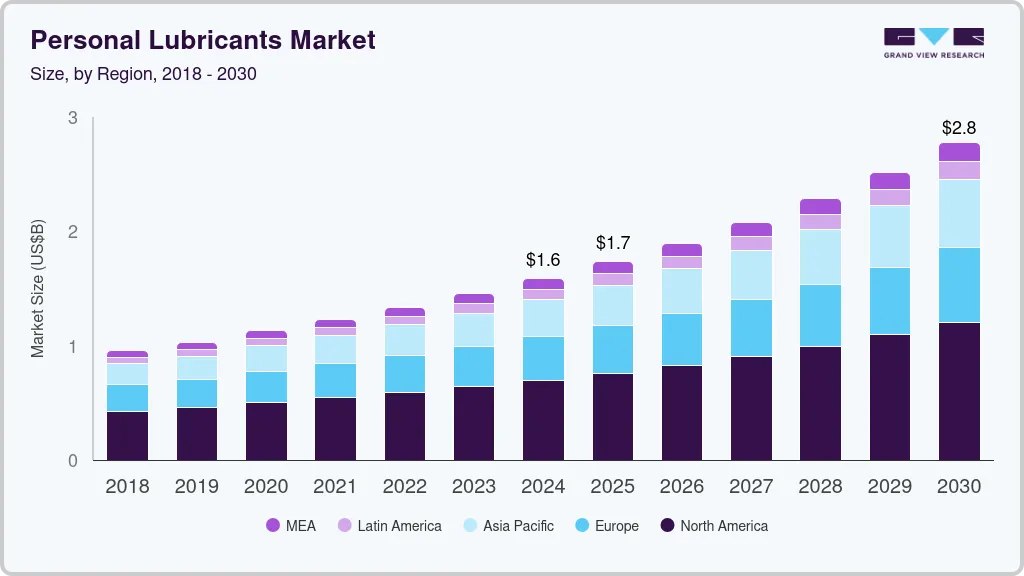

The global personal lubricants market size was estimated at USD 1,586.0 million in 2024 and is projected to reach USD 2,772.8 million by 2030, growing at a CAGR of 9.8% from 2025 to 2030. This growth can be attributed to the increased demand for lubricant products owing to the rising number of vaginal dryness & erectile dysfunction cases, and the growing need for alternatives to enhance the sexual experience.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, water-based accounted for a revenue of USD 832.0 million in 2024.

- Silicone-based is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,586.0 Million

- 2030 Projected Market Size: USD 2,772.8 Million

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

These products are intended to reduce vaginal dryness and offer additional lubrication. According to a factsheet issued by the British Menopause Society in 2023, 17% of women aged 18-50 years in the UK experience vaginal dryness during sexual intercourse before the menopause. This is expected to increase product demand from the middle-aged population.

Marketing strategies used for these products are changing. Manufacturers are rebranding the use of lubes as a healthy means of improving sex life and removing the stigma associated with sexual wellness products. Companies are leveraging social media platforms to engage with their target audience, promote their products, and build brand awareness. Moreover, some companies are creating informative content, such as blog posts and videos, to educate consumers about the benefits and uses of personal lubricants. For instance, in May 2024, Durex launched the #ExplorersWanted campaign, showcasing a variety of Durex Lubes. The campaign aims to reignite the spark of intimacy among couples by creating anticipation around exotic destinations, only to reveal that these captivating landscapes are the contours and landscapes of their partner's body.

Drivers, Opportunities, & Restraints

Improved funding is encouraging the entry of new participants in the industry contributing to the growth of the industry. For instance, in September 2022, Cake, the sexual wellness brand, secured USD 8 million in a Series A fundraising led by its investment partner Silas Capital. In its current inventory of sexual health goods, the company offers lubricants, topicals, condoms, and other items. Moreover, companies are adopting various growth strategies, such as new product launches & market campaigns, to meet the increasing demand for personal lubricants and raise awareness about these products. For instance, in May 2022, Playground, a sexual health company, launched a collection of personal lubricants in the U.S., including four full-sensory lubes designed to stimulate the erogenous zones and five senses to enhance a woman's mood, libido, & cognition.

Changing the perception of consumers toward sex, growing awareness about the importance of sexual health, and sex education for the young generation are factors expected to boost the demand for these products globally. The social stigma regarding sex is decreasing among Gen Z and millennials who are open to exploring new products to improve their sexual experience. Growing influence of western culture & social media and high penetration of the internet have significantly contributed to the growth of market in recent years.

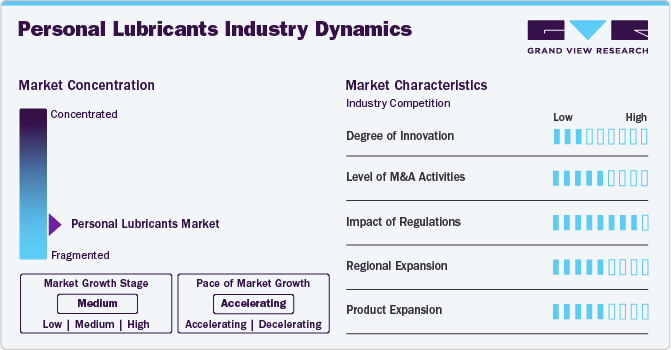

Industry Dynamics

The industry is highly competitive with the presence of major players such as Reckitt Benckiser Group plc; Church & Dwight Co., Inc.; LifeStyles Healthcare Pte Ltd.; Mayer Laboratories Inc.; BioFilm, Inc.; Lovehoney Group Ltd; Sliquid; Trigg Laboratories, Inc.; and Uberlube. The industry is characterized by a medium degree of innovation, with companies continuously introducing new products and formulations to cater to the evolving preferences of consumers. Furthermore, the degree of innovation is low, and the level of M&A activities is moderate. The impact of regulations on the industry is high, while regional expansion is moderate, and product expansion is moderate.

The degree of innovations in the market is low. However, the launch of spermicidal lubes is increasing the degree of innovation in the industry. This trend is driven by the growing demand for effective and safe sexual wellness products, particularly among the geriatric population.

The level of mergers & acquisitions is moderate in the industry. This can be attributed to the growing interest of companies to enter in the market. Companies are acquiring brands with unique positioning to differentiate the products from the market. For instance, in May 2023, COMBE, Inc. signed a definitive agreement to acquire the ASTROGLIDE brand of personal lubricant from BioFilm, Inc.

The impact of regulations on the industry is significant, with companies required to comply with various standards and guidelines related to product safety, labeling, and marketing. In the U.S. and Europe, medical devices are typically categorized into three grades. Lubricants intended for the protection of vaginal mucosa are generally classified as grade 2, as they are not inserted into the body and do not inflict energy on the body.

Product expansion is moderate, with companies introducing new products and formulations to cater to the diverse needs of consumers. Early product launches in developed economies have driven growth by increasing consumer awareness and demand. This expansion has also led to the introduction of new product types, such as water-based, silicone-based, oil-based, and hybrid lubricants, catering to diverse consumer preferences.

The industry is witnessing moderate regional expansion, driven by the decreasing social stigma surrounding sexual wellness products. Despite this trend, cultural taboos in certain regions, such as the Middle East and Africa, have hindered the widespread adoption of these products. In these regions, the penetration of personal lubricants is relatively low due to strict regulations governing their sale and marketing. Many countries have implemented these regulations to protect their cultural heritage and maintain social norms, thereby limiting the industry’s growth in these areas.

Type Insights & Trends

“Silicone-based is expected to register fastest growth at CAGR of 10.35%.”

The water-based lubricant type dominated the market in 2023 and accounted for the largest revenue share of 52.38%, as these products help prevent vaginal dryness and reduce pain. Furthermore, the launch of innovative products, such as fertility lubricants by companies, is expected to boost their demand during the forecast period. The silicon-based segment is anticipated to witness the fastest growth rate during the forecast period. Increased availability of such products across retail chains and supermarkets facilitates greater visibility, enabling customers to choose from different brands.

Furthermore, owing to their ability to offer long-lasting lubrication, they can also be utilized for massaging. Silicone-based products are also used in the production of pre-lubricated condoms, because of their superior latex compatibility and long-lasting properties. The oil-based segment is expected to witness significant growth during the forecast period. Oil-based lubricants might contain plant-based oils, such as sweet almond oil, sunflower seed oil, or coconut oil. These lubricants must be applied with caution. Oil-based cannot be used with latex/rubber condoms, as they may weaken the latex/rubber, making the condom more likely to break or leak, increasing the risk of STIs or unplanned pregnancy.

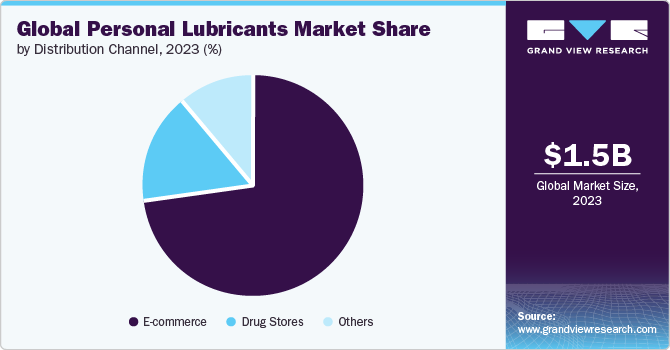

Distribution Channel Insights & Trends

“Drug stores is expected to witness significant growth of 9.45% CAGR over the forecast period.”

The e-commerce segment dominated accounted for the largest revenue share of 72.96% in 2023. The segment is projected to expand further at the fastest CAGR during the forecast period, retaining its leading position throughout the forecast period. This can be attributed to an increasing preference to purchase these products on e-commerce platforms. Online stores offer a range of different products that users can compare for price, quality, and needs. Discrete delivery of packages by online retailers has made it comfortable for individuals to purchase lubricants to enhance sexual health.

The drug stores segment is expected to exhibit a lucrative CAGR during the forecast period. As customers have become more aware of their sexual needs, the sales of sexual wellness products in retail pharmacies and drug stores have significantly increased. Retail pharmacies and drug stores proactively display sexual wellness products, such as condoms, personal lubricants, and sexual enhancement supplements, which offer direct visibility of the product on shelves. Hypermarkets, supermarkets, and retail grocery stores are categorized as other channels for the distribution of sex lubes. Increased sales of sexual wellness products have been reported by these mass merchandisers in the U.S. Rising demand for lubricants is positively impacting the sales of such products across hypermarkets.

Regional Insights

“Asia Pacific region is projected to witness fastest growth of 10.68% CAGR over the forecast period.”

North America dominated the global market in 2023 and accounted for the maximum revenue share of 43.97%. This is owing to the presence of a large number of manufacturers and retailers providing easy access to products. The popularity of lubes is growing in the region, owing to decreasing social stigma around sexual products and the easy availability of products at online retail stores & supermarket chains. These are classified as Class II medical devices in the U.S. and require medical device 510(k) clearance. Asia Pacific is projected to exhibit the fastest growth rate over the forecast period due to the growing manufacturing & exports of products from the region and rising demand for these products in countries, such as India, Australia, Japan, & Thailand.

U.S. Personal Lubricants Market Trends

The personal lubricants market in the U.S. held the largest revenue share in 2023. This can be attributed to the growing prevalence of dyspareunia (painful intercourse) and severe vaginal dryness. Moreover, the launch of innovative products such as fertility lubricants by companies is expected to boost their demand by couples Trying to Conceive (TTC) during the forecast period.

Europe Personal Lubricants Market Trends

The personal lubricants market in Europeheld a significant revenue share of the global market in 2023, with growing demand from Germany, the UK, France, and other western European countries. Lubricant manufacturers are focused on creating awareness regarding the management of vaginal dryness that can lead to abrasions and chafing of the skin, increasing susceptibility to STIs.

The UK personal lubricants market held a significant revenue share in 2023. Easy access to a variety of adult and novelty stores in the UK is expected to boost the growth of the market. Although the UK has a more formal culture when it comes to sex, increased awareness about the importance of sexual health has boosted the demand for the product.

The personal lubricants market in Germany held a significant share of Europe in 2023. The demand for lubes in the country is growing, majorly with sex toys to reduce dyspareunia. Moreover, the demand is higher from people who engage in anal intercourse.

Asia Pacific Personal Lubricants Market Trends

The personal lubricants market in Asia Pacific is projected to exhibit the fastest CAGR over the forecast period, with the growing manufacturing & exports of products from the region and rising demand for lubes in countries such as India, Australia, Japan, & Thailand. Reducing social stigma by changing customer perception toward sex and increasing number of online retailers are expected to drive demand for industry in Asia Pacific.

The China personal lubricants market has dominated Asia Pacific in 2023. This can be attributed to the gradual fading of traditional and cultural taboos. The emergence of e-commerce in China is expected to break the social stigma around people using personal lubricants.

The personal lubricants industry in Japan is robust, with the presence of innovative and technologically advanced products. Manufacturers, such as TENGA, have a wide variety of innovative products for men. The majority of customers in Japan are middle-aged & older men and are generally looking for self-pleasure products. Adult stores in Japan are trying to attract more female customers with attractive offers on women-centered products.

Latin America Personal Lubricants Market Trends

The personal lubricant market in Latin America is anticipated to grow during the forecast period. Key factors driving the growth include the availability of different flavors of lubricants and increasing acceptance of sex toys in Latin America. The Pan American Health Organization (PAHO) started a comprehensive condom and lubricant programming, an initiative that ensures easy access to condoms and their consistent use by sexually active individuals.

The personal lubricants market in Brazil is expected to grow at significant CAGR over the forecast period. Growing prevalence of female sexual dysfunction is boosting the market in the country. Considering the business potential in the country, manufacturers are focusing on establishing and strengthening their presence in the market by launching new products or acquiring a local manufacturer.

Middle East & Africa Personal Lubricants Market Trends

The MEA personal lubricants market’s growthis majorly impacted by a lack of awareness about the benefits of lubricants with condoms, inadequate promotion, and limited distribution in majority of the countries in this region. Several countries in the MEA region face religious restrictions that prohibit men and women from using any kind of personal lubricant.

The Saudi Arabia personal lubricants market is expected to grow at the fastest CAGR over the forecast period. Personal lubricants are an integral part of the National HIV prevention strategy in South Africa. The South Africa's Ministry of Health has mandated to make lubes freely available in clinics across the country, in addition to condoms. As per a report by the community-led monitoring group, Ritshidze, published in 2022, approximately 43 of the 131 South African clinics that provided MSM health services did not have lubricants available.

Key Personal Lubricants Company Insights

Established players face competition from emerging companies that develop and market premium & innovative products to meet the rising demand from customers. Lifestyles Healthcare Pte Ltd.; Unbound; Trigg Laboratories Inc.; and BioFilm IP, LLC are emerging players in the market. These players are adopting various strategies to stay competitive, including new product launches, diversification of existing products, and mergers & acquisitions.

Key Personal Lubricants Companies:

The following are the leading companies in the personal lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group plc

- BioFilm, Inc.

- Trigg Laboratories, Inc.

- LifeStyles Healthcare Pte Ltd.

- The Yes Yes Company Ltd.

- Lovehoney Group Ltd.

- Church & Dwight Co., Inc.

- Mayer Laboratories Inc.

- Überlube

- Sliquid, LLC

Recent Developments

-

In June 2024, Playground, a leading sexual wellness brand, expanded its range of water-based personal lubricants with the introduction of Pillow Talk. This new signature lubricant was developed to promote open and honest discussions about sexual wellness, fostering a culture of acceptance and understanding.

-

In July 2022, JO, a CC Wellness brand, introduced three new flavors from its JO Cocktails line of flavored water-based lubricants including Mimosa, Cosmopolitan, and Mai Tai.

-

In August 2023, Sliquid, LLC launched a Pride-edition personal lubricant, Sliquid Sparkle. Sparkle is a repackaging of the primary brand of the company, Sliquid H2O, is a water-based composition with only five ingredients.

Personal Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.59 billion

Revenue forecast in 2030

USD 2.77 billion

Growth rate

CAGR of 9.76% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Reckitt Benckiser Group plc; BioFilm, Inc.; Trigg Laboratories, Inc.; LifeStyles Healthcare Pte Ltd.; The Yes Yes Company Ltd.; Lovehoney Group Ltd.; Church & Dwight Co., Inc.; Mayer laboratories Inc.; Überlube; Sliquid, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global personal lubricants market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Silicone-based

-

Oil-based

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Drug Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personal lubricants market size was estimated at USD 1.46 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. The global personal lubricants market is expected to grow at a compound annual growth rate of 9.76% from 2024 to 2030 to reach USD 2.77 billion by 2030.

b. North America dominated the personal lubricants market with a share of around 43.97% in 2023. This is attributable to the high demand for products from menopausal women and the millennial population. Most American adults have used lubricants more than once in their lives to enhance sexual experience.

b. Some key players operating in the personal lubricants market include Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; BioFilm, Inc.; LifeStyles Healthcare Pte Ltd; Mayer laboratories Inc; Lovehoney Group Ltd; Sliquid; Trigg Laboratories, Inc.; uberlube; and The Yes Yes Company Ltd.

b. Key factors that are driving the market growth include growing demand for these products for reducing vaginal dryness & erectile dysfunction, and decreasing social stigma of using lubricants for improving sexual experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.