- Home

- »

- Specialty Polymers

- »

-

Perlite Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Perlite Market Size, Share & Trends Report]()

Perlite Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Construction Products, Horticultural & Agricultural, Industrial, Filtration & Process Aid), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-252-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Perlite Market Size & Trends

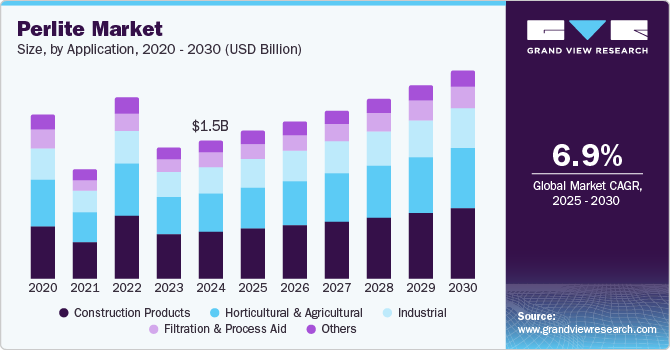

The global perlite market size was estimated at USD 1.55 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030. The increasing demand for lightweight construction materials in the building industry boosts the use of perlite with its properties, such as insulation and lightweight aggregate, enhancing energy efficiency. In addition, the growing popularity of gardening among urban populations has led to increased perlite usage in potting mixes, promoting healthier plant growth. Furthermore, expanding the agricultural sector and emphasizing sustainable farming practices further elevate perlite demand due to its water retention and aeration properties. At the same time, its non-toxic nature and versatility in various applications drive market growth.

The rising popularity of gardening and horticulture, especially in urban areas, drives demand for perlite in potting mixes and soil amendments. In addition, as more individuals engage in gardening, the necessity for effective growing mediums has become increasingly apparent. Moreover, perlite’s lightweight and porous nature enhances soil aeration and drainage, promoting healthier plant growth. Therefore, this trend not only supports individual sustainability efforts but also contributes to the continued growth of the perlite market.

Recent advancements in the perlite include enhanced processing techniques that improve production efficiency and product consistency. In addition, functionalized perlite allows for tailored applications across various industries, including horticulture and construction. Moreover, the growing focus on sustainable applications positions perlite as an eco-friendly material while integrating smart agriculture technologies, further optimizing its use in hydroponics and vertical farming. Therefore, these developments collectively expand the market's scope and enhance perlite's versatility across multiple sectors.

Application Insights

The construction products segment dominated the market, with a revenue share of 33.7% in 2024, attributed to the increasing demand for lightweight and insulating materials in building projects, which enhances perlite's application as an effective insulation solution. Furthermore, its fire-resistant properties make perlite a preferred choice for safety-conscious construction practices, further solidifying its position in the industry. Moreover, a growing trend toward energy-efficient buildings also contributes to the rising utilization of perlite in lightweight aggregates and insulation applications. As a result, these factors emphasize the construction segment's prominent role in the overall perlite market.

The horticultural & agricultural is projected to witness the fastest CAGR of 7.2% over the forecast period, attributed to the increasing consumer demand for sustainable and organic farming products. Therefore, this trend drives the adoption of efficient growing mediums such as perlite, known for its superior aeration and moisture retention. In addition, the rise of urban gardening and controlled-environment agriculture, such as hydroponics and vertical farming, highlights the need for lightweight substrates. As a result, these factors boost agricultural productivity and promote environmentally friendly practices, further solidifying perlite's role in modern horticulture and agriculture.

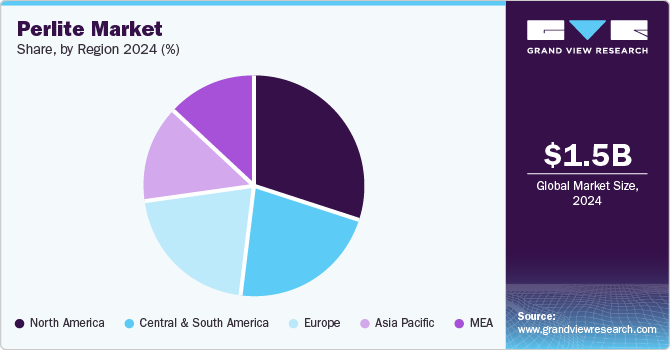

Regional Insights

North America perlite market dominated the global market with a revenue share of 29.8% in 2024, fueled by its large construction industry, which demands lightweight, insulating materials for energy-efficient buildings. Perlite's fire-resistant properties meet stringent safety regulations. In addition, the agricultural sector in this region drives demand through its use in horticultural applications, where perlite enhances soil aeration and moisture retention for healthier plant growth. Therefore, the rise of sustainable farming practices and hydroponics highlights perlite's versatility as a growing medium in North America.

U.S. Perlite Market Trends

The U.S. perlite market dominated North America, with a significant revenue share in 2024, driven by the growing construction and industrial industry. According to The Associated General Contractors (AGC) of America, Inc., the construction industry is a major contributor to the U.S. economy. More than 919,000 construction establishments were in the U.S. in the 1st quarter of 2023, further driving the perlite market.

Europe Perlite Market Trends

Europe perlite market is expected to register the fastest CAGR of 7.5% over the forecast period. According to the European Commission, the four-year EU-funded project EXPERL successfully developed five innovative perlite-based materials, including closed-structure perlite and expanded perlite flakes, for various industrial applications such as lightweight insulating panels and novel paints. Therefore, Life cycle assessments revealed these products have a lower environmental impact than conventional alternatives, driving the positioning of the EU's industrial minerals sector for enhanced competitiveness and new market opportunities.

The perlite market in Germany is expected to grow significantly in the forecast period, attributed to the increasing demand for sustainable and organic products, driving a shift towards eco-friendly horticultural practices. In addition, the popularity of urban gardening is transforming cities into green spaces, leading residents to seek lightweight and efficient growing materials such as perlite. As urban people cultivate plants in limited spaces, the demand for perlite in horticultural applications continues to rise, further supporting sustainable urban agriculture.

Asia Pacific Perlite Market Trends

Asia Pacific perlite market held a substantial market share in 2024, attributed to green building initiatives that significantly catalyzed the demand for perlite by promoting sustainable construction practices that prioritize energy efficiency and environmental responsibility. As governments and organizations focus on reducing carbon footprints, perlite's lightweight and insulating properties make it an attractive choice for eco-friendly building materials. Therefore, these initiatives encourage using natural materials such as perlite in insulation, lightweight aggregates, and growing mediums, which align with broader sustainability goals.

The increasing infrastructure investments in China drive the perlite market. According to the National Development and Reform Commission (NDRC) of China, significant infrastructure investments to drive economic growth, focusing on transportation, energy, and urban development. In 2023, China invested approximately 700 billion in infrastructure projects to enhance connectivity and support sustainable development. These investments aim to drive the perlite market in China further.

Key Perlite Company Insights

Some key companies operating in the market include Aegean Perlites SA, Bergama Perlite, Supreme Perlite Company, Carolina Perlite Company, and Gulf Perlite LLC. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through perlite.

-

Aegean Perlites SA offers a comprehensive range of perlite products tailored to various applications. Their expanded perlite is specifically designed for construction, functioning as an effective insulation material and lightweight aggregate that enhances energy efficiency. The horticultural sector provides specialized grades that improve soil aeration and water retention, making them ideal for potting mixes and agricultural use. In addition, the company supplies industrial-grade perlite for filtration processes and as a lightweight filler in construction materials, demonstrating perlite's versatility across multiple sectors.

-

Bergama Perlite offers a diverse range of perlite products suited for various applications. Their expanded perlite is extensively used in construction as an insulating material and lightweight aggregate, significantly enhancing building thermal efficiency. The company provides specialized perlite grades in horticulture that improve soil structure, aeration, and water retention, making them ideal for gardening and agricultural uses. In addition, it supplies industrial-grade perlite for filtration processes and as a lightweight filler in paints, plastics, and other composite materials, showcasing its versatility across multiple industries.

Key Perlite Companies:

The following are the leading companies in the perlite market. These companies collectively hold the largest market share and dictate industry trends.

- Aegean Perlites SA

- Bergama Perlite

- Supreme Perlite Company

- Carolina Perlite Company

- Gulf Perlite LLC

- Genper Group

- The Schundler Company

- Saudi Perlite Industries

- Imerys SA

Recent Developments

- In July 2024, The parent company of Pleuger Industries (Flacks Group) announced the acquisition of Artemyn, which was formerly owned by Imerys SA and publicly listed on Euronext. This strategic move signified Flacks Group's significant entrance into the mining industry, further strengthening its diversified portfolio and enhancing its global presence.

- In February 2023, Titan Cement acquired a stake in Aegean Perlites. This investment aimed to enhance Titan's direct access to pozzolan reserves, allowing for increased production of pozzolan-based cementitious products with a lower clinker factor.

Perlite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.65 billion

Revenue forecast in 2030

USD 2.32 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Aegean Perlites SA; Bergama Perlite; Supreme Perlite Company; Carolina Perlite Company; Gulf Perlite LLC; Genper Group; The Schundler Company; Saudi Perlite Industries, Imerys SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Perlite Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global perlite market report based on application, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction Products

-

Horticultural & Agricultural

-

Industrial

-

Filtration & Process Aid

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.