- Home

- »

- Advanced Interior Materials

- »

-

Peristaltic Pumps Market Size, Share & Growth Report, 2030GVR Report cover

![Peristaltic Pumps Market Size, Share & Trends Report]()

Peristaltic Pumps Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fixed Speed, Variable Speed), By Discharge Capacity (Up to 30 psi, 30-50 psi, Above 50 psi), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-371-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peristaltic Pumps Market Summary

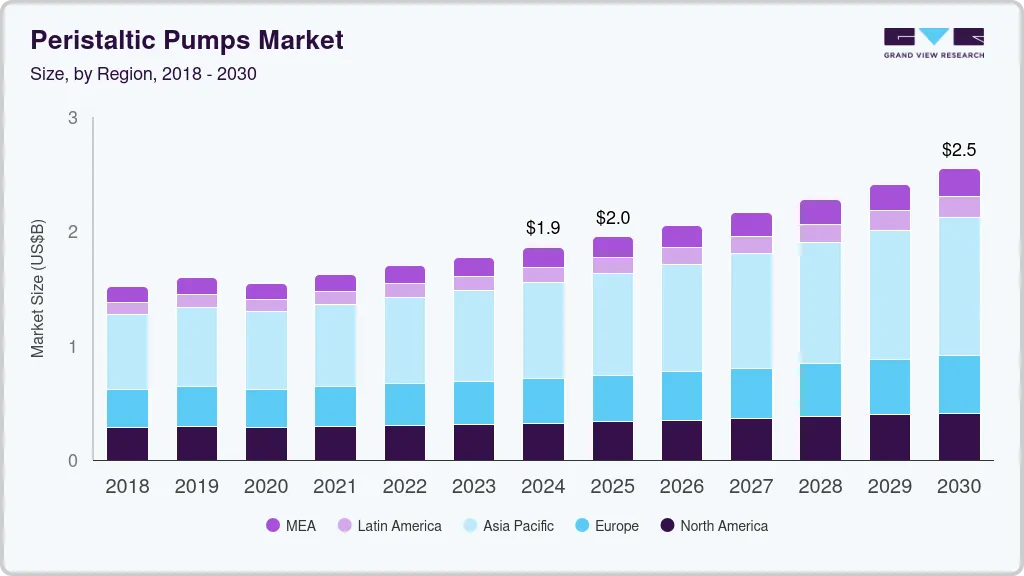

The global peristaltic pumps market size was estimated at USD 1,860.1 million in 2024 and is projected to reach USD 2,549.4 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. Peristaltic pumps are increasingly utilized in various industries such as medical & pharmaceutical, water treatment, food & beverage, and chemical processing due to their gentle pumping action and ability to handle delicate fluids and viscous materials without contamination.

Key Market Trends & Insights

- The Asia Pacific region is expected to witness rapid growth in the peristaltic pumps market.

- The China, as part of the Asia Pacific region, holds a dominant position in the global peristaltic pumps market.

- Based on type, the tube pump segment led the market and accounted for 65.2% of the global market revenue share in 2023.

- Based on discharge capacity, the up to 30 psi segment led the market and accounted for 36.8% of the global market revenue share in 2023.

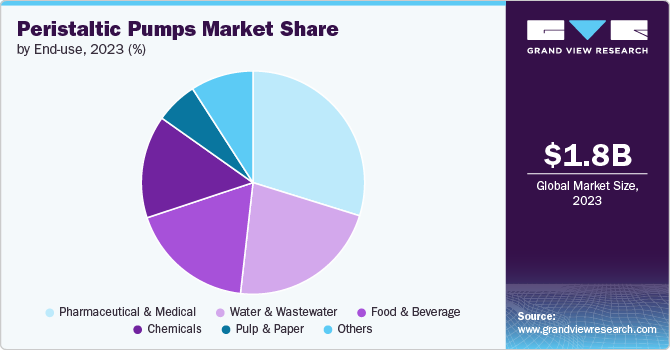

- The medical & pharmaceutical end-use segment held the largest market share in 2023, accounting for 29.8% of the global peristaltic pumps market revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,860.1 Million

- 2030 Projected Market USD 2,549.4 Million

- CAGR (2025-2030): 5.5%

- Asia Pacific: Largest market in 2023

These pumps are essential for applications requiring accurate fluid delivery and sterile conditions, driving their demand across different sectors. The market growth is further supported by technological advancements in pump design, which enhance efficiency, reduce maintenance requirements, and offer greater flexibility in fluid handling capabilities.

Rising investments in healthcare infrastructure and the expansion of water treatment facilities globally are also contributing factors to market expansion. In addition, stringent regulatory standards regarding fluid handling and sanitation in industries such as food processing and pharmaceutical manufacturing are boosting the adoption of peristaltic pumps.

Drivers, Opportunities & Restraints

The demand for peristaltic pumps is primarily driven by the growing need for precise and sterile fluid handling in critical industries such as pharmaceuticals, biotechnology, and food & beverage. These pumps, renowned for their ability to handle corrosive, abrasive, and sensitive fluids without contamination, are indispensable in processes requiring high levels of hygiene and accuracy. In addition, the expanding water and wastewater treatment sector worldwide, due to increasing environmental concerns and stringent government regulations on waste disposal, is significantly contributing to the market growth.

One of the key restraints facing the peristaltic pumps market is the mechanical limitations and performance issues when dealing with high-pressure applications. Though peristaltic pumps excel in handling aggressive and viscous fluids, their efficiency tends to decrease under high-pressure conditions, which can limit their applicability in certain industrial processes.

The integration of smart technologies and renewable energy sources presents a significant opportunity for growth in the peristaltic pumps market. Innovations in automation and smart control systems enhance the efficiency and performance of centrifugal blowers, making them more attractive to industries aiming to optimize energy consumption and reduce operational costs.

The rising emphasis on research and development activities across various sectors, including environmental science, pharmaceuticals, and biotechnology, presents substantial opportunities for the peristaltic pumps market. Innovations aimed at enhancing pump performance, durability, and versatility are likely to widen the scope of applications for peristaltic pumps, thereby driving market expansion. Moreover, the burgeoning demand for automation in liquid handling processes and the integration of smart technologies into pump systems are anticipated to offer lucrative prospects for growth, enhancing operational efficiency and reliability in fluid management.

Type Insights

“The demand for hose pump segment is expected to grow at a CAGR of 6.0% from 2024 to 2030 in terms of revenue”

The tube pump segment led the market and accounted for 65.2% of the global market revenue share in 2023. Tube pumps are known for their precision in handling small volumes of fluids in a variety of applications, from laboratory settings to industrial processes. These pumps work by compressing and releasing a length of flexible tubing, creating a vacuum that draws fluid through the tube. The main advantages of tube pumps is their ability to prevent cross-contamination, as the fluid only contacts the inside of the tubing and not the pump mechanism itself. This makes tube pumps particularly valuable in industries requiring sterile conditions, such as pharmaceuticals, biotechnology, and food processing.

Hose pumps are distinguished by their robust construction and ability to handle highly viscous, abrasive, or corrosive fluids. These pumps operate by compressing a reinforced hose, which contains the fluid, with rollers or shoes. This action propels the fluid through the hose and out of the pump. Hose pumps are typically used in heavier-duty applications, such as mining, wastewater treatment, and chemical manufacturing, where their durability and high-pressure capabilities are essential.

Discharge Capacity Insights

“The demand for 51 to 100 psi segment is expected to grow at a CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The up to 30 psi segment led the market and accounted for 36.8% of the global market revenue share in 2023. Up to 30 psi peristaltic pumps that fall within this segment are typically used in applications requiring gentle handling of fluids at low pressures. They are ideal for laboratories, pharmaceutical manufacturing, and food and beverage processing where precision and the avoidance of fluid contamination are paramount. The lower pressure capabilities ensure delicate and precise fluid transfer, making these pumps perfect for dosing, filling, and sampling applications.

51 to 100 psi segment caters to more rigorous applications that require higher Discharge Capacitys. Pumps capable of operating within this range are adept at handling viscous fluids or working in systems with longer tubing lengths where higher pressures are necessary to move fluids efficiently. Applications might include industrial processing, more extensive water treatment facilities, and certain manufacturing processes where higher pressure is required to ensure proper fluid dynamics.

End-use Insights

“The demand for water & wastewater segment is expected to grow at a significant CAGR of 5.2% from 2024 to 2030 in terms of revenue”

The medical & pharmaceutical end-use segment held the largest market share in 2023, accounting for 29.8% of the global peristaltic pumps market revenue. Peristaltic pumps play a critical role in drug delivery systems, laboratory equipment, and diagnostic devices, where accurate fluid handling and contamination prevention are paramount.

The water and wastewater industry relies heavily on peristaltic pumps for their versatility and ability to handle a wide range of fluids, including abrasive sludges, corrosive chemicals, and clean water. Their robust design allows for the efficient treatment and movement of wastewater and slurry, facilitating operations such as chemical dosing, pH adjustment, and the transfer of thick sludges. Given the increasing focus on environmental regulations and the need for sustainable water management, peristaltic pumps are integral to the infrastructure of municipal and industrial wastewater treatment facilities.Regional Insights

“China to witness market growth at 6.6% CAGR”

The Asia Pacific region is expected to witness rapid growth in the peristaltic pumps market, attributed to extensive industrialization, urbanization, and the expansion of manufacturing sectors in countries like China, India, and Japan. With a burgeoning pharmaceutical industry, increasing investments in water and wastewater treatment infrastructure, and a growing food and beverage sector, the demand for peristaltic pumps in the Asia Pacific is set to surge. The region's focus on technological innovations and increasing environmental awareness further contribute to the adoption of efficient and sustainable pumping technologies.

China, as part of the Asia Pacific region, holds a dominant position in the global peristaltic pumps market due to its expansive industrial base and strategic initiatives aimed at environmental sustainability. The country's massive manufacturing sector, coupled with significant investments in pharmaceuticals, biotechnology, and environmental management, drives the demand for peristaltic pumps. China's emphasis on upgrading its water treatment facilities and adopting high-quality standards in food and drug manufacturing processes significantly contributes to the growth of the peristaltic pumps market.

North America Peristaltic Pumps Market Trends

North America represents a significant market for peristaltic pumps, driven by advanced industrial sectors and stringent regulatory standards requiring precise and sanitary fluid handling. The United States leads the region, leveraging its substantial pharmaceutical, food and beverage, and water treatment industries. Innovations in biotechnology and an emphasis on wastewater recycling and treatment technologies further fuel the demand for peristaltic pumps. Moreover, the presence of key market players and a robust focus on research and development activities in the region are pivotal in the adoption and advancement of peristaltic pumping solutions, catering to a wide range of industrial requirements.

Europe Peristaltic Pumps Market Trends

Europe's market for peristaltic pumps is characterized by its strong emphasis on quality and environmental sustainability, making it a leader in the adoption of efficient and eco-friendly industrial processes. Countries such as Germany, the UK, and France spearhead the region's demand, supported by their well-established pharmaceutical, chemical, and food processing industries. The stringent regulations governing food safety, chemical manufacturing, and waste management in Europe necessitate the use of reliable and contamination-free fluid handling equipment, thereby bolstering the growth of the peristaltic pumps market.

Key Peristaltic Pumps Company Insights

Some of the key players operating in the Peristaltic Pumps Market include A Graco Inc, Watson-Marlow Inc., Boxer GmbH, ANKO, Ingersoll Rand, ProMinent, Verder Inc., Boyser, among others.

-

Graco Inc. product lineup features a robust selection of peristaltic pumps known for their reliability, durability, and efficiency. These pumps are designed to meet the stringent requirements of various applications, ensuring precise and contamination-free fluid handling.

-

Watson-Marlow Fluid Technology Group, a subsidiary of Spirax-Sarco Engineering plc, is a manufacturer specializing in niche peristaltic pumps and associated fluid path technologies. With a strong focus on delivering engineering solutions that support the pharmaceutical, biotechnology, and industrial environments.

-

Boxer GmbH, specializes in the peristaltic pump market, focuses on developing compact and versatile pumping solutions suitable for a variety of application needs. Boxer's peristaltic pumps are especially favored in medical devices, laboratory equipment, and environmental monitoring systems, where their performance and reliability can significantly impact the overall effectiveness and accuracy of the technology they are integrated into.

-

ANKO Products, Inc. is a prominent player specializing in the design and manufacture of peristaltic pumps for diverse sectors including medical, pharmaceutical, and industrial applications. With a strong focus on delivering high-quality, reliable, and user-friendly pumping solutions, ANKO has carved out a niche in providing pumps that offer excellent performance in fluid transfer and dosing applications.

Key Peristaltic Pumps Companies:

The following are the leading companies in the peristaltic pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Graco Inc

- Watson-Marlow Inc.

- Boxer GmbH

- ANKO

- Ingersoll Rand

- ProMinent

- Verder Inc.

- Boyser

- Gilson Incorporated

- Valmet

Recent Developments

-

In August 2023, Verder Liquids unveil significant enhancements and expansions to its Verderflex iDura peristaltic pump lineup. This revamp introduces advanced technological improvements and innovative features, positioning the iDura peristaltic pumps as the premier selection for diverse applications including filter press operations, water treatment, food and beverage processing, and beyond.

-

In July 2023, Duoning Biotechnology Co Ltd announced that its subsidiary, Shanghai Duoning Yuexi Biological Technology Co Ltd, finalized a deal to purchase Changzhou PreFluid Technology Co Ltd, a renowned manufacturer of peristaltic pumps in China. This merger represents a strategic amalgamation of company strengths, solidifying their position to consistently deliver dependable and effective fluid transportation solutions to their clientele.

Peristaltic Pumps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,953.3 million

Revenue forecast in 2030

USD 2,549.4 million

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, discharge capacity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Graco Inc; Watson-Marlow Inc.; Boxer GmbH; ANKO; Ingersoll Rand; ProMinent; Verder Inc.; Boyser; Gilson Incorporated; Valmet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peristaltic Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global peristaltic pumps market report on the basis of type, discharge capacity, end-use, and region:

-

Pressure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tube Pump

-

Hose Pump

-

-

Discharge Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 30 psi

-

31 to 50 psi

-

51 to 100 psi

-

101 to 150 psi

-

Above 150 psi

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Medical

-

Water & Wastewater

-

Food & Beverage

-

Chemicals

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global peristaltic pumps market size was estimated at USD 1.77 billion in 2023 and is expected to reach USD 1.86 billion in 2024.

b. The global peristaltic pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 2.55 billion by 2030.

b. Asia Pacific dominated the peristaltic pumps market with a revenue share of 35.8% in 2023. The expansion of the food & beverage and chemical & pharmaceutical industries in countries like China, India, and Japan is driving the market growth.

b. Some of the key players operating in the peristaltic pumps market include Graco Inc, Watson-Marlow Inc., Boxer GmbH, ANKO, Ingersoll Rand, ProMinent, Verder Inc., Boyser, Gilson Incorporated, Valmet

b. The demand for peristaltic pumps is primarily driven by the growing need for precise and sterile fluid handling in critical industries such as pharmaceuticals, biotechnology, and food & beverage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.