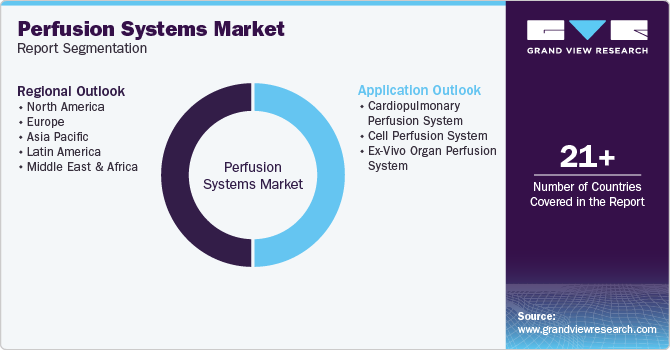

Perfusion Systems Market Size, Share & Trends Analysis Report By Application (Cardiopulmonary Perfusion System, Cell Perfusion System), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-470-3

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Perfusion Systems Market Size & Trends

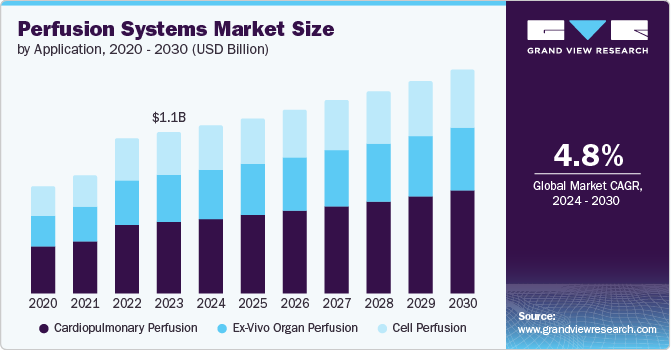

The global perfusion systems market size was estimated at USD 1.12 billion in 2023 and is expected to grow at a CAGR of 4.8% from 2024 to 2030. The rising prevalence of cardiovascular & respiratory diseases, a growing geriatric population base, an increase in the number of organ transplantation procedures, and a rising incidence of multiple organ failures are some of the major factors driving the market growth. According to the World Health Organization (WHO), cardiovascular diseases affect around 17.9 million people each year, making them a leading cause of death worldwide. Moreover, according to the Centers for Disease Control and Prevention (CDC), heart disease causes around 655,000 mortalities in America annually. Such a high prevalence of these conditions underscores the critical need for advanced medical interventions, including perfusion systems, which are essential in cardiopulmonary bypass procedures during heart surgeries.

Perfusion systems play a pivotal role in ensuring the delivery of oxygen and nutrients to tissues during surgical procedures, making them indispensable in the treatment of cardiovascular conditions. The rising incidence of strokes, heart attacks, and other cardiovascular events has led to an increase in the number of surgical interventions, thereby bolstering the demand for perfusion systems. According to the CDC, around 805,000 Americans suffer a heart attack each year, which is increasing the necessity for the development of advanced surgical and perfusion technology to improve patient outcomes.

The continuous medical advancements and development of improved surgical techniques have made organ transplantation more feasible & successful, which has increased the demand for sophisticated perfusion systems. In December 2021, Medtronic plc announced that its INVOS 7100 somatic/cerebral oximetry system had received 510(k) approval from the U.S. FDA for children till the age of 18. This system uses vital signals to inform time-critical decisions by pediatric doctors on airflow, hemodynamic management, and resuscitation for infants, newborns, and children treated by pediatric clinicians.

"There are so many time-critical conditions clinicians face when treating some of our youngest patients in intensive care units, from RSV to complex heart conditions and beyond. We see this as an opportunity to equip providers with technology that can help improve outcomes among the most vulnerable populations,"

-Sam Ajizian, MD, FAAP, FCCM, CPPS, and chief medical officer of the Patient Monitoring business at Medtronic.

The global population is aging, which is anticipated to fuel the prevalence of age-related diseases & conditions, including kidney failure, heart failure, and chronic respiratory diseases. According to CDC, adults aged 65 and above are at higher risk of heart disease, COPD, diabetes, neurological problems, cancer, and other chronic illnesses. Moreover, according to WHO, the number of people aged 60 years & older is anticipated to double by 2050, reaching around 2.1 billion. This demographic shift is expected to increase the incidence of multiple organ failures, thereby increasing the demand for more complex and frequent medical interventions, including advanced surgical procedures and organ transplants.

Several governments and non-governmental organizations (NGOs) are taking initiatives to encourage organ donation by promoting awareness and facilitating the donation process. These initiatives are significantly increasing the number of available organs for transplantation, which is expected to increase the demand for advanced perfusion systems essential for organ preservation and transplantation. For instance, the U.S. Department of Health and Human Services runs the Organ Donation & Transplantation program through its HRSA, which includes campaigns such as “Donate Life”, which tries to educate people about the importance of organ donation. Such efforts by the government bodies have significantly increased the number of registered donors, with HRSA reporting over 170 million people registered as organ donors in the U.S. as of 2024.

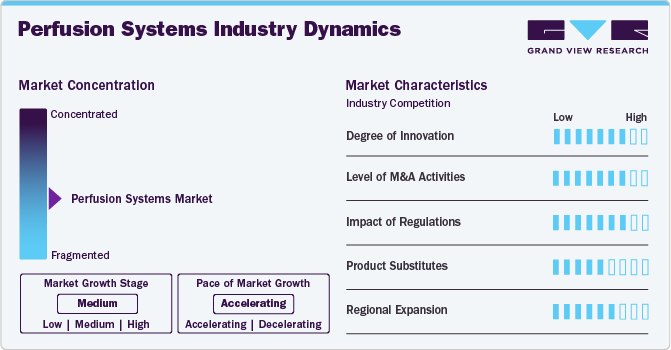

Market Concentration & Characteristics

The perfusion systems market is characterized by a growing concentration of key players such as Getinge, Medtronic, plc, Merck KGaA, and Terumo Corporation, driven by technological advancements in the perfusion system and their increasing demand. The market is driven by the rising prevalence of cardiovascular and respiratory diseases, increasing organ transplantation, rising incidents of organ failure in the elderly population, and the increasing biologics manufacturing.

The perfusion systems industry is characterized by a high degree of innovation driven by a supportive regulatory framework, increasing investments, government inanities, and the development of innovative products by market players to get a competitive edge, leading to the development of advanced products and systems. In March 2023, LivaNova PLC received FDA clearance for its Essenz Heart-Lung Machine (HLM). Essenz HLM, along with the Essenz Patient Monitor, forms the Essenz Perfusion System, which supports a patient-tailored perfusion approach based on data-driven decisions, enhancing both quality of patient care and clinical workflows during Cardiopulmonary Bypass (CPB) procedures.

“A perfusion system acts as a patient’s heart and lungs during an open-heart procedure, so having the highest-quality system backed by the expertise of a skilled perfusionist is paramount,”

-Damien McDonald, Chief Executive Officer of LivaNova

The market is subject to stringent regulatory oversight to ensure the safety and efficacy of these specialized medical devices. Regulatory bodies such as the FDA in the United States and the EMA in Europe have established guidelines and approval processes for perfusion systems used in organ transplantation, cell culture, and other biomedical applications. The regulatory landscape also governs the use of perfusion systems in clinical settings, with guidelines on their operation, maintenance, and monitoring to protect patient safety.

The market is characterized my medium level of mergers and acquisitions owing to the increasing efforts by market players to increase their portfolio offering and enhance their industry presence to get a competitive edge over other market players. For instance, in April 2023, Repligen Corporation acquired FlexBiosys Inc. of Branchburg, NJ. Through the acquisition, Repligen's Fluid Management business was expected to expand even further and provide a wider selection of single-use bioprocessing bags and assemblies.

While there are alternative technologies and approaches that can partially fulfill the functions of perfusion systems, they may not provide the same level of comprehensive support and control over organ and tissue perfusion. Some potential substitute products include extracorporeal membrane oxygenation (ECMO) devices, which can provide temporary respiratory and cardiac support, and hypothermic organ preservation solutions, which can maintain organ viability during transportation. However, the increasing demand for organ transplantation and advancements in cell-based research are driving the continued adoption of perfusion systems, as they play a critical role in maintaining organ and tissue viability during these procedures.

The growing market demand for perfusion systems and the increasing efforts by market players to increase their customer base are leading to the adoption of expansion strategies by the market players, such as opening new facilities, expansion of existing facilities, entering new markets, and others. For instance, in September 2022, Terumo Cardiovascular unveiled its new Perfusion Circuit Technology and Manufacturing Center in Costa Rica. The company aims to enhance its patient care and get in a better position to serve its global customer base.

Application Insights

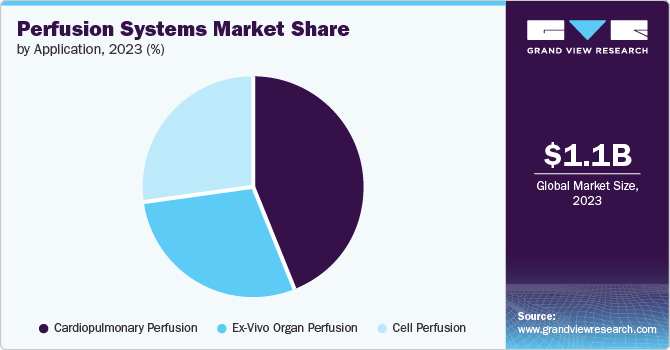

The cardiopulmonary perfusion system segment accounted for the largest market share of 43.9% in 2023 and is expected to witness fastest growth over the forecast period owing to the increasing prevalence of cardiovascular diseases, the growing number of cardiovascular surgeries, and advancements in medical technology. According to a World Heart Federation (WHF) report, cardiovascular disease-related deaths have surged significantly to reach 20.5 million in 2021 from 12.1 million in 1990. This rise in the incidence of cardiovascular diseases has led to a higher demand for cardiovascular surgeries, necessitating reliable and effective support systems such as cardiopulmonary perfusion systems, thereby driving the segment growth.

The cell perfusion system segment is expected to witness significant growth over the forecast period. Cell perfusion systems are essential devices designed to provide cultured cells with essential nutrients, gases, and biochemical factors necessary for their growth and viability under controlled conditions that replicate physiological environments. Moreover, these systems integrate several key components to achieve precise control over the cell culture environment, which is further expected to fuel their demand over the forecast period.

Regional Insights

North Americadominated the overall global market and accounted for the 39.5% revenue share in 2023. The market is expected to expand significantly in North America due well-established healthcare sector, commitment to innovation, advanced infrastructure, a strong emphasis on R&D, and the high prevalence of respiratory and cardiac disorders. North America faces a significant burden of cardiovascular and respiratory diseases, leading to a rising demand for perfusion systems used in surgeries for these conditions, which if further propelling the market growth.

U.S. Perfusion Systems Market Trends

The market in the U.S. held a significant share of North America market in 2023 owing to the presence of key market players in the country, the increase in the prevalence of chronic diseases, and the resulting rise in the number of cardiovascular surgeries in the country. According to CDC data, around 150 million U.S. individuals suffer from at least one chronic illness, which may require surgery. Furthermore, respiratory problems and heart ailments are also significantly contributing to the rising number of surgical procedures in the country, which is expected to fuel the market growth.

Europe Perfusion Systems Market Trends

The market in Europe is witnessing dynamic growth, supported by the increasing public & private investment in R&D, rising demand for healthcare devices and increasing prevalence of chronic diseases are some of the significant factors contributing to the growth of this region. Moreover, increase in government investments in long-term healthcare plans, favorable reimbursement policies, and growing healthcare research infrastructure are also expected to boost adoption of perfusion systems.

The UK perfusion systems market is experiencing notable growth, driven by its an established healthcare system, high per capita income, better access to healthcare services, and favorable reimbursement policies. The UK is one of Europe’s key markets, with the presence of technologically advanced healthcare facilities and research centers. According to the British Lung Foundation, around 700,000 people are hospitalized each year in the UK suffering from lung diseases.

The perfusion systems market in France is driven by a rapidly growing geriatric population at a high risk of developing Acute Respiratory Distress Syndrome (ARDS), making it a favorable market for perfusion systems. According to an article by Béatrice Madeline in March 2023, around 26% of France’s population is aged over 60 years, representing one in every four residents. Moreover, this population is expected to increase to nearly one in three by 2040, highlighting a major demographic shift in the country’s population base.

The Germany perfusion systems market is experiencing notable growth owing to the by growing prevalence of diseases, such as chronic obstructive pulmonary disease, technological advancements in medical research equipment, and growing demand for perfusion systems in hospitals. Furthermore, schemes such as Statutory Health Insurance (SHI) are strengthening healthcare infrastructure and facilitating people to undergo advanced treatment, which is expected to increase the demand for perfusion systems.

Asia Perfusion Systems Market Trends

The Asia Pacific market is experiencing significant growth driven by aging population and a shift toward a sedentary lifestyle contribute to a rise in chronic diseases. Furthermore, a significant demand-supply gap between patients needing organ transplants and available donors is driving the number of strategies being undertaken by government bodies to promote organ donation.

The Japan perfusion systems market is poised for rapid growth, driven by increased awareness of preventive medical devices used to prevent respiratory failure complications, advancements in healthcare infrastructure, and rising healthcare expenditure. Another significant factor is the aging population, with over 10% of people aged 80 and above in 2023, according to the World Economic Forum. This demographic trend is leading to a higher prevalence of chronic diseases, such as COPD and heart failure, due to common comorbidities.

The perfusion systems market in China is expected to grow due to the increasing healthcare reforms, rising prevalence of chronic obstructive pulmonary disease (COPD), growing population base, and developing medical devices industry in the country. For instance, LifeSeeds, part of the China Rural Health Initiative (CRHI), aims to improve healthcare access in underserved regions, creating opportunities for market players. Such favorable government initiatives are expected to drive market growth over the forecast period.

The India perfusion systems market is driven by the country’s liberal medical device regulations and increase in healthcare spending. Moreover, the emergence of new corporate hospitals and growing number of training programs & awareness campaigns about perfusion systems are also promoting their adoption. For instance, according to THG PUBLISHING PVT LTD in May 2024, the Idhayam Kappom Scheme, launched last June, has provided loading doses to 7,896 heart patients through primary health centers and government hospitals.

Latin America Perfusion Systems Patch Market Trends

The Latin American market is fueled by the growing establishment of local manufacturing centers, which is expected to increase the accessibility and affordability of perfusion systems in the country and an increasing number of elderly individuals requiring medical interventions.

Key Perfusion Systems Company Insights

The competitive scenario in the market is highly competitive, with key players such as Medtronic, plc, Merck KGaA and Terumo Corporation holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Perfusion Systems Companies:

The following are the leading companies in the perfusion systems market. These companies collectively hold the largest market share and dictate industry trends.

- Getinge

- Medtronic, plc

- LivaNova PLC

- Terumo Corporation

- Nipro Corporation

- Fresenius SE & Co. KGaA (XENIOS AG)

- Repligen Corporation

- Spectrum Medical

- Merck KGaA

- Harvard Bioscience, Inc.

- Lifeline Scientific

- ALA Scientific Instruments, Inc.

- XVIVO Perfusion AB

Recent Developments

-

In August 2023, TransMedics Group, Inc. acquired intellectual property and assets related to the Ex-Vivo Organ Support System from Bridge to Life Ltd. The company aimed to expand its portfolio and organ transplantation indications.

-

In February 2023, LivaNova initiated the commercial release of its Essenz perfusion system in select European centers. This system allows informed data-backed decision-making for safe cardiopulmonary bypass (CBP) management with its integrated technology.

Perfusion Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.17 billion |

|

Revenue forecast in 2030 |

USD 1.55 billion |

|

Growth rate |

CAGR of 4.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Getinge; Medtronic, plc; LivaNova PLC; Terumo Corporation; Nipro Corporation; Fresenius SE & Co. KGaA (XENIOS AG); Repligen Corporation; Spectrum Medical; Merck KGaA; Harvard Bioscience, Inc.; Lifeline Scientific; ALA Scientific Instruments, Inc.; XVIVO Perfusion AB |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Perfusion Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global perfusion systems market report on the basis of application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiopulmonary Perfusion System

-

Oxygenators

-

Heart-Lung Machine

-

Perfusion Pumps

-

Cannula

-

Monitoring System

-

Others

-

-

Cell Perfusion System

-

Bioreactor Perfusion System

-

Microfluidic Perfusion System

-

Gravity/Pressure-driven Perfusion System

-

Small Mammal Organ Perfusion System

-

-

Ex-Vivo Organ Perfusion System

-

Hypothermic

-

Normothermic

-

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include increasing demand for organ transplantation, technological advancements and increasing initiatives to promote organ donation.

b. The global perfusion systems market size was estimated at USD 1.12 billion in 2023 and is expected to reach USD 1.17 billion in 2024.

b. The global perfusion systems market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 1.55 billion by 2030.

b. North America dominated the perfusion systems market with a share of 39.5% in 2023. This is attributable to the increasing demand for transplant surgery and initiatives undertaken by the government.

b. Some key players operating in the perfusion systems market include XVIVO Perfusion AB; Organ Assist B.V.; Organ Recovery Systems; Organ Transport Systems; Waters Medical Systems; Paragonix Technologies, Inc.; TransMedics, Inc.; OrganOx Limited; and Bridge to Life Ltd.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."