- Home

- »

- Beauty & Personal Care

- »

-

Perfumes And Deodorants Market Size, Industry Report 2030GVR Report cover

![Perfumes And Deodorants Market Size, Share & Trends Report]()

Perfumes And Deodorants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Perfumes, Deodorants), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-617-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Perfumes And Deodorants Market Summary

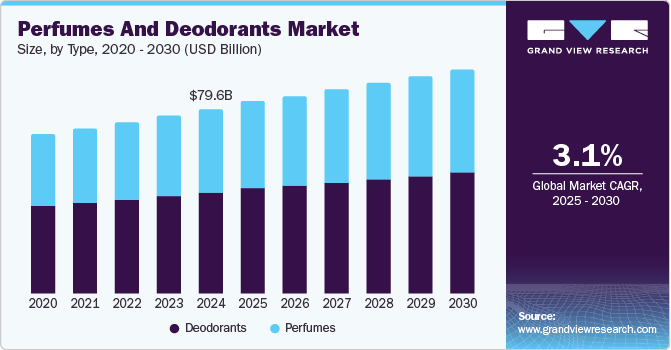

The global perfumes and deodorants market size was estimated at USD 79.58 billion in 2024 and is projected to reach USD 96.66 billion by 2030, growing at a CAGR of 3.1% from 2025 to 2030. The growth experienced by this market is primarily driven by lifestyle changes, increasing demand by urban consumers, and a large number of individuals participating in the corporate workforce.

Key Market Trends & Insights

- North America led the perfumes and deodorants market with the largest revenue share of 33.4% in 2024.

- Asia Pacific perfumes and deodorants market is expected to grow at the fastest CAGR from 2025 to 2030.

- By type, the deodorants segment led the market, with a revenue share of 55.0% in 2024.

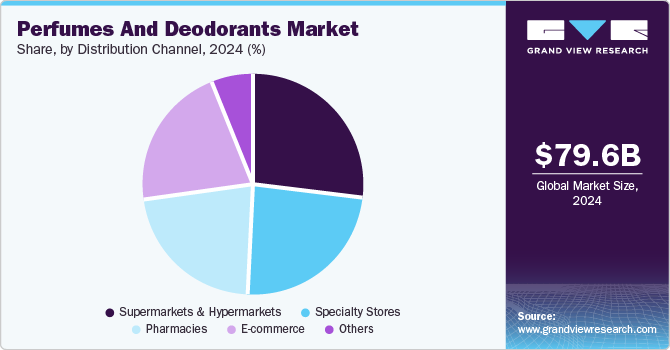

- By distribution channel, the supermarkets & hypermarkets led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 79.58 Billion

- 2030 Projected Market Size: USD 96.66 Billion

- CAGR (2025-2030): 3.1%

- North America: Largest market in 2024

Extended work hours followed by tiring travels and enhanced awareness regarding appearance and personal hygiene are expected to fuel demand for perfumes and deodorants in the coming years.

Trends in the beauty and personal care industry, such as the premiumization of perfumes, portfolios equipped with local preferences, and the essence of traditions and culture, contribute to the growing demand for perfumes and deodorants. Innovations embraced by key industry participants, such as gas-free deodorants and others, have also developed significant influence over the growth of this market. Packaging innovations such as the availability of pocket sprays and others have also become the preferred choice of young consumers.

In recent years, organically developed ingredients and cruelty-free sources have also developed their significance in perfumes and deodorants. This has stimulated the emergence of innovation-based products such as vegan perfumes. For instance, in March 2024, ROAN FRAGRANCES, a clean fragrance brand, launched genderless scents. The newly introduced three vegan scents are Current Culture, Mountain Memories, and Porcelain Pulse. The fragrances infused included various tastes such as ocean breeze, musk, matcha, Oolong tea, black currant buds, Patchouli, leather, Rhubarb, Darjeeling Black Tea, and more.

Prominent brands in the personal care industry, including perfumes and deodorants, have embraced effective marketing strategies through advanced technology tools and modern innovations such as artificial intelligence. In recent years, multiple key companies have also collaborated with celebrities or public figures for brand endorsements. Social media marketing, personalized marketing, AI-driven advertisement, and content delivery tools have also contributed to growing market penetration.

Type Insights

The deodorants segment dominated the global perfumes and deodorants market, with a revenue share of 55.0% in 2024. The growing demand from young and urban consumers primarily influences this segment. Increasing competition driven by the large number of participants in this category has stimulated multiple companies to implement novel marketing strategies and ensure improved digital presence. Innovation-driven product launches by various companies are also adding to the growth of this market. For instance, Native, a brand acquired by Procter & Gamble a few years ago, launched Whole Body Deodorant, with the availability of multiple flavors such as Coconut & Vanilla, Cucumber & Mint, Lilac & White Tea, and Unscented (Stick Only).

The perfume segment is projected to experience the highest CAGR during the forecast period. This segment's growth is mainly influenced by factors such as a large number of premium product buyers, an increasing number of industry participants, and trends of adopting local tastes and adding relatable fragrances to ensure improved customer engagement. The growing popularity of the luxury category of perfumes, enhanced availability through online portals and e-commerce websites, and significant demand from countries with higher disposable income levels are adding growth opportunities for this segment.

Distribution Channel Insights

The supermarkets & hypermarkets dominated the global perfumes and deodorants industry in 2024. Brands prefer large-scale distribution through supermarkets and hypermarkets as it ensures enhanced brand visibility. Significant footfall across the seasons, effective floor management techniques used by organized retail businesses, and offers and discounts provided by supermarkets & hypermarkets are expected to drive the growth of this segment in the next few years.

E-commerce segment is expected to experience the fastest growth from 2025 to 2030. This is primarily driven by the convenience of the e-commerce shopping experience, ease of use, increasing penetration, easy accessibility, and effective personalized marketing strategies adopted by the key e-commerce businesses. Services offered by the e-commerce industry, such as doorstep deliveries, return or replacement of items, availability of multiple payment alternatives, and more, attract many customers.

Regional Insights

North America perfumes and deodorants market held a revenue share of 33.4% in 2024. The growth of this market is mainly influenced by factors such as enhanced availability through online portals and the entry of multiple consumer goods and personal care brands from the region. Additionally, a large number of young buyers and effective advertising strategies adopted by key companies are likely to fuel demand.

U.S. Perfumes and Deodorants Market

The U.S. held the largest revenue share of the regional perfumes and deodorants industry in 2024. The presence of global companies in the country operating in the beauty and personal care industry with deodorants or perfume portfolios primarily drives the growth of this market. Effective marketing and distribution, the inclusion of advanced technologies in manufacturing processes, personalized marketing, and newly embraced brand-building strategies are projected to fuel growth in the approaching years.

Europe Perfumes and Deodorants Market Trends

Europe was identified as one of the key regions of the perfumes and deodorants industry in 2024. The demand for innovation-based products such as vegan fragrances and organic or natural products drives this market. Increasing availability of global brand products, robust fashion and style industry operating in the market, presence of multiple personal care industry manufacturers in the region, and rising accessibility facilitated by online portals and e-commerce websites are projected to generate lucrative growth for this market.

Germany dominated the regional perfumes and deodorants industry in 2024. This is attributed to the increasing availability of international brand products with premium range pricing points and easy access to domestically developed affordable fragrances. Manufacturers' Sustainability awareness and focus on delivering quality have also been influencing this market. Additionally, Eau de Cologne and its cultural significance have led to significant growth in this market.

Asia Pacific Perfumes and Deodorants Market Trends

Asia Pacific perfumes and deodorants market is expected to experience the highest CAGR over the forecast period. This market is primarily driven by the growing demand from highly populated countries such as China and India and the entry of multiple global consumer goods brands in the market. Improved market penetration accomplished through effective offline distribution and ease of access facilitated by online portals and quick commerce platforms also contribute to the growth of this market.

China dominated the regional industry for perfumes and deodorants in 2024. This is attributed to its large share in exports, multiple mass production facilities located in the country, and growing domestic demand from urban consumers. In recent years, China has exported a large amount of personal deodorants and antidepressants to countries such as the U.S., UAE, and others.

Key Perfumes And Deodorants Company Insights

Some of the key companies in the global perfumes and deodorants industry are REVLON, Estée Lauder Companies (ELC), DIOR, Calvin Klein, Inc., BURBERRY and others. To address growing competition and increasing demand for premium products by urban consumers, multiple market participants are embracing strategies such as enhanced offline distribution in developing countries such as India, focus on improving digital footprint, and new product launches.

-

Estée Lauder Companies (ELC), one of the global industry participants in beauty and personal care, offers a wide range of products through more than twenty brands. Innovation based products, portfolios equipped with wide variety and premium category fragrances are some of the key offerings by company.

-

Beiersdorf is a global skincare brand that operates multiple brands, such as NIVEA, Eucerin, Hansplast, la prairie, CHANTECAILLE, Coppertone, Labello, 8X4, HIDROFUGAL, and others. 8X4 offers deodorants such as frozen berry, splashy citrus, pure freshness, dynamic energy, bamboo breeze, and more. CHANTECAILLE products include skincare, makeup, fragrance, and others. Its fragrance portfolio includes Frangipane, Vetyver, Kalimantan, Darby Rose, Le Wild, Pétales, and Tiare.

Key Perfumes And Deodorants Companies:

The following are the leading companies in the perfumes and deodorants market. These companies collectively hold the largest market share and dictate industry trends.

- REVLON

- The Estée Lauder Companies Inc.

- L'Oreal Group

- Beiersdorf

- DIOR

- Calvin Klein, Inc.

- BURBERRY

- Giorgio Armani S.p.A.

- Unilever

- Proctor & Gamble

Recent Developments

-

In November 2024, Unilever announced its plans to invest nearly USD 105 million to develop in-house creation capabilities and fragrance designs. The company is also recruiting professional perfumers with premium expertise from the U.S., the U.K., and India.

-

In October 2024, Estée Lauder announced the official launch of its products on the Amazon Premium Beauty store, including skincare, makeup, and fragrance offerings. It also announced that the Virtual Foundation Tool was exclusively deployed for Amazon customers.

-

In February 2024, Dove Men+Care, one of Unilever's applauded brands, introduced newly designed Whole Body Deo products. The range, created based on customer insights regarding requirements, features three variants: stick, spray, and cream.

-

In February 2024, AMOUAGE, an Omani luxury fragrance perfumery operating in the global market, launched its standalone store in the American continent. The newly inaugurated store in American Dream Entertainment & Retail Centre, New Jersey, is expected to assist the brand in adding lucrative growth to its business in the U.S.

Perfumes And deodorants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.79 billion

Revenue forecast in 2030

USD 96.66 billion

Growth rate

CAGR of 3.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, UAE

Key companies profiled

REVLON; The Estée Lauder Companies Inc.; L'Oreal Group; Beiersdorf; DIOR; Calvin Klein, Inc.; BURBERRY; Giorgio Armani S.p.A.; Unilever; Proctor & Gamble

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Perfumes And Deodorants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global perfumes and deodorants industry report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Perfumes

-

Deodorants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacies

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.