- Home

- »

- Medical Devices

- »

-

Pediatric Cardiac Surgery Market Size & Share Report, 2030GVR Report cover

![Pediatric Cardiac Surgery Market Size, Share & Trends Report]()

Pediatric Cardiac Surgery Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedure (Interventional Procedures, Peripheral Vascular Procedures), By End-use (Hospitals, Specialty Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-380-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pediatric Cardiac Surgery Market Trends

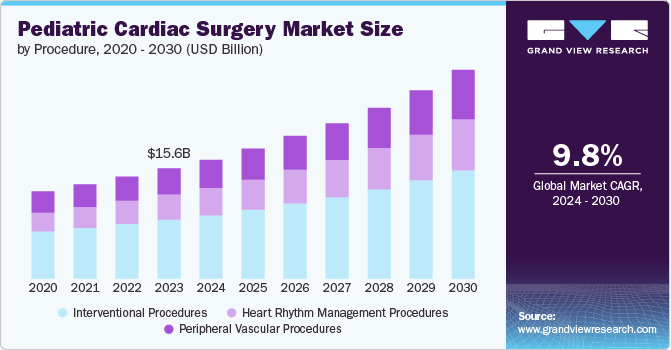

The global pediatric cardiac surgery market size was estimated at USD 15.6 billion in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The market’s growth is primarily driven by the rising incidence of congenital heart defects and heart failure in children. According to the State of Victoria, approximately 1% of newborns are born with a congenital heart defect (CHD), with more than half of these cases requiring treatment due to the severity of the condition. Moreover, as per the Pan American Health Organization study published in March 2023, in the first four weeks of life, an estimated 303,000 newborns die worldwide due to congenital anomalies.

Moreover, increasing enhancements in CPB circuit design, monitoring techniques, perfusion methods, temperature control, and myocardial protection have improved clinical outcomes in pediatric cardiac surgeries. For instance, in April 2024, LivaNova launched the Essenz Perfusion System, a cutting-edge system designed to support open-heart surgery procedures in adult and pediatric patients. It integrates the advanced Essenz Heart-Lung Machine (HLM) with an intuitive Patient Monitor and precise sensing technology. This integration enables data-driven decision-making for safe cardiopulmonary bypass (CBP) management.

Innovations such as specialized pediatric perfusion systems, neonatal CPB oxygenators, low prime volume oxygenators, and integrated arterial filters have improved outcomes and expanded treatment options for complex congenital heart abnormalities in newborns and young children. For instance, in November 2023, Ortho-Clinical Diagnostics announced a 510(k) premarket notification by the FDA for a medical device called “VITROS Immunodiagnostic Products HIV Combo Reagent Pack and Calibrators.” The purpose of these 510(k) submissions is to demonstrate that the VITROS HIV Combo Reagent Pack and Calibrators are substantially equivalent to a predicate device, the VITROS ECi/ECiQ Immunodiagnostic System HIV Combo Assay.

The government is invested in improving pediatric cardiac surgical facilities, further propelling the market growth. For instance, in October 2023, new recommendations were released in the field of congenital heart surgery and were developed under the leadership of the Congenital Heart Surgeons’ Society (CHSS). This society is a prestigious organization comprising leading experts in the field. The collaboration involved 15 prominent medical and surgical societies, indicating a comprehensive and multidisciplinary approach to formulating these recommendations.

Increasing investments and funding for producing pediatric perfusion products have also played a crucial role in driving the market growth. Companies are developing cutting-edge procedures and technologies tailored specifically for pediatric CPB, enhancing the quality of care and expanding the range of available treatment options. For instance, in August 2023, Boston Scientific launched the POLAR Cryoablation System, a cutting-edge medical device designed for cardiac surgery, specifically for treating pediatric patients with congenital heart defects. This system utilizes cryoablation technology, which involves freezing tissue to create lesions that can interrupt abnormal electrical pathways in the heart. By receiving FDA approval, Boston Scientific has achieved a significant milestone in advancing pediatric cardiac surgery.

Moreover, there are growing awareness programs for spreading the knowledge and availability of several healthcare facilities for pediatric cardiovascular disorders globally. For instance, the World Congress of Pediatric Cardiology and Cardiac Surgery, a significant international event, was held in August 2023. This event brings together thousands of pediatric cardiologists and pediatric cardiac surgeons from around the world. This congress is considered the most comprehensive, up-to-date, and technologically advanced meeting for pediatric and congenital heart disease. It is a highly anticipated gathering that provides a platform for professionals to engage, share knowledge, discuss advancements, and collaborate on improving care for pediatric patients with heart conditions.

In addition, the recent court ruling in July 2023, allowing the centralization of pediatric heart surgery in the Netherlands, is likely to impact the market significantly. This decision will influence various market aspects, including healthcare infrastructure, patient access to specialized care, competition among healthcare providers, and advancements in pediatric cardiac surgery techniques and technologies.

Procedure Insights

The interventional procedures segment accounted for the largest market share of 53.47% in 2023. The increasing prevalence of congenital heart defects among infants and children is a significant driver for the growth of interventional procedures in pediatric cardiac surgery. These procedures offer less invasive alternatives to traditional open-heart surgeries, reducing risks and improving outcomes for young patients. Technological advancements in imaging techniques, catheterization tools, and surgical equipment have also fueled the demand for interventional procedures in pediatric cardiac surgery. Furthermore, the growing expertise of pediatric cardiologists and cardiac surgeons in performing these minimally invasive interventions has further boosted the market.

The heart rhythm management procedures segment is expected to grow at a lucrative CAGR over the forecast period. The complexity and diversity of congenital heart diseases in pediatric patients often necessitate intricate surgical interventions involving the peripheral vasculature. These procedures are essential for correcting anomalies such as coarctation of the aorta, pulmonary artery stenosis, or anomalous coronary arteries, among others. Moreover, the growing expertise of pediatric cardiac surgeons and specialized healthcare facilities dedicated to pediatric cardiovascular care plays a pivotal role in adopting peripheral vascular procedures to address complex cardiac anomalies in children.

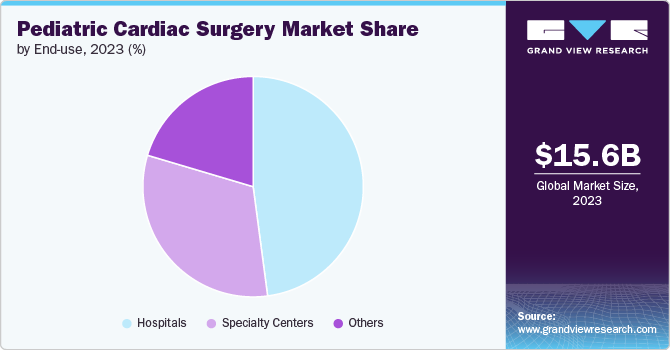

End-use Insights

The hospitals segment accounted for the largest market share of 47.89% in 2023. The convenience factor plays a significant role. The growth can be attributed to the increased number of minimally invasive surgeries under these facilities. Moreover, heart-related issues cause many children to be hospitalized; as a result, the care team is overworked and occasionally fails to notice changes in the patient's state. By utilizing MCT, an automated monitoring system, the hospital's medical staff can identify and address any irregularities sooner. Furthermore, favorable reimbursement policies are expected to fuel the demand in the forthcoming years. Moreover, the growing funds and investments in hospital facilities are further fueling the segment's growth. For instance, in May 2023, the Children’s Hospital of Philadelphia (CHOP) received a substantial donation from long-term supporters of the CHOP Cardiac Center to establish the Topolewski Pediatric Heart Valve Center. This generous contribution will bolster CHOP’s Valve Center, a pioneering initiative, enabling research into managing valve disorders and advancing knowledge regarding these complex conditions.

Special centers are anticipated to grow at the fastest CAGR over the forecast period. These centers have access to state-of-the-art equipment, cutting-edge surgical techniques, and specialized medical staff trained in the latest advancements in pediatric cardiac care. This technological advantage attracts patients seeking the best possible outcomes for their children’s heart conditions. Moreover, specialized expertise and experience are significant drivers for the success of specialty centers in pediatric cardiac surgery. These centers typically have highly skilled cardiac surgeons, cardiologists, nurses, and support staff specializing exclusively in treating pediatric patients with complex heart conditions.

Regional Insights

North America pediatric cardiac surgery market dominated the overall global market and accounted for the 48.02% revenue share in 2023. The market is primarily driven by advancements in technology, the increasing prevalence of congenital heart defects, rising awareness about pediatric cardiac conditions, and the presence of skilled healthcare professionals. Moreover, collaborations between healthcare institutions and research organizations play a crucial role in driving innovation and improving outcomes in pediatric cardiac surgery. In June 2023, the Duke Children’s Cardiology and Heart Surgery program achieved a new milestone by being ranked as the second pediatric heart program in the nation by the U.S. World and News Report, marking a significant improvement of five places from the previous year. Program leaders emphasize the key factors that contribute to such prestigious recognitions.

U.S. Pediatric Cardiac Surgery Market Trends

The pediatric cardiac surgery market in the U.S. held a significant share of the North American market in 2023.The market’s growth is expected to be boosted by the increasing number of diseases in the U.S., such as heart disease. For instance, as per the data published by the CDC in October 2022, approximately 1.3% of children aged 0-4 in the U.S. were reported to be in fair or poor health conditions in 2021. In addition, about 3.3% of children aged 5-11 missed 11 or more school days last year due to illness or injury. Furthermore, statistics show that around 20.3% of children aged 6 to 11 in the U.S. are affected by obesity, which is a significant risk factor for various cardiovascular diseases. This prevalence of obesity among children is expected to contribute to an increase in the burden of pediatric diseases in the country, thereby potentially driving growth in the relevant market.

Europe Pediatric Cardiac Surgery Market Trends

The pediatric cardiac surgery market in Europe is witnessing dynamic growth due to significant advancements in surgical techniques and increased healthcare investments. European countries are improving their infrastructure and adopting innovative technologies, such as minimally invasive procedures and advanced imaging, to enhance outcomes for congenital heart defects. The rising incidence of pediatric cardiac conditions and a focus on specialized care drive market expansion. The Heart Unit at SJD Barcelona Children's Hospital is a leading European center, treating more than 8,000 children annually. It boasts the lowest surgical mortality rates and a very low rate of reinterventions. Performing 250 surgeries annually with a 98.8% survival rate significantly drives market growth.

Asia Pacific Pediatric Cardiac Surgery Market Trends

The Asia Pacific pediatric cardiac surgery market is experiencing significant due to improved healthcare technologies and heightened awareness. Countries such as India, China, and Japan are making strides in surgical techniques and infrastructure, supported by public and private investments. Regional collaborations with international organizations are enhancing knowledge and skills. This progress aims to tackle the growing prevalence of pediatric cardiac conditions and increase access to quality care. In India alone, over 200,000 children are born with congenital heart disease each year, primarily in populous states like Bihar and Uttar Pradesh, according to PharmEasy in January 2022. Innovations such as minimally invasive procedures are improving outcomes for these conditions.

Key Pediatric Cardiac Surgery Company Insights

The competitive scenario in the market is highly competitive, with key players such as The Kroger Co., Walgreen Co., and Giant Eagle, Inc. holding significant positions. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Pediatric Cardiac Surgery Companies:

The following are the leading companies in the pediatric cardiac surgery market. These companies collectively hold the largest market share and dictate industry trends.

- Cedars-Sinai Medical Center

- NYU Langone Hospitals

- Mount Sinai Hospital

- Stanford Health Care-Stanford Hospital

- Heart Center Hirslanden Zurich

- Medical University of Vienna, Department of Cardiology

- University Medical Center Hamburg

- Columbia Asia Hospitals

- Brigham and Women’s Hospital

- Saint Luke’s Mid America Heart Institute

Recent Developments

-

In September 2023, CardioStart International announced a forthcoming mission to Clinica Corazones Unidos Hospital in Santo Domingo, Dominican Republic. This upcoming two-week endeavor will primarily focus on managing pediatric congenital cardiac surgery and procedures in the pediatric catheterization lab. The Rotary Gift of Life DL7490 and Trinity International Missions are playing crucial roles in providing essential support to facilitate these cases.

-

In June 2023, the Texas Children’s Hospital Heart Failure Team was honored with the prestigious title of the 2023 Outstanding Heart Failure Care Team award by the Heart Failure Society of America. This recognition is a testament to the exceptional dedication, expertise, and compassionate care the team at Texas Children’s Hospital provides in managing heart failure patients.

-

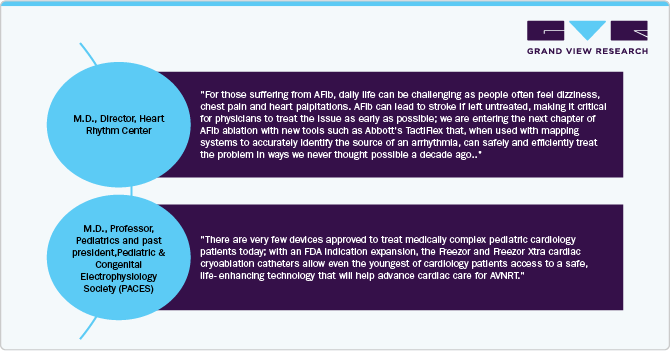

In May 2023, Abbott received FDA approval for its TactiFlex Ablation Catheter, designed to treat abnormal heart rhythms. This approval signifies a significant advancement in the field of cardiac electrophysiology, offering healthcare professionals a new tool to address conditions such as atrial fibrillation and other arrhythmias effectively.

-

In February 2022, Medtronic received expanded approval from the U.S. FDA for its cardiac cryoablation catheters. This approval specifically pertains to the pediatric treatment of a common heart rhythm condition.This approval provides healthcare providers with an additional tool to effectively manage arrhythmias in pediatric patients, potentially improving outcomes and quality of life for these individuals.

Pediatric Cardiac Surgery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.0 billion

Revenue forecast in 2030

USD 29.7 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cedars-Sinai Medical Center; NYU Langone; Hospitals; Mount Sinai Hospital; Stanford Health Care-Stanford Hospital; Heart Center Hirslanden Zurich; Medical University of Vienna, Department of Cardiology; University Medical Center Hamburg; Columbia Asia Hospitals; Brigham and Women’s Hospital; Saint Luke’s Mid America Heart Institute

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Cardiac Surgery Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric cardiac surgery market report based on procedure, end-use, and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Procedures

-

Peripheral Vascular Procedures

-

Heart Rhythm Management Procedures

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric cardiac surgery market size was estimated at USD 15.6 billion in 2023 and is expected to reach USD 17.0 billion in 2024.

b. The global pediatric cardiac surgery market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 29.7 billion by 2030.

b. North America dominated the pediatric cardiac surgery market with a share of 48% in 2023. The North America pediatric cardiac surgery market is primarily driven by advancements in technology, increasing prevalence of congenital heart defects, rising awareness about pediatric cardiac conditions, and the presence of skilled healthcare professionals.

b. Some key players operating in the pediatric cardiac surgery market include Cedars-Sinai Medical Center; NYU Langone; Hospitals; Mount Sinai Hospital; Stanford Health Care-Stanford Hospital; Heart Center Hirslanden Zurich; Medical University of Vienna, Department of Cardiology; University Medical Center Hamburg; Columbia Asia Hospitals; Brigham and Women’s Hospital; Saint Luke’s Mid America Heart Institute

b. The market’s growth is being primarily driven by the rising incidence of congenital heart defects and heart failure in children.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.