- Home

- »

- Pharmaceuticals

- »

-

Peanut Allergy Treatment Market Size, Industry Report, 2033GVR Report cover

![Peanut Allergy Treatment Market Size, Share & Trends Report]()

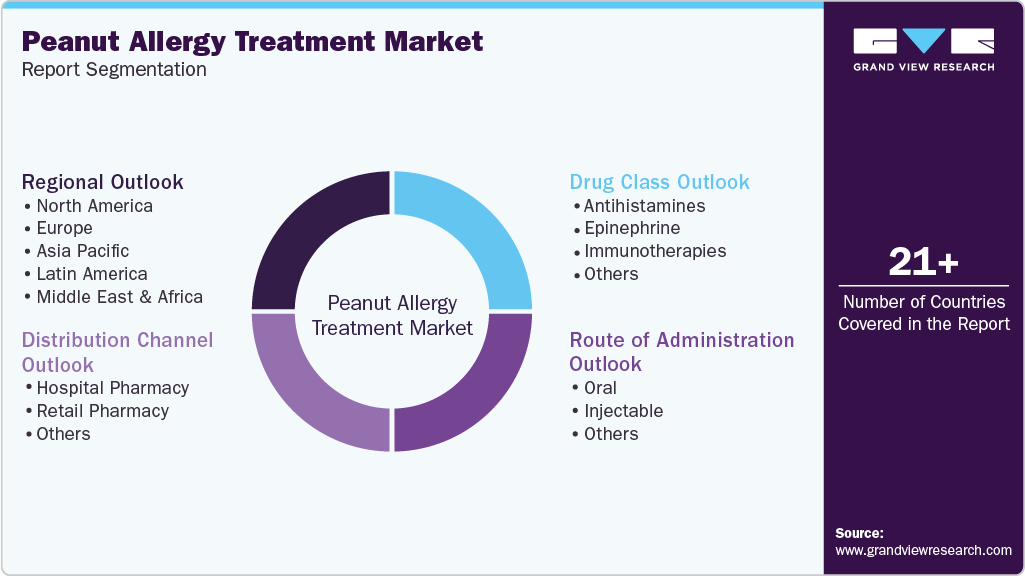

Peanut Allergy Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug Class (Antihistamines, Epinephrine, Immunotherapies), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-097-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peanut Allergy Treatment Market Summary

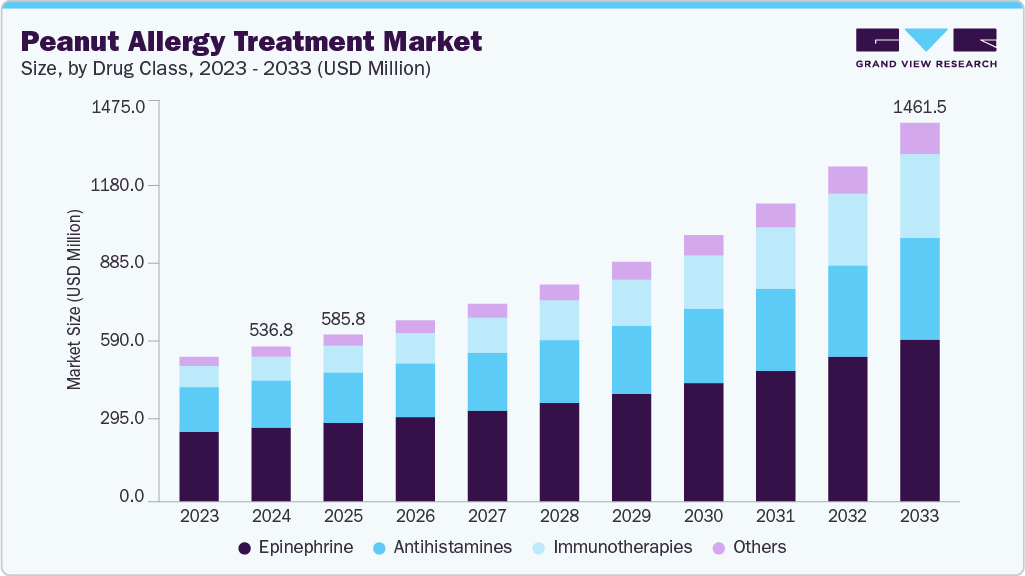

The global peanut allergy treatment market size was estimated at USD 536.8 million in 2024 and is projected to reach USD 1,461.5 million by 2033, growing at a CAGR of 11.43% from 2025 to 2033. This market is witnessing robust expansion, fueled by rising peanut allergy prevalence and innovative therapeutic advancements.

Key Market Trends & Insights

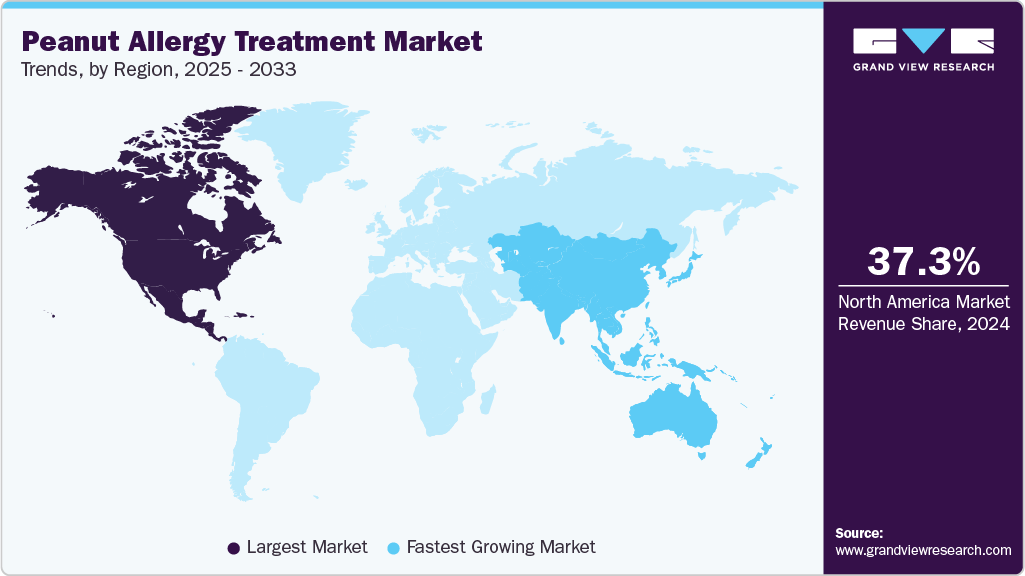

- North America dominated the Peanut Allergy Treatment market with a revenue share of 37.31% in 2024.

- The Asia Pacific region is the fastest-growing market, driven by rising allergy diagnoses and expanding healthcare access.

- By drug class, epinephrine held the largest share in the market with 46.63% in 2024.

- By route of administration, injectable treatment dominated the market in 2024, holding 61.72% share.

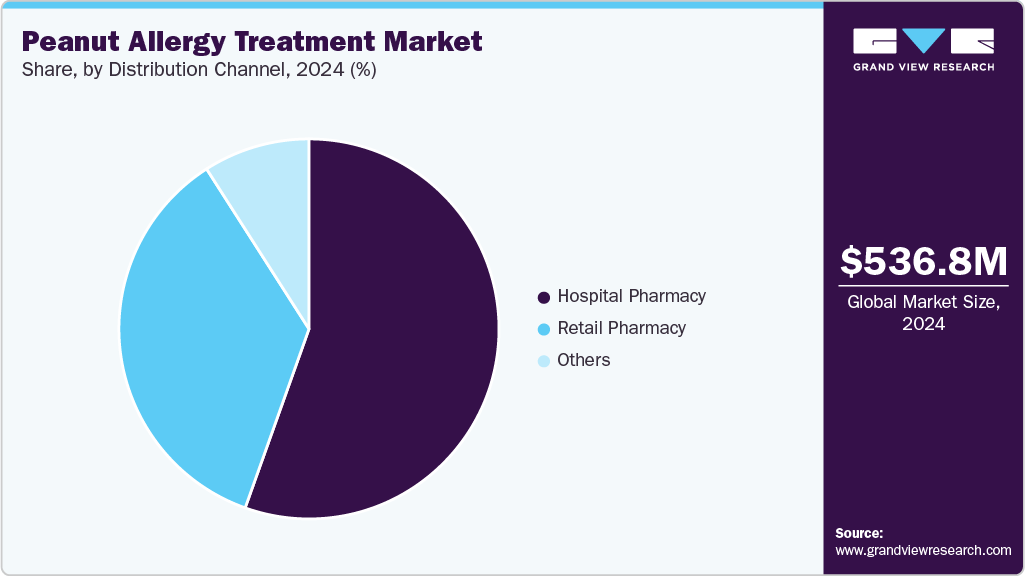

- By distribution channel, hospital pharmacies dominated in 2024 with a 55.46% share.

Market Size & Forecast

- 2024 Market Size: USD 536.8 Million

- 2033 Projected Market Size: USD 1,461.5 Million

- CAGR (2025-2033): 11.43%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Key trends include a shift from allergen avoidance to proactive treatments such as oral immunotherapy and biologics, improving patient quality of life. The market is evolving with regulatory approvals and R&D, focusing on safer, effective solutions. This growth reflects a dynamic industry addressing a critical health need with significant opportunities for innovation.

Palforzia, the first FDA-approved oral immunotherapy for peanut allergies, represents a significant advancement in allergy treatment. Unlike traditional avoidance strategies, Palforzia offers a controlled desensitization approach aimed at reducing the severity of allergic reactions. This innovative therapy has demonstrated improved clinical outcomes and has seen widespread adoption, particularly in North America. By 2024, over 60.0% of eligible pediatric patients in the region will have transitioned to such immunotherapies. The market's growth is further fueled by increasing awareness of food allergies and ongoing advancements in diagnostic technologies, which collectively drive the demand for novel and effective treatment solutions.

Peanut Allergy Treatment Market: Palforzia’s Impact and the Path Forward

Palforzia’s initial success can be attributed to its ability to reduce the severity of allergic reactions through controlled, gradual exposure, marking a significant advancement over the emergency-only use of epinephrine. Approved by the FDA in 2020, Palforzia introduced a structured oral immunotherapy protocol that improved patient adherence, driving early acceptance among healthcare providers and families pursuing long-term allergy management.

However, despite its clinical promise, Palforzia has encountered commercial challenges. Nestlé, which acquired Aimmune Therapeutics for USD 2.6 billion, divested the drug following a disappointing sales performance. While the structured dosing protocol enhances compliance, the need for frequent clinic visits and close monitoring has hindered broader market penetration.

Looking ahead, emerging therapies such as Viaskin Peanut-a non-invasive, patch-based treatment-are poised to reshape the competitive landscape. Offering an alternative for patients concerned about gastrointestinal side effects, Viaskin is gaining attention for its ease of use. With late-stage clinical trials showing favorable outcomes, the product is anticipated to receive regulatory approval, potentially expanding the peanut allergy treatment industry by 15-20% by 2030.

This shift highlights the market’s evolution toward patient-centric, diversified treatment modalities, emphasizing convenience, safety, and sustained efficacy.

Pipeline Analysis

The pipeline for peanut allergy treatments is vibrant, featuring sublingual immunotherapy (SLIT) and biologics such as omalizumab, aimed at improving safety and efficacy. SLIT offers a less invasive option compared to oral immunotherapy, with candidates in Phase II trials showing reduced side effects. Biologics target severe allergies by modulating immune responses, potentially lowering anaphylaxis risks. Novel delivery systems, such as microneedle patches, are also in early development, promising enhanced patient adherence. These innovations cater to a broad spectrum of allergy severities, signaling a shift towards personalized treatment approaches.

DBV Technologies’ Viaskin Peanut, a patch-based immunotherapy, stands out in late-stage trials, offering a non-invasive alternative to Palforzia. Its anticipated approval could expand the market by 20-30% by 2030, driven by its appeal to pediatric patients and those seeking convenience. Combination therapies, pairing biologics with immunotherapy, are also under exploration to boost efficacy and shorten treatment duration. This robust pipeline reflects the industry’s focus on addressing unmet needs and improving the quality of life for allergy sufferers.

Table: Intellectual Property and Market Protection for Peanut Allergy Treatments

Region

Protection Type

Expiry Year

Notes

United States

Orphan Drug Exclusivity

2027

7 years from Palforzia FDA approval (2020)

Europe

Orphan Drug Exclusivity

2030

10 years from EMA approval (2020)

Japan

Patent Protection

2035

20-year term from filing (2015)

United States

Composition of Matter Patent

2031

Covers Palforzia’s formulation (USPTO)

Europe

Formulation Patent

2032

Protects the Viaskin Peanut delivery system

Global

Method of Use Patent

2034

Covers immunotherapy protocols

United States

Biologic Exclusivity

2036

12 years from omalizumab approval (2024)

Canada

Patent Protection

2033

Covers the manufacturing process

Market Concentration & Characteristics

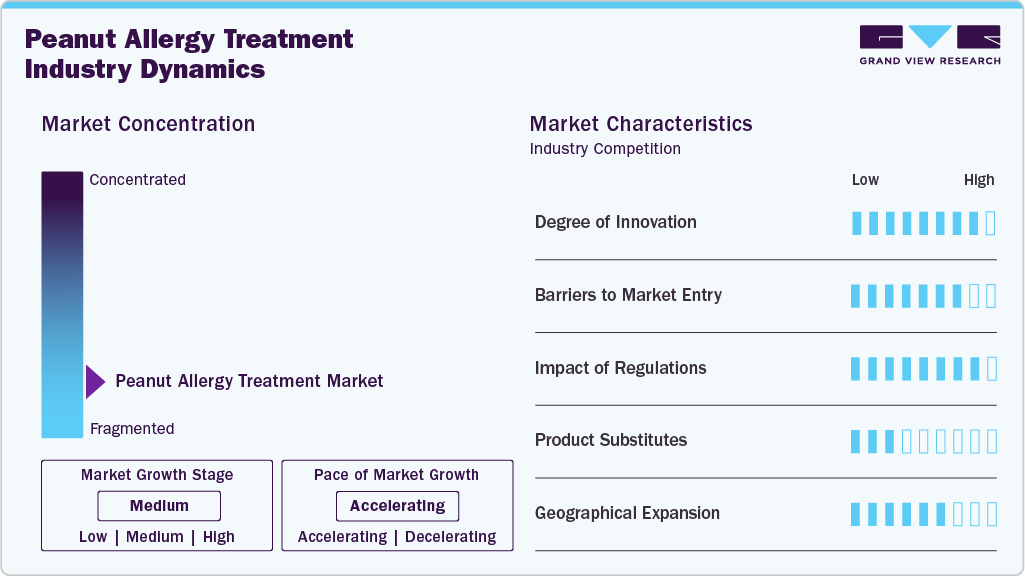

The peanut allergy treatment industry is highly concentrated, with major players like Aimmune Therapeutics and DBV Technologies leading due to high entry barriers. Significant R&D investments, complex clinical trials, and stringent manufacturing requirements deter new competitors, consolidating market power among established firms. These companies drive innovation, focusing on safer, proactive therapies like immunotherapy over traditional emergency treatments, aligning with patient demand for long-term solutions.

Regulatory frameworks, such as FDA and EMA oversight, ensure safety and efficacy but lengthen approval timelines, reinforcing market stability. This concentration fosters a competitive yet innovation-driven environment where firms invest heavily in R&D to maintain leadership. Challenges include managing treatment side effects and ensuring consistent dosing, which requires ongoing refinement of existing products.

Strategic partnerships enhance market dynamics, exemplified by Aimmune’s collaboration with Nestlé Health Science, boosting Palforzia’s global reach and funding. Such alliances enable firms to leverage distribution networks and accelerate product development, critical in a market where technological edge is paramount. These collaborations also facilitate entry into emerging markets, broadening the competitive landscape.

Opportunities for growth lie in expanding indications and geographic reach, particularly in Asia Pacific and Latin America, where allergy awareness is rising. However, high costs and regulatory hurdles could limit penetration in these regions. The market’s concentrated nature thus balances stability with innovation, positioning it for sustained expansion through strategic and technological advancements.

Drug Class Insights

Epinephrine held the largest share in the market with 46.63% in 2024, emphasizing its role as the primary emergency solution for anaphylaxis. Antihistamines are widely used for managing mild reactions, while immunotherapies, including Palforzia, show potential for long-term allergy management. Other emerging treatments, such as biologics, highlight ongoing innovation in the field.

The peanut allergy treatment industry is evolving, with biologics emerging as the fastest-growing segment due to advances in targeted immune response therapies. Increased prevalence of allergies, especially among children, is driving demand for innovative treatments that improve safety and efficacy. Industry players are focused on developing diverse solutions, including oral immunotherapies, peptide-based therapies, and epicutaneous immunotherapy, ensuring better accessibility and patient compliance. Research collaborations and regulatory support are accelerating next-generation treatments, shaping a more effective landscape for allergy management. As biotechnology continues to advance, the market is expected to maintain steady growth, offering improved options for affected individuals.

Route Of Administration Insights

Injectable treatment dominated the market in 2024, holding 61.72% share, primarily due to its rapid effectiveness in emergency situations. Epinephrine injections remain the gold standard for anaphylaxis management, ensuring immediate relief for severe allergic reactions. Oral therapies, including immunotherapy options like Palforzia, reflect the growing adoption of long-term desensitization strategies. While oral treatments are gaining traction, their gradual effect compared to injectables limits their market share.

The market is evolving with oral therapies growing at the fastest rate, driven by advancements in immunotherapy and patient preference for non-invasive options. While injectables remain critical for emergency care, the shift toward preventive treatments is expected to reshape market dynamics in the coming years. Innovative research and new drug developments will likely expand treatment accessibility, offering more tailored solutions for peanut allergy management.

Distribution Channel Insights

Hospital pharmacies dominated in 2024 with a 55.46% share, as they handle initial immunotherapy doses under medical supervision and supply epinephrine for emergencies. Their critical role in specialized allergy care ensures their leadership, supported by integration with healthcare systems for high-risk patient management.

Retail Pharmacies hold the largest share in the market, serving as the primary channel for outpatient needs due to their widespread accessibility and ability to cater to ongoing treatment requirements.

Regional Insights

North America peanut allergy treatment industry dominated globally in 2024, capturing a substantial 37.31% of global revenue share. This leadership is primarily attributed to the United States, which accounted for approximately 85% of the region's market share. The U.S. market is bolstered by advanced healthcare infrastructure, high levels of allergy awareness, and robust regulatory support from agencies like the FDA. The approval and adoption of innovative treatments such as Palforzia have been significant drivers, with over 60% of eligible pediatric patients transitioning to immunotherapy by 2024. Additionally, Canada's growing allergy management programs and Mexico's expanding healthcare access contribute to the region's overall market strength. The North American market is projected to grow at a steady CAGR through 2033, supported by ongoing R&D investments and favorable reimbursement policies.

U.S. Peanut Allergy Treatment Market Trends

The United States peanut allergy treatment industry maintains a dominant position, largely driven by strong regulatory support and widespread immunotherapy adoption. The availability of advanced biologics, coupled with an increasing focus on pediatric allergy management, continues to shape the landscape. Schools and healthcare systems are actively integrating treatment programs, enabling broader accessibility for affected children. Research collaborations and ongoing clinical trials contribute to innovation in therapeutic approaches, strengthening the country’s global leadership in allergy treatment.

Despite substantial market expansion, challenges remain. The high costs associated with biologic therapies create affordability barriers for certain demographics, particularly in rural areas where access to specialized treatment is limited. Insurance coverage and assistance programs play a crucial role in overcoming these hurdles, ensuring sustained demand for existing and emerging therapies. Looking ahead, new product launches and expanded treatment indications will further bolster the market, catering to both pediatric and adult patients and reinforcing the U.S. position as a frontrunner in peanut allergy management.

Europe Peanut Allergy Treatment Market Trends

The Europe peanut allergy treatment industry continues to establish itself as a significant player in the market, benefiting from structured healthcare systems and stringent allergy management guidelines. The region's emphasis on research and development, particularly in biologics, positions it as a key innovator in immunotherapy. Germany peanut allergy treatment industry is leading the region in advancing allergy-related research, fostering new treatment pathways that align with evolving patient needs.

The UK peanut allergy treatment industry is driven by the favorable healthcare policies aimed at improving allergy care accessibility, and has ensured steady demand for therapies. France peanut allergy treatment industry is characterized by the investment in medical infrastructure that further supports market expansion.

A major factor shaping the European market is the increasing focus on personalized medicine. Advances in combination therapies are gaining traction, providing patients with tailored approaches that enhance treatment efficacy. However, disparities in healthcare across various European nations present challenges in achieving uniform market penetration. While larger economies such as Germany and France drive innovation, smaller nations experience slower adoption due to regulatory complexities and reimbursement structures.

Another key trend contributing to market growth is the heightened awareness surrounding pediatric allergy treatment. Healthcare initiatives promoting early intervention have encouraged immunotherapy adoption in children, creating a strong demand for specialized therapies. Government-backed healthcare reforms continue to foster this growth, ensuring comprehensive coverage and expanding treatment availability across different socioeconomic groups.

Looking ahead, Europe is expected to maintain a positive growth trajectory, aided by ongoing investments in research and increasing consumer education. The focus on next-generation biologics and innovative treatment delivery methods will ensure sustained expansion, reinforcing the region’s role in shaping the future of peanut allergy management worldwide.

Asia-Pacific Peanut Allergy Treatment Market Trends

The Asia Pacific peanut allergy treatment industry has emerged as the fastest-growing market in peanut allergy treatment, propelled by several transformative healthcare advancements. A rise in allergy diagnoses, expanding healthcare infrastructure, and heightened consumer awareness collectively drive demand for novel therapeutic interventions. Countries such as Japan stand at the forefront of innovation, pioneering non-invasive treatment modalities that address the unique needs of allergy sufferers, thereby driving the growth of Japan peanut allergy treatment industry.

China’s peanut allergy treatment industry growth is driven by the burgeoning healthcare sector and growing middle-class population, leading to an uptick in demand for advanced immunotherapies. Parallel developments in India’s urban centers showcase increasing treatment adoption as awareness campaigns and rising incomes make allergy management more accessible. Government-backed initiatives, coupled with strategic partnerships with global pharmaceutical firms, continue to introduce next-generation therapies, accelerating the pace of market expansion.

Despite promising growth, Asia Pacific faces certain regulatory challenges that impact the widespread adoption of peanut allergy treatments. Varying healthcare policies and infrastructure gaps create inconsistencies in accessibility, particularly in rural and underserved regions. However, collaborative efforts between local healthcare providers and international firms are working to bridge these gaps, ensuring greater availability of treatment options across diverse populations.

In addition, pediatric allergy management has gained prominence, leading to a surge in specialized therapy development. With Asia Pacific home to a significant pediatric demographic, early intervention programs have become a focal point in market expansion. Growing investments in immunotherapy research indicate a promising future, positioning the region as a central hub for innovation in allergy treatment.

Looking forward, Asia Pacific is expected to sustain its rapid growth momentum, supported by ongoing advancements in technology and increasing healthcare modernization. The integration of non-invasive solutions, combined with enhanced market accessibility, will continue to define the evolving landscape of peanut allergy treatment.

Latin America Peanut Allergy Treatment Market Trends

Latin America’s peanut allergy treatment industry has shown steady progress, largely influenced by improving healthcare frameworks and awareness programs. Brazil has emerged as a key player, implementing modernization strategies that aim to enhance medical accessibility and allergy management. Efforts to educate both physicians and patients on treatment options have led to increased adoption of innovative therapies, helping establish a more structured approach to allergy care.

Economic instability presents a challenge, particularly in countries such as Argentina and Mexico, where affordability remains a limiting factor in treatment accessibility. Government-backed initiatives, including collaborations with international medical organizations, are beginning to alleviate these issues by expanding healthcare infrastructure and fostering new therapy introductions. As efforts continue to drive progress, the market anticipates further expansion, supporting both pediatric and adult allergy sufferers.

Middle East & Africa Peanut Allergy Treatment Market Trends

The Middle East & Africa peanut allergy treatment industry is driven by the ongoing transformation in allergy care, primarily led by Saudi Arabia’s ambitious healthcare reforms. Vision 2033 initiatives focus on improving emergency allergy treatment accessibility, with substantial investments in medical technology and infrastructure. These developments set the stage for enhanced immunotherapy adoption and increased patient education regarding allergy management.

Despite notable growth opportunities, market expansion remains tempered by infrastructure limitations and cost barriers, particularly in emerging markets such as South Africa and the UAE. However, increasing medical tourism and strategic healthcare investments are gradually overcoming these hurdles, ensuring broader access to treatment options. As awareness initiatives gain traction, the region is poised for steady growth, reinforcing its role in shaping the evolving landscape of peanut allergy treatment.

Key Peanut Allergy Treatment Company Insights

Aimmune Therapeutics leads with Palforzia, leveraging Nestlé’s resources for global expansion and R&D. DBV Technologies advances Viaskin Peanut, focusing on non-invasive delivery to capture market share. Sanofi dominates emergency treatment with epinephrine auto-injectors, emphasizing distribution strength. ALK-Abelló explores sublingual options, targeting niche growth. These firms drive innovation and competition through strategic partnerships and pipeline investments.

Key Peanut Allergy Treatment Companies:

The following are the leading companies in the peanut allergy treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Aimmune Therapeutics (Nestlé Health Science)

- DBV Technologies

- Sanofi

- ALK-Abelló

- Prota Therapeutics

- Camallergy

- Aravax

- Genentech

Recent Developments

-

In January 2024, DBV Technologies announced delays in FDA approval for Viaskin Peanut, a non-invasive patch-based immunotherapy designed to gradually desensitize patients to peanut allergens. Originally expected in 2024, the approval process was extended as the company conducts additional safety studies, with a revised submission planned for 2026.

-

In March 2024, Aimmune Therapeutics expanded Palforzia's availability in select markets, though its Japan launch remains unverified. Palforzia remains the only FDA-approved oral immunotherapy for peanut allergy, helping patients build tolerance through controlled exposure to peanut protein. While expansion in Asia-Pacific is anticipated, no official confirmation of its entry into Japan has been provided.

-

In October 2024, Regeneron continued research into peanut allergy treatments, focusing on Dupilumab rather than developing a new biologic. Clinical studies have demonstrated Dupilumab's potential to reduce allergic reactions in peanut-sensitive individuals. While Regeneron remains engaged in immunotherapy advancements, no new biologic targeting peanut allergies was announced.

-

In December 2024, Aravax progressed with Phase II clinical trials for PVX108, but reports of EMA fast-tracking its approval were unverified. PVX108, a peptide-based immunotherapy, is designed to modify immune responses to peanut allergens without requiring direct exposure. Regulatory discussions continue, with trial results expected by 2026.

Peanut Allergy Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 585.8 million

Revenue forecast in 2033

USD 1,461.5 million

Growth rate

CAGR of 11.43% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, route of administration, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aimmune Therapeutics (Nestlé Health Science); DBV Technologies; Sanofi; ALK-Abelló; Prota Therapeutics; Camallergy; Aravax; Genentech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peanut Allergy Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global peanut allergy treatment market report based on drug class, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Antihistamines

-

Epinephrine

-

Immunotherapies

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.