- Home

- »

- Digital Media

- »

-

Pay TV Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Pay TV Market Size, Share & Trends Report]()

Pay TV Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Cable TV, Satellite TV, IPTV), By Application (Residential, Commercial), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-538-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pay TV Market Summary

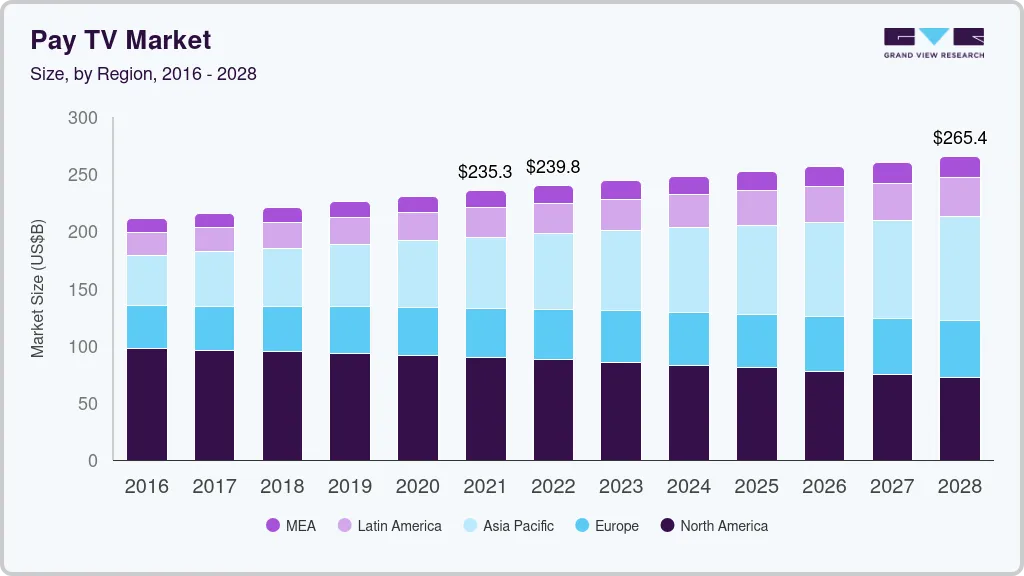

The global pay TV market size was estimated at USD 235,293.4 million in 2021 and is projected to reach USD 265,436.1 million by 2028, growing at a CAGR of 1.7% from 2022 to 2028. The emerging demand amongst consumers to leverage better quality content with high picture resolution offers promising growth opportunities to the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, the U.S. is expected to register the highest CAGR from 2022 to 2028.

- In terms of technology, cable TV accounted for a leading revenue share of 36.9% in the global market.

- Internet Protocol Television(IPTV) is the most lucrative technology segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 235,293.4 Million

- 2028 Projected Market Size: USD 265,436.1 Million

- CAGR (2022-2028): 1.7%

- North America: Largest market in 2021

One of the primary growth drivers of the market is the ability to access high-quality content from different service providers on a single platform at affordable prices. Moreover, pay TV service providers now offer several value-added services such as customizable channel subscriptions, reduced subscription rates, internet connectivity, and bundled packages according to the users’ needs and demands, thus offering profit generation opportunities to service providers.

The increasing popularity of live sports events such as soccer, football, basketball, and tennis has compelled viewers to subscribe to Pay TV services, with companies offering different channel packs to select from. Subscribers can easily access a variety of channels encompassing different genres including sports, movies, TV shows, news, and regional content. Service providers such as DISH and DIRECTV rely on monthly subscriptions availed by consumers and thus, focus on providing content that can justify service costs and ensure customer retention while also attracting new ones. The service providers are increasingly offering various value-added services, such as bundled packages as per viewer requirements and internet connectivity at competitive prices to achieve subscriber growth.

The global cord-cutting trend has led to consumers moving away from conventional cable subscriptions toward streaming alternatives, compelling market players to adapt their strategies that can help them retain customers and stay competitive. The high popularity of OTT (over-the-top) services has led providers to form partnerships with these platforms that have aided them in expanding their content library and attracting a wider audience. The integration of OTT services enables viewers to access different types of content via a single interface, improving their viewing experience. In September 2024, ZTE Corporation announced its collaboration with Netgem, a France-based provider of Pay TV OTT services, to develop a comprehensive and innovative Pay TV OTT ecosystem. As per the agreement, ZTE will provide a range of high-performance multimedia terminal products including dongles, set-top-boxes (STBs), and TV sticks having an open operating system. These solutions have been pre-installed with popular streaming platforms such as Disney+, Netflix, and Amazon Prime Video, meeting consumer demand for content variety and high-quality video playback.

Pay TV offers several notable benefits that have sustained its presence in global markets, particularly in emerging economies. For instance, viewers can subscribe to premium networks that offer exclusive content while also availing of services such as DVR that enable them to record live shows and watch the recorded shows at their convenience. Additionally, since this service does not depend on the Internet, consumers can have a consistent and reliable viewing experience without any buffering issues that are generally encountered during streaming. This has made Pay TV a preferred choice in rural areas with poor internet connectivity. Broadcasters have become aware of the benefits of ultra-high-definition (UHD) services and the importance of offering options to download programs or TV shows to gain a competitive advantage. Service providers have developed smartphone applications that can help subscribers manage their accounts, select different channel packages, and view programming content. This has helped ensure convenience for subscribers and aided market expansion.

Technology Insights

Cable TV accounted for a leading revenue share of 36.9% in the global pay TV market in 2024 due to steady demand among customers to have access to unbundled packages. Additionally, easy access to live sports continues to be a significant driver for this segment. Many viewers prefer the reliability of cable for watching major sports events, thus offering a strong selling point for providers. However, the popularity of this technology has declined consistently in recent years, particularly in developed and emerging economies, where technological advancements and improving Internet infrastructure have led to the proliferation of the 'cord-cutting' concept. Research published by Leichtman in 2023 highlighted that cable TV providers in the U.S. saw a loss of 3.8 million subscribers in 2023, with this number standing at 3.5 million in 2022. These numbers reflect a global trend that is expected to ensure a slow pace of growth for this segment.

The satellite TV segment held a substantial revenue share in the global market in 2024. Satellite providers are increasingly offering extensive channel packages, including premium channels and international programming, while also providing live broadcasting of sports and major events. Satellite TV providers have a niche presence, particularly in areas that lack other viewing options. As a result, they have started offering hybrid services with streaming capabilities to remain competitive. For instance, in October 2024, DIRECTV announced the imminent launch of the 'MyFree DIRECTV' free ad-supported streaming TV (FAST) platform. The service would initially offer viewers seamless access to curated content and an extensive On-Demand library, with additional channels scheduled to join the platform from 2025 onwards. It will be accessible online via mobile, as well as on select smart TVs and streaming devices across the U.S.

Meanwhile, the IPTV segment is expected to advance at the fastest CAGR during the forecast period. This can be attributed to the current technological advancements in the market, coupled with a healthy surge in the number of IPTV subscribers owing to its convenience. The demand is witnessing a steady growth due to the rapid shift of consumers towards streaming, with IPTV offering a suitable alternative due to its on-demand and live-streaming capabilities. Additionally, IPTV allows users to watch content on various devices, including smart TVs, tablets, and smartphones, anytime and anywhere. Several IPTV platforms allow users to personalize their viewing experience, including creating custom channel lists and selecting content categories. Promising trends such as 5G integration that can bring AR and VR experiences to viewers, as well as content recommendations via artificial intelligence (AI) by understanding user preferences, are expected to drive expansion. In September 2024, SK Broadband announced that it had upgraded its IPTV service's voice command function through the integration of the 'A dot' generative AI model developed by its parent company, SK Telecom. This allow customers to engage in seamless conversations and obtain more reliable content recommendations, boosting their viewing experience.

Application Insights

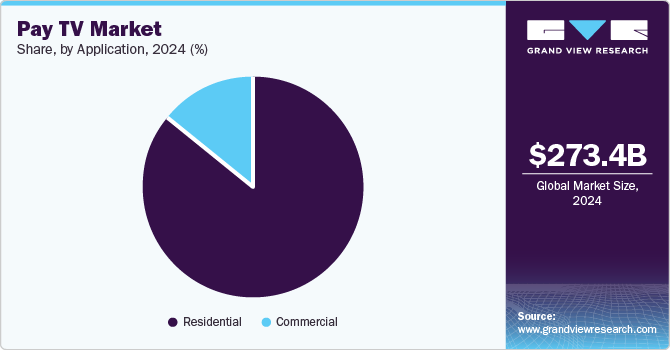

The residential segment accounted for a dominant revenue share in the global market in 2024, aided by the increasing adoption of Pay TV services in developing economies. Consumers are demanding the availability of programs and channels in high resolution from service providers, as well as the provision of accessible menus and commands to improve their viewing experience. Furthermore, Pay TV generally includes channels and programming that are suitable for all age groups, making it a preferred choice for family households. With continued technological evolution, pay TV providers are integrating streaming capabilities and enhancing their offerings to retain customers. However, as residential consumers shift toward other alternatives, such as streaming, the segment growth is expected to remain moderate over the coming years.

The commercial segment is anticipated to advance at the fastest CAGR from 2025 to 2030. Restaurants and hotels, among other businesses, are constantly looking to offer quality entertainment options to their guests, leading to a substantial demand for Pay TV services. The trend of broadcasting live sports events such as football, soccer, cricket, and basketball in pubs has grown significantly, as it ensures constant traffic of sports enthusiasts, patrons, and younger demographics in such establishments. Additionally, the use of Pay TV services can ensure that businesses are able to create special promotions around sporting events or popular shows, encouraging customers to spend more on food, drinks, and merchandise during the broadcast. Commercial spaces must ensure that they comply with licensing requirements for broadcasting pay TV, which generally differs from residential usage. Moreover, the commercial spaces may need specialized equipment and installation services to support multiple screens and ensure premium viewing experience.

Regional Insights

North America accounted for a leading revenue share of 31.6% in the global pay TV market in 2024. The high adoption rate of television and the internet contributes to this region's strong share. Additionally, the presence of several key players in the region, such as Charter Communications, DIRECTV, and Cox Communications, has created a competitive environment that has driven innovations in the industry. Increasing focus on the adoption of Integrated Broadband-Broadcast (IBB) systems among regional pay TV service providers is another factor anticipated to aid the growth of the pay TV market over the coming years.

U.S. Pay TV Market Trends

The U.S. pay TV market accounted for a dominant revenue share in the regional market in 2024. Technological developments, increasing competition from streaming platforms, and evolving customer viewing demands have shaped the pay TV industry in the country. Television sets are present across most American households, while there is a growing consumer base with multiple TVs in their households. The number of pay TV subscribers remains high in the country; however, the emergence of OTT services and the ease of viewing content on smartphones is anticipated to restrict market growth in the coming years. As a result, service providers are introducing value-added services at competitive prices to boost subscriber numbers.

Europe Pay TV Market Trends

The European pay TV market accounts for a substantial revenue share globally, with millions of subscribers utilizing various platforms, including cable, satellite, and IPTV services. The market has witnessed growth in some economies, while others have experienced fluctuations in recent years. The widespread presence of OTT platforms such as Netflix, Amazon Prime Video, and Disney+ is reshaping consumer behavior, leading to increased competition for traditional pay TV providers. As per a report by Digital TV Research, Western Europe is projected to lose around 9 million subscribers between 2023 and 2029, indicating a shift towards OTT services. As a result, pay TV operators in the region are increasingly integrating streaming services into their offerings, providing customers with access to both live TV and on-demand content.

Asia Pacific Pay TV Market Trends

The Asia Pacific region is anticipated to advance at the fastest CAGR from 2025 to 2030. A constantly rising demand for HD-resolution video content, particularly in fast-growing economies such as Japan, China, and India, is anticipated to drive steady regional market expansion. For instance, The Asia Video Industry Report 2024 stated that the number of overall regional pay TV subscribers stood at approximately 798 million in 2023, with India and China accounting for a majority of the total pay TV households. The growing popularity and demand for Internet Protocol TV (IPTV) services due to the increased pace of digitalization has created potential growth avenues for the regional market over the coming years.

India is expected to account for a significant revenue share in the regional market in the coming years. Growing sales of television sets in rural regions, along with the presence of a highly competitive market defined by companies such as TATA Play, DISH, and Videocon, have enabled steady market expansion in the country. However, this growth is anticipated to be restricted in the future as cheaper alternatives and streaming services become more popular. The revenue losses experienced by the Pay TV industry are expected to be compensated for a moderate growth in TV advertising.

Key Pay TV Company Insights

Some of the major companies involved in the global pay TV market include DIRECTV, Foxtel, and Comcast, among others.

-

DIRECTV is a leading provider of digital television entertainment services in the U.S. The company has become a prominent player in the pay TV market, offering satellite television services and a variety of programming options. DIRECTV provides a wide range of satellite TV packages, including local and national channels, premium networks, and specialty channels. Its Genie DVR system allows users to record multiple shows simultaneously and store hundreds of hours of programming.

-

Foxtel is a major Australian subscription television provider known for delivering a wide range of entertainment, sports, and news programming. The company is a joint venture between News Corp Australia and Telstra Corporation and offers Pay TV services, streaming services such as Kayo Sports and Binge, and on-demand content.

Key Pay TV Companies:

The following are the leading companies in the pay TV market. These companies collectively hold the largest market share and dictate industry trends.

- DIRECTV, LLC

- DISH Network L.L.C.

- Foxtel

- Comcast

- Fetch TV Pty Limited

- Rostelecom PJSC

- Charter Communications

- Tata Play

- d2h

- Cox Communications, Inc.

Recent Developments

- In September 2024, DIRECTV and The Walt Disney Company announced an agreement that has led to the latter's full linear suite of networks being restored to customers of DIRECTV, DIRECTV STREAM, and U-verse. This will allow DIRECTV to broadcast Disney’s sports, entertainment, and news programming from its extensive portfolio, which includes ESPN networks, ABC-owned Television Stations, Disney-branded channels, FX networks, and National Geographic channels. Moreover, Disney's direct-to-consumer streaming services, including Disney+, Hulu, and ESPN+, would also be included in select DIRECTV packages.

Pay TV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 284.23 billion

Revenue forecast in 2030

USD 336.75 billion

Growth rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

DIRECTV, LLC; DISH Network L.L.C.; Foxtel; Comcast; Fetch TV Pty Limited; Rostelecom PJSC; Charter Communications; Tata Play; d2h; Cox Communications, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pay TV Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pay TV market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cable TV

-

Satellite TV

-

IPTV

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.