- Home

- »

- Electronic & Electrical

- »

-

Paper Shredder Market Size & Share, Industry Report, 2030GVR Report cover

![Paper Shredder Market Size, Share & Trends Report]()

Paper Shredder Market (2024 - 2030) Size, Share & Trends Analysis Report By Bin Capacity, By Type (Strip-cut, Cross-cut, Micro-cut), By Application, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-365-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Paper Shredder Market Summary

The global paper shredder market size was estimated at USD 2.10 billion in 2023 and is projected to reach USD 3.68 billion by 2030, growing at a CAGR of 8.4% from 2024 to 2030. Stringent data protection norms, increased efforts toward sustainable waste management, and innovations in shredder machines have led to market growth.

Key Market Trends & Insights

- North America dominated the global paper shredder market with the largest revenue share of 40% in 2023.

- By type, the cross-cut paper shredders segment led the market, holding the largest revenue share in 2023.

- By bin capacity, the 20 to 71-liter capacity segment held the dominant position in the market and accounted for the leading revenue share in 2023.

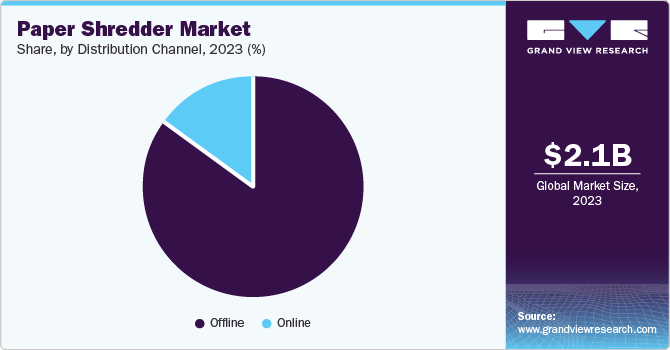

- By distribution channel, the online channels segment is expected to grow at the fastest CAGR from 2024 to 2030.

- By application, the residential segment is expected to grow at a significant CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 2.31 Billion

- 2030 Projected Market Size: USD 3.68 Billion

- CAGR (2024-2030): 24.3%

- North America: Largest market in 2023

These machines are used across enterprises to shred used papers before moving them into waste. This practice ensures that confidential data is destroyed and no sensitive information about stakeholders is leaked. The increasing prevalence of data protection regulations, such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), has compelled organizations to opt for secure document disposal methods. As more countries adopt these regulations, the market is anticipated to witness high growth during the forecast period.

Major facilities such as banking and finance, healthcare, and government offices contain a substantial amount of sensitive data about their customers, patients, partners, and related stakeholders. Leakage of this data may cause substantial damage to the reputation and credit of such organizations. This vulnerability compels them to implement robust document destruction protocols. Additionally, growing environmental concerns and efforts toward sustainable practices have encouraged organizations to adopt paper shredders for responsible waste management. Paper shredders facilitate paper recycling, contributing to resource conservation and reducing the environmental impact of paper waste.

Continuous advancements in shredder technology and innovations in cutting sizes, such as cross-cut and micro-cut, have substantially expanded the market by offering enhanced security and efficiency. The emergence of smart shredders with features such as automatic feed and energy-saving modes has broadened the appeal of paper shredders to a wider audience. As organizations are transitioning from offline document databases toward cloud-based data storage, older documents need to be shredded securely. These factors are expected to generate a steady demand for paper shredders during the forecast period.

Bin Capacity Insights

The 20 to 71-liter capacity segment led the market with a revenue share of 35.0% in 2023. This is owing to the optimum combination of capacity and functionality offered by paper shredders in this segment. Shredding machines of this capacity address the requirements of most organizations and office spaces. For instance, smaller office spaces may opt for a lighter machine with a capacity of around 20 to 30 liters, whereas offices dealing with large amounts of documents may choose a higher bin capacity in the range of 40 to 50 liters. Such flexibility of options accounts for market dominance of this segment.

The 71 to 135-liter segment is expected to witness the fastest CAGR over the forecast period. This is attributed to a substantial growth in the number of documents generated across organizations. For instance, government offices usually generate large amounts of data owing to changing demographic patterns. This steady rise in the volume of documents requires equally efficient shredding mechanisms to deal with sensitive data. Additionally, manufacturers are incorporating innovative shredding mechanisms in their products and focusing on sustainability concepts to cater to customer requirements. These factors are expected to lead to a heightened demand for large-capacity paper shredders.

Type Insights

Cross-cut paper shredders accounted for the largest market revenue share in 2023. This is owing to the enhanced security and shredding speed offered by such shredders. For instance, cross-cut shredders offer better security than strip-cut shredders and better shredding speeds than micro-cut shredders. Additionally, cross-cut shredders are suitable for various paper types and volumes, catering to the diverse needs of both residential and commercial users. These factors lead to market dominance of this segment.

Meanwhile, the micro-cut segment is expected to witness the fastest CAGR from 2024 to 2030. Rising prevalence of data breaches and stringent data privacy regulations have amplified the demand for advanced security measures. Micro-cut shredders produce virtually unreadable paper particles and offer a high level of protection against information leakage. Sectors such as finance, defense, healthcare, and government regularly handle highly confidential information. Consequently, they have adopted micro-cut shredders as a necessary tool to comply with regulatory mandates and safeguard sensitive data. As concerns for data privacy rise, micro-cut shredders are expected to witness strong adoption in the coming years.

Application Insights

Commercial applications segment held a highest market revenue share of the market in 2023. Commercial organizations such as banking and finance, e-commerce, hospitals & healthcare, and government offices generate substantial volumes of paper documents, requiring efficient and reliable shredding solutions to manage the workflow effectively. Furthermore, paper shredders are essential for maintaining business continuity and mitigating risks associated with data breaches, making them a priority investment for commercial enterprises. These factors compel the commercial sector to adopt advanced paper shredding solutions, leading to market domination of this segment.

Residential applications segment is projected to capture a significant CAGR during the forecast period. The adoption of remote work practices has led to a rise in home-based offices. This has created a steady demand for paper shredders to manage personal and professional documents securely. Moreover, the proliferation of online shopping has resulted in a surge of paper-based documents, such as shipping labels, invoices, and return slips, requiring secure disposal through shredding. As individuals are becoming increasingly conscious about the protection of their personal data, steady demand growth for these appliances is expected through this segment.

Distribution Channel Insights

Offline distribution channels segment accounted for the largest revenue share of the paper shredder market in 2023. A well-established network of physical retail outlets such as electronics stores, office supply stores, and departmental stores has ensured a widespread availability of paper shredders. Such an extensive distribution network facilitates easy access to these appliances for consumers. Additionally, commercial sectors place bulk orders for paper shredders to their regular offline stationary suppliers. These factors account for segment dominance in the global market.

Online channels are expected to witness the fastest CAGR during the forecast period. This is owing to a widespread proliferation of e-commerce platforms across global economies. These platforms provide a variety of paper shredding solutions, catering to the requirements of both commercial and residential customers. Additionally, secure and faster payment options and improved logistics networks have developed a sense of trust in online channels among customers. The combined effect of these factors has led to a high anticipated demand through this distribution mode.

Regional Insights

North America held the highest revenue share of 37.0% in the global market in 2023. This is owing to the prevalence of stringent data protection laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada and CCPA in the U.S. These laws compel commercial organizations to follow safer data storage and disclosure practices. Furthermore, increasing consumer awareness regarding data security has led to heightened demand for paper shredders in the region to responsibly and securely dispose of confidential documents.

U.S. Paper Shredder Market Trends

The U.S. dominated the regional market with a significant revenue share in 2023. The country is home to several multinational organizations having operations across critical industries such as IT services, banking and finance, defense, and manufacturing. These organizations handle substantial amounts of sensitive data of their partners, customers, governments, and other stakeholders. As a result, secure and efficient disposal of unwanted data becomes extremely crucial to maintain confidentiality. This creates a high growth potential for the U.S. market.

Europe Paper Shredder Market Trends

Europe accounted for a notable market share in 2023. European economies such as Germany, France, and the UK adhere to strict data privacy regulations. These laws require organizations in the region to comply with safe paper disposal practices. Additionally, environmental concerns about waste paper disposal compel regional enterprises to efficiently manage recycling procedures. These factors lead to an increasing demand for energy-efficient paper shredding machines in Europe.

The UK held a considerable share of the European paper shredder market. The country has a strict waste disposal and recycling framework, which mandates the use of environment-friendly paper waste disposal. Shredding machines cut paper documents into fine pieces, which can be utilized for recycling purposes without having any data leakage concerns. This has compelled local organizations to increasingly adopt paper shredding solutions in their facilities.

Asia Pacific Paper Shredder Market Trends

Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030. The region has experienced robust economic growth, leading to increased business activities and document generation. This surge in paper-based documentation has consequently driven demand for paper shredders to manage information securely. Furthermore, a growing culture of small and medium enterprises has led to increased spending on office equipment, such as paper shredders to support home office setups. As these organizations grow their operational volumes, a proportionate increase in demand for paper shredders is anticipated over the forecast period.

India is expected to capture a significant CAGR of the regional market during the forecast period. A substantial growth in industrialization and commercialization activities has led to the establishment of major businesses in India across sectors such as defense, finance, and healthcare, which puts a greater emphasis on responsible management of data. The implementation of stringent data protection regulations in the country has highlighted the importance of secure document disposal. Paper shredders have emerged as a critical tool for compliance with these mandates. Moreover, a heightened awareness of environmental sustainability has stimulated the demand for paper shredders as a means of recycling paper waste and contributing to eco-friendly practices.

Key Paper Shredder Company Insights

Some key companies involved in the paper shredder market include Dahle North America, Inc., ELCOMAN Srl, and ACCO Brands, among others.

-

Dahle North America, Inc. is a U.S.-based company offering various office-related stationery such as cutting mats, sharpeners, shredders, and trimmers. The company offers a wide range of oil-free shredding machines. These shredders are equipped with CleanTEC dust filtration for a cleaner shredding process. Dahle offers auto-feed shredders under its brand ShredMATIC and compact deskside shredders under the brand PaperSAFE. Dahle also provides shredder related accessories such as oil, bags, and CleanTEC filters for maintaining optimum performance of these shredders.

-

ELCOMAN Srl is an Italy-based manufacturer of document and media shredders operating in over 90 countries worldwide. The company offers its shredders under the brand name KOBRA in a variety of functions and capacities. For instance, Hybrid Line KOBRA shredders come with a sheet capacity ranging from up to 9 sheets to up to 28 sheets. Classic Line shredders come with an oil-free operation and automatic feed. The company also offers high-security P-7 shredders for enhanced data security.

Key Paper Shredder Companies:

The following are the leading companies in the paper shredder market. These companies collectively hold the largest market share and dictate industry trends.- Intimus Shredders

- Fellowes Brands

- ACCO Brands

- HSM GmbH + Co. KG

- Krug & Priester GmbH & Co. KG

- ELCOMAN Srl

- Dahle North America, Inc.

- Martin Yale Industries

- ERYUN Co., Ltd.

- SASCO (Shredders & Shredding Company)

Recent Developments

-

In June 2023, Fellowes announced the expansion of the company’s Powershred 400 Series paper shredder line with the addition of the Powershred 425HS. The new addition is a first-of-its-kind P7 high-security paper shredder that is compliant with Trade Agreement Act (TAA) and Buy American Act (BAA) standards. The company has also expanded its manufacturing capabilities at its Itasca facility in Illinois to increase the production of U.S.-manufactured, business-specific machines.

Paper Shredder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.27 billion

Revenue Forecast in 2030

USD 3.68 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Bin capacity, type, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, Singapore, India, Brazil, South Africa

Key companies profiled

Intimus Shredders; Fellowes Brands; ACCO Brands; HSM GmbH + Co. KG; Krug & Priester GmbH & Co. KG; ELCOMAN Srl; Dahle North America, Inc.; Martin Yale Industries; ERYUN Co., Ltd.; SASCO (Shredders & Shredding Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paper Shredder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paper shredder market report based on bin capacity, type, application, distribution channel, and region.

-

Bin Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Above 135 Liters

-

71 to 135 Liters

-

20 to 71 Liters

-

Upto 20 Liters

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Strip-cut

-

Cross-cut

-

Micro-cut

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.