- Home

- »

- Plastics, Polymers & Resins

- »

-

Paint Packaging Market Size, Share, Industry Report, 2030GVR Report cover

![Paint Packaging Market Size, Share & Trends Report]()

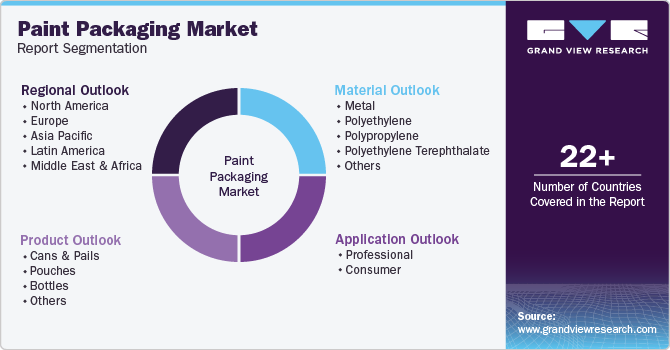

Paint Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Metal, Polyethylene, Polypropylene), By Product (Cans & Pails, Pouches), By Application (Professional, Consumer), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-811-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Paint Packaging Market Summary

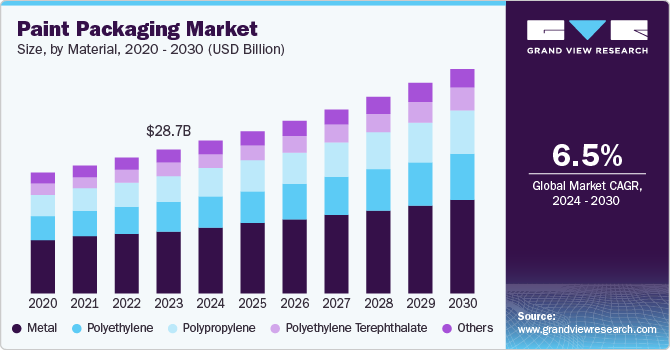

The global paint packaging market size was estimated at USD 28.7 billion in 2023 and is projected to reach USD 44.5 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The market is driven by the increasing spending on construction and infrastructure and a rising consumption of exterior paints.

Key Market Trends & Insights

- The Asia Pacific dominated with a market share of 53.9% in 2023.

- The U.S. paint packaging market is expected to grow rapidly due to the presence of major automobile companies and rapid growth in the construction sector.

- Based on material, the metal segment dominated the market in 2023 with a share of 44.2%.

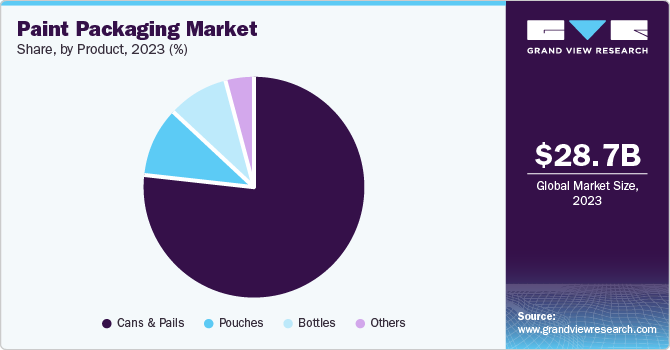

- Based on product, the cans and pails segment dominated the market in 2023 with a share of 77.0% due to the rising popularity of aerosol metal cans.

- Based on application, the professional segment dominated the market in 2023 with a share of 91.5% due to the rising demand for paint in the construction sector.

Market Size & Forecast

- 2023 Market Size: USD 28.7 Billion

- 2030 Projected Market USD 44.5 Billion

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

The market has been witnessing a soaring demand for exterior paint applications. Exterior paints protect the exterior surfaces of buildings from harsh weather conditions. While they are widely employed for exterior walls, packaging paints are also gaining popularity as waterproofing agents. The availability of a wide spectrum of exterior paints has driven the demand for these products to enhance the aesthetic appeal of buildings. Such factors have necessitated the large-scale application of packaging products across the globe.

Increasing construction activities in various industries positively influences paint consumption. Rapid urbanization and rising consumer living standards have shaped market trends in recent years. An increase in R&D spending is positively influencing global market growth. The global demand for paints and related products is increasing due to the development of water-based, chemical-free, and low-odor paints. Developing modern painting equipment, such as spray painting and rolling brushes has reduced the need for technical constraints for repainting.

The increasing demand for personalized products is a crucial factor influencing market expansion. Market players emphasize custom products due to rising competition and the dominance of established players in the market. Customizing these items includes size, shape, materials in the design, and coatings for specific products inside the cans. Hence, these factors are responsible for the growth of the paint packaging market in the forecast period.

Material Insights

The metal segment dominated the market in 2023 with a share of 44.2%. Increased demand for aerosol cans has significantly contributed to the segment growth. Metal containers made from steel and aluminum provide durability and resistance against punctures and scratches. This helps with the safety of the paint during transportation and usage. The environment-friendly approach by manufacturing businesses has resulted in the recycling of materials for further reuse. The containers can be manufactured in any shape and size required. Therefore, these factors account for segment growth in the forecast period.

The polypropylene segment is expected to grow at a CAGR of 7.6% during the forecast period. The market growth is attributed to the rise in polypropylene containers as they are lightweight and offer protection against various chemicals. Polypropylene containers resist alkalis and solvents in the paint products. The barrier properties and versatility of polypropylene also promote their demand as containers are manufactured in several formats such as cans, pails, and bottles.

Product Insights

The cans and pails segment dominated the market in 2023 with a share of 77.0% due to the rising popularity of aerosol metal cans. Increased consumption of spray paints has necessitated large-scale consumption of cans across the globe. One of the key factors driving the demand for cans & pails is the increasing popularity of lightweight packaging. Metal cans and plastic cans are preferred for their unique benefits in the industry. Cans and pails effectively protect against moisture, oxygen, and other factors that result in paint degradation. The shape of cans offers effective storage and is stacked easily. In addition, metal cans can be recycled hence packaging companies are adopting metal cans and pails to promote sustainability.

The pouches segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. The growth is due to the rising popularity of stand-up pouches. The abundant availability of polymeric raw materials has significantly contributed. Polyethylene is the preferred material for production of pouches. From a logistics standpoint, easy and safe transportability drives the demand for polyethylene thereby positively influencing the growth of packaging pouches manufactured using this material.

Application Insights

The professional segment dominated the market in 2023 with a share of 91.5% due to the rising demand for paint in the construction sector. Painters require large quantities of paints in bulk packaging. The paint used by professional painters often needs robust packaging to withstand harsh conditions on the site. The packaging also helps in easy storage and dispensing. Major paint companies launch products with features such as lids that can be resealed, ergonomic handles, and proper labeling. Hence, these factors are attributed to the segment growth.

The consumer segment is expected to grow at a CAGR of 7.7% during the forecast period. The rising availability of user-friendly paint products and market trends have resulted in segment growth. Companies manufacture paints with convenient packaging to improve the manageability of the painting products. The rise in preference for customized home décor has increased paint demand.

Regional Insights

Asia Pacific dominated with a market share of 53.9% in 2023. The robust growth of the construction industry, most notably in China and India, contributes to the regional market's growth. Increased consumption of industrial and architectural paints in the countries has bolstered the market growth in the region. Urbanization has led to increased focus on the appearance of homes. Furthermore, government investments to improve infrastructure have also helped in market growth.

China Paint Packaging Market Trends

China held a substantial market share in the Asia Pacific paint packaging market. The rise in infrastructure development due to rapid urbanization has led to market growth. The presence of a developed manufacturing sector has led to increased demand for industrial coatings and paints. Rising disposable income has increased spending on home renovation and decoration. Hence, these factors are accountable for the market growth.

Europe Paint Packaging Market Trends

Europe held a significant market share in 2023 due to the growing construction sector. The consumers in the region focus more on sustainability driving the demand for paint packaging manufactured from reusable and recyclable materials. The rising disposable income drives demand in the paint packaging industry which has further helped market growth.

The Germany paint packaging market is expected to grow rapidly due to the rising demand for sustainable paint packaging in industries such as construction and automobiles. Germany has a robust automobile industry and incurs a huge demand for paints and coatings for automobiles.

North America Paint Packaging Market Trends

North America paint packaging market was identified as a lucrative region in this industry in 2023. Rapid urbanization, growth in construction activities, and the rising demand for high-quality paints in the construction, automobile, and manufacturing industries further encourage market growth.

The U.S. paint packaging market is expected to grow rapidly due to the presence of major automobile companies and rapid growth in the construction sector. Rising population and disposable income have led to increased demand for vehicles and homes, which has increased the demand for paints and coatings required for residential needs and vehicle parts.

Key Paint Packaging Company Insights

Some major companies in the paint packaging market are Amcor plc, Mondi, Ball Corporation, Crown, Smurfit Kappa, and more.

-

Amcor plc offers packaging solutions and provides high-quality packaging solutions for several industries. The company emphasizes eco-friendly and sustainable packaging solutions to cater to the broad array of products from diverse industries.

-

Kian Joo Can Factory specializes in producing and distributing metal cans in Malaysia. It offers packaging solutions for industries such as food and beverages, paints, chemicals, and confectioneries.

Key Paint Packaging Companies:

The following are the leading companies in the paint packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Ball Corporation

- Crown

- RPC Superfos

- BWAY Corporation

- Kian Joo Can Factory

- Greif

- Moldtek Packaging Ltd.

- CL Smith

Recent Developments

-

In October 2023, Amcor plc announced a partnership with SK Geo Centric in which SK Geo Centric agreed to provide recycled packaging material to Amcor. The supply is scheduled to occur in the Asia Pacific region starting from 2025. The partnership empowers Amcor to fulfill its target of 30% recycled content in its portfolio by 2030.

Paint Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.4 billion

Revenue forecast in 2030

USD 44.5 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; Ball Corporation; Crown; RPC Superfos; BWAY Corporation; Kian Joo Can Factory; Greif; Moldtek Packaging Ltd.; CL Smith

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paint Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paint packaging market report based on material, product, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cans & pails

-

Pouches

-

Bottles

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Consumer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.