- Home

- »

- Next Generation Technologies

- »

-

Platform As A Service Market Size, Industry Report, 2030GVR Report cover

![Platform As A Service Market Size, Share & Trends Report]()

Platform As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Enterprise Size, By Deployment (Public, Private, Hybrid), By End Use (BFSI, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-932-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Platform As A Service Market Summary

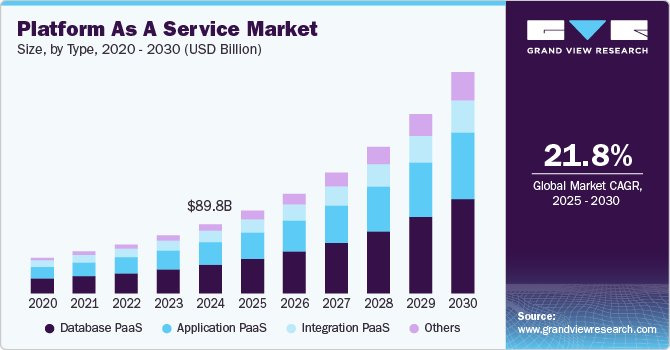

The global platform as a service (paas) market size was estimated at USD 89.81 billion in 2024 and is projected to reach USD 287.81 billion by 2030, growing at a CAGR of 21.8% from 2025 to 2030. Platform as a service (PaaS) is a cloud-based solution that offers a virtual environment for developers to create and deploy software applications.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the U.S. PaaS industry is expected to grow at a significant CAGR from 2025 to 2030.

- By type, the Database PaaS (DPaaS) segment led the market in 2024, accounting for over 40% share.

- By deployment, the public cloud segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 89.81 Billion

- 2030 Projected Market Size: USD 287.81 Billion

- CAGR (2025-2030): 21.8%

- North America: Largest market in 2024

Additionally, the global adoption of cloud services and the expanding number of enterprises are further contributing to market growth. For instance, in October 2024, Egen Solutions, LLC, a technology services provider, announced its acquisition of Qarik Group. Together, the merged company will boast a team of over 800 certified experts in cloud, data, AI, and platform technologies, empowering organizations to develop innovative, optimized solutions that tackle their most complex challenges while driving growth, operational efficiency, and human performance.

Global digitization is driving the increasing adoption of PaaS, contributing significantly to market growth. Enterprises are leveraging PaaS for its operational efficiency, cost efficiency, and access to development tools and templates, further fueling demand. The rise in digital enterprises, coupled with heightened capital investments in developing enterprise, web, and mobile applications, is anticipated to offer substantial growth opportunities. Additionally, advancements in technology, such as the integration of AI capabilities, are expected to play a pivotal role in market expansion during the forecast period. For instance, in April 2024, Aurionpro Solutions Limited announced the strategic acquisition of Arya.ai, a Mumbai-based PaaS startup specializing in banking and insurance solutions. This acquisition is intended to strengthen Aurionpro's enterprise fintech portfolio by promoting the responsible, accurate, and auditable implementation of AI technologies.

The growing adoption of cloud-based services for application development among enterprises is expected to drive market growth. IT companies increasingly leverage these services to accelerate application development and deployment processes. Cloud offerings like PaaS also lower software development costs and timelines, enhancing their demand among large enterprises. Furthermore, features such as ease of operation drive the demand of PaaS among developers. PaaS systems relieve users of responsibilities like installation, configuration, and management of application infrastructure, as these tasks are handled by the cloud service provider.

Type Insights

The Database PaaS (DPaaS) segment led the market in 2024, accounting for over 40% share of the global revenue. This is owing to the increasing adoption of cloud computing, data-driven decision-making, integration with advanced technologies, and growth in edge computing. Increased reliance on cloud infrastructure by organizations is boosting demand for DPaaS solutions that simplify database management, reduce operational complexity, and enhance scalability. Moreover, by providing a pay-as-you-go model, DPaaS reduces upfront IT costs, making database solutions accessible to both large enterprises and SMEs. This flexibility encourages its adoption across industries such as BFSI, healthcare, and retail.

The others segment such as Business Analytics PaaS, and API Management PaaS are anticipated to grow significantly in the coming years. The surge in digital transformation initiatives and the growing importance of integrating multiple services and applications across business ecosystems are key drivers for the API Management PaaS market. Moreover, the demand for data-driven decision-making is propelling the growth of Business Analytics PaaS. These platforms help organizations gain insights from vast amounts of data, enhancing operational efficiency and improving customer experiences.

Deployment Insights

The public cloud segment accounted for the largest market revenue share in 2024. Public cloud solutions offer scalability and flexibility, making it easier for businesses to scale their operations without the upfront costs of maintaining physical infrastructure. This is suitable to organizations looking for cost-effective solutions to handle varying workloads. The rise of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics in the cloud is driving the adoption of public cloud services. These technologies enable businesses to leverage powerful analytics and data processing capabilities without heavy investment in specialized hardware.

The hybrid cloud segment is anticipated to witness significant growth in the coming years. The segment is gaining momentum in the Platform as a Service (PaaS) market due to the flexibility it offers businesses to seamlessly integrate on-premises infrastructure with cloud services. This combination allows organizations to scale more efficiently while maintaining data control. The demand for hybrid cloud solutions is driven by enterprises seeking the benefits of both private and public clouds, including cost savings and the ability to manage fluctuating workloads without compromising security.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises benefit from PaaS due to its ability to minimize operational costs related to application development. By leveraging PaaS, enterprises eliminate the need for purchasing hardware or managing independent software tools, thus significantly lowering the total cost of ownership. PaaS also helps reduce time-to-market, which is crucial for staying competitive in dynamic industries. For instance, in December 2024, Karya, a Bengaluru-based pioneer in ethical data platforms, introduced its PaaS offering. This initiative aims to scale ethical data work while providing AI-driven earning opportunities for low-income communities. Karya’s AI-powered platform streamlines data collection and management.

The SMEs segment is anticipated to witness significant growth in the coming years. SMEs are increasingly adopting PaaS solutions due to the reduced upfront investment and operational costs. PaaS platforms operate on a subscription or pay-as-you-go model, which makes them financially accessible for smaller businesses that may not have the resources for large-scale infrastructure. Moreover, PaaS solutions offer development environments that empower SMEs to customize and innovate their applications. This is particularly important for businesses looking to differentiate themselves in a competitive market. With the growth of digital transformation, SMEs are increasingly looking for solutions that integrate easily with existing tools and enhance team collaboration.

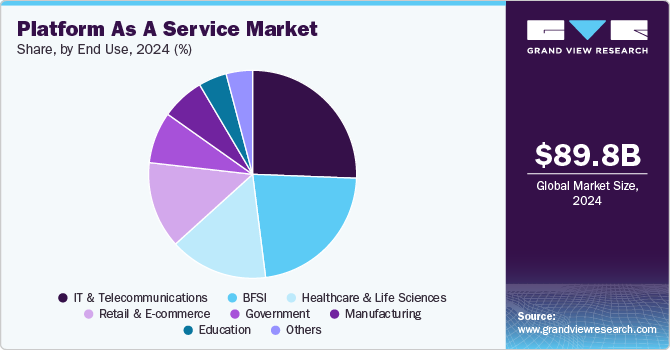

End Use Insights

The IT & telecommunications segment accounted for the largest market revenue share in 2024. The growth in internet users worldwide is fueling demand for cloud-based applications and services. The expansion of broadband infrastructure globally, especially in emerging markets, is enhancing the reach and availability of PaaS platforms, which are heavily used in IT and telecom for application development, integration, and management. Moreover, with an increasing focus on cloud computing, many telecommunications and IT companies are investing heavily in public cloud services, including PaaS, to reduce operational costs and scale their infrastructure more efficiently. This is particularly evident as organizations move from traditional data centers and on-premises solutions to adopt more flexible and cost-effective cloud platforms.

The healthcare & life sciences segment is likely to show notable growth over the forecast period. Healthcare organizations are increasingly leveraging cloud technologies to streamline operations, improve patient outcomes, and reduce costs. PaaS enables scalable, secure, and compliant environments necessary for managing sensitive healthcare data. The growing use of Generative AI (GenAI) within healthcare is transforming drug discovery, research, and patient care. PaaS platforms that integrate AI enable faster data processing and personalized treatment planning, driving the growth of the segment. Furthermore, healthcare companies must comply with strict regulations such as Health Insurance Portability and Accountability Act in the U.S. PaaS offerings ensure data is stored and processed in ways that meet these regulatory standards while reducing the burden on healthcare organizations to manage infrastructure.

Regional Insights

North America Platform as a Service (PaaS) market dominated with a revenue share of over 34% in 2024. North American businesses are increasingly undergoing digital transformation. The need for more flexible, scalable, and efficient IT environments is driving the adoption of PaaS. Companies in various sectors are looking for agile platforms that can speed up application development and reduce time to market.

U.S. Platform As A Service Market Market Trends

The U.S. PaaS industry is expected to grow at a significant CAGR from 2025 to 2030. The widespread adoption of DevOps practices among U.S. businesses has accelerated PaaS growth. DevOps fosters collaboration between development and operations teams, resulting in faster development cycles, improved product quality, and reduced time-to-market. PaaS platforms facilitate this by providing integrated tools for continuous integration, continuous delivery, and automated workflows.

Europe Platform As A Service Market Trends

The PaaS industry in the Europe region is expected to witness significant growth over the forecast period. The adoption of Industry 4.0 practices in manufacturing is significantly influencing the demand for PaaS solutions in the region. As manufacturers embrace the Internet of Things (IoT), edge computing, and smart automation, PaaS platforms provide the flexibility and scalability needed to support complex, data-heavy applications such as digital twins and predictive maintenance tools.

Asia Pacific Platform As A Service Market Trends

The PaaS industry in the Asia Pacific region is expected to witness significant growth over the forecast period. Governments in countries like China and India are pushing for initiatives that encourage digital innovation, including cloud computing and PaaS adoption. These initiatives include regulatory support and subsidies for technology infrastructure development.

Key Platform As A Service Market Company Insights

Some key players in the PaaS industry, such as Amazon Web Services, Inc. and Microsoft.

-

Amazon Web Services, Inc. offers a wide range of PaaS products, including Amazon Elastic Beanstalk for application deployment, AWS Lambda for serverless computing, and AWS Fargate for containerized application deployment. Its extensive portfolio caters to various industries and developer needs, ensuring it appeals to both startups and large enterprises.

-

Microsoft provides PaaS platform, known for its comprehensive integration with other Microsoft services, such as Office 365 and Windows Server. This has made it particularly suitable to enterprises looking for hybrid cloud solutions

Key Platform As A Service Companies:

The following are the leading companies in the platform as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Broadcom Inc.

- IBM Corporation

- Microsoft

- Salesforce, inc.

- SAP SE

- ServiceNow

- Tencent

Recent Developments

-

In December 2024, Capgemini announced the completion of its acquisition of Syniti, a leading provider of enterprise data management services and software, following the fulfillment of all regulatory requirements. Syniti's global team of over 1,200 data specialists will strengthen Capgemini's data-driven digital transformation services, particularly in large-scale SAP migrations, including transitions to SAP S/4HANA.

-

In December 2024, Czech Radiokomunikace a.s.,an internet service provider, selected Netmore Group AB’s, IoT operator, Operator Platform-as-a-Service (PaaS) to update and streamline the process of delivering commercial Internet of Things (IoT) services. Netmore Group AB’s PaaS allows Czech Radiokomunikace a.s. to provide LoRaWAN network connectivity while also improving its network monitoring and technical support for IoT deployments across various industries.

-

In November 2024, Aviatrix, cloud network security company, launched Aviatrix Cloud Network Security Platform-as-a-Service (Aviatrix PaaS), a cloud network security platform. This managed service option expands the range of choices for both new and existing enterprise customers, offering a fully managed, ready-to-deploy solution that is fast, scalable, and AI-enhanced for secure cloud networking, while supporting cloud security and optimizing the cost.

Platform As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 107.55 billion

Revenue forecast in 2030

USD 287.81 billion

Growth rate

CAGR of 21.8% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; and KSA

Key companies profiled

Alibaba Cloud; Amazon Web Services, Inc.; Broadcom Inc.; Google; IBM Corporation; Microsoft; Salesforce, inc.; SAP SE; ServiceNow; and Tencent

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Platform As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global platform as a service market report based on type, deployment, enterprise size, end use and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Application PaaS (aPaaS)

-

Integration PaaS (iPaaS)

-

Database PaaS (dbPaaS)

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

IT & Telecommunications

-

Manufacturing

-

Education

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

Frequently Asked Questions About This Report

b. The global platform as a service market size was estimated at USD 89.81 billion in 2024 and is expected to reach USD 107.55 billion in 2025.

b. The global platform as a service market is expected to grow at a compound annual growth rate of 21.8% from 2025 to 2030 to reach USD 287.81 billion by 2030.

b. North America dominated the PaaS market with a share of 35.4% in 2024. North American businesses are increasingly undergoing digital transformation. The need for more flexible, scalable, and efficient IT environments is driving the adoption of PaaS.

b. Some key players operating in the PaaS market include Alibaba Cloud; Amazon Web Services, Inc.; Broadcom; Google; IBM Corporation; Microsoft; Salesforce, inc.; SAP SE; ServiceNow; and Tencent

b. Key factors that are driving the PaaS market growth include the increasing demand among enterprises to reduce costs and shorten time-to-market (TTM) for application development. Additionally, the global adoption of cloud services and the expanding number of enterprises are further contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.