- Home

- »

- Processed & Frozen Foods

- »

-

Oyster And Clam Market Size, Share & Trends [2023 Report]GVR Report cover

![Oyster And Clam Market Size, Share & Trends Report]()

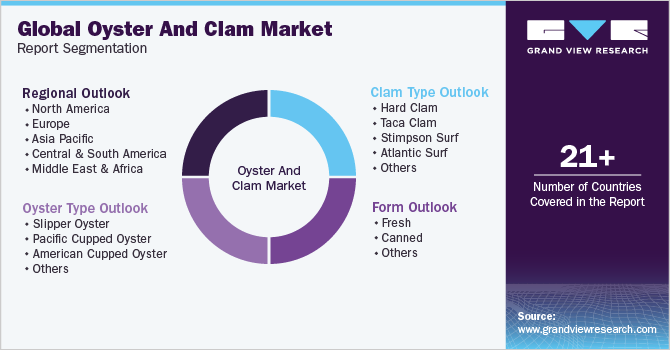

Oyster And Clam Market (2023 - 2030) Size, Share & Trends Analysis Report By Oyster Type (Slipper Oyster, Pacific Cupped Oyster), By Clam Type Hard Clam, Taca Clam, Stimpson Surf), By Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-070-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oyster And Clam Market Summary

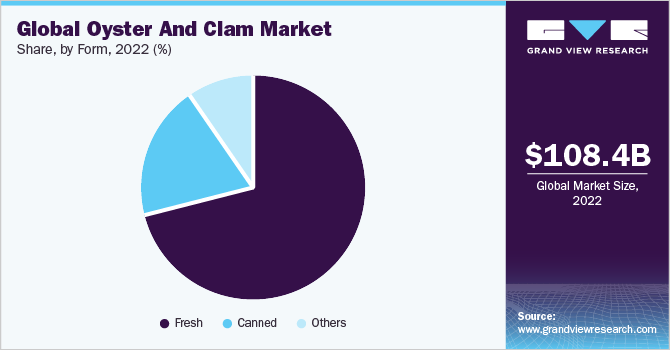

The global oyster and clam market size was estimated at USD 108.4 billion in 2022 and is projected to reach USD 143.28 billion by 2030, growing at a CAGR of 3.5% from 2023 to 2030. Rising popularity of seafood and growing awareness of the health benefits offered by clams and oysters are the major factors propelling the demand for the market.

Key Market Trends & Insights

- Asia Pacific led the market and accounted for a share of 45.1% share of the global revenue in 2022.

- China’s oyster and clam market is growing at a CAGR of 5.2% by revenue during the forecast period.

- North America oyster and clam market showcased significant growth with a CAGR of 3.7% by revenue during the forecast period.

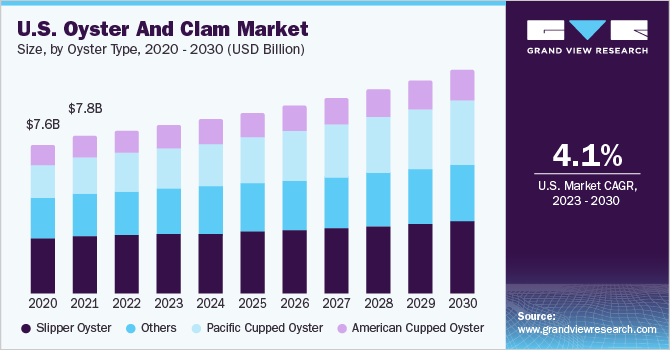

- By oyster type, slipper oysters dominated the oyster segment, accounting for the highest revenue share of 31.85% in 2022.

- By clam type, the hard clam dominated the clam segment with the largest share of 29.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 108.4 Billion

- 2030 Projected Market Size: USD 143.28 Billion

- CAGR (2023-2030): 3.5%

- Asia Pacific: Largest market in 2022

Oysters and clams are a good source of protein, vitamins, and minerals, including iron, and zinc. They are also low in calories, making them an ideal food for consumers looking to maintain a healthy diet. Additionally, oysters and clams are high in omega-3 fatty acids, which are essential for brain and heart health. The rise of farm-to-table restaurants and an increased focus on local, sustainable sourcing has led to a surge in demand for locally sourced oysters and clams. Another factor driving the demand for oysters and clams in the restaurant industry is their versatility. These shellfish can be prepared in a wide range of ways, from raw on the half-shell to grilled, fried, or steamed. They can be incorporated into soups, stews, and other dishes, and their unique flavor and texture make them a popular choice for chefs looking to create unique and flavorful dishes. As more consumers seek out sustainable and locally sourced food options, the demand for oysters and clams in the restaurant industry is likely to continue to grow.

The companies operating in the industry are investing in R&D to improve the health benefits and sustainability provided by their products. Initiatives such as developing new farming techniques to reduce environmental impacts. For instance, U.S.-based Taylor Shellfish Farms have a recirculating sea water holding system that can hold close to 30,000 dozens of oysters during critical temperatures. Furthermore, companies operating in the doubling their production capacity to cater to the high consumer demand for seafood.

Also, in February 2021, Canada-based Angel Seafood, a sustainability-focused oyster farming company plans to double its production capacity to 20 million oysters per annum at its Australian farms to meet the rising demand for oysters, as well as improve profitability.

Oyster Type Insights

Slipper oysters dominated the oyster segment, accounting for the highest revenue share of 31.85% in 2022. The demand for slipper oysters is being driven by their unique flavor profile and appearance. Slipper oysters are considered a premium product, which means they can command higher prices and appeal to consumers willing to pay more for high-quality seafood. In addition, slipper oysters are filter feeders, which can help to improve water quality in the areas where they are grown. This can be an attractive selling point for environmentally conscious consumers.

The Pacific cupped oyster is predicted to expand at a CAGR of 5.6% during the forecast period 2022-2030 by revenue.The Pacific oyster is a species of shellfish become popular in North America, Australia, Europe, and New Zealand. The increasing popularity of oysters is driving demand for Pacific cupped oysters. Oysters are becoming more widely appreciated as a gourmet food item, and as a result, several consumers are seeking out oysters like Pacific cupped oysters. This has led to an increase in demand for these oysters both in restaurants and seafood markets.

Clam Type Insights

The hard clam dominated the clam segment with the largest share of 29.5% in 2022. Hard clam, quahog, is a bivalve mollusk native to shores of Central & North America. One of the main factors driving the demand for hard clams is the taste, which is briny and sweet with a firm texture, making them a popular choice for consumers. Hard clams are also versatile and can be used in various dishes like chowders, stews, and pasta dishes.

The Atlantic surf clam is anticipated to expand at a CAGR of 5.0% by revenue during the forecast period.Factors such as easy availability and rising demand for clam-based products in the retail and food service sectors are the major factors driving the demand for the segment. For instance, in April 2023, according to a study conducted by the Science Center for Marine Fisheries (SCEMFIS) in the U.S., Atlantic surf clams are not in danger of being overfished and are available in abundance for the U.S. market.

Also, companies operating in the industry are constantly launching innovative products to cater to the rising demand for clams. For instance, U.S.-based Atlantic Cape Fisheries offers a wide range of frozen stuffed clams for the food service and retail sector under its Galilean Kitchen brand. The range includes New England-style stuffed clams, Gourmet Stuffed clams in flavors such as chili lime, and bacon& cheddar.

Form Insights

The fresh segment dominated the form segment with the largest revenue share of 71.2%.The increasing availability and accessibility of fresh oysters and clams are driving demand for the segment. Improved transportation and distribution methods have improved access to fresh seafood for consumers who live far from the coast. This has further led to an increase in demand for fresh oysters and clams, both in restaurants and retail markets. In addition, as several consumers seek out healthy and sustainable food choices, they are turning to seafood as an alternative to meat and poultry. Additionally, the increasing popularity of raw seafood dishes like sushi and ceviche has led to an increased demand for fresh oysters and clams.

The canned oyster & clam is anticipated to expand at a CAGR of 5.7% by revenue during the forecast period. Canned oysters and clams are pre-cooked and preserved, making them easy to store and use in a variety of recipes. The convenience and affordability of canned seafood also make it an attractive option for food service providers, such as restaurants and cafeterias. In June 2022, Campbell Soup Co. announced plans to launch soups and stews by utilizing a new Old-Bay seasoned clam chowder.

Regional Insights

Asia Pacific led the market and accounted for a share of 45.1% share of the global revenue in 2022. The increasing availability of clams and oysters in the Asia Pacific region is driving demand for the overall market. Factors such as rising economic growth and growing disposable income have led to the growing demand for seafood. This has led to rising demand for premium seafood products, which are considered luxury food items in many Asian cultures.

China’s oyster and clam market is growing at a CAGR of 5.2% by revenue during the forecast period. The growth of aquaculture in China has led to an increase in the availability of oysters and clams, making them more accessible and affordable for consumers. Additionally, improved transportation and distribution methods have made it easier to import fresh oysters and clams from other countries.

North America oyster and clam market showcased significant growth with a CAGR of 3.7% by revenue during the forecast period. The rise in number of food service and retail outlets offering a vast variety of oyster and clam products is a significant factor driving the demand for the market in the region. In December 2021, the U.S.-based Island Seafood Co. announced the launch of a web service that offers packages of 10, 20, and 50 oysters to be shipped across Canada. The company is also offering a promotional party package that includes a shucking knife, beer, charcuterie, and a music playlist to drive demand for the product and services.

The European market for oyster and clam is anticipated to grow at a CAGR of 2.1% by volume during the forecast period. The European region is one of the major producers of oysters. In 2022, As per EUFOMA, the consumption of oysters was around 91,488 tonnes live weight. In addition, the availability of oysters and clams in the region has increased due to the development of aquaculture techniques that make it easier and more cost-effective to farm these shellfish.

Key Companies & Market Share Insights

The global oyster & clam market is expected to witness competition among companies due to the presence of several players across the industry. Key players have increasingly focused on the Southeast Asian market over the years because of the presence of a target consumer base in the region. Manufacturers are expanding their production capacities to meet the growing demand for oysters & clams. For instance, Clearwater Seafoods offers pre-cut and portioned sushi-ready slices of natural, wild-caught Arctic Surfclams. The key companies operating in the global oyster and clam market are:

-

Clearwater Seafoods

-

High Liner Foods

-

Pacific Seafood

-

Taylor Shellfish Farms

-

Mazetta Company, LLC

-

Pangea Shellfish Company

-

Royal Hawaiian Seafood

-

Island Creek Oysters

Oyster And Clam Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 111.64 billion

Revenue forecast in 2030

USD 143.28 billion

Growth rate (Revenue)

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Oyster type, clam type, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain, China; India; Japan; Brazil; South Africa

Key companies profiled

Clearwater Seafoods; High Liner Foods; Pacific Seafood; Taylor Shellfish Farms; Mazetta Company, LLC; Pangea Shellfish Company; Royal Hawaiian Seafood; Island Creek Oysters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oyster And Clam Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global oyster and clam market report based on oyster type, clam type, form and region

-

Oyster Type Outlook (Revenue, USD Million; Volume, Tons, 2017 - 2030)

-

Slipper Oyster

-

Pacific Cupped Oyster

-

American Cupped Oyster

-

Others

-

-

Clam Type Outlook (Revenue, USD Million; Volume, Tons, 2017 - 2030)

-

Hard Clam

-

Taca Clam

-

Stimpson Surf

-

Atlantic Surf

-

Others

-

-

Form Outlook (Revenue, USD Million; Volume, Tons, 2017 - 2030)

-

Fresh

-

Canned

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Oyster & Clam market is expected to grow at a compound annual growth rate of 3.5% from 2022 to 2030 to reach USD 143.28 billion by 2030.

b. Slipper oysters accounted for the largest share of 31.85% in the oyster & clam market

b. The global oyster & clam market size was estimated at USD 108.4 billion in 2022 and is expected to reach USD 111.64 billion in 2023.

b. Some of the key market players in the Oyster & Clam market are Clearwater Seafoods, High Liner Foods, Pacific Seafood , Taylor Shellfish Farms, Mazetta Company, LLC, Pangea Shellfish Company, Royal Hawaiian Seafood, Island Creek Oysters.

b. Key factors that are driving the oyster & clam market growth is increasing consumer awareness regarding health benefits of seafood.

b. Asia Pacific region dominated the Oyster & Clam market with a revenue share of 45.1% in the year 2022 owing to the high demand and large consumer base present in the region.

b. China showcased the fastest CAGR of 5.2% in the oyster & clam market with a revenue share owing to the high consumption of shellfish in the country

b. France showcased the fastest CAGR of 5.6% in the oyster & clam market with a revenue share owing to the high demand for premium seafood.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.