- Home

- »

- Organic Chemicals

- »

-

Oxalic Acid Market Size And Share, Industry Report, 2030GVR Report cover

![Oxalic Acid Market Size, Share & Trend Report]()

Oxalic Acid Market (2025 - 2030) Size, Share & Trend Analysis Report, By Application (Bleaching/Cleaning, Pharmaceuticals, Water Treatment, Textile Dyeing, Metal Leaching), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-506-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oxalic Acid Market Size & Trends

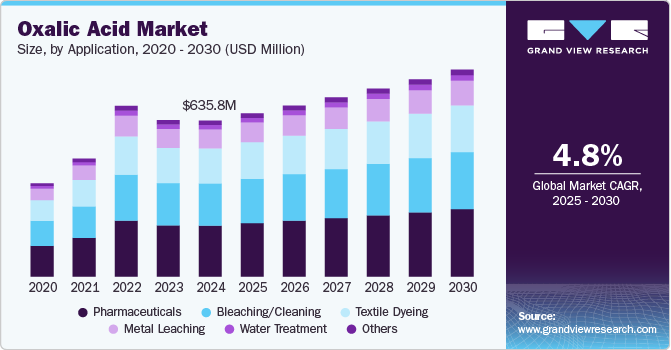

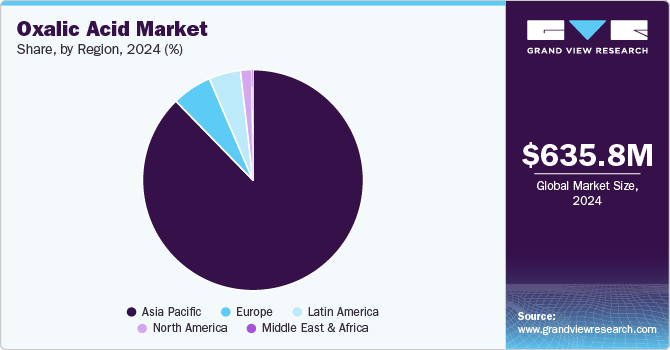

The global oxalic acid market size was estimated at USD 635.8 million in 2024 and is projected to reach USD 843.4 billion by 2030, at a CAGR of 4.8% from 2025 to 2030. Oxalic acid is used in the textile sector for bleaching, dyeing, and finishing. With the expansion of the global textile industry, especially in emerging economies such as China, India, and Southeast Asia, the demand for oxalic acid has surged. The growing population and increasing disposable income in these regions have led to greater consumption of clothing and textiles, directly boosting the need for chemicals such as oxalic acid in production processes.

Oxalic acid is a valuable component in synthesizing various drugs, such as analgesics and antipyretics, and is also used for purifying active pharmaceutical ingredients. The demand for pharmaceutical-grade oxalic acid has increased with the growing emphasis on healthcare and wellness globally, especially in developed markets. The aging population in many countries also drives the demand for healthcare products and treatments, further accelerating the pharmaceutical industry's need for this chemical compound.

In addition to textiles and pharmaceuticals, the oxalic acid market also benefits from its widespread application in the metal and mining industries. Oxalic acid is an essential component in metal cleaning and polishing, as well as in extracting certain minerals like uranium and rare earth elements. The rapid industrialization and expansion of the mining sector in countries such as China, Australia, and South Africa have created a growing need for oxalic acid in mining operations. Moreover, its use as a rust remover and cleaning agent in maintaining machinery and metal products contributes to its increasing demand in this sector.

The agricultural sector is another important driver of the oxalic acid market. Oxalic acid is used in agriculture for various purposes, such as in controlling certain pests and as a cleaning agent for equipment. It is also applied in beekeeping to control varroa mites, a significant threat to honeybee populations. With the growing focus on sustainable farming practices and the increasing adoption of organic farming methods, the demand for oxalic acid in agriculture has risen. In addition, the need to protect crops and maintain healthy ecosystems prompts farmers and beekeepers to utilize oxalic acid for pest control, further boosting the market.

Drivers, Opportunities & Restraints

The oxalic acid market is primarily driven by its diverse applications across various industries, including textiles, chemicals, pharmaceuticals, and agriculture. Its increasing use as a bleaching agent and rust remover, in producing various chemicals such as oxalates, and as a precursor for synthetic compounds is driving growth. The rising demand for oxalic acid in cleaning products and its role as a reducing agent in the metal and mining industries also contribute to market expansion. In addition, the growing use of oxalic acid in agriculture to remove pests and clean plant surfaces further fuels demand.

The oxalic acid market presents several growth opportunities due to the advancements in the pharmaceutical and biotechnological sectors, where oxalic acid is utilized to synthesize active pharmaceutical ingredients (APIs). Emerging economies, particularly in Asia Pacific, are seeing an increased demand for oxalic acid as urbanization and industrialization progress, leading to new applications. In addition, with the rising trend of sustainable and eco-friendly products, oxalic acid’s biodegradable nature positions it as a promising solution in green chemistry initiatives, thus opening up new opportunities in various industrial sectors.

Oxalic acid is toxic and can cause severe irritation or poisoning if handled improperly, causing environmental and health concerns. These hazards can lead to stringent regulations and safety protocols, increasing operational costs. In addition, the volatility in raw material prices and the potential for supply chain disruptions may hinder market stability. The limited availability of natural sources of oxalic acid and reliance on synthetic production processes may also affect its overall cost-effectiveness and market growth.

Application Insights

The pharmaceuticals segment dominated the market with a market share of 32.7% in 2024. Oxalic acid manufactures certain analgesics, antibiotics, and other therapeutic compounds. With the increasing demand for better medical treatments and the expansion of the global healthcare sector, the pharmaceutical industry's need for high-quality raw materials, including oxalic acid, has risen. The growing population further bolsters this demand, as the increasing prevalence of chronic diseases and the expanding focus on developing new medicines continue to drive the pharmaceutical segment within the oxalic acid market.

Bleaching/Cleaning is anticipated to register the fastest CAGR of 5.1% over the forecast period. Oxalic acid, known for breaking down organic stains and removing rust and mineral deposits, is widely used in household and industrial cleaning applications. The rise in consumer awareness about the benefits of using safer, less toxic chemicals for cleaning has accelerated the demand for oxalic acid-based products. In addition, its widespread application in the textile industry for fabric bleaching and in wood and metal cleaning processes has significantly bolstered its market growth. As consumers seek more sustainable and efficient cleaning solutions, oxalic acid is an ideal alternative to harsher, traditional chemicals.

Regional Insights

The growth of the oxalic acid market in North America is primarily driven by its increasing applications across various industries. Oxalic acid is widely used in the textile, chemical, and pharmaceutical industries, where it serves as a key component in processes such as bleaching, dyeing, and cleaning. The demand for oxalic acid in the textile industry is bolstered by the growing trend of high-quality fabric production, particularly in countries such as the U.S. and Canada.

Asia Pacific Oxalic Acid Market Trends

The Asia Pacific oxalic acid market accounted for the largest market revenue share of 72.2% in 2024 due to its extensive use in textile, leather, and chemical industries including bleaching, dyeing, and as a reducing agent. The rapid industrialization in countries such as China, India, and Southeast Asia has resulted in higher consumption of chemicals, including oxalic acid, for these sectors. Furthermore, the automotive industry’s growth, especially in China, has contributed to the rise in demand for oxalic acid as a cleaning agent and in manufacturing batteries and other electronic components. This surge in industrial activity is fueling the demand for oxalic acid across various manufacturing processes.

Europe Oxalic Acid Market Trends

Europe is expected to experience rapid growth. With its advanced manufacturing capabilities, the chemical industry in Europe is a key driver of demand for oxalic acid, particularly for its use in metal cleaning, rust removal, and textile bleaching. As European manufacturers continue to focus on high-quality production and environmental standards, oxalic acid is increasingly utilized for its effectiveness and relatively low environmental impact compared to other chemicals.

Latin America Oxalic Acid Market Trends

In Latin America, the growth of the oxalic acid market is largely driven by its increasing application in agriculture, particularly in the treatment of pests and crop diseases. Countries such as Brazil and Argentina, major players in global agriculture, are witnessing a rising demand for oxalic acid as a safer, more sustainable alternative to traditional chemical pesticides. The growing trend towards organic farming and adopting integrated pest management (IPM) practices across the region has fueled the need for biocontrol agents and non-toxic solutions such as oxalic acid.

Middle East & Africa Oxalic Acid Market Trends

The Middle East and African agrochemicals market is expected to grow significantly over the forecast period. In countries such as South Africa, where agriculture plays a significant role in the economy, oxalic acid controls pests such as varroa mites in beekeeping, which is essential for maintaining healthy bee populations for pollination. In addition, the growing interest in organic farming practices in Morocco and Egypt is driving the demand for environmentally friendly agricultural chemicals, with oxalic acid being a popular choice due to its biodegradability and non-toxic properties.

Key Oxalic Acid Company Insights

Some of the key players operating in the market include Mudanjiang Fengda Chemical Co., Ltd., Oxaquim, Merck KGaA, and others.

-

Mudanjiang Fengda Chemical Co., Ltd. specializes in the production and supply of oxalic acid, which is a versatile chemical used across various industries. In metallurgy, it serves as a precipitating agent for rare-earth metals, while in the pharmaceutical sector, it is utilized in the formulation of drugs such as Tetracycline and Phenobarbital.

-

Merck KGaA offers oxalic acid, an important organic compound used in various industrial applications, including chemical synthesis and as a cleaning agent. The company provides oxalic acid in its anhydrous form, characterized by its chemical formula HOOCCOOH, which is utilized in diverse sectors such as pharmaceuticals, agriculture, and materials science.

Key Oxalic Acid Companies:

The following are the leading companies in the oxalic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Mudanjiang Fengda Chemical Co., Ltd.

- Oxaquim

- Merck KGaA

- UBE Industries Ltd.

- Clariant International Limited

- Indian Oxalate Limited

- Shijiazhuang Taihe Chemical Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Shandong Fengyuan Chemical Co., Ltd.

- Penta s.r.o

Oxalic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 665.2 million

Revenue forecast in 2030

USD 843.4 million

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Mudanjiang Fengda Chemical Co., Ltd.; Oxaquim; Merck KGaA; UBE Industries Ltd.; Clariant International Limited; Indian Oxalate Limited; Shijiazhuang Taihe Chemical Co., Ltd.; Spectrum Chemical Manufacturing Corp.; Shandong Fengyuan Chemical Co., Ltd.; Penta s.r.o

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oxalic Acid Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oxalic acid market report on the basis of application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bleaching/Cleaning

-

Pharmaceuticals

-

Water Treatment

-

Textile Dyeing

-

Metal Leaching

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oxalic acid market size was estimated at USD 635.8 million in 2024 and is expected to reach USD 665.2 million in 2025.

b. The oxalic acid market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 843.4 million by 2030.

b. Pharmaceuticals accounted for the largest revenue share of 32.7% in 2024 of oxalic acid market owing to its use as a reagent in drug synthesis and as a key component in the production of certain medications.

b. Some of the key players operating in the oxalic acid market include Mudanjiang Fengda, Chemical Co., Ltd., Oxaquim, Merck KGaA, UBE Industries Ltd., among others.

b. The key factors that are driving the oxalic acid market include the increasing demand in industries such textiles, chemicals, and pharmaceuticals and the rising use of oxalic acid in metal cleaning and water treatment applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.