- Home

- »

- Electronic Devices

- »

-

Outsourced Semiconductor Assembly And Test Services MarketGVR Report cover

![Outsourced Semiconductor Assembly And Test Services Market Size, Share & Trends Report]()

Outsourced Semiconductor Assembly And Test Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service Type (Assembly & Packaging, Testing), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-063-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Outsourced Semiconductor Assembly And Test Services Market Summary

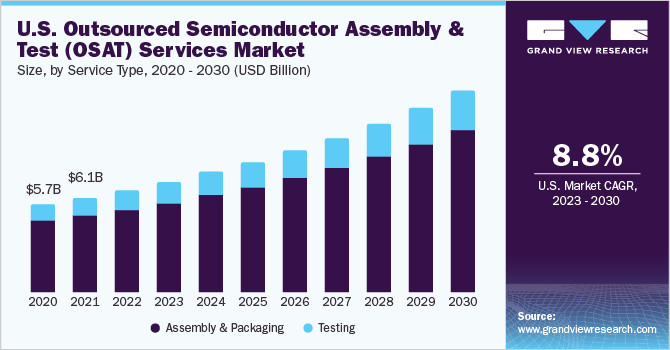

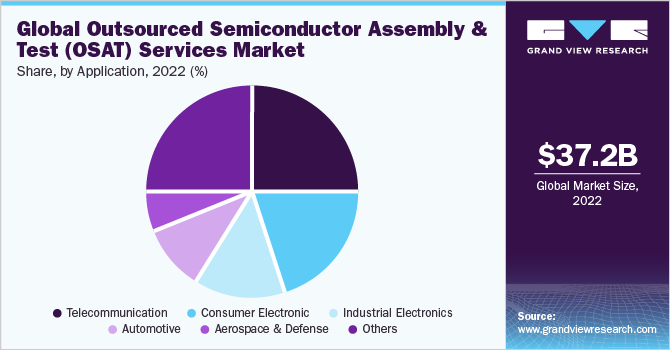

The global outsourced semiconductor assembly and test services market size was estimated at USD 37.22 billion in 2022 and is projected to reach USD 67.92 billion by 2030, growing at a CAGR of 7.9% from 2023 to 2030. This growth can be attributed to the increasing demand for consumer electronics, advancements in next-generation electric vehicles, and the pivotal role of semiconductor devices in industrial automation and smart manufacturing.

Key Market Trends & Insights

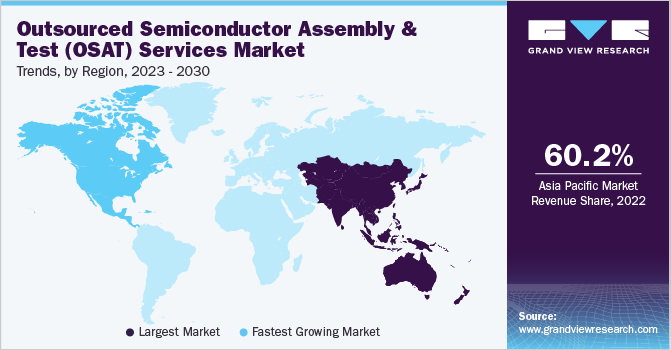

- The Asia Pacific held the largest revenue share of the OSAT services market, accounting for 60.2% in 2022.

- The North America is anticipated to grow at the fastest CAGR of 8.5% throughout the forecast period.

- Based on service type, the assembly & packaging segment accounted for 82.0% of the global revenue share in 2022.

- Based on application, the telecommunication segment accounted for the largest revenue share of 25.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 37.22 Billion

- 2030 Projected Market USD 67.92 Billion

- CAGR (2023-2030): 7.9%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

Furthermore, there is a rising preference for advanced packaging technology, as chip functional requirements continue to evolve with the advancements in 5G, IoT, AI, and other latest technologies, and their integration into digital consumer electronics and wearable devices. The demand for high-performance, low-cost, multi-functional, and highly integrated chips is also on the rise.

outsourced semiconductor assembly and test (OSAT) vendors refer to third-party providers offering integrated circuit device testing, assembly, and packaging services. These services help bridge the gap between semiconductor foundries and end-consumers. The growth of the OSAT market is primarily driven by the increasing use of these services by semiconductor device manufacturers worldwide.

This growth is further propelled by the rise in the number of connected devices and consumer electronics, and the emphasis on quality improvement and end-to-end testing solutions by companies. Additionally, the OSAT market is expected to benefit from the growing dominance of fabless market players in IC sales. The market is analyzed based on service type and application to identify the largest and fastest-growing segments and sub-segments of the OSAT market.

In the context of next-generation electric vehicles (EVs), OSAT services serve a specialized function of improving the performance of their batteries to match the travel range of internal combustion engine (ICE) vehicles. As the trend toward electric vehicles and enhancements in their electrification continues, advanced driver assistance systems (ADAS) are becoming more commonplace to ensure comfort and uninterrupted connectivity while maintaining safety.

In response, integrated device manufacturers (IDMs) are increasingly seeking out OSAT service providers to expedite product development while adhering to rigorous safety, quality, and design standards. With the continued advancement of electric vehicle powertrain technology, mechanical parts like gearboxes and auxiliary motors found in ICE vehicles will become obsolete. Tier-one suppliers of electric powertrains will become more vertically integrated with their manufacturing processes. This shift in the industry encourages automakers to outsource the design, assembly, and testing of electrification components to specialist companies, thus driving the demand for OSAT services.

COVID-19 Impact

The outbreak of the COVID-19 pandemic took a severe toll on the global supply chain and subsequently led to raw material shortages and price escalations. Several industries and industry verticals were affected by the shortage of raw materials, and the semiconductors industry was not an exception. The demand for semiconductors increased significantly in line with the growing demand for electronics as businesses opted for remote working, consumers tried to brace themselves for the new, work-from-the-home trend, and internet service providers (ISPs) tried aggressively to strengthen internet connectivity.

Businesses involved in manufacturing activities mainly opted for manufacturing and production solutions based on IoT technology and smart devices to facilitate remote operations and monitoring. However, the supply of semiconductors was unable to keep up with the growing demand as fabrication centers or foundries were already running close to capacity or experiencing staffing problems as a result of the outbreak of the pandemic.

As a result, the supply of semiconductors continued to plummet when the demand showed no signs of abating. Looking forward, the demand-supply imbalances will take longer to resolve until the disrupted supply chains restore wholly and both raw material supplies and production levels resume the pre-pandemic levels.

Service Type Insights

In terms of service type, the market is bifurcated into assembly & packaging and testing. The assembly & packaging segment accounted for 82.0% of the global revenue share in 2022. Packaging and assembly are critical components of semiconductor production and design as they impact the power, performance, and cost at the macro level and the basic operation of all chips at the micro level. Assembly services allow the cost-efficient incorporation of functional diversifications through System-in-Package (SiP) technology. This encourages a continuing rise in functional density and reduces the cost per function, ensuring progress in the field of electronics in terms of cost and performance.

Prominent semiconductor manufacturers are offering new and improved packaging and assembly solutions to stay ahead in the fiercely competitive market. For instance, in May 2021, Samsung Electronics Co., Ltd. announced the launch of an innovative chip packaging technology, I-Cube4. By incorporating an innovative chip-packing approach, the latest technology has resulted in the more efficient and faster development of semiconductors. Designers are also incorporating miniaturized chip-scale packaging, especially for high-pin count designs. Miniaturization in semiconductor packaging helps increase density and leads to shorter signal routes, enabling higher frequencies and clocking speeds.

The packaging market is segmented into ball grid array packaging, multi-chip packaging, chip scale packaging, quad-flat & dual-inline packaging, and stacked die packaging. Among these segments, the ball grid array packaging segment dominated the market in 2022, capturing a revenue share of 28.3%. Ball grid array (BGA) packaging is an integrated circuit surface-mount packaging type that has become a preferred option for high I/O devices due to its several benefits over traditional large lead count packages. It reduces handling issues and placement problems during packaging and is used for installing electronics like microprocessors permanently.

BGA packaging can accommodate more connectivity pins than dual in-line or flat packages by using the entire bottom surface of the gadget. Meanwhile, the multi-chip packaging segment is projected to experience the highest growth, with a CAGR of 9.2% throughout the forecast period. Multi-chip packaging (MCP) is a system-in-package that combines multiple integrated circuits into a single device. MCP comes in different types, including multi-chip module plastic laminate (MCM-L), multi-chip module ceramic (MCM-C) thin film, and multi-chip module deposited (MCM-D) thin film, depending on the designer's development and complexity requirements.

An essential feature of MCP is that it utilizes standard packages as a vehicle for minimal multi-chip module (MCM) applications. End-users can quickly implement MCP since the test, handling, and installation equipment is already available in the industry. MCM technology has been utilized in products such as the Intel Pentium Pro, IBM Bubble memory MCMs, Xeon Dempsey, Pentium D Presler, Clovertown, and Sony memory sticks.

The testing segment is anticipated to grow at a faster rate, at a CAGR of 9.8% throughout the forecast period. Semiconductor testing is a vital component of the production process, particularly as Integrated Circuit (IC) architectures become increasingly sophisticated and the focus on optimizing time-to-market increases. Rapid upgrades and iterations in semiconductor chip technology and the constantly growing number of functions carried out on chips, including autonomous driving, artificial intelligence, virtual reality, cloud computing, 5G, and the Internet of Things (IoT), are driving the need for updating test equipment and testing methods.

As the number of transistors in ICs increases and increasingly complicated functionality is incorporated into each chip, the need for more efficient test methods is highlighted. Semiconductor testing guarantees that a processing flaw has not hampered a chip's operation and that the design fulfills the requisite performance criteria. IC test equipment (IC tester) and Automated Test Equipment (ATE) are systems for transmitting electrical pulses to a semiconductor device to evaluate output signals against expected values and determine if the device performs as described in design requirements.

Testers fall into three broad categories, namely memory testers, analog testers, and logic testers. A wafer test, also known as a die sort or probing test, is often undertaken before wafers are packaged. The package test, also known as the final test, is conducted after the wafers are packaged.

Application Insights

In terms of application, the market is classified into telecommunication, consumer electronics, industrial electronics, automotive, aerospace & defense, and others. The telecommunication segment accounted for the largest revenue share of 25.2% in 2022. As disruptive technologies 5G, artificial intelligence, and high-performance computing continue to influence consumer lives, demand for semiconductor devices that provide greater performance, bandwidth, lower latency, and power efficiency has increased.

Semiconductor chips play a critical role in the advent of 5G technology and in fulfilling its promise of delivering high performance and improved user experience. Telecom corporations are heavily investing in 5G chips to develop the necessary infrastructure for the large-scale deployment of the technology. Furthermore, key OSAT vendors are offering 2.5D and 3D IC packaging solutions featuring higher energy efficiency and higher packaging density for the telecom industry. For instance, ASE has introduced the high-density Fan Out technology for die stacking and multi-die solutions to deliver high bandwidth and high performance throughout the market landscape, catering to the growing demand across high-density data centers and the telecom space.

The automotive segment is also projected to register the fastest CAGR of 9.5% during the forecast period. The automobile industry has come a long way in terms of offering pre-installed electronic systems that improve the comfort and safety of vehicles. OSAT vendors play a vital role in the automotive sector supply chain. Tier-1 electronic systems suppliers in the automotive ecosystem avail services of OSAT vendors, who then incorporate the technology into modules and ship them to the original equipment manufacturers (OEM) for assembly.

Furthermore, an increasing number of integrated device manufacturers (IDMs) are availing OSAT services to build products at a faster rate while still meeting safety, quality, reliability, and overall design integrity standards. The large number of package types being used in automotive applications is also driving the demand for effective OSAT services. OSAT services ensure that automotive manufacturers meet the demand for efficient, integrated, and dependable electronics to support current automotive industry development trends.

For instance, UTAC is an ISO/TS 16949:2016 and ISO 26262-certified OSAT service provider that caters to the automobile industry. The company also specializes in the assembly and testing of semiconductors in a variety of industries and is well-positioned to assist IDMs and fabless semiconductor businesses targeting the automotive industry.

Regional Insights

Asia Pacific held the largest revenue share of the OSAT services market, accounting for 60.2% in 2022. This growth can be attributed to the presence of leading players and key innovators such as ASE Technology Holding Co., ChipMOS Technologies Inc., and HANA Micron Inc. The growth was further supported by the rapid adoption of robotic processes in various industries, particularly in the automotive and consumer electronics sectors, across Japan, South Korea, India, and China. China, India, and Taiwan are among the key regions in the Asia Pacific witnessing rapid growth in the semiconductor industry and are expected to increase their industry share in the coming years.

In October 2022, the Indian government announced a modification to its existing initiative for establishing semiconductor-related facilities, under which eligible applicants would receive financial assistance of 50% (up from 30%) of CAPEX. In 2020, the Taiwan government revealed its five-year plan to invest USD 54.15 million in the semiconductor industry to develop the necessary workforce for research and development.

North America is anticipated to grow at the fastest CAGR of 8.5% throughout the forecast period. Increased implementation of the Internet of Things (IoT), artificial intelligence, and smart devices across verticals such as healthcare, transportation, and manufacturing is one of the factors propelling the growth. For instance, the growing demand for healthcare applications such as medical instruments, consumer medical electronics, medical imaging, and diagnostic patient monitoring & therapy during and post-COVID-19 pandemic has increased the demand for semiconductors, in turn driving the demand for OSAT services.

In 2021, the U.S. held the largest share of more than 78% of the North American OSAT market. Leading players, such as Amkor Technology Inc. and Aehr Test Systems, are the major contributors to U.S. revenue. Increased demand for OSAT services from end-users, including Electric Vehicles (EV), defense, and aerospace manufacturers such as Tesla, Rivian, Boeing, Lockheed Martin, and GE Aviation, is contributing to the market’s growth. Additionally, the high demand for semiconductor testing services across the computing and data storage equipment in the U.S. and Canada is positively impacting the growth.

Key Companies & Market Share Insights

The outsourced semiconductor assembly and test service market is competitive, wherein the top five players, namely Jiangsu Changdian Technology Co., Ltd.; Powertech Technology Inc.; Siliconware Precision Industries; ASE Technology Holding Co; and Amkor Technology accounted for nearly 70% of the market in 2022. Other players, such as King Yuan ELECTRONICS CO., LTD., ChipMOS, Chipbond, and UTAC Holdings Ltd., are among the top 10 market players.

Business expansion through strategic partnerships and new service offerings are some of the key strategies adopted by OSAT market players. OSAT service providers are engaging in partnerships with companies across the semiconductor ecosystem to achieve technological advancements and business growth. In addition, companies are also investing in the expansion of facility centers to cater to the significantly growing demand for assembly and testing services. Players are trying to fill the demand-supply gap in the semiconductor industry by increasing their service capabilities. Some prominent players in the global Outsourced Semiconductor Assembly and Test (OSAT) services market include:

-

Powertech Technology, Inc.

-

Amkor Technology Inc.

-

ASE Technology Holding Co.

-

ChipMOS Technologies Inc.

-

King Yuan Electronics Co., Ltd.

-

JCET Group Co., Ltd.

-

Hana Micron Inc.

-

UTAC Holdings Ltd.

-

Lingsen Precision Industries, Ltd.

-

Shenzhen CPET Electronics Co., Ltd.

-

Siliconware Precision Industries Co., Ltd.

-

Aehr Test Systems

Outsourced Semiconductor Assembly And Test Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.92 billion

Revenue forecast in 2030

USD 67.92 billion

Growth Rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service type, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Taiwan; South Korea; Brazil

Key companies profiled

Powertech Technology, Inc.; Amkor Technology Inc.; ASE Technology Holding Co.; ChipMOS Technologies Inc.; King Yuan Electronics Co., Ltd.; JCET Group Co., Ltd.; Hana Micron Inc.; UTAC Holdings Ltd.; Lingsen Precision Industries, Ltd.; Shenzhen CPET Electronics Co., Ltd.; Siliconware Precision Industries Co., Ltd.; Aehr Test Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Outsourced Semiconductor Assembly And Test Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and offers analysis of the latest qualitative as well as quantitative industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global outsourced semiconductor assembly and test services market report based on service type, application, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Assembly & Packaging

-

Ball Grid Array Packaging

-

Chip Scale Packaging

-

Multi-chip Packaging

-

Stacked Die Packaging

-

Quad-flat & Dual-inline Packaging

-

-

Testing

-

-

Application Outlook(Revenue, USD Billion, 2017 - 2030)

-

Telecommunication

-

Consumer Electronics

-

Industrial Electronics

-

Automotive

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global outsourced semiconductor assembly and test services market size was estimated at USD 37.22 billion in 2022 and is expected to reach USD 39.92 billion in 2023.

b. The global outsourced semiconductor assembly and test services market is expected to progress at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 67.92 billion by 2030.

b. The telecommunication segment accounted for the largest revenue share of more than 25% in 2022 in the outsourced semiconductor assembly and test (OSAT) services market and will maintain its dominance over the forecast period owing to the increasing demand for OSAT services for manufacturing of equipment such as analog and digital equipment, base transceiver stations, satellites, and multiplexers.

b. The key players in the outsourced semiconductor assembly and test services market are Jiangsu Changdian Technology Co., Ltd., Powertech Technology Inc., Siliconware Precision Industries, ASE Technology Holding Co, and Amkor Technology.

b. The growing demand for consumer electronics, continued electrification enhancements in next-generation electric vehicles, and the crucial role of semiconductor devices in industrial automation and smart manufacturing is propelling the market growth of OSAT services in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.