- Home

- »

- Display Technologies

- »

-

Outdoor LED Display Market Size & Share Report, 2030GVR Report cover

![Outdoor LED Display Market Size, Share & Trends Report]()

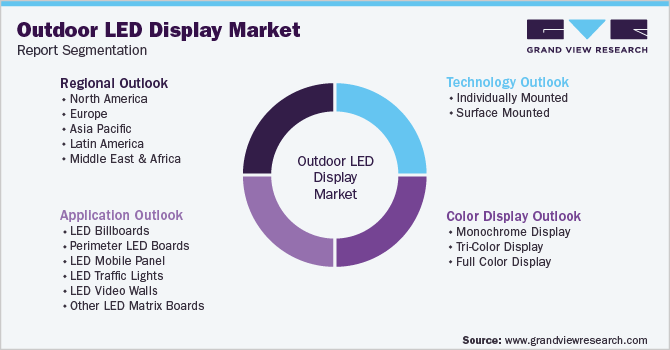

Outdoor LED Display Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Individually Mounted, Surface Mounted), By Color Display, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-538-0

- Number of Report Pages: 91

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Outdoor LED Display Market Summary

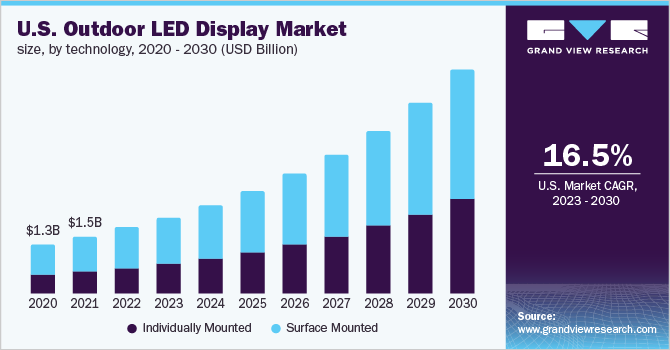

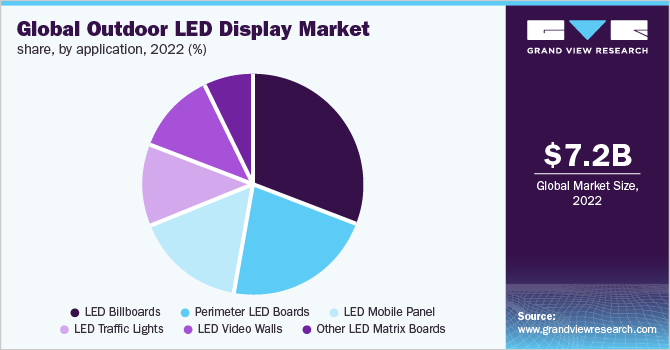

The global outdoor LED display market size was valued at USD 7236.9 million in 2022 and is projected to reach USD 23,381.5 million by 2030, growing at a CAGR of 15.9% from 2023 to 2030. The increasing demand for digital advertising and the rising popularity of large-scale events drive market growth.

Key Market Trends & Insights

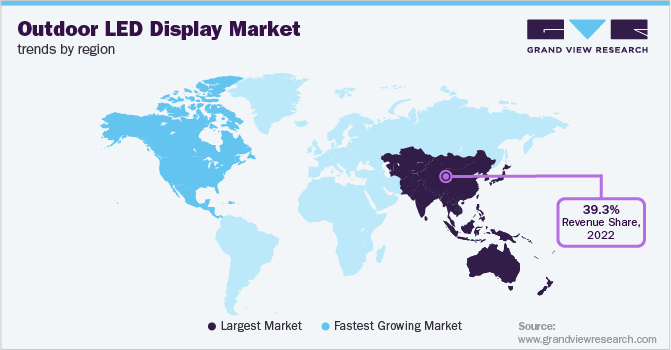

- Asia Pacific led the overall market in 2022, with a market share of 39.3%.

- The North America segment is anticipated to witness the fastest growth at a CAGR of 17.0% throughout the forecast period.

- By technology, the surface mounted segment dominated the overall market, gaining a market share of 59.9% in 2022.

- By color display, the full color display segment is expected to dominate in 2022, gaining a market share of 42.7%.

- By application, the LED billboards segment dominated the market, gaining a market share of 30.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7236.9 Million

- 2030 Projected Market Size: USD 23,381.5 Million

- CAGR (2023-2030): 15.9%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

The expansion of exhibitions and sports events, ceremonies, seminars, and other similar events are the key factors for the market for outdoor displays. Sponsors can more effectively present information about their company's products and reach a larger audience at a lower cost using displays at popular events to advertise and display their offerings to potential consumers. In addition, these displays provide a feasible medium for exhibiting dynamic data, which is relatively simpler to manage than static data, and the adaptability to implement instant changes in the displays while the events are taking place.

For instance, In February 2023, Daktronics Inc., a provider of visual communication and dynamic audio systems, partnered with Drexel University, in Pennsylvania, U.S. to manufacture and install an indoor audio system and twenty-two new LED displays at the university campus at the Daskalakis Athletic Center in Philadelphia, Pennsylvania. The installation features a five-display center-hung design completed ahead of the 2022 winter sports season. In January 2023, Daktronics Inc. collaborated with Qatari Diar and Lusail Boulevard to manufacture and install eight latest LED displays along Qatar's Lusail Commercial Boulevard. The displays were built along the main route to Lusail Stadium in the middle of 2023 and turned on in early September to display sponsors and other public messaging.

The increased use of advanced technology tools and devices in human lives in recent years has resulted in a strong demand for electronics, worldwide. Digital displays have grown increasingly important in a digital society, with tremendous improvements in display technology in the last decade along with the introduction of interactive displays that can take user commands via touch, stylus, or other peripheral devices. Interactive displays are widely used in various sectors for a wide range of applications and their demand is expected to increase in the near future, thanks to the growing set of applications, increased investments in R&D, increased gamification, growing digitization, rising internet penetration, and changing consumer preference for technologies.

COVID-19 Impact On The Outdoor LED Display Market

The COVID-19 pandemic had a negative impact on the global outdoor light-emitting diode display industry. In the face of the pandemic, new construction projects were delayed worldwide, impacting demand for various businesses. The pandemic also adversely affected the outdoor display market as a massive workforce across the globe was working from home. Many countries imposed or continue to impose lockdowns to control the spread of COVID-19. This disrupted the supply chain of different markets, including the outdoor light-emitting diode display market.

Display manufacturers were faced with difficulty in manufacturing and selling their products due to supply chain constraints in the early stages of the pandemic, affecting businesses in China, which is one of the leading display manufacturers. Furthermore, several businesses worldwide suffered significant losses, decreasing the need for outdoor advertising. The resulting reduction in spending on advertisements impacted the demand for outdoor displays. Outdoor traffic was curtailed due to stringent lockdown restrictions and people were obliged to stay at home for their safety. As a result, the need for outdoor advertising dropped significantly.

Technology Insights

In terms of technology, the market is classified into individually mounted and surface mounted. The surface mounted segment dominated the overall market, gaining a market share of 59.9% in 2022 and witnessing a CAGR of 15.3% during the forecast period. A surface mounted display is an electronic billboard or sign that is made up of a grid of LEDs that are fixed directly to a flat surface, usually a metal or plastic frame. The grid-like arrangement of the LEDs produces a sizable display that can show real-time text, pictures, and video. In contrast to individually installed displays, a surface mounted display's LED modules cannot be replaced, therefore if one LED breaks, the entire module must be changed. Despite this drawback, surface mounted displays are preferable to individually installed displays since they are lighter and simpler to install.

The individually mounted segment is anticipated to witness the fastest growth, at a CAGR of 16.7% throughout the forecast period. An individually mounted display is made up of a matrix of light-emitting diodes that are mounted on separate circuit boards or modules. A large display is then made using a grid arrangement of these modules. The display is frequently used for outdoor advertising, public information, and entertainment reasons and is capable of displaying text, photos, and video in real time. The growing need for huge displays with long viewing distances is projected to push commercial builders and retailers to use this technology.

Color Display Insights

In terms of color display, the market is classified into monochrome display, tri-color display, and full color display. Among these, the full color display market is expected to dominate in 2022, gaining a market share of 42.7%. It is expected to expand at the fastest CAGR of 17.0% throughout the forecast period. A full-color display is a form of electronic billboard or sign that consists of a matrix of light-emitting diodes that emit various hues of light. The benefit of a full-color display is that it can create realistic, high-quality images, which makes it perfect for use in settings where visibility is crucial, including indirect sunlight. Full-color displays, however, may be more expensive and difficult to maintain than monochrome or tri-color displays.

The tri-color segment is anticipated to expand at a considerable CAGR of 15.5% throughout the forecast period. Tri-color displays are frequently used for outdoor advertising, public education, and entertainment. Tri-color displays have the benefit of producing vivid, eye-catching images, which makes them perfect for usage in settings where visibility is crucial, including in direct sunlight. However, compared to monochrome displays, tri-color displays might be more expensive and difficult to maintain. Tri-color LEDs are generally utilized in indicator lamps that may indicate three statuses or circumstances.

Application Insights

In terms of application, the market is classified into perimeter LED boards, LED billboards, LED video walls, LED traffic lights, LED mobile panels, and other LED matrix boards. The LED billboards segment dominated the market, gaining a market share of 30.9% in 2022 and witnessing a CAGR of 16.8% during the forecast period. LED billboards are typically used for outdoor advertising, public education, and entertainment. LED billboards can be seen in a variety of places, such as on highways, in cities, and during sporting events. LED billboards provide a number of benefits over conventional printed billboards, including the capacity to show dynamic, animated material, the simplicity and speed with which the content may be changed, and the ability to operate continuously. As they consume less energy and have a longer lifespan than conventional billboards, they are also more environmentally friendly.

The LED video walls segment is anticipated to witness the fastest growth at a CAGR of 17.7% throughout the forecast period. LED video walls are enormous displays comprised of numerous individual LED panels put together to make one big screen. They are frequently used for digital signs, advertising, and broadcasting in public places including shopping malls, stadiums, and concert venues. Different configurations of LED video walls are possible, such as tiled formats with individually replaceable panels or fine pixel pitch formats with significantly smaller and closer-spaced LEDs that provide seamless, high-resolution images. They are quite adaptable, enabling unique and innovative displays.

Regional Insights

Asia Pacific led the overall market in 2022, with a market share of 39.3%. The demand for outdoor LED displays has witnessed a remarkable increase in Asia Pacific as the region has some of the world’s largest and fastest-growing economies, such as China, India, and Japan. The demand for digital signage solutions is growing in the retail and tourism industries with the growing popularity of outdoor entertainment. For instance, Seoul deploys LED displays to display schedules of music festivals, information about the artists, and event updates. Many businesses in Asia Pacific have invested in outdoor LED screens to provide real-time information on traffic information, emergency alerts, and weather details, among others.

The North America segment is anticipated to witness the fastest growth at a CAGR of 17.0% throughout the forecast period. The growth of the North American market can be attributed to factors such as the growing adoption of digital signage, rising technological advancements, and increasing spending on media and advertising. With the rise of digital technology, businesses are innovating techniques to reach target audiences with the help of outdoor LED displays. Advancements in LED technology have enabled vendors to offer high quality displays that are bright, energy-efficient, and have a long lifespan. The proliferation of smart city solutions has increased in North America as several countries are implementing digital signage to provide real-time information to citizens. Outdoor LED displays are widely used in transportation hubs such as airports and train stations to inform passengers of flight schedules, arrivals and departures, and other important updates.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in an LED display used for billboards, video walls, etc., which has intensified the competition among these players. These players are focusing on partnership and collaboration to gain a competitive edge over their peers and capture a significant market share. For instance, in February 2023, Daktronics Inc. partnered with Drexel University to install and manufacture an indoor audio system and 22 new LED displays at the campus of Daskalakis Athletic Center in Philadelphia, Pennsylvania. The installation featured a five-display center-hung design completed ahead of the 2022 winter sports season. Some of the prominent players in the global outdoor LED display market:

-

Barco

-

Daktronics Inc.

-

Electronic Displays Inc.

-

LG Electronics

-

Panasonic Holdings Corporation

-

Sony Corporation

-

Toshiba Corporation

-

LEYARD

-

Lighthouse Technologies Limited

-

Shenzhen Dicolor

-

Optoelectronics Co. Ltd

Outdoor LED Display Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8,311.0 million

Revenue forecast in 2030

USD 23,381.5 million

Growth rate

CAGR of 15.9% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, color display, application, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Mexico; Brazil

Key companies profiled

Barco; Daktronics Inc.; Electronic Displays Inc.; LG Electronics; Panasonic Holdings Corporation; Sony Corporation; Toshiba Corporation; LEYARD; Lighthouse Technologies Limited; Shenzhen Dicolor; Optoelectronics Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Outdoor LED Display Market Segmentation

This report forecasts market shares and CAGR at global, regional, as well as country levels and offers market trends analysis on each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global outdoor LED display market report based on technology, color display, application, and region.

-

Technology Outlook (Revenue, USD Million; 2017 - 2030)

-

Individually Mounted

-

Surface Mounted

-

-

Color Display Outlook (Revenue, USD Million; 2017 - 2030)

-

Monochrome Display

-

Tri-Color Display

-

Full Color Display

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

LED Billboards

-

Perimeter LED Boards

-

LED Mobile Panel

-

LED Traffic Lights

-

LED Video Walls

-

Other LED Matrix Boards

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global outdoor LED display market size was estimated at USD 7236.9 million in 2022 and is expected to reach USD 8,311.0 million in 2023.

b. The global outdoor LED display market is expected to grow at a compound annual growth rate of 15.9% from 2023 to 2030 to reach USD 23,381.5 million by 2030.

b. Asia Pacific dominated the outdoor LED display market with a share of 39.3% in 2022. This is attributable to the rise in investments by established companies for improving viewer experience and surge in promotional and sports activities.

b. Some key players operating in the outdoor LED display market include Sony, LG Electronics, Toshiba, Panasonic, Daktronics, Electronic Displays, Shenzhen Dicolor Optoelectronics Co Ltd, Barco NV, Leyard Optoelectronic Co Ltd, Lighthouse Technologies Ltd, and Barco NV.

b. Key factors that are driving the market growth include increasing display advertisement in the mall, the growing number of sports activities combined with increasing promotional activities of corporate brands, environmental friendliness, impact resistance, and energy efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.