- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Optical Coating Market Size, Share And Growth Report, 2030GVR Report cover

![Optical Coating Market Size, Share & Trends Report]()

Optical Coating Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Product (Reflective Coatings, Filter Coatings), By Application (Solar), By Region, And Segment Forecasts

- Report ID: 978-1-68038-740-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Coating Market Summary

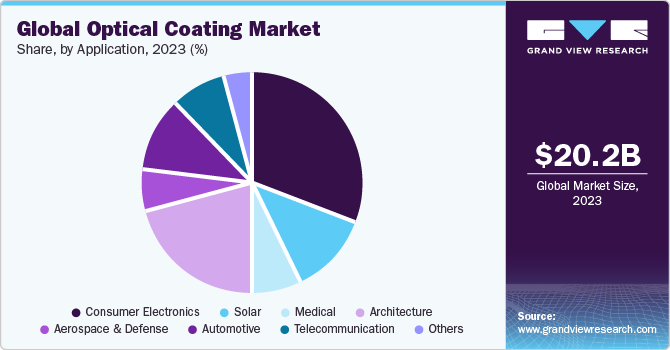

The global optical coating market size was estimated at USD 20.20 billion in 2023 and is projected to reach USD 37.58 billion by 2030, growing at a CAGR of 9.2% from 2024 to 2030. Recent technological advancements in the field of optical deposition techniques and fabrication coupled with rising demand for efficient optical devices in end-use applications are expected to drive the market over the forecast period.

Key Market Trends & Insights

- North America dominated the global optical coating market with the largest revenue share of 37.0% in 2023.

- Country-wise, the optical coating market in India is accounted for the largest market revenue share in Asia Pacific in 2023.

- By application, the consumer electronics segment led the market with the largest revenue share of more than 31.0% in 2023.

- By product, the anti-reflective segment led the market with the largest revenue share of more than 29.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 20.20 Billion

- 2030 Projected Market Size: USD 37.58 Billion

- CAGR (2024-2030): 9.2%

- Largest Market: North America

These products are being increasingly used in numerous applications including architecture, consumer electronics, solar panels, automotive, medical, telecommunication, and military and defense.

The rapid growth of the solar PV market, driven by the increasing focus on the generation of clean energy, and rising demand for consumer electronics is expected to fuel the market growth. Reflective coatings are mainly used in construction, telecommunication, and space applications. The growing use of reflective coatings in green buildings for heat retention and reducing energy consumption is expected to drive its demand over the forecast period. In addition, the increasing usage of handheld consoles, coupled with rising demand for portable consumer electronics, is expected to propel market growth over the forecast period.

Price volatility of raw materials is one of the major factors affecting the prices of optical coating. It leads to a decrease in profitability for manufacturers and increases the market costs of these products, thus restraining market growth. Although prices of metals have witnessed a declining trend over the past few years, sudden variations in prices can lead to a negative impact, thus affecting market growth.

Changes in the price of precious metals used for high-end applications, especially gold and platinum, significantly affect the overall cost of the application, thus impacting the product demand. The recent outbreak of COVID-19 is hampering the product demand in various applications including automotive, telecommunication, solar, aerospace and defense, architecture, and others owing to the stalled manufacturing activities, restrictions in supply, and transportation, and economic slowdown across the globe.

Market Concentration & Characteristics

Market growth stage is high and pace of the growth is accelerating. The global optical coatings market is characterized by a high degree of innovation. Ongoing research and development (R&D) activities for new sustainable coatings techniques, nanostructured coatings, magnetron sputtering, and other advances in coating design and simulation, among others, drive innovations in production.

The manufacturing and utilization of optical coatings are subject to a myriad of regulations and standards aimed at safeguarding the safety and quality of the coatings used. While regulatory specifics may diverge contingent on country or region, there exist overarching regulatory frameworks governing the industry. Key regulatory bodies and organizations overseeing the market include The Vision Council, OFH, The International Society for Optics and Photonics, and ISO, among others.

End-user concentration plays a pivotal role in shaping the dynamics of the global optical coating market. With a multitude of product manufacturers increasingly incorporating these products into their formulations, there's a tendency towards larger volume purchases. This trend can engender economies of scale for suppliers of the product, potentially yielding cost efficiencies in both production and distribution processes. Moreover, heightened end-user concentration often fosters enduring relationships between suppliers of the product and major players in the end-use industries. This stability lays the groundwork for collaborative ventures, mutual comprehension, and the establishment of enduring business partnerships.

Most of the key players have integrated their raw material production and distribution operations to maintain product quality and expand regional outreach. This provides companies with a competitive advantage in the form of cost benefits, thus increasing their profit margin. Companies focus on research and development activities to develop new products to sustain market competition and changing end-user requirements. Research activities focused on new materials that combine several properties are projected to gain wide acceptance in the industry in the coming years.

Technological Insights

Vacuum deposit technology is used within a vacuum environment to deposit thin films onto a substrate. It entails heating a solid or gaseous material source to produce an ionized or vaporized form. A thin film layer is then formed on the substrate when this vapor condenses. Common methods for vacuum deposition include chemical vapor deposition (CVD) and physical vapor deposition (PVD), such as evaporation and sputtering. With this technology, one may precisely regulate the qualities, content, and thickness of the film. It is widely used in the coating, electronics, and optical sectors to produce high-quality thin films used in protective layers, optical coatings, and semiconductors.

Application Insights

The consumer electronics application segment led the market and accounted for a revenue share of more than 31.0% in 2023. Rapidly growing demand for smartphones and rising consumer disposable income are factors anticipated to propel the segment growth over the forecast period. Furthermore, technological advancements in the field of smart televisions and smart consumer devices, including smartwatches and smartphones, are anticipated to positively affect the market over the forecast period. In addition, increased demand for multipurpose devices and the growing number of key players are expected to propel the product demand over the forecast period.

Infrared and anti-reflective coatings are widely used in the electronics industry owing to the rising demand for superior optical display and impact resistance properties. The growing semiconductor industry, coupled with technological advancements, is expected to increase the demand for these optical coatings over the forecast period. However, reducing discretionary spending aimed at COVID-19 across the globe is impacting the demand for consumer electronics products. This in turn is further anticipated to hamper the demand for optical coatings in consumer electronics products. In the automotive industry, it is used in speedometer displays owing to its high impact resistance and abrasion resistance. The rising use of optical coatings in numerous automobile components including gear knob tops, car windows, windshields, and headlight lenses is anticipated to drive the growth of the market over the forecast period. In addition, UV-resistant and abrasion-resistant coatings are used for components in the automobile industry.

Product Insights

The anti-reflective product segment led the market and accounted for a revenue share of more than 29.0% in 2023. Anti-reflective coatings are thin-film optical coatings that consist of multiple layers of coatings with different refractive indexes between each layer. The thickness of every layer is designed to cause self-extinguishing interference for light beams reflected by the surface. This makes it suitable for magnifying lenses, display screens, camera lenses, and eyeglasses wherein they are used on glass and plastic substrates.

Growing demand for anti-reflective coatings for the construction of photovoltaic solar panels, automotive displays, windows, and GPS navigation systems is expected to propel the growth of the market over the forecast period. The conductive coatings product segment is expected to witness significant growth over the forecast period owing to the large-scale usage of solar panels. Rising emphasis on the development of alternate energy sources, coupled with huge investments in solar energy generation by countries such as India, the U.S., and China, is likely to propel the growth in the coming years. Furthermore, increased usage in display windows, solar panels, heaters, LCD fabrication, heads-up display, shielding for radio frequency interference, LED displays, and instrument display windows are anticipated to support market growth over the forecast period.

Regional Insights

North America dominated the optical coating market and accounted for a revenue share of more than 37.0% in 2023. North America is a major manufacturing hub for mid-scale and small-scale medical equipment companies, which is expected to propel the demand for optical coatings over the forecast period. In addition, the strong presence of industries like instrumentation, microelectronics, biotechnology, and software development and advancements in the medical devices sector will ultimately lead to increased demand for optical coatings over the forecast period.

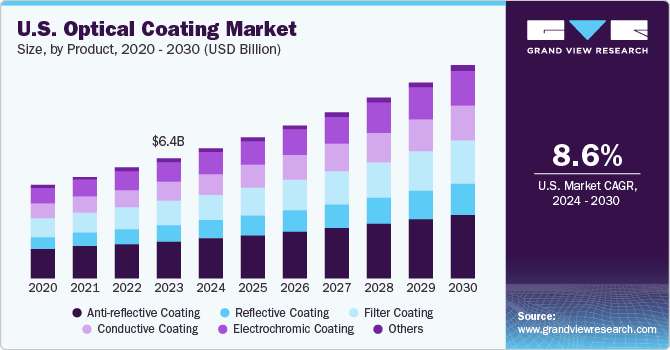

U.S. Optical Coating Market Trends

The growing solar industry in the U.S. and the focus on developing domestic industries are driving the demand in this region. An increase in the U.S. defense budget is creating strong growth potential for reflective coating products in the aerospace and defense segment. Additionally, the strong presence of industries like instrumentation, microelectronics, biotechnology, and software development, along with advancements in the medical devices sector, is expected to lead to increased demand for optical coatings over the forecast period.

The optical coating market in Canada is influenced by several key factors. Firstly, the price volatility of raw materials, particularly precious metals like gold and platinum, significantly impacts the overall cost of the application, thus affecting the demand for optical coatings. Sudden variations in prices can lead to a negative impact, restraining market growth and decreasing profitability for manufacturers.

Europe Optical Coating Market Trends

Growth in residential projects owing to a huge influx of migrants in Western Europe and Nordic countries including Germany, Netherlands, Denmark, Finland, and Sweden is expected to augment demand for optical coating in the construction sector. The growing need to maintain the interior temperature of the buildings and the emphasis on constructing energy-efficient green buildings is expected to propel the regional market growth in the forthcoming years.

The Germany optical coating market is influenced by several key factors. The price volatility of raw materials, particularly precious metals like gold and platinum, significantly impacts the overall cost of the application, thus affecting the demand for optical coatings. Sudden variations in prices can lead to a negative impact, restraining market growth and decreasing profitability for manufacturers.

The optical coating market in the UK the rise in utilization of consumer electronics, coupled with the emergence of new technologies in smartphones, tablets, TVs, and computers, is expected to drive the demand for optical coatings in the UK.

Asia Pacific Optical Coating Market Trends

The consistent demand from numerous end-use industries, including the automotive, healthcare, and electronics industries, is driving the demand for optical coatings in Asia Pacific. The expansion of the automotive sector, which uses optical coatings for cutting-edge safety features, is a significant driver for the regional market growth.

The China optical coating market in China is expected to be driven by the country's sizable population, expanding middle class, and growing urbanization. This trend is expected to persist as the region's desire for smart devices and cutting-edge automobile technologies increases.

The optical coating market in India is expected to account for a significantly large revenue share during the forecast period due to the rising demand for optical coatings across a range of end-use industries, including aerospace, defense, and healthcare.

Key Optical Coating Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In October 2022, Schott AG and Edmund® Optics extended their partnership to provide designers an easy access to thin coated optical filter glass with reduced lead times.

-

In June 2022, PPG Industries Inc. and Meta Materials announced their collaboration to create multi-functional, lightweight, and high-index smart lenses for eyewear, thus a major contribution in the market of optical coating.

-

In January 2022, Alluxa Inc. introduced a groundbreaking capability in extending the optical range performance with next-generation SIRRUS plasma physical vapor deposition (PVD) platform for optical filters.

Key Optical Coating Companies:

The following are the leading companies in the optical coating market. These companies collectively hold the largest market share and dictate industry trends.

- Alluxa, Inc.

- Cascade Optical Corporation

- Chroma Technology Crop.

- Inrad Optics

- Optical Coatings Japan

- PPG Industries Inc.

- Viavi Solutions

- Schott AG

- Abrisa Technology

- Berliner Glas

Optical Coating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.05 billion

Revenue forecast in 2030

USD 37.58 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; South Korea; Brazil

Key companies profiled

Alluxa, Inc.; Cascade Optical Corporation; Inrad Optics; Schott AG; PPG Industries Inc.; Chroma Technology Corp; Optical Coatings Japan; Viavi Solutions; Abrisa Technologies; Berliner Gas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

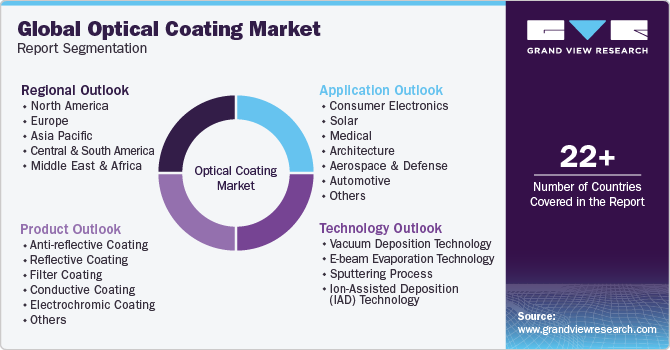

Global Optical Coating Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical coating market report based on technology, product, application, and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vacuum Deposition Technology

-

E-beam Evaporation Technology

-

Sputtering Process

-

Ion-Assisted Deposition (IAD) Technology

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anti-reflective Coating

-

Reflective Coating

-

Filter Coating

-

Conductive Coating

-

Electrochromic Coating

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Solar

-

Medical

-

Architecture

-

Aerospace & Defense

-

Automotive

-

Telecommunication

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Netherlands

-

Poland

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

Malaysia

-

Australia

-

Thailand

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Qatar

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global optical coating market size was estimated at USD 20.20 billion in 2023 and is expected to reach USD 22.05 billion in 2024.

b. The global optical coating market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 37.5 billion by 2030.

b. The anti-reflective product segment led the market and accounted for a revenue share of more than 29.0% in 2023. Anti-reflective coatings are thin-film optical coatings that consist of multiple layers of coatings with different refractive indexes between each layer. The thickness of every layer is designed to cause self-extinguishing interference for light beams reflected by the surface. This makes it suitable for magnifying lenses, display screens, camera lenses, and eyeglasses wherein they are used on glass and plastic substrates.

b. The consumer electronics application segment led the market and accounted for a revenue share of more than 31.0% in 2023. Rapidly growing demand for smartphones and rising consumer disposable income are factors anticipated to propel the segment growth over the forecast period.

b. North America dominated the optical coatings market and accounted for a revenue share of more than 37.0% in 2023. The growing solar industry in U.S. and focus on developing domestic industries are driving the demand in this region

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.