- Home

- »

- Advanced Interior Materials

- »

-

Optical Coating Equipment Market Size & Share Report 2030GVR Report cover

![Optical Coating Equipment Market Size, Share & Trends Report]()

Optical Coating Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Filter Coatings, Reflective Coatings), By Technology (Ion Beam Sputtering, Evaporation Deposition), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Coating Equipment Market Trends

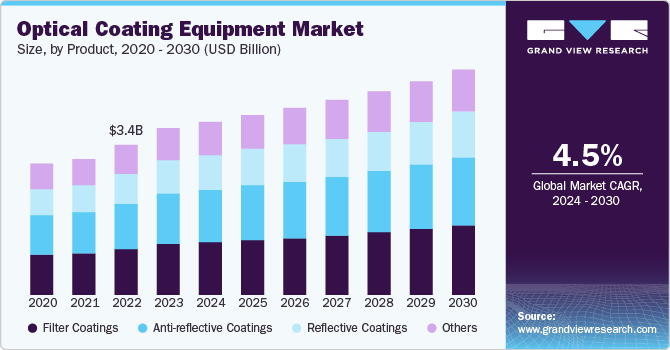

The global optical coating equipment market size was estimated at USD 3.81 billion in 2023 and is anticipated to grow at a CAGR of 4.5% from 2024 to 2030. A major driver is the rising demand for optical components in various applications, including telecommunications, consumer electronics, and aerospace. As technology advances, there is an increasing need for high-performance optical coatings that enhance the functionality of lenses, mirrors, and filters, leading to greater investment in coating equipment.

The expansion of industries such as healthcare and automotive, where precision optics play a crucial role, further boosts demand for advanced optical coatings. The growing trend toward miniaturization and integration of optical systems into compact devices also necessitates sophisticated coating technologies that can deliver high-quality results in smaller form factors.

Drivers, Opportunities & Restraints

Ongoing innovations in materials and coating processes are enhancing the capabilities of optical coating equipment, allowing manufacturers to produce more complex and effective coatings. Environmental considerations are also driving market growth as industries seek sustainable solutions and materials that meet regulatory standards.

A significant restraint is the high initial investment and operational costs associated with advanced coating equipment. This can deter smaller manufacturers from entering the market or expanding their capabilities, limiting overall market growth.

The increasing demand for cutting-edge applications, such as augmented reality (AR) and virtual reality (VR), opens new avenues for optical coatings, driving the need for innovative equipment. The expanding telecommunications sector, particularly with the rollout of 5G technology, also presents significant growth potential as more sophisticated optical components are required.

Product Insights

“The reflective coatings segment is expected to grow at a significant CAGR of 4.9% from 2024 to 2030 in terms of revenue”

Reflective coatings are experiencing an increase in demand due to their essential role in improving energy efficiency in applications such as solar panels and lighting systems. The rising focus on renewable energy sources is pushing demand for reflective coatings that maximize light absorption and reduce energy loss, making them vital for both commercial and residential applications.

The filter coatings segment dominated the market in 2023, accounting for a 30.5% market share. Filter Coatings are driven by the growing need for precise optical filtering in various applications, including imaging systems, medical devices, and consumer electronics. As technologies advance, the demand for specialized filter coatings that enhance performance and reduce interference is increasing, particularly in sectors where color accuracy and light transmission are crucial.

Technology Insights

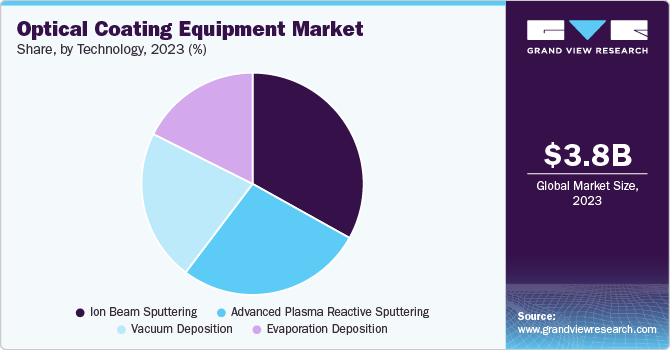

The demand for the advanced plasma reactive sputtering segment is expected to grow at a rapid CAGR of 5.2% from 2024 to 2030 in terms of revenue”

Advanced plasma reactive sputtering is increasingly sought after for its versatility and ability to create complex multilayer coatings with superior adhesion and durability. The demand for innovative solutions in aerospace and electronics, where performance under extreme conditions is required, fuels interest in this advanced technology.

The ion beam sputtering segment accounted for 33.1% of the market share in 2023, driven by increasing industrial activity and urban development, which often lead to Ion Beam Sputtering contamination through the release of pollutants such as heavy metals, hydrocarbons, and toxic chemicals. As industries expand and urban areas develop, the demand for cleaning and restoring contaminated Ion Beam Sputtering to make it suitable for reuse or development grows.

End Use Insights

The growth of telecommunications segment is expected to grow at a significant CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The demand for optical coating equipment in the telecommunications sector is growing. This growth is driven by the need for high-performance optical components that enable faster data transmission and improved network reliability. The expansion of 5G infrastructure and the increasing demand for bandwidth create significant opportunities for optical coatings that enhance signal clarity and reduce loss.

The electronics segment held 26.4% of the market share in 2023, propelled by the rapid development of smart devices, displays, and wearable technologies. The integration of advanced optics in consumer electronics drives the need for high-quality coatings that improve visual performance and durability, fostering continuous innovation in the optical coating segment

Regional Insights

North America optical coating equipment market is driven by significant technological advancements and innovation. The region is home to major players in the aerospace, automotive, and electronics industries, which require high-quality optical coatings for various applications. The emphasis on research and development fosters an environment conducive to adopting advanced coating technologies. Moreover, the increasing demand for smart devices and high-speed telecommunications infrastructure supports growth in this sector, particularly with the rollout of 5G networks.

Asia Pacific Optical Coating Equipment Market Trends

“India to witness the fastest market growth at 6.1% CAGR”

The optical coating equipment market in Asia Pacific is growing due to rapid industrialization and urbanization in the region. The region is a hub for semiconductor manufacturing and electronics production, which creates a strong demand for high-performance optical coatings. Additionally, the increasing adoption of advanced technologies such as 5G, IoT, and AI is spurring investment in telecommunications and electronics, leading to a growing need for optical components. The expanding renewable energy sector, particularly solar power, is also driving demand for reflective and filter coatings in solar applications.

India optical coating equipment market is estimated to grow at a CAGR of 6.1% over the forecast period.The rapid growth of the electronics and semiconductor industries in India is a major catalyst. As the country aims to enhance its manufacturing capabilities, there is increasing demand for high-quality optical components, leading to a greater need for advanced optical coatings. Moreover, the rise of the renewable energy sector in the country, particularly solar energy, is significant. India’s commitment to expanding its solar capacity creates demand for reflective and anti-reflective coatings that improve the efficiency of solar panels.

Europe Optical Coating Equipment Market Trends

The optical coating equipment market in Europe is growing due to stringent regulations regarding energy efficiency and sustainability. The EU's focus on renewable energy and reducing carbon emissions enhances the demand for reflective coatings in solar and energy-efficient applications. Furthermore, Europe’s strong automotive industry is increasingly integrating advanced optics into vehicle systems, driving the need for innovative optical coatings. The presence of well-established research institutions and a commitment to technological advancement also support the growth of optical coating technologies across various industries.

Key Optical Coating Equipment Company Insights

Some of the key players operating in the market include ENTACT and WSP among others.

-

Mustang Vacuum Systems is a global manufacturer of vacuum deposition equipment based in Sarasota, Florida. Additionally, its offerings include batch metallizers, sputtering systems, optical coating units, tribological coating equipment, physical vapor deposition systems, coaters for glass and rigid substrates, and roll-to-roll machines for flexible substrates. The company’s products serve various applications, such as thin film solar, medical coatings, decorative finishes, automotive, and hard coatings. Mustang's global reach is supported by a skilled team of sales and service representatives and a network of distributors.

-

Optimax Systems, Inc. has been engaged in optics since 1991 and employs resources to manufacture and enhance various technologies, such as solid-state lighting, fiber optic telecommunications, displays, diagnostic medicine, and digital photography. The company has been involved in critical programs across aerospace, government research, and defense, with the successes of its customers driving its growth.

Key Optical Coating Equipment Companies:

The following are the leading companies in the optical coating equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Mustang Vacuum Systems.

- Optimax Systems, Inc

- Optorun Co., Ltd.

- Alluxa inc.

- Buhler Holding AG

- Coburn Technologies, Inc.

- OptoTech Optikmaschinen GmbH

- Inrad Optics,

- Nippon Sheet Glass Co. Ltd.

- Newport Corporation

- Cutting Edge Coatings GmbH

- Dongguan Huicheng Vacuum Technology Co., Ltd.

- Dynavac

- Evatec AG

Recent Developments

-

In May 2023, Finnish Atomic Layer Deposition (ALD) equipment manufacturer Beneq formed a partnership with Lung Pien Vacuum Industry Co., Ltd., a vacuum coating equipment producer based in Taiwan. The two companies will work together to develop and actively promote ALD coating technology, specifically for high-end curved lenses in Taiwan’s optical market. ALD technology enables the creation of uniform conformal thin film layers for complex structures, making it particularly suitable for premium optical applications.

-

In January 2023, Researchers at Fraunhofer Institute for Applied Optics and Precision Engineering IOF developed an optical coating system that prevents fogging and reduces reflections, enhancing lidar performance in autonomous vehicles. The coating combines a polymer film acting as a water reservoir with porous silicon dioxide nanostructures minimizing reflections. Known as AR-plas2, this multilayer system demonstrated low reflectance without compromising antifog properties in lab tests. The technology has potential applications in lighting, quantum computing, and various materials.

Optical Coating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.95 billion

Revenue forecast in 2030

USD 5.14 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil,

Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Mustang Vacuum Systems, Optimax Systems, Inc, Optorun Co., Ltd., Alluxa inc., Buhler Holding AG, Coburn Technologies, Inc., OptoTech Optikmaschinen GmbH, Inrad Optics, Nippon Sheet Glass Co. Ltd., Newport Corporation, Cutting Edge Coatings GmbH, Dongguan Huicheng Vacuum Technology Co., Ltd., Dynavac, Evatec AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

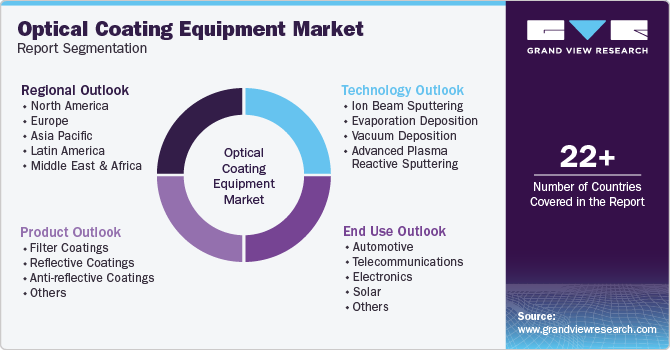

Global Optical Coating Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical coating equipment market based on product, technology, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Filter Coatings

-

Reflective Coatings

-

Anti-reflective Coatings

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ion Beam Sputtering

-

Evaporation Deposition

-

Vacuum Deposition

-

Advanced Plasma Reactive Sputtering

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Telecommunications

-

Electronics

-

Solar

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global optical coating equipment market size was estimated at USD 3.81 billion in 2023 and is expected to reach USD 3.95 billion in 2024.

b. The global optical coating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 and reach USD 5.14 billion by 2030.

b. The electronics segment dominated the market in 2023, accounting for 26.4% of the market share in 2023. The demand for optical coating equipment in the electronics sector is rapidly increasing due to the rising need for high-performance displays and advanced imaging systems in smart devices. As manufacturers seek to enhance optical performance and durability, innovative coatings are becoming essential for improving device functionality and user experience.

b. Some of the key players operating in the optical coating equipment market are Mustang Vacuum Systems, Optimax Systems, Inc, Optorun Co., Ltd., Alluxa inc., Buhler Holding AG, Coburn Technologies, Inc., OptoTech Optikmaschinen GmbH, Inrad Optics, Nippon Sheet Glass Co. Ltd., Newport Corporation, Cutting Edge Coatings GmbH, Dongguan Huicheng Vacuum Technology Co., Ltd., Dynavac, and Evatec AG.

b. The optical coating equipment market is experiencing growth driven by rising demand for high-performance optical components across telecommunications, consumer electronics, and aerospace. Key factors include advancements in technology, expansion in the healthcare and automotive industries, the trend toward miniaturization, and ongoing innovations in materials and processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.