- Home

- »

- Next Generation Technologies

- »

-

Online Tutoring Services Market Size, Industry Report, 2030GVR Report cover

![Online Tutoring Services Market Size, Share & Trends Report]()

Online Tutoring Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Course Type (Language, STEM), By Duration (Short-Term Courses, Long-Term Courses), By Tutoring Style, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-202-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Tutoring Services Market Summary

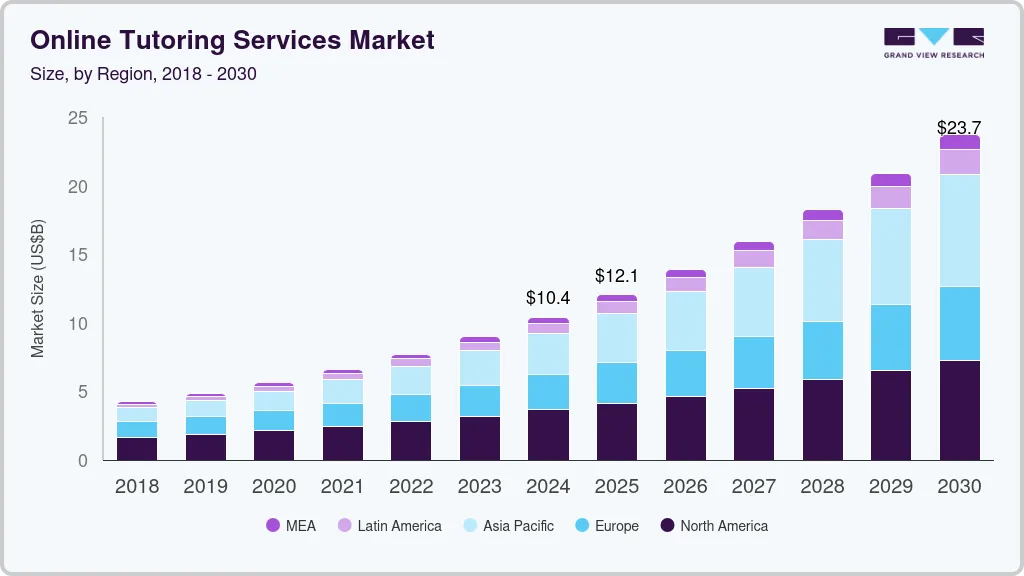

The global online tutoring services market size was estimated at USD 10.42 billion in 2024 and is projected to reach USD 23.73 billion by 2030, growing at a CAGR of 14.5% from 2025 to 2030. This growth is primarily driven by the increasing demand for flexible, on-demand learning solutions as students and professionals seek to enhance their skills and knowledge online.

Key Market Trends & Insights

- North America online tutoring services market dominated with a revenue share of over 35% in 2024.

- The U.S. online tutoring services market is poised for substantial growth in 2024.

- By tutoring type, The on-demand tutoring segment led the online tutoring services industry in 2024, accounting for over 76% share of the global revenue.

- By course type, The Science, Technology, Engineering, and Mathematics (STEM) courses segment accounted for the largest revenue share in online tutoring services market in 2024

- By duration, The long-term courses segment accounted for the largest revenue share in online tutoring services industry in 2024

Market Size & Forecast

- 2024 Market Size: USD 10.42 Billion

- 2030 Projected Market Size: USD 23.73 Billion

- CAGR (2025-2030): 14.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The proliferation of smartphones and high-speed internet has made it easier to access tutoring platforms, which are increasingly incorporating interactive technologies like AI to personalize learning experiences. Additionally, the COVID-19 pandemic accelerated the shift toward online education, with many institutions integrating digital learning tools into their curriculum.

Beyond the flexibility and accessibility that online tutoring services industry provides, the rise in demand for specialized learning and test preparation is significantly driving the market’s growth. Many students seek additional support for competitive exams such as SAT, GRE, and GMAT, and online tutoring platforms are well-positioned to cater to this need with on-demand and targeted learning modules. Moreover, parents and guardians increasingly invest in online tutoring services for personalized educational support, seeing it as a valuable supplement to traditional schooling. Advanced technologies such as AI-driven analytics also allow for personalized progress tracking, which improves outcomes and engagement.

The increasing prevalence of online education platforms in emerging economies, majorly in regions with limited access to quality education, is driving the market growth. In areas where physical infrastructure for quality tutoring is lacking, online tutoring is a cost-effective solution that reaches a broad student base. Government initiatives promoting digital literacy and education are further boosting online tutoring adoption, especially in countries such as India and Brazil. Additionally, collaborations between educational institutions and online tutoring companies are making these services more affordable and accessible to students.

Tutoring Type Insights

The on-demand tutoring segment led the online tutoring services industry in 2024, accounting for over 76% share of the global revenue due to its ability to offer flexible, immediate support tailored to individual student needs. This segment allows students to access tutoring at any time, providing a highly convenient solution for busy schedules and urgent academic requirements. The appeal of on-demand services lies in their adaptability, as students can focus on specific subjects or problem areas without committing to long-term courses. Furthermore, the rise of mobile apps and digital platforms has made on-demand tutoring easily accessible, mainly for younger students who are used to instant digital resources.

The structured tutoring segment is predicted to foresee significant growth in the forecast years due to its comprehensive and systematic approach to learning, which allows students to seek more consistent academic improvement. Structured programs follow a set curriculum and provide continuity, making them useful for long-term goals such as mastering a subject or preparing for major exams. These programs also incorporate regular assessments, progress tracking, and dedicated tutors, which foster a stable learning environment and measurable results. As demand for in-depth, goal-oriented educational support rises, structured tutoring is well-positioned to expand within the online tutoring market.

Course Type Insights

The Science, Technology, Engineering, and Mathematics (STEM) courses segment accounted for the largest revenue share in online tutoring services market in 2024 due to the growing demand for skills and expertise in these high-impact fields. STEM courses are highly sought after by students aiming for competitive careers in technology, engineering, and scientific research, which are crucial sectors in today's innovation-driven economy. Additionally, the rapid advancements in technology have created an increased need for specialized knowledge, prompting students to seek supplementary support in complex subjects such as coding, data science, and robotics. Online tutoring platforms meet this need by offering specialized STEM courses and personalized support, making these subjects more accessible and manageable for students.

The language courses segment is expected to showcase significant growth over the forecast period, driven by globalization and the rising importance of multilingual skills in the international job market. As companies expand globally, there is a growing need for professionals proficient in multiple languages, making language learning a valuable asset for career advancement. Additionally, increased migration and travel have contributed to a demand for language skills for both personal and professional communication. Online tutoring platforms make language learning more accessible and flexible, enabling users to learn at their own pace with native-speaking tutors or AI-driven programs.

Duration Insights

The long-term courses segment accounted for the largest revenue share in online tutoring services industry in 2024 due to the growing demand for structured, in-depth learning pathways that lead to substantial knowledge gains and skill development. Long-term courses are in demand as students prepare for academic qualifications, professional certifications, or career advancement, as these programs offer a comprehensive curriculum and steady progress. Additionally, parents and educators often favor long-term courses for school-aged students, seeing them as effective for building a strong foundation across subjects. Many online platforms have adapted to this demand by offering long-term subscriptions or memberships, which allow students to access a full suite of learning resources over an extended period.

The short-term courses segment is expected to experience significant growth in the coming years, driven by the rising demand for quick, flexible learning options that address specific skills or topics. These courses allow students and professionals who want to enhance their knowledge or acquire new skills without committing to long-term programs. With the fast-paced evolution of industries, many learners seek short-term courses to stay updated on the latest trends, tools, and technologies, especially in fields such as digital marketing, data analytics, and programming. Additionally, online platforms are expanding their catalog of micro-courses and certification programs, enabling learners to achieve targeted outcomes in a shorter timeframe.

Tutoring Style Insights

The subject tutoring service segment accounted for the largest revenue share in 2024 due to its ability to address the specific academic needs of students across a wide range of disciplines. The subject tutoring service allows students to focus on particular subjects where they may be struggling or need additional support, such as mathematics, science, or language arts. With personalized instruction, students can receive targeted assistance to improve their grades, understanding, and performance in school. The rise of online platforms has made it easier for students to access subject-specific tutors, offering convenience and flexibility in scheduling.

The test preparation service segment will witness significant growth in the coming years in the online tutoring services industry due to the increasing emphasis on standardized testing for academic admissions, scholarships, and professional certifications. As competitive exams such as the SAT, GRE, GMAT, and professional qualification tests become pivotal in shaping educational and career outcomes, students are seeking specialized tutoring to improve their performance. The rise of online platforms offering flexible, personalized test prep services makes it easier for students to access tailored study plans, practice tests, and expert guidance. Additionally, the growing number of international students applying to universities worldwide increases the demand for test preparation services to meet varying academic standards.

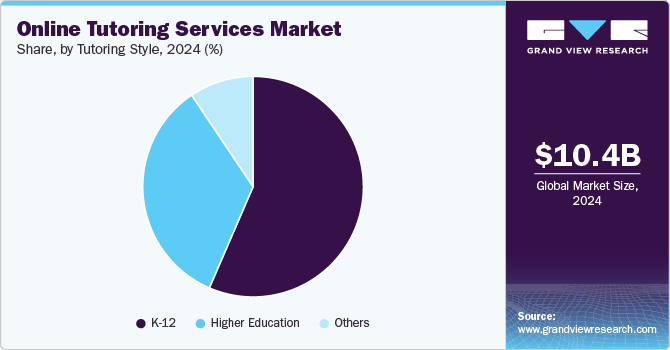

End Use Insights

The K-12 segment accounted for the largest market revenue share in 2024 due to the increasing demand for supplementary education services that support students from kindergarten through high school. As parents and educators prioritize academic success, there is a growing reliance on online tutoring to help students improve their performance in core subjects such as mathematics, reading, and science. The shift towards digital learning, accelerated by the pandemic, has also contributed to the rapid adoption of online tutoring platforms for K-12 students. These services provide personalized, flexible learning experiences that can cater to different learning styles and paces, ensuring better outcomes.

The higher education segment is expected to witness significant growth in the coming years due to the increasing demand for specialized knowledge and skill development in fields such as technology, healthcare, business, and engineering. As students pursue advanced degrees and certifications to remain competitive in the job market, there is a rising need for supplemental tutoring and academic support in challenging subjects. Online platforms offer flexible, accessible learning options, allowing college and university students to receive tailored assistance outside traditional classroom environments. Additionally, the global shift toward online and hybrid learning models in higher education is boosting the demand for virtual tutoring services.

Regional Insights

North America online tutoring services market dominated with a revenue share of over 35% in 2024. The region has a high concentration of tech-savvy consumers, with widespread access to the internet and digital devices, making online education more accessible. Additionally, there is a strong demand for academic support across various education levels, mainly in K-12 and higher education, where students and parents prioritize academic success and career readiness. The presence of leading online tutoring platforms and educational technology companies in North America has also contributed to market growth, providing innovative solutions that cater to diverse learning needs.

U.S. Online Tutoring Services Market Trends

The U.S. online tutoring services market is poised for substantial growth in 2024. The flexibility online tutoring offers enables students to learn at their own pace, making it useful for those with busy schedules or living in remote areas. Additionally, the growing demand for personalized learning, with customized instruction tailored to individual needs, is a key factor in the market's expansion. Furthermore, the increase in educational adoption of advanced technologies, such as video conferencing and interactive tools, has improved the quality of virtual learning, addressing some challenges related to student-teacher interaction.

Europe Online Tutoring Services Market Trends

The online tutoring services market in Europe is expected to witness significant growth over the forecast period. The focus on STEM education in countries such as the U.K., where a significant portion of the workforce is employed in STEM-related jobs, is fueling demand for online tutoring, mainly in technical and science subjects. Additionally, the strong emphasis on test preparation and structured tutoring services is boosting market demand across Europe.

Asia Pacific Online Tutoring Services Market Trends

The online tutoring services industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Rapid economic development in countries such as China, India, and Southeast Asia is fueling the demand for online education, supported by government initiatives aimed at improving access to learning resources. The widespread adoption of mobile devices and the Internet has made online tutoring services more accessible, even in rural areas.

Key Online Tutoring Services Company Insights

Some key players in the online tutoring services market, such as Chegg Inc.; Qkids Teacher; Varsity Tutors; and Vedantu are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products. This proactive approach allows them to enhance their market presence and innovate in response to evolving needs.

-

Chegg Inc. is a prominent player in the online tutoring market, offering a comprehensive platform for students to access various learning tools. Chegg Inc.’s services cater to a wide range of educational needs, including tutoring, textbook rentals, study resources, and career support. The company provides personalized tutoring through Chegg Study, which includes AI-driven help and access to expert tutors across subjects. Additionally, Chegg offers a broad suite of services, such as Chegg Math, Writing, and Test Prep, catering to both academic and career-oriented learning.

-

Vedantu is an Indian edtech company, specializing in providing live online tutoring services. The company has grown rapidly over the years, establishing a robust platform that facilitates personalized, live learning between teachers and students. Initially, Vedantu started with one-on-one tutoring but later scaled to group-based classes, significantly improving its reach. Its focus on high-quality teaching tools and interactive lessons has helped it attract millions of students, mainly in India.

Key Online Tutoring Services Companies:

The following are the leading companies in the online tutoring services market. These companies collectively hold the largest market share and dictate industry trends.

- Ambow Education

- ArborBridge

- Beijing Magic Ears Technology Co., Ltd

- BYJU'S

- Chegg Inc.

- Club Z! Inc.

- iTutorGroup

- Qkids Teacher

- Varsity Tutors

- Vedantu

Recent Developments

-

In October 2024, Digital Ready announced a partnership with Varsity Tutors for Schools to offer on-demand academic support for students. This collaboration aims to provide students with live tutoring resources that can be accessed anytime throughout the school year, supporting their academic progress and career goals. The Varsity Tutors platform integrates interactive study tools, collaborative workspaces, and dynamic tutoring resources, making it easier for students and families to access personalized assistance.

-

In August 2024, Tutors International partnered with Highgrove Online School to support students in non-traditional learning environments. This collaboration enables Tutors International to offer Highgrove Online elective courses and provide tutoring services to students struggling in traditional schooling. The partnership aims to help students catch up and thrive through personalized, flexible learning options, combining online schooling with expert tutoring support.

-

In January 2024, Kuwait-based edtech company Baims acquired Orcas Edtech, an online tutoring company, and announced plans to launch an AI-based test preparation tool. This tool is designed to enhance accessibility for students in the Gulf Cooperation Council (GCC) countries, helping them prepare for exams with AI-driven resources. As part of its expansion strategy, Baims aims to strengthen its presence in Saudi Arabia, particularly focusing on Riyadh, which is emerging as a key hub for startups in the region.

Online Tutoring Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.06 billion

Revenue forecast in 2030

USD 23.73 billion

Growth rate

CAGR of 14.5% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tutoring type, course type, duration, tutoring style, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Ambow Education; ArborBridge; Beijing Magic Ears Technology Co., Ltd; BYJU'S; Chegg Inc.; Club Z! Inc.; iTutorGroup; Qkids Teacher; Varsity Tutors; Vedantu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Tutoring Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global online tutoring services market report based on tutoring type, course type, duration, tutoring style, end use, and region:

-

Tutoring Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Structured Tutoring

-

On-Demand Tutoring

-

-

Course Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Language Courses

-

Science, Technology, Engineering, and Mathematics (STEM) Courses

-

Others

-

-

Duration Outlook (Revenue, USD Billion, 2017 - 2030)

-

Short-Term Courses

-

Long-Term Courses

-

-

Tutoring Style Outlook (Revenue, USD Billion, 2017 - 2030)

-

Test Preparation Service

-

Subject Tutoring Service

-

Remediation

-

Maintenance

-

Support

-

Enrichment

-

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

K-12

-

Higher Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global online tutoring services market size was estimated at USD 10.42 billion in 2024 and is expected to reach USD 12.06 billion in 2025.

b. The global online tutoring services market is expected to grow at a compound annual growth rate of 14.5% from 2025 to 2030 to reach USD 23.73 billion by 2030

b. North America dominated the online tutoring services market with a share of 35% in 2024. The region has a high concentration of tech-savvy consumers, with widespread access to the internet and digital devices, making online education more accessible.

b. Some key players operating in the online tutoring services market include Ambow Education; ArborBridge; Beijing Magic Ears Technology Co., Ltd; BYJU'S; Chegg Inc.; Club Z! Inc.; iTutorGroup; Qkids Teacher; Varsity Tutors; Vedantu

b. Key factors driving the market growth include the increasing need for upskilling of corporate employees and the growing demand for a flexible education system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.