- Home

- »

- Renewable Chemicals

- »

-

Oleyl Alcohol Market Size, Share And Growth Report, 2030GVR Report cover

![Oleyl Alcohol Market Size, Share & Trends Report]()

Oleyl Alcohol Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Beef Fat, Fish Oil, Olive Oil), By Application (Textile, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-962-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oleyl Alcohol Market Summary

The global oleyl alcohol market size was estimated at USD 1.02 billion in 2023 and is projected to reach USD 1.36 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The demand is anticipated to be driven by its eco-friendliness, purity, and high effectiveness in terms of performance and quality.

Key Market Trends & Insights

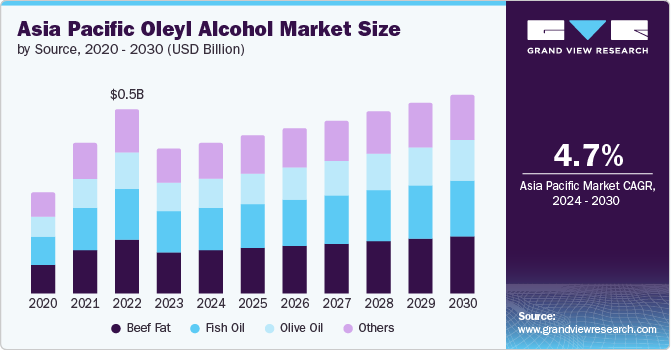

- The Asia Pacific oleyl alcohol market dominated the global market in 2023 with the largest revenue share of 38.6%.

- The U.S. is majorly driven by the personal care and pharmaceutical industries along with applications in cleaning and laundry products.

- Based on source, the fish oil segment dominated the market in 2023 by accounting for a revenue share of 31.3%.

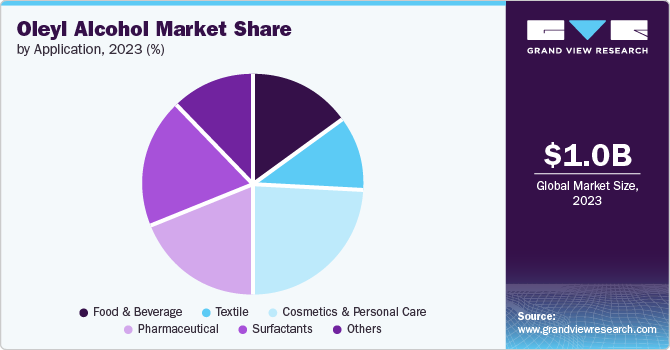

- The personal care and cosmetics application segment dominated the market in 2023 with a revenue share of 23.7%.

Market Size & Forecast

- 2023 Market Size: USD 1.02 Billion

- 2030 Projected Market Size: USD 1.36 Billion

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

It is used as a defoaming agent, cosmetic emollient, plasticizer, rheology modifier, chemical intermediate, and automotive lubricant in numerous industrial applications. Oleyl alcohol is an organic compound derived from plant and animal sources. It is a clear liquid with a unique odor. Natural sources include soybean oil, castor oil, palm kernel oil, and rapeseed. Synthetic sources are chemically processed by the synthesis of propylene glycols and ethylene.

It is manufactured by catalytic hydrogenation of oleic acid esters. It can also be formulated by the Boweault-Blanc reduction reaction of butyl oleate using butyl alcohol and sodium as key ingredients. Thus, it is naturally available in fish oil and oils of other aquatic mammals. Moreover, increasing product use in R&D activities in pharmaceutical formulations for drug delivery is estimated to offer lucrative growth opportunities to the global market in the coming years.

However, the varying prices of raw materials have been a major concern for manufacturers, making them a major barrier to the industry's growth. However, the growing development of cost-effective, biobased surfactants with the help of oleyl alcohol by major product manufacturers is likely to positively influence product demand over the forecast period.

Oleyl alcohol is supplied either directly to end users (manufacturers of cosmetic ingredients, food & beverages, cleaning chemicals, detergents, and surfactants) via direct supply channels or third-party distributors (indirect supply channel). Manufacturers offer oleyl alcohol directly to bulk volume buyers who contribute a significant portion to the revenue of the manufacturers.

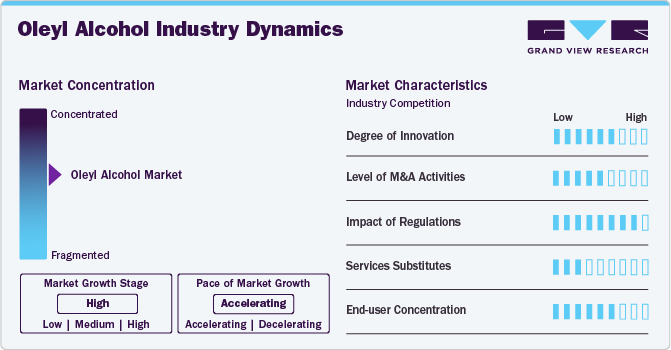

Market Concentration & Characteristics

The market is moderately competitive, with key participants involved in research & development activities related to oleyl alcohol. Constant innovations by product vendors are among the most important factors for companies to perform in this market. Ecogreen Oleochemicals Pte. Ltd., Croda International Plc, Stepan Company, Sasol, and The Lubrizol Corporation, among others, are the key oleyl alcohol manufacturers operating in the market.

The market growth stage is medium, with an accelerating pace. Oleyl alcohol is a long chain of fatty alcohol used in the manufacturing of cosmetics and personal care products. When used in the formulation of skin care products, oleyl alcohol acts as a lubricant on the skin surface, providing softness and smoothness to the skin. Moreover, the growing inclination of consumers toward bio-based products is increasing the demand.

Driven by sustainability concerns, the demand for bio-based oleyl alcohol derived from renewable sources such as vegetable oils is surging. This is in line with increasing consumer preference for green cosmetics and biodegradable cleaning products.

Source Insights

The fish oil segment dominated the market in 2023 by accounting for a revenue share of 31.3%. The growth of the segment can be attributed to its exceptional benefits such as reducing blood pressure, lowering risks related to heart diseases, help in increasing good cholesterol levels, and promoting the release of serotonin. Furthermore, rising awareness among consumers and medical professionals regarding the importance of omega-3 fatty acids has led to an increase in the consumption of fish oil, thereby positively influencing the overall market growth.

Oleyl alcohol is derived from a reaction between esters and oleic acid from olive oil. Various benefits associated with olive oil used in the food & beverage industry have triggered industry growth across the world. The benefits of olive oil include being rich in antioxidants, monosaturated fats, anti-inflammatory properties, and reducing risks of diabetes and heart failure. The growing consumer awareness regarding healthy eating has influenced the demand for olives, thus benefitting market growth.

Application Insights

The personal care and cosmetics application dominated the market in 2023 with a revenue share of 23.7%. This can be attributed to increasing consumer awareness regarding personal hygiene along with the growing demand for anti-aging products at a global level, which is expected to boost the demand for oleyl alcohol in the personal care & cosmetics industry. Oleyl alcohol is found in products such as eye care creams, hair conditioners, anti-aging creams, styling gels, lipsticks, eye shadow, and lip gloss. The moisturizing and emollient properties of the product are expected to drive its demand in personal care and cosmetic applications.

The surfactants sector is projected to grow at the fastest CAGR over the forecast period. Oleyl alcohol is used as a precursor for the formulation of sulfuric ester derivatives, which are widely used as wetting agents in detergents. It is commonly used in laundry, dish, auto, and surface care products. It has cleaning ingredient functions such as a foaming agent, surface protectant, wetting agent, surfactant, and detergent additive, which are expected to boost the demand for oleyl alcohol in surfactant applications.

Oleyl alcohol can be used in numerous applications as a softening and lubricating agent for textile fabrics, manufacturing carbon paper, printing ink, and stencil paper. It is also used in several product formulations for drug delivery in the pharmaceutical industry. It is used in delivering medications via skin or mucus membranes and lungs. In addition, it is used as a precursor for the formulation of sulfuric ester derivatives, widely used in wetting agents and detergents.

Regional Insights

The oleyl alcohol market in North America is anticipated to witness significant growth. North America is a major market due to the presence of large-scale end-use industries in the region. These industries, including personal care & cosmetics, food & beverages, and textiles, are the major consumers of oleyl alcohol in North America. The U.S. Food and Drug Administration (FDA) has approved the use of oleyl alcohol as a multipurpose additive for indirect addition in food products. The Cosmetic Ingredient Review (CIR) panel has evaluated oleyl alcohol and declared it fit for usage in personal care and cosmetics products.

U.S. Oleyl Alcohol Market Trends

The oleyl alcohol market in the U.S. is majorly driven by the personal care and pharmaceutical industries along with applications in cleaning and laundry products. The rising environmental awareness among consumers in the U.S. is driving the demand for bio-based surfactants, which have a lower environmental impact.

Asia Pacific Oleyl Alcohol Market Trends

The Asia Pacific oleyl alcohol market dominated the global market in 2023 with the largest revenue share of 38.6%. This can be attributed to the increasing demand for bio-based products owing to growing consumer awareness coupled with stringent regulations.

Key Oleyl Alcohol Company Insights

Some of the key players operating in the market include Corda International Plc, BASF SE, Tokyo Chemical Industries, and The Lubrizol Corporation.

-

BASF SE is a chemical manufacturer and supplier with a presence across Europe, North America, Asia Pacific, South America, Africa, and the Middle East.

-

The Lubrizol Corporation has a global presence across 100 countries. It operates in Europe, Asia Pacific, Latin America, and North America. The company caters to different end-use industries such as healthcare, medical, beauty, and home care

Ecogreen Oleochemicals Pte. Ltd., Acme Synthetic Chemicals, ATAMAN KIMYA, and Zhengzhou Alfa Chemical Co., Ltd. are some of the emerging participants in the market.

-

PT. Ecogreen Oleochemicals is a manufacturer and distributor of chemicals and related products worldwide. The product portfolio of the company includes short-chain glycerin, fatty acids, primary fatty amines, sugar, unsaturated fatty Alcohol (oleyl alcohol), specialty esters, and alcohol ethoxylates.

-

Acme Synthetic Chemicals is a manufacturer and supplier of organic chemicals. The company's product range includes fatty acids, high-purity lipids, and specialty chemicals based on oils and fats, including oleyl alcohol.

Key Oleyl Alcohol Companies:

The following are the leading companies in the oleyl alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- PT. Ecogreen Oleochemicals

- Croda International Plc

- The Lubrizol Corporation

- Acme synthetic chemicals

- SimSon Pharma Limited

- ATAMAN KIMYA

- Zhengzhou Alfa Chemical Co., Ltd.

- BASF SE

- Tokyo Chemical Industry Co., Ltd.

Recent Developments

-

In October 2023, Croda International Plc recently announced a new greenfield site in Guangzhou, China. This new site will be used as a multi-purpose production facility for active beauty ingredients and fragrances, which will help the company establish a strong foothold in the Asia Pacific region and deliver its products faster. The Guangzhou facility will primarily be used for manufacturing fragrances, and the existing fragrance production in China will be consolidated at this new site. The Guangzhou site will be commissioned in 2025 including application laboratories, R&D facilities, offices, and manufacturing.

-

In October 2023, Ecogreens Oleochemicals Ltd. announced the expansion of its fatty alcohol facility in Batam, Indonesia, by 180,000 tons annually. This strategic decision is expected to elevate Ecogreen Oleochemicals Ltd.’s fatty alcohol production capability to an impressive 360,000 tons yearly, doubling its prior capacity.

-

In October 2023, BASF SE invested in the production of emollient specialties at its German site. This investment is aimed at producing skin and sun protection products. The expansion of production capacity has been made possible by installing a new reactor and upgrading the distillation units. The company also specializes in cosmetics and personal care ingredients and already offers a comprehensive portfolio of emollients. Düsseldorf is BASF's prominent production site in Europe and is the largest BASF site for the production and development of cosmetic ingredients worldwide.

Oleyl Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.05 billion

Revenue forecast in 2030

USD 1.36 billion

Growth Rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Netherlands, Russia, Switzerland, Poland, Sweden, China, Japan, India, South Korea, Australia, Malaysia, Singapore, Indonesia, Taiwan, Brazil, Argentina, Saudi Arabia, and South Africa

Key companies profiled

PT. Ecogreen Oleochemicals; Croda International Plc; The Lubrizol Corporation; Acme synthetic chemical; SimSon Pharma Limited; ATAMAN KIMYA; Zhengzhou Alfa Chemical Co., Ltd; BASF SE; Tokyo Chemical Industries.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oleyl Alcohol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global oleyl alcohol market report based on source, application, and region:

-

Source Outlook (Volume. Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Beef Fat

-

Fish Oil

-

Olive Oil

-

Others

-

-

Application Outlook (Volume. Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Textile

-

Cosmetics & Personal Care

-

Pharmaceutical

-

Surfactants

-

Others

-

-

Regional Outlook (Volume. Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Switzerland

-

Poland

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Indonesia

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oleyl alcohol market size was estimated at USD 1.02 billion in 2023 and is expected to reach USD 1.05 billion in 2024.

b. The global oleyl alcohol market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 1.36 billion by 2030.

b. Asia Pacific dominated the oleyl alcohol market with a share of 38.6% in 2023. This is attributable to the increasing demand for bio-based products owing to growing consumer awareness coupled with stringent regulations across the region.

b. Some key players operating in the oleyl alcohol market include AkzoNobel, Procter & Gamble, Stepan Company, The Lubrizol, Henkel AG & Co. KGaA, and Ashland Inc. among others.

b. Key factors that are driving the oleyl alcohol market growth include eco-friendly, pure, and highly effective in terms of performance and quality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.