- Home

- »

- Automotive & Transportation

- »

-

Off-highway Vehicle Lighting Market Size, Share Report 2030GVR Report cover

![Off-highway Vehicle Lighting Market Size, Share & Trends Report]()

Off-highway Vehicle Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (LED, Halogen, HID, Incandescent), By Application (Head Lamp, Tail Lamp, Work Light), By End-use (Construction), By Vehicle (Excavator, Loader), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-692-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Off-highway Vehicle Lighting Market Summary

The global off-highway vehicle lighting market size was estimated at USD 1.17 billion in 2024 and is projected to reach USD 1.26 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. The high demand for mining and construction equipment mainly drives this market growth.

Key Market Trends & Insights

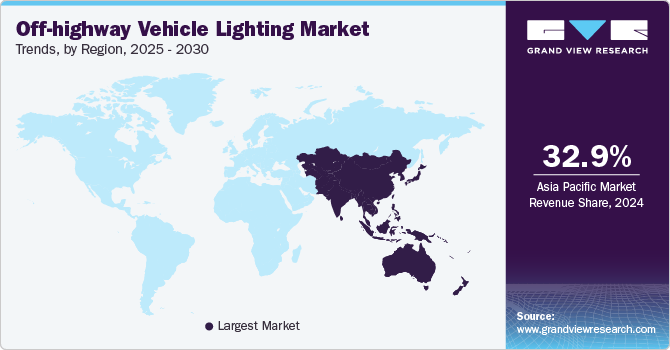

- In terms of region, Asia Pacific dominated the off-highway vehicle lighting market with a revenue share of 32.9% in 2024.

- Country-wise, China off-highway vehicle lighting market held significant revenue share of the regional industry.

- In terms of product, The Halogen segment dominated the global off-highway vehicle lighting market with revenue share of 56.8% in 2024.

- In terms of application, The headlamp accounted for the largest revenue share of the global off-highway vehicle lighting market in 2024.

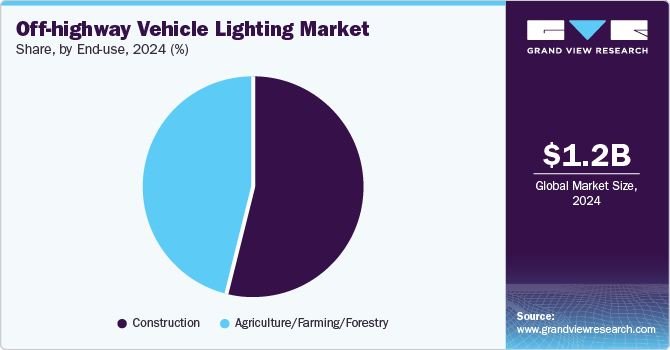

- In terms of ens use, The construction segment held the largest revenue share of the global off-highway vehicle lighting industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.17 Billion

- 2030 Projected Market Size: USD 1.26 Billion

- CAGR (2025-2030): 7.9%

- Asia Pacific: Largest market in 2024

Furthermore, the growing adoption of LED lighting due to its capability to deliver enhanced performance is expected to drive industry growth by 2030. Government regulations regarding vehicle lights and workspace safety are also projected to facilitate the growing adoption. Additionally, increasing demand for enhanced comfort, safety, and convenience in automobiles, particularly in developing and mature economies, is anticipated to fuel market growth over the forecast period.The growing demand for heavy construction equipment and earthmoving equipment from the mining and construction industry is primarily influencing the growth experienced by this market. In recent years, multiple companies operating in manufacturing and delivering earthmoving and heavy construction equipment have focused on modernizing the existing portfolio. This includes changes in current designs, the development of new product ranges, and the addition of advanced features. Changing regulations, increased focus on sustainability red, reduction of environmental impact, and new product designs have also stimulated changes and new product developments. This is expected to fuel demand for the off-highway vehicle lighting market.

Increasing urbanization and growing infrastructure development projects in countries such as India, China, and a few other developing economies contribute to increasing demand for well-equipped construction equipment. To cater to the increasing demand for advanced products, manufacturers of earthmoving equipment and heavy construction machinery worldwide have focused on securing supplies and stocks. These aspects are expected to develop a positive influence on the growth of this market.

New product launches and developments are also adding lucrative growth opportunities for the off-highway vehicle lighting market. For instance, in January 2025, Volvo Construction Equipment (Volvo CE) launched new-generation models of 28-to-61-ton articulated dump trucks. A newly designed 50-ton A50 equipped with an electronic system, LED lighting, predictive gear selection, and added advanced features is expected to strengthen its portfolio.

Product Insights

The Halogen segment dominated the global off-highway vehicle lighting market with revenue share of 56.8% in 2024. This is attributed to the low initial cost of these lights compared to LEDs. However, vehicle manufacturers have started shifting to LED lights due to their declining prices over the years. Moreover, regulations are mandating the adoption of front, side, and rear identification lamps so that the approaching vehicle driver can judge the vehicle's dimensions and prevent a crash. The regulations about vehicle lighting would influence the demand for off-highway vehicle lighting in the forecast period.

The LED segment is projected to experience fastest CAGR during the forecast period. The increasing demand for energy-efficient lighting sources used in off-highway vehicles drives the segment. A significant decline in the production cost of LEDs is expected to increase the market share of these products. Furthermore, these lights offer better brightness, consume less power, and are highly durable, with an average lifespan of more than five years.

Application Insights

The headlamp accounted for the largest revenue share of the global off-highway vehicle lighting market in 2024. This is attributed to introducing advanced technologies, such as adaptive front lighting, night vision, and laser lights. The work lights segment is also projected to witness considerable growth in the future. These lights are an integral part of the equipment used in construction and mining applications, as they improve visibility and augment safety in the workplace. The demand for LED-based work lamps has grown significantly in recent years due to better light brightness and quality.

The others segment is expected to experience significant growth over the forecast period. The segment includes light bars, interior lighting, and various other lights. The growth can be attributed to the growing importance of aesthetic interiors in off-highway vehicles, such as concrete mixers and dump and excavators. Additionally, government regulations mandating additional safety lights in heavy vehicles are expected to boost the segment's growth prospects over the forecast period.

End-use Insights

The construction segment held the largest revenue share of the global off-highway vehicle lighting industry in 2024. The growth experienced by the construction industry, especially owing to the increasing number of public infrastructure development and enhancement projects in developing countries such as India and others, adds significant growth opportunities to this segment. Increasing product launches and portfolio upgrades by manufacturers of construction machinery and earthmoving equipment are expected to influence the segment’s growth.

The agriculture/farming/forestry segment is estimated to experience significant growth from 2025 to 2030. Demand for advanced agriculture and farming machinery is increasing in developing countries, including India, where traditional agriculture techniques are still highly used. Thus, continuous technological advancements in emerging economies are expected to result in high demand for LED-based lights.

Vehicle Insights

The tractor segment accounted for the largest market share in 2024. This is attributed to the increasing demand for these types of equipment in the agriculture and farming sectors. The growing number of medium-scale farmers and the rising demand for mechanization globally are expected to drive the adoption of tractors over the forecast period, which is expected to work well for the segment's growth. The increasing inclination across regions to adopt advanced machinery in the agriculture industry is expected to add significant growth opportunities to this market.

The dump trucks segment is projected to experience significant growth over forecast period. This is attributed to factors such as introducing the Advanced Driver Assistance System (ADAS), which has features such as adaptive front lighting and night vision. Additionally, the upward trend in the production of class 7 and 8 trucks is expected to boost the segment's growth prospects. In addition, the launch of new products and upgrades or expansion of existing product lines by key manufacturers is expected to add lucrative growth to this segment.

Regional Insights

Asia Pacific dominated the off-highway vehicle lighting market with a revenue share of 32.9% in 2024. This is attributed to the growing demand for construction machinery and earthmoving equipment in the region. A growing number of infrastructure development and enhancement projects in countries such as India and China are adding to the demand for construction equipment.

China Off-highway Vehicle Lighting Market Trends

China off-highway vehicle lighting market held significant revenue share of the regional industry. The presence of multiple manufacturers of construction machinery and earthmoving equipment in the country has a noteworthy influence on this market. In recent years, China has initiated multiple infrastructure development projects, including the Belt and Road Initiative (BRI) and a few renewable energy projects. This is expected to add growth in demand for heavy construction equipment and, in turn, to this market over the next few years.

India off-highway vehicle lighting market is expected to experience substantial growth over forecast period. This market is mainly driven by the increasing demand for construction machinery and earthmoving equipment associated with large infrastructure developments ongoing in the country. Increasing urbanization and a growing number of commercial construction projects in India are expected to add growth to this market. Focus of multiple manufacturers to enhance market presence in India is projected to add lucrative opportunities.

Europe Off-highway Vehicle Lighting Market Trends

Europe was identified as one of the key regions of the global off-highway vehicle lighting market in 2024. The presence of multiple manufacturers of earthmoving equipment and construction machinery plays a vital role in this market's growth. In addition, many public infrastructure projects, ongoing commercial construction projects, and factors such as a focus on sustainability also contribute to the development.

Germany off-highway vehicle lighting market held significant revenue share of the regional industry in 2024. This is attributed to the strong manufacturing industry operating in the country. The increasing focus of multiple manufacturers on safety regulations associated with heavy machinery and the growing demand for earthmoving equipment from sectors such as mining and construction is expected to add noteworthy growth opportunities to this market.

The UK off-highway vehicle lighting market is anticipated to experience substantial growth over the forecast period. This market is mainly driven by the increasing inclination towards the incorporation of LED lights for improved visibility, machine performance, and safety capabilities. Government regulations associated with the additional safety of construction machinery and earthmoving equipment also influence this market.

North America Off-highway Vehicle Lighting Market Trends

North America off-highway vehicle lighting market is expected to experience significant growth during the forecast period. This is attributed to the growing demand for construction equipment and machinery driven by increasing commercial construction projects and infrastructure development across the region. The mining sector in North America plays a significant role in the growth experienced by this market.

The U.S. dominated the North American off-highway vehicle lighting market in 2024. This is attributed to the country's multiple off-highway vehicle manufacturers. Increasing demand for agricultural machinery, construction machinery, and earthmoving equipment in the U.S. is anticipated to add significant growth opportunities to this market.

Key Off-highway Vehicle Lighting Company Insights

Some of the key companies in the off-highway vehicle lighting industry include Grote Industries, HELLA GmbH & Co. KGaA, WESEM, Peterson Manufacturing Co., Hamsar Diversco Inc. and others. To address the changing requirements of manufacturers and clients, the key market participants are embracing strategies such as adoption of advanced technologies, new product launches and more.

-

WESEM, one of the key manufacturers of lighting for advanced agricultural machinery and other vehicles, offers a wide range of products. The portfolio includes work lamps, front lamps, rally lights, special lamps, rear lamps, and accessories.

-

HELLA GmbH & Co. KGaA develops signal and interior lights, rear combination lamps, and other lighting products for multiple manufacturers in the automotive industry. The company's off-road lighting portfolio features categories including performance lighting, automotive lighting, emergency lighting, and work lights. The products featured in these categories include light bars, cubes/pods, round lights, scene lights, accessories, bulbs, headlights, beacons, light heads, and more.

Key Off-highway Vehicle Lighting Companies:

The following are the leading companies in the off-highway vehicle lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Truck-Lite

- APS Lighting and Safety

- Grote Industries

- ECCO Safety Group

- Hamsar Diversco Inc.

- J.W. Speaker Corporation

- WESEM

- HELLA GmbH & Co. KGaA

- ABL Lights Group

- Peterson Manufacturing Co.

Recent Developments

-

In February 2025, FORVIA HELLA, one of the international automotive industry suppliers, announced the expansion of the SlimLine product range by adding a new LED combination lamp. Equipped with a rectangular design, adding a new product has strengthened its SlimLine range, which now caters to seven distinctive lighting functions.

-

In October 2024, WESEM launched CRP3 lamps, which are durable and capable of performing continuously for extensive hours in extreme conditions, especially in forest operations and construction or mining projects.

Off-highway Vehicle Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2030

USD 1.84 billion

Growth Rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Truck-Lite; APS Lighting and Safety; Grote Industries; ECCO Safety Group; Hamsar Diversco Inc.; J.W. Speaker Corporation; WESEM; HELLA GmbH & Co. KGaA; ABL Lights Group; Peterson Manufacturing Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Off-highway Vehicle Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global off-highway vehicle lighting market report based on product, application, end-use, vehicle, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

LED

-

Halogen

-

HID

-

Incandescent

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Head Lamp

-

Tail Lamp

-

Work Light

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Construction

-

Agriculture/Farming/Forestry

-

-

Vehicle Outlook (Revenue, USD Million; 2018 - 2030)

-

Excavator

-

Loader

-

Crane

-

Dump Truck

-

Tractor

-

Other

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global off-highway vehicle lighting market size was estimated at USD 1.17 billion in 2024 and is expected to reach USD 1.26 billion in 2025.

b. The global off-highway vehicle lighting market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 1.84 billion by 2030.

b. The halogen segment accounted for the largest revenue share of around 56.8% in 2024 in the off-highway vehicle lighting market. This can be attributed to the low initial cost associated with these lights as compared to LEDs.

b. The headlamp segment accounted for the largest share of over 60.1% of the off-highway vehicle lighting market in 2024. This can be ascribed to the introduction of advanced technologies, such as adaptive front lighting, night vision, and laser lights.

b. The construction segment accounted for the largest share of around 54.0% in 2021 in the off-highway vehicle lighting market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.