Nylon 6 Filament Yarn Market Size & Trends

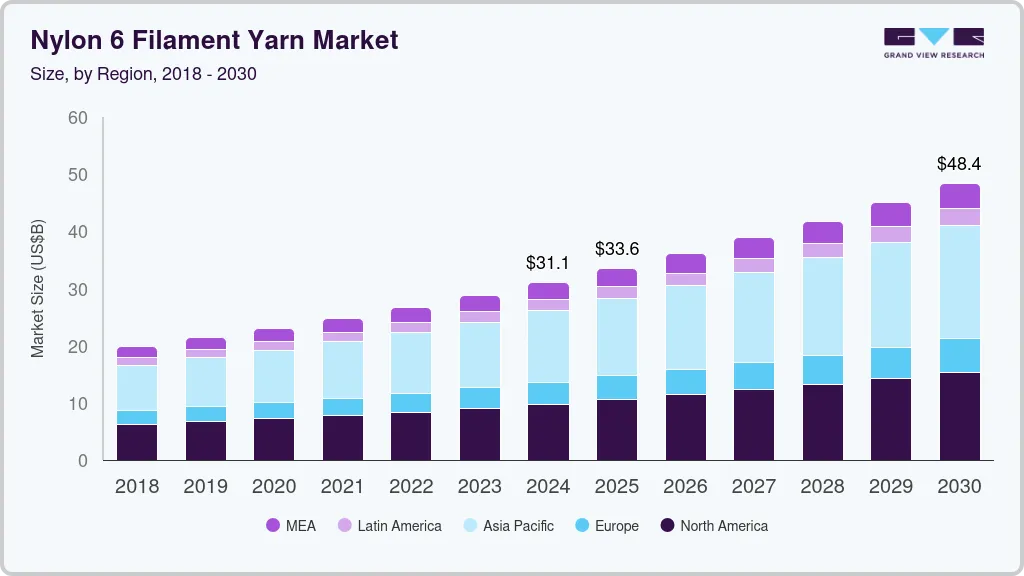

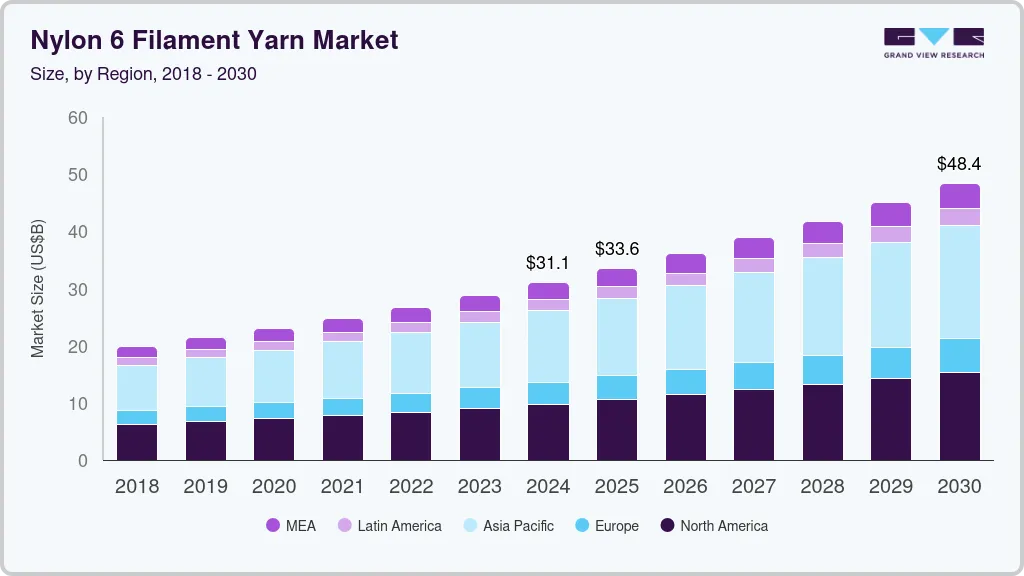

The global nylon 6 filament yarn market size was valued at USD 31.06 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The increasing popularity of sports and fitness activities, as well as the need for high-performance activewear and, sportswear, are driving the market. The increasing need for durable, lightweight, and high-performance materials in the automotive industry is driving market growth. Car makers are always looking for materials to improve safety, boost fuel efficiency, and enhance performance while also cutting down on vehicle weight. Furthermore, increasing knowledge of consumers and industries about the characteristics of nylon 6 filament yarn, like durability, strength, and versatility, the increasing partnerships among producers, distributors, and sellers greatly impacting the market.

The growing urbanization and construction of infrastructure in developing countries are increasing the need for carpets, textiles, and other goods produced with nylon 6 filament yarn. Moreover, the retail and e-commerce sectors are speeding up the availability and accessibility globally, driving the market further. Moreover, the implementation of government regulations and standards regarding quality, safety, and sustainability has encouraged the usage of nylon 6 filament yarn in different sectors. Moreover, the popularity of sports footwear is increasing, especially for specific sports like football, cricket, basketball, and more. In addition, international entities are backing sports tournaments and competitions like the FIFA World Cup, Olympics, Asian Games, Cricket World Cup, Commonwealth Games, and more.

Furthermore, nylon fishing nets are showing lucrative market growth, the ability of nylon fabrics to resist knotting, thereby improving their strength and durability, is a key reason why they are a popular choice for fishing nets. Moreover, they are less heavy and have a lower water absorption rate than other materials, making them ideal for deep-sea fishing. The demand for nylon 6 products in crankcases and oil containers is projected to increase in the future due to their high tensile strength, elasticity, and excellent abrasion resistance, leading to a growing preference for metal components.

In addition, the high demand is due to technological advancements in polymer modification and customization options like shape, color, and material. This allows manufacturers to deliver tailored products and is expected to significantly contribute to market growth. Moreover, the successful advancement of essential end use industries drives market demand, contributing to steady growth in the future. Increased demand for affordable high-quality clothing and rapidly changing fashion trends are driving growth in the nylon 6 filament yarn industry.

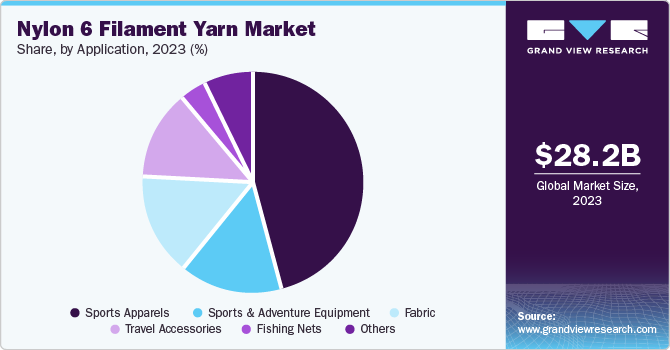

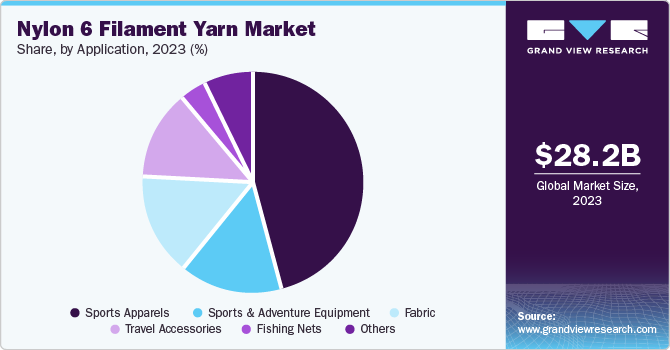

Application Insights

Sports apparel dominated the market in 2023 and is expected to register the fastest CAGR during the forecast period. Fueled by a growing worldwide focus on health and fitness that has increased the need for sports clothing, it is a key element of modern style. The exceptional strength, elasticity, and moisture-wicking abilities of Nylon 6 make it a perfect option for fabrics designed for performance. Moreover, its quick-drying capability and robustness have established it as the top choice for a range of sports apparel, such as running tights, jerseys, sports bras, and jackets. In addition, the increasing trend of athleisure clothing, combining athletic and casual looks, has also increased the need for nylon 6 filament yarn.

Furthermore, as the demand grows for clothing that can easily go from exercise to daily activities, the market for athletic wear made from nylon 6 has grown drastically. Moreover, the increase in popularity of sports and outdoor activities based on performance, like trail running hiking, and cycling, has aided in the expansion of this sector. Together, these factors highlight the important impact of sports apparel on the growth of the nylon 6 filament yarn market.

Regional Insights

The North America's nylon 6 filament yarn market is anticipated to witness significant growth in the coming years. The strong automotive industry in the area, requiring high-quality tire cords and interior components, plays a major role. The rise in popularity of fitness and outdoor activities has increased the need for performance apparel made from nylon 6.

U.S. Nylon 6 Filament Yarn Market Trends

The U.S. nylon 6 filament yarn market held a substantial share in 2023. The region is a center for fashion and textile advancement, leading the creation of innovative nylon 6 fabrics with improved qualities.

Asia Pacific Nylon 6 Filament Yarn Market Trends

The Asia Pacific nylon 6 filament yarn market held the largest share in 2023 due to fast industrial growth, increasing population, and a strong textile industry. Countries such as China and India have emerged as major players. The rising disposable income along with an expanding middle class has driven the need for clothing, especially sportswear, where nylon 6 stands out for its performance characteristics. Moreover, the growth of the automotive sector, which needs nylon 6 for tire cords and interior parts, has stimulated market growth.

The China nylon 6 filament yarn market held a substantial share in 2023. The high population and increasing disposable income in the country has led to a growing need for clothing, especially in the sportswear categories where nylon 6 is a popular choice of material.

The India nylon 6 filament yarn market held a substantial share in 2023. The strong manufacturing sector in the area, along with supportive governmental initiatives for textile exports, has increased the production and use of nylon 6 filament yarn.

Europe Nylon 6 Filament Yarn Market Trends

The Europe nylon 6 filament yarn market was identified as a lucrative region in 2023. The region boasts a long-standing textile heritage, with established manufacturing capabilities and a strong consumer base for premium apparel and accessories.

Key Nylon 6 Filament Yarn Company Insights

Some of the key companies in the nylon 6 filament yarn market include JCT Group, Century Enka Limited, Singhal Industries Pvt. Ltd., and others. Organizations are concentrating on expanding their customer base to achieve a competitive advantage in the market.

Key Nylon 6 Filament Yarn Companies:

The following are the leading companies in the nylon 6 filament yarn market. These companies collectively hold the largest market share and dictate industry trends.

- JCT Group

- Century Enka Limited

- Zhejiang Century ChenXing Fiber Technology Co., Ltd.

- Singhal Industries Pvt. Ltd.

- Salud Industry (Dongguan) Co., Ltd.

- Changzhou Yida Chemical Fiber Co., Ltd.

- Anand Rayons Ltd.

- Yiwu Huading Nylon Co., Ltd.

- TORAY INDUSTRIES, INC.

- Prutex Nylon Co., Ltd.

- EAST ASIA TEXTILE TECHNOLOGY LTD.

Nylon 6 Filament Yarn Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 33.57 billion

|

|

Revenue forecast in 2030

|

USD 48.38 billion

|

|

Growth Rate

|

CAGR of 7.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion, Volume in Kilotons, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Spain, The Netherlands, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, South Arabia and South Africa

|

|

Key companies profiled

|

JCT Group; Century Enka Limited; Zhejiang Century ChenXing Fiber Technology Co., Ltd.; Singhal Industries Pvt. Ltd.; Salud Industry (Dongguan) Co., Ltd.; Changzhou Yida Chemical Fiber Co., Ltd.; Anand Rayons Ltd.; Yiwu Huading Nylon Co., Ltd.; TORAY INDUSTRIES, INC.; Prutex Nylon Co., Ltd.; and EAST ASIA TEXTILE TECHNOLOGY LTD.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Nylon 6 Filament Yarn Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nylon 6 filament yarn report based on application and region.

-

Application Outlook (Volume (Kilotons), Revenue, USD Billion, 2018 - 2030)

-

Regional Outlook (Volume (Kilotons), Revenue, USD Billion, 2018 - 2030)