- Home

- »

- Medical Devices

- »

-

Global Nurse Call Systems Market Size, Share Report, 2030GVR Report cover

![Nurse Call Systems Market Size, Share & Trends Report]()

Nurse Call Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Wired Communication Equipment, Wireless Communication Equipment), By Type, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-791-9

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nurse Call Systems Market Summary

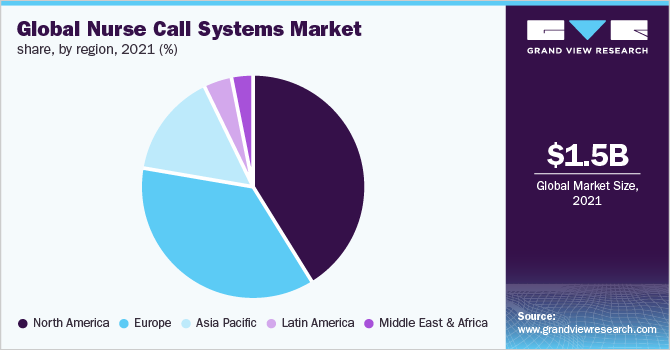

The global nurse call systems market size was estimated at USD 1.7 billion in 2022 and is projected to reach USD 4.2 billion by 2030, growing at a CAGR of 12.1% from 2023 to 2030. The growing need for a diverse and integrated platform that increases the preference for mobility aids are driving the market.

Key Market Trends & Insights

- North America dominated the overall market with a revenue share of over 41.1% in 2022.

- Asia Pacific is expected to witness remarkable growth at a CAGR of 13.52% during the forecast period.

- In terms of technology, the wired communication equipment segment held the largest revenue share of over 53.9% in 2022.

- In terms of end-use, the hospital segment held the largest revenue share of over 51.7% in 2022.

- In terms of application, the wanderer control segment accounted for the largest revenue share of over 34.7% in 2022.

- In terms of type, the integrated communication systems segment dominated the market in 2022 with a revenue share of over 26.3%.

Market Size & Forecast

- 2022 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 4.2 Billion

- CAGR (2023-2030): 12.1%

- North America: Largest market in 2022

Medicare decides to refund schemes based on quality and outcome rather than quantity owing to the rising healthcare cost. Medicare estimates that current reimbursement practices are costing an additional USD 2.1 billion and expects to curtail this by using technology-focused healthcare. With this change in reimbursement policies, hospitals and other healthcare facilities are trying to streamline their workflow processes by adopting technology-oriented nurse call systems.

Nurse call systems enable reliable and flexible communication between the patient and the caregiver. Increasing patient numbers in healthcare facilities and the introduction of advanced ways to expand communication, workflow, and management to provide quality patient care are fueling the market growth. The market is primarily driven by technological advancements that have allowed players to create innovative devices. For instance, in December 2019, Tunstall Group launched Tunstall Carecom, a wireless and digital nurse call system.

Growing adoption of real-time location systems (RTLS) integrated with wireless technologies in various healthcare facilities is propelling the market growth. RTLS allows the healthcare facilities to track the movement of the attendants and equipment to increase productivity. For instance, Televic's AQURA Care Communication Platform is an integrated platform with various modules such as nurse call, personal localization (RTLS), patient and staff safety, alarm delivery, personal mobility, and mediator control. The platform is open to integrating both its module and the mediator module, along with the current hospital infrastructure.

COVID-19 nurse call systems market impact: 24.2% increase from 2019 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic boosted the demand for nurse call systems to offer critical care monitoring, which is vital in preserving patients' lives and protecting the safety of healthcare personnel.

The coronavirus outbreak underlined the importance of providing safe and secure communication between patients and caregivers, necessitating the development of these technologies. Similarly, nursing homes that employ innovative nurse calling technology may be able to provide better care while minimizing the risk of cross-infection.

Hospitals are focusing on creating new COVID-19 patient care areas. Due to this and a surge in demand for healthcare communications and bedhead services, many manufacturers such as Static Systems Group, and Rauland Corporation have increased their manufacturing capacity. For instance, the Rauland Rapid Response Kit enables to deployment emergency communication system within a day.

Several companies have been working on the development of wireless communication devices to help healthcare professionals fight COVID-19. For instance, the LoRa Alliance has introduced the Push & Call QuickDeploy nurse call system to improve patient care facilities that require immediate assistance from health professionals.

However, the high implementation costs can hinder the market expansion. The effectiveness of integrated communication technologies is based on several factors, including software, hardware, and the training level of medical staff. This increases the need for high investments by hospitals, clinics, and home care facilities to effectively implement the devices. In addition, strict regulatory policies related to data breaches can impede industry growth during the forecast period.

Moreover, with the rise in home healthcare and nursing home facilities, major industry players are focusing on the need for better patient response time along with eliminating nurse fatigue. Vendors are differentiating their products by integrating their devices with different diagnostic solutions and technologies. For instance, in June 2019, Vocera Communications, Inc. introduced a new analytics solution that provides information about the number of calls, texts, alarms, and alerts that clinicians receive. Industry players offer customized services as per hospital needs, through such integration.

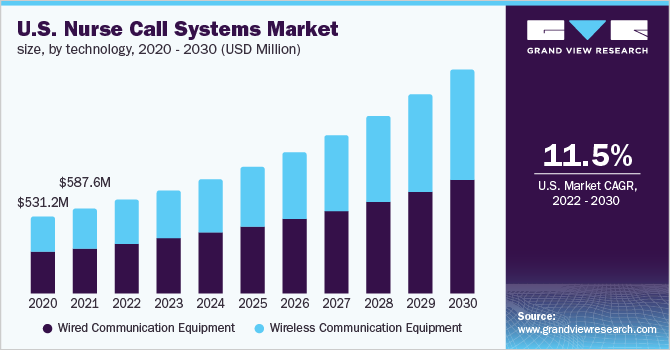

Technology Insights

The wired communication equipment segment held the largest revenue share of over 53.9% in 2022. Industry players are offering integrated solutions, wherein the data saved on the monitor screen is a summation of the readings from different systems. Hospitals are expanding their facilities to offer real-time information by incorporating technology-updated systems. In March 2016, Waupun Memorial Hospital announced a USD 23 million expansion plan for its facility. The beds that are connected to diagnostics systems send all information to the nurse call systems and allow two-way communication. Based on technology, the market is segmented into wired communication equipment and wireless communication equipment.

The wireless communication equipment segment is anticipated to witness lucrative growth with a CAGR of 12.73% during the forecast period owing to the higher level of integration, reduced cost for installation as compared to wired technology, and better patient mobility. For senior and assisted living facilities, patient mobility is crucial, where wireless nurse call buttons or pendants are of great help. In January 2019, Rauland Corporation launched a next-generation platform for its Responder intelligent nurse call solution to optimize clinical workflow for better patient outcomes.

In addition, wireless communication is becoming more frequently intuitive and user-friendly. Patients can now "talk" to the caregivers from pillow speakers via a handheld ID card and smartphone. That will improve the patient experience and improve the HCAHPS score. For instance, in March 2019, TekTone announced the launch of Tek-CARE Staff app, combined with 2-way audio-enabled calling solutions, making it easier for medical staff to respond to patients’ needs.

Type Insights

The integrated communication systems dominated the market in 2022 with a revenue share of over 26.3%. Increased acceptance of the latest technology, increased patient satisfaction and improved care efficiency factors fueling the growth of the segment. With rapid technological advances, the government is putting its efforts to fund hospitals to support the use of state-of-the-art communication devices. For instance, the Kiwanis Care Centre received USD 750 thousand from the British Columbia government to upgrade its old nurse calling equipment. Therefore, the demand from medical professionals for easy-to-use intuitive equipment, which has specialized options to handle patient requests and emergencies is expected to favor the segment growth.

The mobile systems segment is expected to register maximum CAGR of 12.41% during 2023-2030. Patients typically use a push-button device to alert the caregivers that assistance is needed. These devices are easy to use because the patient only has to press a push-button switch. The button system can be used in various healthcare settings such as hospitals, clinics, and home medical facilities, and contributes to the smooth operation of medical facilities while ensuring the safety of patients.

Application Insights

The wanderer control segment accounted for the largest revenue share of over 34.7% in 2022. Increasing funding projects to implement the most effective healthcare model for improved care is propelling the segment growth. In terms of application, the market is segmented into alarms and communications, workflow optimization, wanderer control, and fall detection and prevention. The workflow optimization segment is projected to exhibit fastest CAGR of 12.52% during the forecast period. The increasing need to reduce operating costs and effective healthcare resource allocation are likely to favor the growth of the segment.

Increasing efforts by hospitals to reduce the incidence of falls are augmenting the growth of the fall detection and prevention segment. The alarm and communications segment is projected to grow as it plays a critical role in increasing patient safety by facilitating communication between patients and caregivers. For instance, Amplion Alert uses the RTLS badge to connect to medical devices for alert management. It instantly collects data on room activity when caregivers enter the room.

End-use Insights

The hospital segment held the largest revenue share of over 51.7% in 2022. An increasing patient flow, incorporation of sophisticated clinical alert devices, and increasing incidences of emergency cases are factors fueling the segment growth. In July 2021, Austco Marketing & Service (Asia) Pte Ltd. received a contract of USD 3.3 million to supply the Tacera Nurse Call platform to the 795-bed general and acute care hospital Khoo Teck Puat Hospital (KTPH). The high demand for integrated communication solutions from hospitals is fuelling the segment growth. Based on end-use, the market is segmented into hospitals, long-term care facilities, and ASCs/clinics.

The ASCs/clinics segment is likely to grow owing to the increasing adoption of emergency medical alert systems in clinics and rising investment in integrated communication technologies. Furthermore, the increasing number of large chain private clinics is anticipated to drive the segment. Long-term care facilities are projected to register a considerable CAGR of 13.22% during the forecast period owing to the increasing number of senior care facilities. The nurse call pendants such as Tek-CARE have a passive infrared (PIR) motion detector, which helps staff keep a check on the patients. Moreover, with technology advancements, patient monitoring and medical reporting are integrated with the nurse calling devices to improve quality and productivity. The online software keeps track of the caregiver response time, several emergency calls, and patients’ requests, thus improving patient care.

Regional Insights

North America dominated the overall market with a revenue share of over 41.1% in 2022. Growing awareness, favorable health reimbursement, and the strategic presence of industry players in the region are fueling the market growth in North America. Furthermore, higher health care costs, lower caregiver-patient population ratios, and an increase in the number of older people are augmenting the market growth in the U.S.

Asia Pacific is expected to witness remarkable growth at a CAGR of 13.52% during the forecast period due to the presence of a sizeable geriatric population and the increasing flow of patients in outpatient clinics and nursing homes. Domestic manufacturers in India and China are striving to establish an advantage in their home countries to gain a broad domestic consumer base. This has intensified competition in emerging markets such as the Asia Pacific. Increasing efforts to reduce burnout in medical staff and improve hospital workflow are projected to boost the market growth in Europe. Furthermore, the increasing incidence of patient falls and strong government support to boost digital health adoption in hospitals are propelling the market growth in the region.

Key Companies & Market Share Insights

The market is fragmented. Competitors in this market are increasing their share through a variety of marketing strategies, including product launches, investments, and mergers and acquisitions. Companies are further investing in improving their products. For instance, in July 2020, Hill-Rom Holdings Inc. collaborated with Aiva for hands-free communication between caregiver-to-patient and caregiver-to-caregiver using Hill-Rom’s Voalte Mobile solution. Some prominent players in the global nurse call systems market include:

-

Hill-Rom Holding, Inc.

-

Rauland Corporation

-

Honeywell International, Inc.

-

Ascom Holding AG

-

TekTone Sound and Signal Mfg., Inc.

-

Austco Healthcare

-

Stanley Healthcare

-

Critical Alert Systems LLC

-

West-Com Nurse Call Systems, Inc.

-

JNL Technologies

-

Cornell Communications

Nurse Call Systems Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 1.9 billion

The revenue forecast in 2030

USD 4.2 billion

Growth rate

CAGR of 12.11% from 2023 to 2030

The base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Tyco SimplexGrinnell; Hill-Rom Holding, Inc.; Rauland-Borg Corporation; Honeywell International, Inc.; Ascom Holding; TekTone Sound and Signal Mfg., Inc.; Azure Healthcare; Stanley Healthcare; Critical Alert Systems LLC; West-Com Nurse Call Systems, Inc.; JNL Technologies; Cornell Communications.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global nurse call systems market report based on technology, type, application, end-use, and region:

-

Technology Outlook (Revenue, USD Billion, 2016 - 2030)

-

Wired Communication Equipment

-

Wireless Communication Equipment

-

-

Type Outlook (Revenue, USD Billion, 2016 - 2030)

-

Integrated Communication Systems

-

Buttons

-

Mobile Systems

-

Intercoms

-

-

Application Outlook (Revenue, USD Billion, 2016 - 2030)

-

Alarms & Communications

-

Workflow Optimization

-

Wanderer Control

-

Fall Detection & Prevention

-

-

End-use Outlook (Revenue, USD Billion, 2016 - 2030)

-

Hospitals

-

ASCs/Clinics

-

Long Term Care Facilities

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global nurse call system market size was estimated at USD 1.7 billion in 2022 and is expected to reach USD 1.9 billion in 2023.

b. The global nurse call system market is expected to grow at a compound annual growth rate of 12.11% from 2023 to 2030 to reach USD 4.2 billion by 2030.

b. North America dominated the nurse call system with a share of around 41.1% in 2022. This is attributable to growing awareness, favorable health reimbursement, and the strategic presence of industry players.

b. Some key players operating in the nurse call system market include Tyco SimplexGrinnell; Hill-Rom Holding, Inc.; Rauland-Borg Corporation; Honeywell International, Inc.; Ascom Holding; TekTone Sound and Signal Mfg., Inc.; Azure Healthcare; Stanley Healthcare; Critical Alert Systems LLC; West-Com Nurse Call Systems, Inc.; JNL Technologies; and Cornell Communications.

b. Key factors that are driving the nurse call system market growth include the need for diversified and integrated platforms with increasing preference for mobility devices, and changing reimbursement scenarios.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.