- Home

- »

- Conventional Energy

- »

-

Nuclear Decommissioning Services Market Size Report, 2030GVR Report cover

![Nuclear Decommissioning Services Market Size & Share Trends Report]()

Nuclear Decommissioning Services Market (2024 - 2030) Size & Share Trends Analysis Report By Reactor Type (PWR, BWR, PHWR, GCR, and Others), By Strategy, And Segment Forecasts

- Report ID: GVR-2-68038-326-3

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

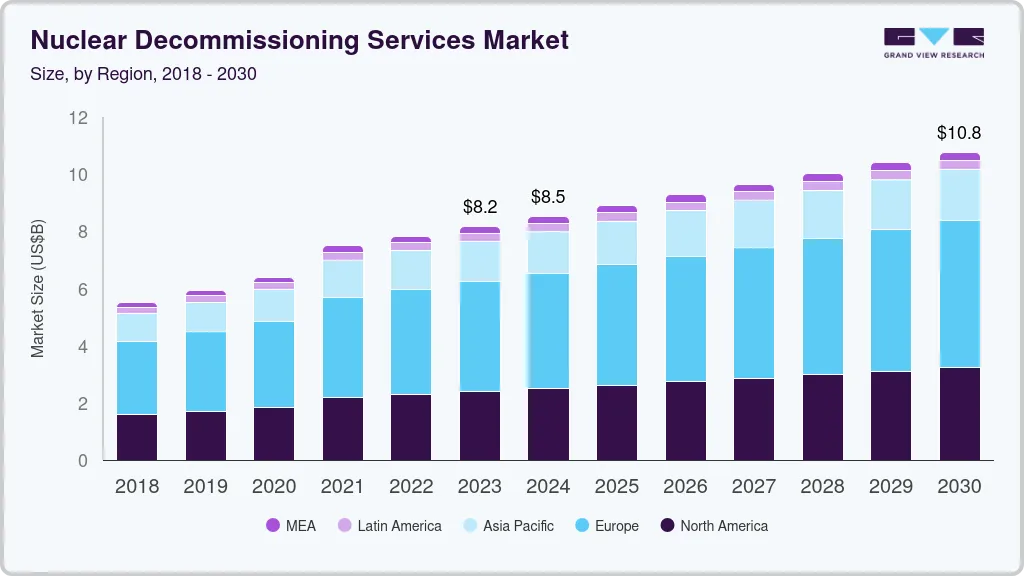

The global nuclear-decommissioning services market size was valued at USD 8,170.1 million in 2023 and is projected to register a CAGR of 4.0% during the forecast period. The worldwide shutdown of older nuclear reactors owing to aging and the transitioning trend toward renewable sources of energy due to minimal environmental impact is likely to be the major forces driving the growth of the market in the coming years. Due to Covid-19, the nuclear sector faced a few challenges such as unavailability of workers, restrictions on the number of on-site workers, and disruption in supply chains. Travel restrictions and government guidelines had an adverse impact on the progress of some nuclear decommissioning projects, owing to the limited availability of staff and experts. The end dates of project completion faced the risk of extension.

The demand for nuclear decommissioning has observed a tremendous surge due to the growing support from the governments of various countries post-nuclear accidents. Pressure from the public as well as governments are building up due to which nuclear phase-out has become the need of the hour. Increasing safety concerns, especially in regions such as Europe and North America, are anticipated to positively impact market growth.

Nuclear dismantling can take several years as radioactive waste degrades over a long period of time. In general, the lifespan of a reactor is expected to be around 40 to 60 years, beyond which, it becomes difficult to operate them. Therefore, at the end of their lifespan, power plants need to be decommissioned or demolished so that the site can be made available for other uses.

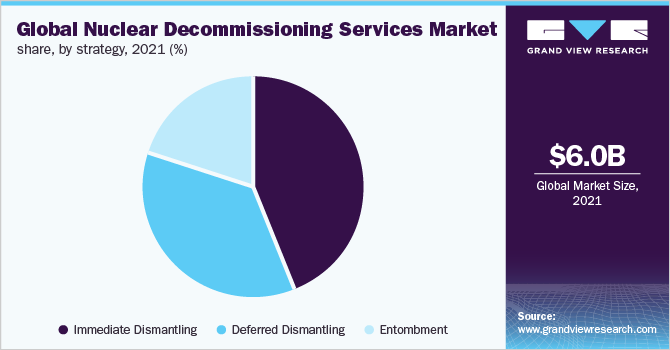

The process of decommissioning includes the entire clean-up of radioactivity when the plant wears out or the operating license expires. Different methods of decommissioning nuclear facilities are available with industry operators. These include immediate dismantling, deferred dismantling, and entombment. The majority of the materials can be reused and as the collective dose is relatively low, deferred dismantling is preferred. Some of the major players in the industry are constantly striving for technological advancements to deliver better services with increased efficiency.

Decommissioning the nuclear facilities involves extensive research and development to build up efficient dismantling techniques. Such technological advancements to deliver effective decommissioning of the plants escalate costs and make the entire process expensive. Therefore, the high cost of dismantling reactors is expected to threaten market growth. Furthermore, service providers are required to conform to the numerous standards and regulations established by authorities in different regions, posing a challenge.

Reactor Type Insights

Nuclear reactors can be categorized into two key types: water-cooled reactors and gas-cooled reactors. Water-cooled reactors include pressurized water reactors (PWR), pressurized heavy water reactors, and boiling water reactors. Pressurized water reactors held the maximum share in the global nuclear decommissioning services market in 2021.

PWRs are highly preferred by industry operators due to the factors such as a high level of stability and ease of operation. This segment is also projected to exhibit the strongest growth rate during the forecast period due to its widespread use and installation.

Strategy Insights

Decommissioning of nuclear facilities can be done in various ways, including immediate dismantling, deferred dismantling or safe enclosure, and entombment. These methods have their own merits and demerits. However, with the rise in the global shutdown of nuclear reactors, especially in Europe, the immediate dismantling of reactors soon after the shutdown has dominated the market.

However, with the growing energy crisis across the globe, the key nations have realized the importance of nuclear power in their energy portfolio and are, therefore, extending the lifespan of the reactors. Deferred dismantling is thus expected to be the fastest-growing segment during the forecast period due to reduced levels of radiation as compared to other methods.

The entombment strategy calls for the nuclear plant to be entombed forever. This is a much faster and more economical strategy in comparison to the other two. However, most industry operators have not yet accepted this strategy due to environmental as well as other public concerns.

Regional Insights

Europe accounted for the largest share of 47.0% in the nuclear decommissioning services market in 2021. It is also likely to be the second-fastest-growing region after North America, with a CAGR of 5.3% during the forecast period. It was valued at USD 2.84 billion in 2021 and is anticipated to be valued at USD 4.49 billion by 2030.

The market in North America was valued at USD 1.78 billion in 2021 and the region is anticipated to register the fastest growth of 5.5% during the forecast period. The U.S., which is a major market in the region, is likely to witness the shutdown of several reactors by 2025. The rise of nuclear decommissioning services in Japan and other Asian countries is likely to spur the market in Asia-Pacific during the forecast period.

Key Companies & Market Share Insights

In June 2019, AECOM signed an alliance agreement with Japan-based Toshiba Corporation, a multinational conglomerate, to work on nuclear reactor decommissioning in Japan. It aims to offer decommissioning services for nuclear reactors and facilities of Japanese government organizations and commercial power utilities with this partnership.

Providers of nuclear decommissioning services continue to focus on innovation and technological advancements in dismantling techniques to deliver enhanced performance. Such developments, coupled with competitive pricing, are likely to assist them in increasing their market share during the forecast period. Companies are investing profoundly in research and development to overcome barriers faced while decommissioning nuclear facilities.

In April 2022, Westinghouse Electric Company LLC announced the signing of an agreement for the acquisition of U.S.-based BHI Energy, a company providing services in power generation and delivery. Westinghouse Electric Company LLC aims to expand its expertise and capabilities in nuclear plant modification and maintenance, and other such services with this acquisition. Some of the prominent players in the global nuclear decommissioning services market include:

-

Orano Group

-

Babcock International Group PLC

-

Westinghouse Electric Company LLC

-

AECOM

-

Studsvik AB

-

Bechtel Corporation

-

Magnox Ltd.

Nuclear Decommissioning Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8,527.2 million

Revenue forecast in 2030

USD 10,763.9 million

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2019 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Reactor type, strategy, region

Regional scope

North America; Europe; Asia Pacific; South & Central America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; Japan; South Korea

Key companies profiled

Orano Group; Babcock International Group PLC; Westinghouse Electric Company LLC; AECOM; Studsvik AB; Bechtel Corporation; GE Hitachi Nuclear Energy; Ansaldo Energia; Jacobs (CH2M Hill Company Ltd.); Magnox Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global Nuclear Decommissioning Services Market report based on the reactor type, strategy, and region:

-

Reactor Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Pressurized Water Reactor (PWR)

-

Boiling Water Reactor (BWR)

-

Pressurized Heavy Water Reactor (PHWR)

-

Gas Cooled Reactor (GCR)

-

Others

-

-

Strategy Outlook (Revenue, USD Million, 2019 - 2030)

-

Immediate Dismantling

-

Deferred Dismantling

-

Entombment

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

South Korea

-

-

South & Central America

-

The Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global nuclear decommissioning services market size was estimated at USD 6.05 billion in 2021 and is expected to reach USD 6.32 billion in 2022.

b. The global nuclear decommissioning services market is expected to grow at a compound annual growth rate of 5.1% from 2022 to 2030 to reach USD 9.42 billion by 2030.

b. Europe dominated the nuclear decommissioning services market with a share of 47% in 2021. This is attributable the shutdown of several reactors over the forecast period.

b. Some key players operating in the nuclear decommissioning services market include Orano Group; Babcock International Group PLC; Westinghouse Electric Company LLC; AECOM; Studsvik AB; Bechtel Corporation; and Magnox Ltd.

b. Key factors that are driving the nuclear decommissioning services market growth include the worldwide shutdown of older nuclear reactors due to aging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.