- Home

- »

- Agrochemicals

- »

-

NPK Fertilizers Market Size, Share And Growth Report, 2030GVR Report cover

![NPK Fertilizers Market Size, Share & Trends Report]()

NPK Fertilizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Crop Type (Cereals & Grains, Oilseeds & Pulses), By Mode of Application (Fertigation, Foliar), By Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-355-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

NPK Fertilizers Market Summary

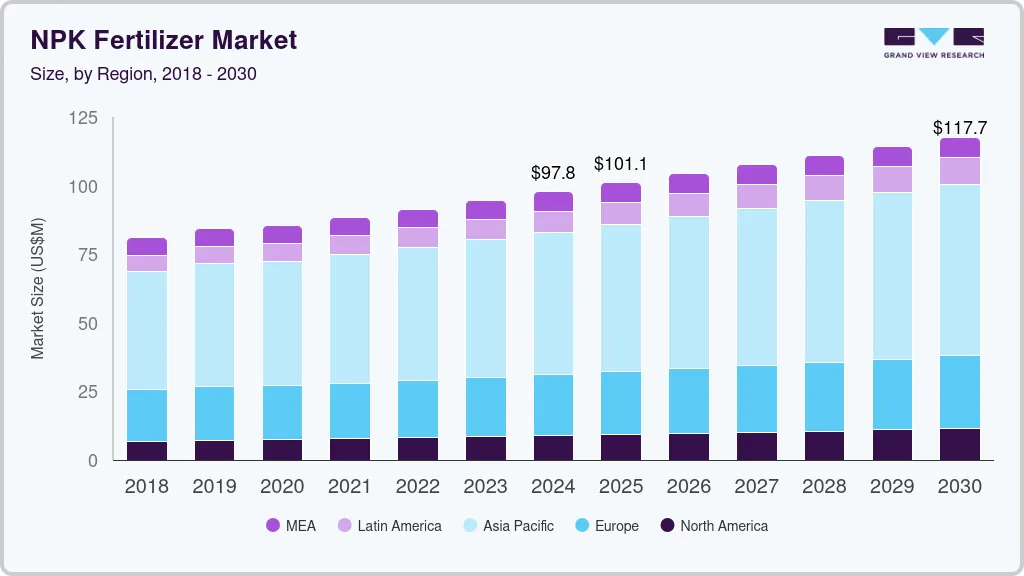

The global NPK fertilizer market size was estimated at USD 94.60 billion in 2023 and is projected to reach USD 117.70 billion by 2030, growing at a CAGR of 3.1% from 2024 to 2030. The increasing adoption of farming and enhanced crop protection offered by market products contribute to the market's growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- China dominated the regional market and accounted for a share of 27.50% in 2023.

- In terms of form, the liquid segment dominated the market and accounted for a revenue share of 61.29% in 2023.

- Dry is the most lucrative form segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 94.60 Billion

- 2030 Projected Market Size: USD 117.70 Billion

- CAGR (2024-2030): 3.1%

- Asia Pacific: Largest market in 2023

In addition, the rising consumption of dairy and meat products and the growing awareness about food and feed quality are key factors driving the market's expansion.

NPK fertilizer is a chemical fertilizer that contains three primary nutrients: nitrogen (N), phosphorus (P), and potassium (K). These are important in horticulture and modern agriculture. Nitrogen is vital for leafy green growth, as it plays a key role in forming enzymes, proteins, and chlorophyll. The product helps to enhance the plant's photosynthetic capacity and vigorous foliage. Phosphorus aids in root development, fruit and flower formation, and overall energy transfer within the plant. Potassium supports various metabolic processes and enhances and regulates water uptake, loss, and disease resistance. It ensures that plants are well-structured, resilient, and capable of withstanding environmental issues.

Drivers, Opportunities & Restraints

The global population and the need for more agricultural land to produce food increases. This expansion involves converting forests, grasslands, and other ecosystems into farmland. This, in turn, increases the demand for the product market to ensure the productivity of these newly cultivated areas. Agriculture is not limited to staple crops such as maize, rice, and wheat. Farmers diversify into high-value crops such as vegetables, fruits, and cash crops. These crops often require specialized nutrient formulations NPK fertilizers provide to ensure quality and yield. As diversification occurs, NPK fertilizers become indispensable.

Excessive use of the product can result in nutrient runoff into water bodies, carrying nitrogen and phosphorus into lakes, rivers, and oceans. This causes nutrient pollution and encourages the growth of harmful algal blooms and dead zones, which can harm aquatic ecosystems. To address this issue, innovative NPK formulations and management practices are being developed to reduce nutrient runoff and mitigate water pollution. In addition, the production and use of product markets are linked to greenhouse gas emissions, particularly nitrous oxide (N2O), which significantly impacts global warming. Due to these environmental concerns, efforts are being made to develop NPK formulations and application techniques that minimize emissions and improve the overall carbon footprint of fertilizers.

Traditionally, the product had a fixed nutrient ratio, but modern agriculture requires more precision. New developments in nutrient blends include creating fertilizers with customized nutrient ratios to suit the specific needs of different crops, soil types, and growth stages. This allows farmers to improve nutrient delivery, leading to healthier plants and better yields. In addition to the primary nutrients (Nitrogen, Phosphorus, and Potassium), plants need essential micronutrients like iron, zinc, and manganese. Advanced formulations now include these micronutrients to address deficiencies, ensuring that crops receive a well-rounded nutrient package for optimal growth and development.

Form Insights

Liquid form dominated the market and accounted for a revenue share of 61.29% in 2023. Liquid NPK fertilizer is a concentrated solution that provides plants with the essential nutrients Nitrogen (N), Phosphorus (P), and Potassium (K) in a soluble form. This formulation allows plants to quickly absorb, leading to more immediate effects than solid fertilizers. Being in a liquid form, it's easier to apply evenly and can be used in various ways, such as foliar feeding or irrigation systems. This versatility and efficient nutrient delivery make liquid NPK fertilizers popular for commercial agriculture and home gardening.

Dry form emerged as the fastest growing end use with a CAGR of 3.4%. Dry NPK fertilizer is a granular form of essential nutrients, Nitrogen (N), Phosphorus (P), and Potassium (K), blended. It's slow releasing, providing a steady supply of nutrients over time, making it well-suited for long-term soil health. This fertilizer is typically applied directly to the soil and is favored for its ease of storage and lower cost. Due to its form, it's essential to ensure even distribution to prevent nutrient hotspots. Dry NPK is versatile and widely used in commercial farming and home gardening applications.

Crop Type Insights

Cereals & grains dominated the market and accounted for a revenue share of 47.02% in 2023. Cereals and grains benefit significantly from targeted NPK fertilizers tailored to their specific nutrient requirements. The optimal balance of these fertilizers supports robust growth, improves grain quality, and enhances yield. By incorporating essential micronutrients like zinc and manganese, which are critical for grains, these specialized NPK formulations ensure that crops receive a comprehensive nutrient package. This approach is vital for meeting the nutritional demands of cereals and grains throughout their various growth stages, leading to healthier plants and increased productivity.

Fruits & vegetables emerged as the fastest-growing form with a CAGR of 3.8%. Fruits & vegetables also greatly benefit from NPK fertilizers, which have a composition more suited to their unique nutritional needs. The correct NPK formulas enhance fruit size, improve vegetable quality, and boost overall yield. By including essential micronutrients such as potassium, which is pivotal for fruit and vegetable crops, a tailored product market ensures these plants receive a well-rounded diet. This precise nutrient management is crucial for maximizing the health and productivity of fruit and vegetable gardens.

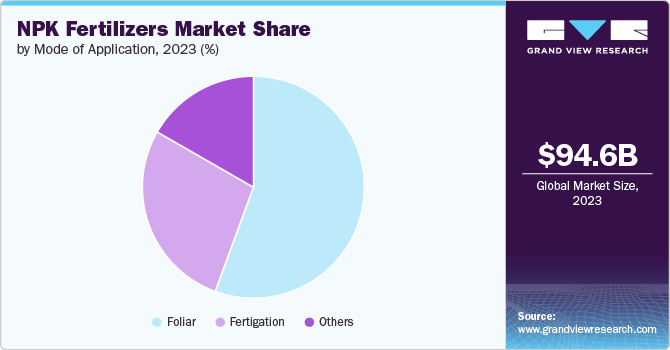

Mode of Application Insights

Foliar dominated the market and accounted for a revenue share of 55.60% in 2023.The foliar application involves spraying NPK fertilizers directly onto the leaves of plants, allowing for rapid absorption of nutrients through the stomata. This method is particularly useful for correcting nutrient deficiencies in a targeted and timely manner. It complements traditional soil applications by providing a quick nutritional boost during critical growth stages or when the root uptake of nutrients is limited. Moreover, foliar feeding can enhance plant nutrient use efficiency and support their health and vigor, especially in high-value fruit and vegetable crops.

Fertigation emerged as the fastest-growing mode of application, with a CAGR of 3.6%. Fertigation involves injecting NPK fertilizers into the irrigation system and distributing nutrients directly to the plant's root zone. This method allows for precise control over the timing and rate of fertilizer application, ensuring that plants get exactly what they need for optimal growth. Integrating fertilization with watering improves nutrient uptake efficiency, reduces nutrient leaching, and can lead to more uniform crop growth. In addition, it supports the sustainable use of fertilizers, making it an effective strategy for enhancing the health and productivity of fruit and vegetable gardens.

Regional Insights

Asia Pacific dominated the market and accounted for a 53.05% share in 2023. This growth is attributed to increasing demand and consumption of processed and convenience food in the region. China and India are traditionally agricultural countries and have the largest production in the region, leading to a rise in demand for the product market in the region.

China NPK Fertilizers Market Trends

China dominated the market and accounted for a market share of 27.50% in 2023. This growth is attributed to the increasing demand for fertilizers in the country. This rise in demand for fertilizers is due to the increase in crop production in the region.

North America NPK Fertilizers Market Trends

The North American market is expected to grow due to increasing agricultural activities in the region. This growth will lead to a rise in demand for the product. The increased demand for food has resulted in expanded agricultural activities in the region.

Europe NPK Fertilizers Market Trends

Europe plays a significant role in the market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for food, which leads to increased agricultural activities and, eventually, a rise in demand for NPK fertilizers.

Key NPK Fertilizers Company Insights

Some of the key players operating in the global NPK fertilizers market include

-

K+S Aktiengesellschaft is a German mineral company that researches, produces, and sells standard and specialty fertilizers, plant care products, and salt products. It extracts crude salts containing potassium, magnesium, and sulfur from German mines.

-

Akzo Nobel N.V. is involved in manufacturing and marketing paints & performance coatings. It operates through three business segments: specialty chemicals, performance coatings, and decorative paints. Major products offered by the company are industrial chemicals, functional chemicals, pulp & performance chemicals, powder coatings, and automotive & aerospace coatings. It caters its services to various industries including aerospace, automotive, chemicals, household appliances, safety, furniture & flooring, marine, mining, oil & gas, packaging, and energy. The performance coatings segment includes protective coatings, marine coatings, vehicle refinishes, metal coatings, specialty coatings, powder coatings, wood coatings, and industrial coatings. The company has a global presence.

Evonik Industries and LG Chem are some of the emerging market participants in the global NPK fertilizers market.

-

Aditya Birla Chemicals has businesses in various industry sectors such as carbon black, cement, fashion, financial services, insulators, mining, metals, research & development, telecom, textiles, trading, and chemicals. It manufactures epoxy resins through Aditya Birla Chemicals, which is a part of Aditya Birla Group’s chemicals business. The group’s chemical business has manufacturing plants in India, Thailand, and Germany. It has five production units located in Thailand that manufacture epoxy resins in the entire ASEAN region. Through its chemical business, the company offers products such as advanced materials, agribusiness, chlor-alkali, chlorine derivatives, fluorides, insulators, peroxides, phosphates, and viscose filament yarn. Its chemical business serves industries such as coating & construction, composites, fashion, food, industrial, plastics, and water.

-

The Mosaic company is a renowned company that specializes in producing concentrated phosphate and potash. These nutrients are essential for crop growth and help farmers yield more per acre. Mosaic mines produce and distribute billions of tons of top-quality potash and phosphate products annually.

Key NPK Fertilizers Companies:

The following are the leading companies in the NPK fertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- AGROFERT

- Yara International ASA

- The Mosaic Company

- Isarel Chemicals Ltd.

- Eurochem

- PotashCorp.

- K+S Akitengesellschaft

- Haifa Chemical Ltd

- Aditya Birla Chemicals

Recent Developments

-

In June 2023, Fertilizers and Chemicals Travancore (FACT) joined the one-nation fertilizer initiative by launching the first consignment of Bharat NPK. The Indian government has established the Pradhan Mantri Bhartiya Jan Urvarak Pariyojna to provide guaranteed quality and low prices for fertilizers sold under the unified brand name "Bharat."

-

In June 2022, AGROFRET acquired Borealis AG's nitrogen business, including fertilizers, valued at USD 878.96 million. The acquisition aims to enhance AGROFRET's presence in the fertilizers business.

NPK Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 97.80 billion

Revenue forecast in 2030

USD 117.70 billion

Growth rate

CAGR of 3.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, crop type, mode of application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzo Nobel N.V.; AGROFERT; Yara International; The Mosaic Company; Isarel Chemicals Ltd.; Eurochem; PotashCorp; K+S AKTIENGESELLSCHAFT; Haifa Chemical Ltd; Aditya Birla Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global NPK Fertilizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global NPK fertilizers market report based on crop type, mode of application, form, and region:

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Crop Types

-

-

Mode of Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Fertigation

-

Foliar

-

Others

-

-

Form Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Dry

-

Liquid

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global NPK fertilizers market size was estimated at USD 94.60 billion in 2023 and is expected to reach USD 97.80 billion in 2024.

b. The global NPK fertilizers market is expected to grow at a compound annual growth rate of 3.1% from 2024 to 2030 to reach USD 117.70 billion by 2030.

b. Asia Pacific dominated the NPK fertilizers market with a share of 53.1%. This growth is attributed to increasing demand and consumption of processed and convenience food in the region. China and India are traditionally agricultural country and have the largest production in the region leading to rise in demand for the product market in the region.

b. Some key players operating in the NPK fertilizers market include Akzo Nobel N.V.; AGROFERT; Yara International; The Mosaic Company; Isarel Chemicals Ltd.; Eurochem; PotashCorp; K+S Akitengesellschat; Haifa Chemical Ltd; and Aditya Birla Chemicals.

b. Key factors that are driving the market growth include increasing adoption of farming and enhanced crop protection offered by market products contribute to the growth of the NPK fertilizers market. Additionally, the rising consumption of dairy and meat products and the growing awareness about food and feed quality are key factors driving the market's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.