- Home

- »

- Next Generation Technologies

- »

-

Novel Spectrometry Market Size, Industry Report, 2030GVR Report cover

![Novel Spectrometry Market Size, Share & Trends Report]()

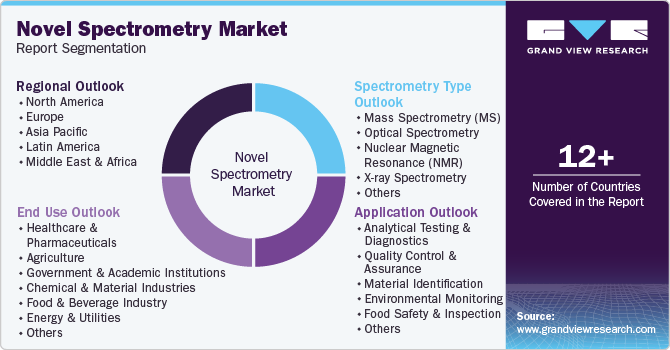

Novel Spectrometry Market (2025 - 2030) Size, Share & Trends Analysis Report By Spectrometry Type (Mass Spectrometry, Optical Spectrometry, X-ray Spectrometry, Nuclear Magnetic Resonance), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-550-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Novel Spectrometry Market Size & Trends

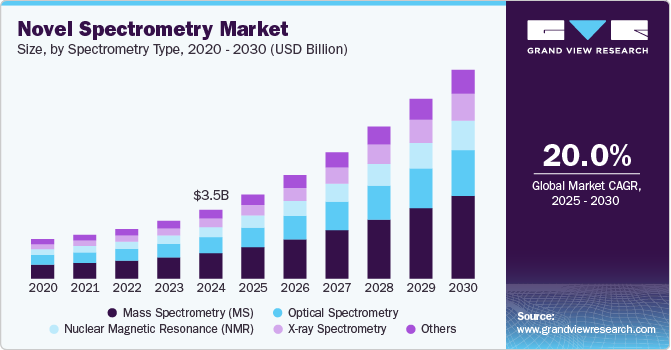

The novel spectrometry market size was estimated at USD 3,486.0 million in 2024 and is expected to expand at a CAGR of 20.0% from 2025 to 2030. The market is experiencing strong growth, driven by advancements in mass spectrometry, optical spectrometry, and nuclear magnetic resonance (NMR) technologies. Increasing demand for precision diagnostics in healthcare and pharmaceuticals is a key trend, as spectrometry plays a crucial role in biomarker detection and drug development. Rising investments in chemical and material industries are further boosting market growth, particularly in material identification and forensic applications. Technological innovations, such as AI-driven data analysis and miniaturized portable spectrometers, are expanding adoption across various sectors.

The rise of personalized healthcare is fueling innovations in biomedical spectrometry, with applications ranging from non-invasive diagnostics to therapeutic monitoring. The novel spectrometry industry is developing cutting-edge solutions for real-time blood analysis, cancer screening, and metabolic profiling. Technologies such as surface-enhanced Raman spectroscopy (SERS) and infrared spectroscopy are enabling early disease detection with minimal sample preparation. The shift toward point-of-care diagnostics is increasing the demand for portable spectrometry devices that offer rapid and accurate results. As precision medicine continues to gain traction, novel spectrometry solutions will play a vital role in advancing healthcare outcomes.

Quantum-enhanced spectrometry is emerging as a transformative technology within the novel spectrometry industry, offering unprecedented sensitivity and resolution. Techniques such as quantum entanglement-based spectroscopy and single-photon detection are revolutionizing molecular and atomic analysis. These advancements are particularly beneficial for biomedical applications, where ultra-sensitive detection of biomarkers can lead to early disease diagnosis. The integration of quantum computing with spectrometry is further enhancing data processing capabilities, enabling new breakthroughs in material science. As research in quantum optics progresses, the commercial adoption of quantum spectrometry is expected to accelerate in the coming years.

The demand for portable and handheld spectrometry devices is increasing, leading to significant advancements in miniaturization within the novel spectrometry industry. Compact spectrometers are being developed for field applications such as agricultural testing, counterfeit detection, and point-of-care diagnostics. These devices offer real-time analysis with high sensitivity, enabling on-the-spot decision-making without the need for extensive laboratory infrastructure. The development of smartphone-integrated spectrometers is further expanding the accessibility of spectrometry technology. As a result, industries that require rapid and cost-effective material analysis are driving the adoption of miniaturized spectrometry solutions.

The novel spectrometry industry is playing a crucial role in drug discovery and pharmaceutical research, where precision and sensitivity are essential. Advanced mass spectrometry and Raman spectrometry techniques are being adopted to accelerate biomarker identification, protein analysis, and small molecule screening. The increasing focus on personalized medicine and biologics is driving the need for novel spectrometry solutions capable of handling complex biological samples. Regulatory agencies are also encouraging the adoption of advanced spectrometry technologies for quality control and compliance. Consequently, pharmaceutical companies are partnering with spectrometry providers to enhance drug development pipelines.

Spectrometry Type Insights

The optical spectrometry segment captured significant market share of over 23% in 2024, driven by innovations in miniaturization, automation, and AI-powered data analysis. Ultraviolet-visible (UV-Vis), infrared (IR), and Raman spectrometry are widely used across industries, including pharmaceuticals, environmental monitoring, and food safety. The demand for portable and handheld spectrometers is rising, enabling real-time, on-site analysis in applications such as agricultural quality control and industrial material identification. AI integration enhancing spectral interpretation, reducing manual processing, and improving detection sensitivity in complex sample analysis. As industries move towards sustainability, non-destructive optical spectrometry techniques are becoming increasingly essential, ensuring efficient and eco-friendly material testing.

The mass spectrometry (MS) segment is expected to witness a highest CAGR of over 21% from 2025 to 2030. Mass spectrometry (MS) is evolving rapidly, driven by advancements in high-resolution techniques, automation, and artificial intelligence integration. The growing demand for precision medicine and biomarker discovery is fueling the adoption of MS in clinical diagnostics and pharmaceutical research. In addition, the miniaturization of mass spectrometers is enabling real-time, on-site analysis in fields like food safety, environmental monitoring, and forensic investigations. The integration of AI and machine learning in MS is enhancing data interpretation, reducing analysis time, and improving accuracy in complex sample analysis.

Application Insights

The analytical testing & diagnostics segment captured the highest market share in 2024. The analytical testing & diagnostics segment in the novel spectrometry market is experiencing rapid growth due to advancements in high-precision and real-time detection technologies. The increasing need for early disease diagnosis, food safety testing, and environmental monitoring is driving the adoption of mass spectrometry, infrared spectroscopy, and chromatography-spectrometry hybrids. With the rise of point-of-care testing (POCT) and lab-on-a-chip technologies, spectrometry is becoming more accessible and efficient for rapid diagnostics and personalized medicine. Additionally, AI-powered data analysis enhances the accuracy and speed of spectrometric testing, enabling better decision-making in clinical and industrial applications.

The quality control & assurance segment is expected to witness the significanr CAGR from 2025 to 2030. The quality control & assurance segment in the novel spectrometry market is expanding rapidly due to increasing regulatory requirements and industry demand for high-precision material analysis. Advanced mass spectrometry (MS), X-ray spectrometry, and optical spectrometry are being widely adopted for detecting impurities, verifying composition, and ensuring product consistency across pharmaceuticals, food, and manufacturing sectors. The integration of real-time, non-destructive testing (NDT) technologies is streamlining quality assessment, reducing waste, and improving operational efficiency. AI-powered spectrometry solutions are enhancing automation, enabling faster and more accurate defect detection while minimizing human error.

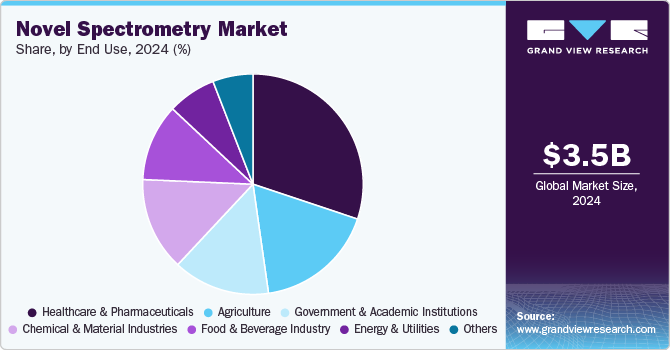

End Use Insights

The chemical & material industries segment captured a significant market share in 2024. The novel spectrometry industry is transforming the chemical & material industries by enabling precise composition analysis, quality control, and process optimization. Advanced spectrometry techniques, such as X-ray fluorescence (XRF) and nuclear magnetic resonance (NMR) spectroscopy, are being widely adopted to detect impurities, ensure material integrity, and enhance product consistency. The demand for real-time, non-destructive testing solutions is rising, particularly in sectors like polymers, coatings, and specialty chemicals.

The healthcare & pharmaceuticals segment is expected to witness the highest CAGR from 2025 to 2030. The novel spectrometry market is witnessing significant growth in the healthcare & pharmaceuticals segment, driven by advancements in precision medicine, biomarker discovery, and drug development. The increasing demand for high-throughput and real-time analysis in clinical diagnostics is propelling the adoption of mass spectrometry and Raman spectrometry. The rise of portable and AI-integrated spectrometry devices is further enhancing their application in point-of-care diagnostics and personalized treatment strategies.

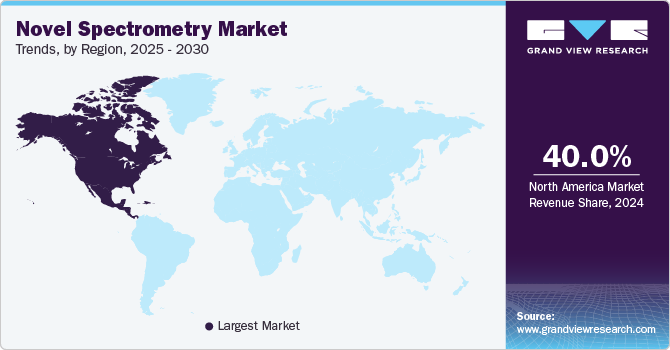

Regional Insights

The Novel spectrometry market in North America generated the highest revenue share, accounting for over 40% in 2024. The novel spectrometry market in North America is driven by advancements in biotechnology, pharmaceuticals, and environmental monitoring. Increased funding for research institutions and the adoption of high-performance spectrometry in clinical diagnostics have accelerated market growth. The region is also witnessing a surge in AI-integrated spectrometry solutions, enhancing precision in real-time analysis.

U.S. Novel Spectrometry Market Trends

The U.S. Novel spectrometry market held a dominant position in 2024. The U.S. remains the largest market for novel spectrometry, with strong demand from pharmaceutical companies, forensic labs, and government agencies. The FDA’s emphasis on stringent drug quality standards has led to the widespread adoption of advanced mass spectrometry techniques in regulatory testing. Additionally, increasing investments in proteomics and metabolomics are driving innovations in high-resolution spectrometry.

Europe Novel Spectrometry Market Trends

The Europe Novel spectrometry market was identified as a lucrative region in 2024. Europe's novel spectrometry market is expanding due to strict regulatory frameworks for environmental safety and food quality control. The demand for mass spectrometry in clinical research and drug discovery is growing, particularly in precision medicine applications. European initiatives promoting green chemistry and sustainable manufacturing are also fostering innovation in spectroscopy-based chemical analysis.

The U.K. spectrometry market is driven by growing investments in life sciences, biomedical research, and environmental monitoring. Universities and research institutes are increasingly deploying high-resolution mass spectrometry (HRMS) for proteomics and genomics studies. The expansion of point-of-care testing and real-time spectrometric diagnostics is further propelling market growth.

Germany is a leading hub for novel spectrometry, fueled by its strong industrial base in pharmaceuticals, chemicals, and automotive sectors. The country is witnessing rising adoption of Raman and laser-induced breakdown spectroscopy (LIBS) for quality control in manufacturing. With government support for cutting-edge research in nanotechnology and life sciences, spectrometry applications in analytical chemistry continue to expand.

Asia-Pacific Novel Spectrometry Market Trends

The novel spectrometry market in the Asia Pacific region is expected to grow at the highest CAGR of over 24% from 2025 to 2030. Asia Pacific is experiencing rapid growth in the novel spectrometry market due to increasing industrialization and government initiatives supporting scientific research. The region's pharmaceutical sector is adopting advanced spectrometry techniques for drug development and quality assurance. Emerging economies, including China and India, are investing heavily in spectroscopic technologies for food safety, environmental monitoring, and materials science.

The China novel spectrometry market is expanding due to heavy investments in biotechnology, pharmaceuticals, and semiconductor manufacturing. The government's push for technological self-reliance has led to increased local production of spectrometers, reducing dependence on imports. Additionally, the demand for real-time, portable spectrometry devices is rising in food safety and environmental monitoring sectors.

The India spectrometry market is witnessing growth fueled by its booming pharmaceutical and biotech industries. The increasing need for rapid drug testing, food safety analysis, and forensic applications has accelerated the adoption of mass spectrometry and FTIR spectrometry. Government initiatives promoting research and innovation, along with expanding academic collaborations, are further supporting market expansion.

Middle East & Africa Novel Spectrometry Market Trends

The Middle East & Africa (MEA) region is witnessing a surge in the adoption of novel spectrometry techniques for oil and gas exploration, driven by the need for precise material characterization and contamination detection. Advanced spectrometry methods, such as mass spectrometry (MS) and X-ray spectrometry, are increasingly being used for real-time monitoring of crude oil composition and quality control. The growing focus on sustainable energy exploration and stringent environmental regulations is further accelerating the demand for novel spectrometry solutions in the MEA region.

The UAE's healthcare and pharmaceutical industries are expanding rapidly, increasing the demand for advanced spectrometry technologies for drug development, quality assurance, and medical diagnostics. The country’s strategic initiatives, such as the Dubai Health Strategy 2025, emphasize technological advancements in medical research, further driving the adoption of nuclear magnetic resonance (NMR) and optical spectrometry. With rising investments in biotechnology and precision medicine, the novel spectrometry industry in the UAE is expected to experience sustained growth.

Saudi Arabia is placing greater emphasis on food safety and quality control, driving the adoption of novel spectrometry solutions for detecting contaminants, pesticides, and adulterants in food products. The Saudi Food and Drug Authority (SFDA) has implemented stringent regulations to ensure food safety, leading to increased demand for high-precision analytical tools like mass spectrometry (MS) and optical spectrometry. With the country’s Vision 2030 initiative focusing on food security and sustainability, the novel spectrometry industry is poised for significant expansion in the Saudi market.

Key Novel Spectrometry Company Insights

Some of the key players operating in the market include Bruker Corporation and Thermo Fisher Scientific

-

Thermo Fisher Scientific is a global leader in mass spectrometry, molecular spectroscopy, and chromatography, serving diverse industries, including life sciences, pharmaceuticals, and environmental analysis. Their cutting-edge technologies enable precise biomolecular analysis, clinical diagnostics, and drug discovery. With continuous innovation in high-resolution mass spectrometry (HRMS) and inductively coupled plasma mass spectrometry (ICP-MS), Thermo Fisher remains at the forefront of analytical science.

-

Bruker Corporation is a dominant player in nuclear magnetic resonance (NMR) spectroscopy, Fourier-transform infrared (FTIR) spectrometry, and high-performance mass spectrometry. Their innovations support a wide range of applications, from biomolecular research and pharmaceuticals to materials science and industrial quality control. With a focus on expanding imaging and molecular characterization technologies, Bruker continues to push the boundaries of scientific discovery..

Keit Industrial Analytics, and LightMachinery are some of the emerging participants in the Novel spectrometry market.

-

Keit Industrial Analytics specializes in rugged Fourier-transform infrared (FTIR) spectrometry designed for real-time process monitoring in harsh industrial environments. Their spectrometers are widely used in food and beverage, pharmaceuticals, and chemical processing, providing continuous, in-line analysis without sample preparation. By offering compact, vibration-resistant analyzers, Keit enables manufacturers to improve efficiency, reduce waste, and maintain quality control in challenging conditions.

-

LightMachinery focuses on high-precision laser-based spectrometry solutions, including Fabry-Pérot interferometers and etalons, for applications in aerospace, semiconductor, and research fields. Their high-resolution spectrometers are essential in studying atomic and molecular properties with unmatched accuracy. With a strong emphasis on optics and photonics, LightMachinery’s innovations support advanced scientific research and industrial metrology.

Key Novel Spectrometry Companies:

The following are the leading companies in the novel spectrometry market. These companies collectively hold the largest market share and dictate industry trends.

- Rigaku Group

- Thermo Fisher Scientific

- PerkinElmer AES

- LightMachinery, Inc.

- Bruker Corporation

- Keit Industrial Analytics

- Agilent Technologies, Inc.

- SPECTRO Analytical Instruments GmbH

- DetectaChem

- Advion, Inc.

Recent Developments

-

In March 2025, At Pittcon 2025, BrightSpec launched the world’s first commercial Molecular Rotational Resonance (MRR) instruments in 50 years, introducing the BrightSpec-MRR product suite. This suite features three innovative models-spectraMRR, isoMRR, and nanoMRR-designed to enhance chemical analysis with superior molecular specificity and minimal sample preparation. These advancements aim to make high-precision spectroscopy more accessible for scientists, educators, and industry professionals across various fields.

-

In February 2025, Bruker Advances unveiled timsTOF Ultra 2, integrating the Athena Ion Processor (AIP) to improve protein group identification by up to 20% and peptide identification by 25%. The company also introduced DeutEx software for hydrogen-deuterium exchange analysis and OmniScape 2025b for advanced protein sequencing, alongside enhancements in ProteoScape and GlycoScape. These innovations provide deeper biological insights, accelerating advancements in molecular diagnostics and drug discovery.

-

In October 2024, MOBILion Systems introduced Parallel Accumulation with Mobility Aligned Fragmentation (PAMAF) technology, replacing traditional quadrupole filters with high-resolution ion mobility (HRIM) separation for enhanced mass spectrometry. This breakthrough improves fragmentation data quality with a tenfold increase in signal-to-noise ratios and a fivefold boost in processing speed. PAMAF technology enables superior detection of low-abundance biomolecules, driving progress in proteomics, lipidomics, and metabolomics research.

Novel Spectrometry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,262.0 million

Revenue forecast in 2030

USD 10,596.1 million

Growth rate

CAGR of 20.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Spectrometry type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Australia, Japan, India, South Korea, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Rigaku Group, Thermo Fisher Scientific, PerkinElmer AES, LightMachinery, Inc., Bruker Corporation, Keit Industrial Analytics, Agilent Technologies, Inc., SPECTRO Analytical Instruments GmbH, DetectaChem, Advion, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Novel Spectrometry Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the novel spectrometry market report based on spectrometry type, application, end use, and region:

-

Spectrometry Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Spectrometry (MS)

-

Optical Spectrometry

-

Nuclear Magnetic Resonance (NMR)

-

X-ray Spectrometry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Analytical Testing & Diagnostics

-

Quality Control & Assurance

-

Material Identification

-

Environmental Monitoring

-

Food Safety & Inspection

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare & Pharmaceuticals

-

Agriculture

-

Government & Academic Institutions

-

Chemical & Material Industries

-

Food & Beverage Industry

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global novel spectrometry market size was estimated at USD 3,486.0 million in 2024 and is expected to reach USD 4,262.0 million in 2025

b. The global novel spectrometry market is expected to grow at a compound annual growth rate of 20.0% from 2025 to 2030 to reach USD 10,596.1 million by 2030.

b. North America dominated the novel spectrometry market with a share of over 40% in 2024, driven by advancements in biotechnology, pharmaceuticals, and environmental monitoring. Increased funding for research institutions and the adoption of high-performance spectrometry in clinical diagnostics have accelerated market growth.

b. Some key players operating in the novel spectrometry market include Rigaku Group, Thermo Fisher Scientific, PerkinElmer AES, LightMachinery, Inc., Bruker Corporation, Keit Industrial Analytics, Agilent Technologies, Inc., SPECTRO Analytical Instruments GmbH, DetectaChem, Advion, Inc.

b. Key factors that are driving the market growth include rising demand for real-time and precise chemical analysis in pharmaceuticals, growing adoption in environmental monitoring for detecting pollutants, and increasing use in food safety testing to ensure quality and compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.