- Home

- »

- Green Building Materials

- »

-

North America Sodium Silicate Market Size, Industry Trend Report 2025GVR Report cover

![North America Sodium Silicate Market Size, Share & Trends Report]()

North America Sodium Silicate Market (2018 - 2025) Size, Share & Trends Analysis Report By Application (Detergent, Catalysts, Elastomers, Paper, Food, Healthcare), By Countries (U.S., Canada, Mexico), And Segment Forecasts

- Report ID: GVR-1-68038-596-0

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

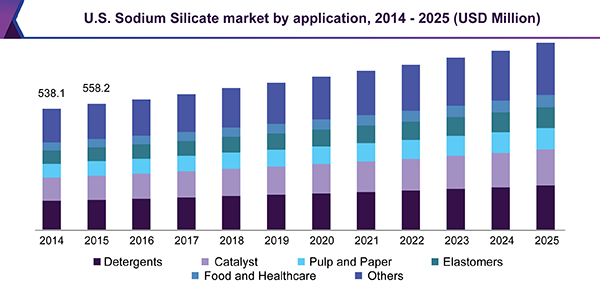

The North America sodium silicate market size was estimated at USD 730.7 million in 2016. Increasing demand for sodium silicate-derived products including precipitated zeolite, silica, and silica gel across various industries including detergents, rubber, food & beverages, paper, and pulp is expected to drive the industry growth.

The North America sodium silicate industry is highly competitive with the presence of key industry players which are integrated across the value chain. It reduces their dependency on raw material suppliers thus increasing their profit margins. Demand-supply gap due to higher production volumes of existing manufacturers such as PQ Corporation, OxyChem Corporation, and PPG Industries is expected to pose a threat to new players.

The U.S. dominated the product demand owing to the presence of several of oil refineries, pulp and paper industries and detergent manufacturing companies. The geographical advantage for the region regarding raw material availability is expected to have a positive impact on the industry in the U.S.

The presence of alternative chemicals such as sodium carbonate, trisodium phosphate which can be easily employed to manufacture sodium silicate derived products is likely to hamper industry growth over the projected period. In addition, the presence of low-cost substitute for silicate downstream product such as carbon black is expected to impact market growth.

Silicates are a key welding additive, and all both solid and liquid forms of the product are used in this application. Though the demand for sodium silicate in welding application is niche, it is expected to be an important application segment owing to rising demand for welding in consumer care, manufacturing and automotive industry.

The price of the sodium silicate is derived from the three key parameters including raw material cost, operational and transportation expenses associated with the product. Increasing raw material pricing coupled with rising industry rivalry in the region is likely to compel manufacturers to lower product cost, which is expected to hamper the profit margins for the industry players.

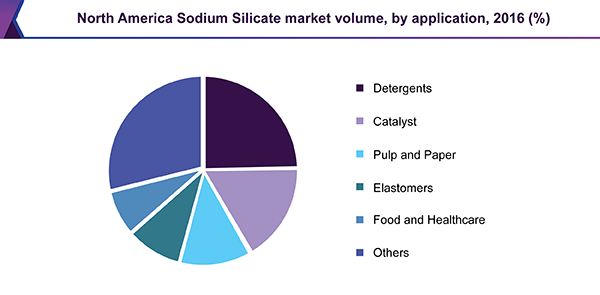

Application Insights

In North America, sodium silicate demand in detergents was valued over USD 180.7 million in 2016 and is likely to grow at a CAGR of 4.1% from 2017 to 2025. The product offers superior deflocculation, wetting and emulsification properties which improve the overall detergent performance. Increasing use of liquid detergents in the region owing to rising consumer concerns towards hygiene is expected to propel industry growth.

Elastomers is expected to grow at a CAGR of over 5.7% from 2017 to 2025, owing to high product penetration in tire manufacturing industry. Sodium silicate increases tear strength and tensile resistance of elastomers, thus improving the overall product performance. The aforementioned factors coupled with the growth of automotive industry in the region is expected to drive industry growth.

Zeolite, a downstream product of sodium silicate is the most preferred refinery catalyst and is accountable for over 30% of the refinery catalyst market. Growing demand for zeolites in various refinery processes including FCC, catalytic reforming, and hydrotreating is expected to drive demand.

The demand for the product in pulp and paper manufacturing is likely to grow at a CAGR of 3.1% from 2017 to 2025. The product is used for various applications in the paper manufacturing industry including bleaching, paper sizing and coatings, thus driving the industry growth over the projected period.

Country Insights

The U.S accounted for a significant share of sodium silicate production owing to the presence over 20 soluble silicate manufacturing plants in the region ensuring adequate production volume. The North America sodium silicate market benefitted from the increased penetration of the silica derivatives in various application industries including food, oral care, health care, and pulp and paper industry.

The U.S. is a hub for oil & gas operations, with the existence of over 140 refineries as of 2016. As a result, the product demand for catalyst manufacturing is expected to grow at a significant rate over the projected period. Furthermore, the presence of major pulp and paper manufacturing companies in the region including Georgia-Pacific and Mississippi River Pulp is expected to propel product demand over the projected period.

The product demand in detergents in Mexico was valued at USD 8.71 billion in 2016 and is likely witness growth of CAGR of 5.6% from 2017 to 2025. The Presence of major detergent manufacturing companies such as Unilever and P&G in the region is expected to drive growth.

Canada is world’s fifth largest producer of natural gas and sixth largest producer of oil. The increasing demand for the product in oil drilling activities for thinning of limestone and petroleum muds in the pipeline or bore well is expected to have a positive impact on the industry growth.

Key Companies & Market Share Insights

The manufacturers in the region had been historically served the domestic markets, however, with the enhancement in material handling and distribution process these producers are emerging as the global players. Opportunities for new product development with low cost is expected to compel manufacturers to invest more on innovations and R&D.

The manufacturers in the region are likely to focus on the niche application segments for the product including welding rods, mining, cement, water treatment and agriculture to strengthen their market presence. Furthermore, the manufacturers are expected to shift their focus to alternative bio-based raw materials such as rice husk in order to compete the rising prices associated with traditional raw materials.

North America Sodium Silicate Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 823.0 million

Revenue forecast in 2025

USD 1050 million

Growth Rate

CAGR of 4.1% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2015

Forecast period

2017 - 2025

Quantitative units

Revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S, Canada and Mexico

Key companies profiled

PQ Corporation, BASF SE, PPG Industries, W.R. Grace & Company, Huber Engineered Materials, and Occidental Petroleum Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America Sodium Silicate market on the basis of application, and countries:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Detergents

-

Catalyst

-

Pulp and Paper

-

Elastomers

-

Food and Healthcare

-

Others

-

-

Country Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America sodium silicate market size was estimated at USD 823.0 million in 2019 and is expected to reach USD 856.6 million in 2020.

b. The North America sodium silicate market is expected to grow at a compound annual growth rate of 4.1% from 2017 to 2025 to reach USD 1.05 million by 2025.

b. Detergents dominated the North America sodium silicate market with a share of 24.4% in 2019. This is attributable to superior deflocculation, wetting, and emulsification properties which improve the overall detergent performance.

b. Some key players operating in the North America sodium silicate market include PQ Corporation, BASF SE, PPG Industries, W.R. Grace & Company, Huber Engineered Materials, and Occidental Petroleum Corporation.

b. Key factors that are driving the market growth include increasing demand for sodium silicate derived products including precipitated zeolite, silica, and silica gel across various industries including detergents, rubber, food & beverages, paper and pulp.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.