- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Polyamide Market Size, Industry Report, 2035GVR Report cover

![North America Polyamide Market Size, Share & Trends Report]()

North America Polyamide Market (2025 - 2035) Size, Share & Trends Analysis Report By Product (Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamides), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-529-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Polyamide Market Trends

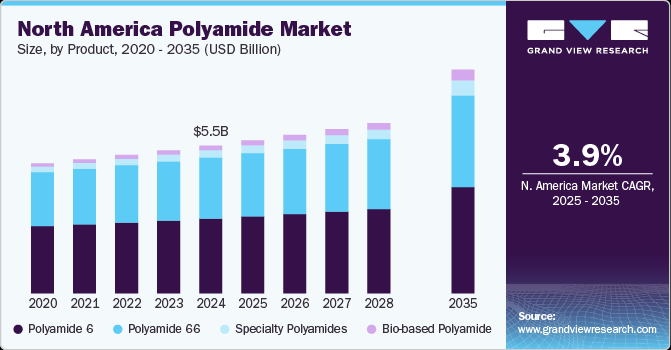

The North America polyamide market size was valued at USD 5.50 billion in 2024 and is expected to grow at a CAGR of 3.9% from 2025 to 2035. The North American polyamide industry is primarily driven by the increasing demand for high-performance materials in various industries, particularly automotive, textiles, and electronics.

The industry is experiencing significant growth due to the increasing demand from the automotive industry, particularly as manufacturers seek lightweight, high-performance materials to enhance vehicle efficiency. Polyamides are widely used in engine components, fuel systems, and structural parts due to their excellent mechanical strength, heat resistance, and chemical durability. As automakers focus on improving fuel efficiency and reducing vehicle weight to meet stringent emission standards, polyamide-based composites are replacing traditional metal components.

The textile industry is another significant driver for the polyamide market. North America's demand for high-quality fabrics used in activewear, outdoor gear, and fashion apparel continues to rise. Polyamide fibers are valued for their strength, elasticity, and resistance to wear and tear. The growth of sportswear brands and the increasing interest in athletic activities contribute to the demand for polyamide-based textiles, with companies such as Nike and Under Armour incorporating polyamide blends in their products for enhanced durability and comfort.

Technological advancements in polyamide production are also fueling market growth. The development of bio-based polyamides, produced from renewable sources such as castor oil, is gaining traction in North America as companies aim to meet sustainability goals and reduce reliance on petroleum-based feedstocks. Additionally, innovations in polyamide processing techniques, such as injection molding and extrusion, are expanding the material's application scope, offering improved performance and cost-efficiency for manufacturers in industries such as electronics and consumer goods. These technological improvements are key factors in driving the North American polyamide market forward.

Product Insights

The polyamide 6 product segment recorded the largest revenue share of 50.62% in 2024. Polyamide 6 is a widely used engineering polymer known for its excellent balance of mechanical properties, thermal stability, and ease of processing. It finds applications in automotive components, electrical and electronic goods, consumer appliances, and packaging due to its good impact resistance and abrasion resistance. Its versatility makes it a preferred choice for injection molding and extrusion processes, supporting a broad range of industrial applications.

The bio-based polyamide segment is projected to grow at the fastest CAGR of 7.7% during the forecast period. The adoption of bio-based polyamides is driven by increased environmental awareness and stringent regulatory frameworks aimed at reducing carbon footprints. Consumer demand for greener products and increased investments in renewable resource technologies are key factors boosting the segment growth. Moreover, governmental incentives and corporate sustainability initiatives further propel the shift toward bio-based alternatives in various applications.

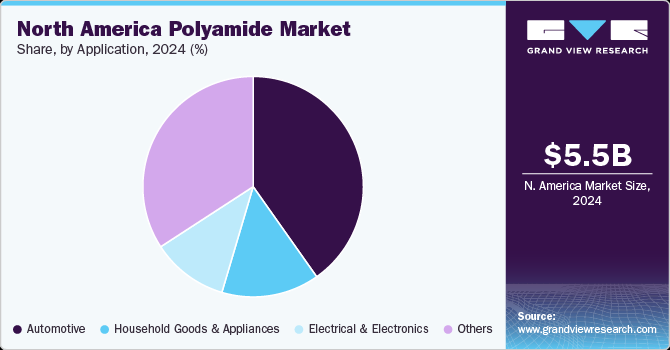

Application Insights

The automotive segment recorded the largest revenue share, over 40.0%, in 2024. Polyamides are widely used for manufacturing lightweight components such as engine covers, fuel system parts, and interior components. Their excellent mechanical properties, thermal resistance, and durability make them ideal for replacing heavier metals, thereby contributing to overall vehicle efficiency and performance. The shift toward fuel efficiency and reduced emissions is a key driving factor for the segment.

The household goods & appliances segment is projected to grow at the fastest CAGR of 5.2% during the forecast period. Polyamides are extensively used in household goods and appliances, including components for kitchen appliances, washing machines, and dryers. Their resistance to wear, chemicals, and high temperatures, combined with ease of molding and design flexibility, make them a preferred choice for durable, high-quality consumer products.

In the electrical and electronics segment, polyamides are utilized for components like circuit breakers, connectors, and housings, thanks to their excellent insulation properties, flame retardancy, and dimensional stability. Their ability to withstand high temperatures and provide reliable performance under stress makes them crucial in the rapidly evolving electronics industry.

Country Insights

U.S. Polyamide Market Trends

The U.S. polyamide market dominated the regional industry and accounted for the largest revenue share of over 54.50% in 2024. This is due to its extensive manufacturing base, particularly in the automotive and electronics industries, which creates a consistently high demand for polyamide resins and compounds. Additionally, the U.S. dominates the market through its advanced production capabilities and strategic supply chain management. The country's robust petrochemical industry provides ready access to key raw materials like adipic acid and hexamethylenediamine needed for polyamide production. This vertical integration gives U.S. manufacturers a competitive edge in pricing and supply reliability compared to other North American countries.

Canada Polyamide Market Trends

The polyamide market in Canada is experiencing robust growth, driven by the country's robust manufacturing sector, particularly in the automotive and aerospace industries, which create substantial demand for high-performance polyamide materials. Besides, its strategic focus on sustainability has accelerated polyamide adoption, with manufacturers increasingly utilizing bio-based and recycled polyamides to meet stringent environmental regulations.

Mexico Polyamide Market Trends

Mexico polyamide market is experiencing robust growth due to the growth in automotive production facilities. Major global OEMs are establishing operations to leverage Mexico's strategic location, lower labor costs, and favorable trade agreements. Moreover, the implementation of the United States-Mexico-Canada Agreement (USMCA) has further strengthened Mexico's position by creating more integrated supply chains across North America.

Key North America Polyamide Company Insights

The competitive environment of this market is characterized by the presence of key global players, regional manufacturers, and compounders competing based on product innovation, customization, and sustainability. Major companies dominate the market with strong R&D investments, advanced production technologies, and strategic partnerships with automotive, electronics, and consumer goods industries. The market is fragmented, with numerous small and medium-sized compounders catering to niche applications. Additionally, the increasing emphasis on bio-based and recycled polyamides is shaping the competitive landscape, as sustainability concerns push manufacturers toward eco-friendly alternatives.

-

In December 2024, Aurora Material Solutions acquired Lastique International Corporation. As part of this acquisition, Lastique was expected to integrate into Aurora's Sustainable Product Solutions platform. This move aligns with Aurora's strategic expansion and commitment to sustainable practices in the materials sector.

-

In February 2024, BASF and Inditex achieved a significant breakthrough in textile recycling with the development of loopamid, the first circular nylon 6 (polyamide 6) made entirely from textile waste. This innovation enables the recycling of post-industrial and post-consumer polyamide 6 textiles into virgin-quality synthetic fibers, promoting circularity in the fashion industry. Technology can process fabric mixtures, such as polyamide 6 and elastane, and allows materials to be recycled multiple times without losing their original properties.

Key North America Polyamide Companies:

- Amco Polymers

- Celanese Corporation

- BASF

- Asahi Kasei Plastics North America

- DOMO Engineering Plastics US, LLC

- Adell Plastics, Inc.

- Nylene

- Star Plastics, LLC

- Aurora Material Solutions

- Nytex

- Americhem

- Ultima Plastics

- Conventus Polymers LLC

- Polykemi

- Ingenia Polymers Corp.

- LEHVOSS NORTH AMERICA

- Wellman Advanced Materials

- Osterman North America

- Entec Polymers

- PolyVisions

North America Polyamide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.69 billion

Revenue forecast in 2035

USD 8.33 billion

Growth Rate

CAGR of 3.9% from 2025 to 2035

Historical data

2018 - 2024

Forecast period

2025 - 2035

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2035

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

States scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Amco Polymers; Celanese Corporation; BASF; Asahi Kasei Plastics North America; DOMO Engineering Plastics US, LLC; Adell Plastics, Inc.; Nylene; Star Plastics, LLC; Aurora Material Solutions; Nytex; Americhem; Ultima Plastics; Conventus Polymers LLC; Polykemi; Ingenia Polymers Corp.; LEHVOSS NORTH AMERICA; Wellman Advanced Materials; Osterman North America; Entec Polymers; PolyVisions

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Polyamide Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Grand View Research has segmented the North America polyamide market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Polyamide 6

-

Polyamide 66

-

Bio-based Polyamide

-

Specialty Polyamides

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Automotive

-

Engine covers

-

Battery modules (EVs)

-

Housing & Connectors

-

Instrumental Panels

-

Others

-

-

Electrical & Electronics

-

Cables & Connectors

-

Smartphone Casings

-

Laptop Frames

-

Enclosures

-

Others

-

-

Household Goods & Appliances

-

Gears

-

Hinges

-

Microwave Components

-

Others

-

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America polyamide market was estimated at around USD 5.50 billion in the year 2024 and is expected to reach around USD 5.69 billion in 2025.

b. The North America polyamide market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2035 to reach around USD 8.33 billion by 2035.

b. Automotive emerged as a dominating application with a value share of around 40.0% in the year 2024, owing to the increasing demand for lightweight, high-performance materials for fuel efficiency and electric vehicle components. The growing adoption of polyamide in engine parts, interior applications, and advanced safety systems further drives its dominance.

b. The key players in the North America polyamide market include Amco Polymers; Celanese Corporation; BASF; Asahi Kasei Plastics North America; DOMO Engineering Plastics US, LLC; Adell Plastics, Inc.; Nylene; Star Plastics, LLC; Aurora Material Solutions; Nytex; Americhem; Ultima Plastics; Conventus Polymers LLC; Polykemi; Ingenia Polymers Corp.; LEHVOSS NORTH AMERICA; Wellman Advanced Materials; Osterman North America; Entec Polymers; and PolyVisions

b. The North America polyamide market is driven by rising demand from the automotive and electrical & electronics industries due to its lightweight, high-strength, and heat-resistant properties. Additionally, increasing adoption in packaging and consumer goods, along with advancements in bio-based polyamides, further fuels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.