- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Linear Low-Density Polyethylene Market, 2030GVR Report cover

![North America Linear Low-Density Polyethylene Market Size, Share & Trends Report]()

North America Linear Low-Density Polyethylene Market (2025 - 2030) Size, Share & Trends Analysis By Product (Films, Liners), By Process (Injection Molding, Rotomolding), By End-use, By Layer, By Country And Segment Forecasts

- Report ID: GVR-4-68038-447-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

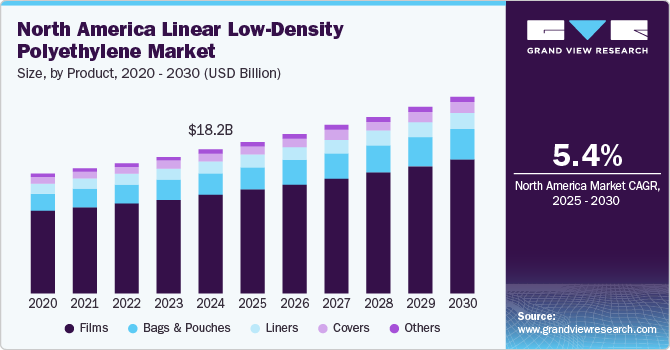

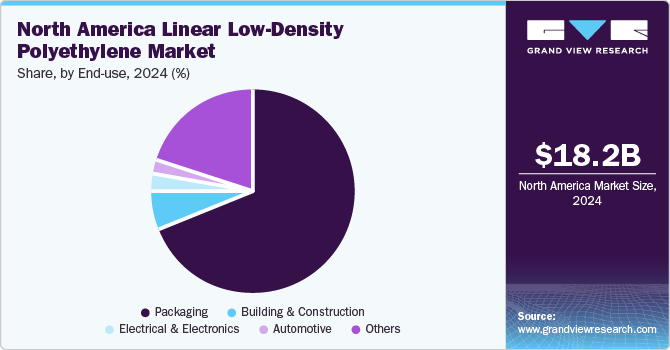

The North America linear low-density polyethylene market size was valued at USD 18.2 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2030. The region's robust demand from various end-use industries, including packaging, automotive, construction, and electrical and electronics, significantly contributes to market growth. The superior properties of LLDPE, such as high impact strength, puncture resistance, and flexibility, make it a preferred material for these applications. Additionally, the abundant availability of raw materials, such as ethylene and crude oil, supports the production of LLDPE in North America. The region's focus on sustainability and the development of advanced LLDPE grades with improved properties also drive market expansion.

North America is one of the prominent suppliers of polyethylene owing to the abundant availability of raw materials to manufacture ethylene and other derivatives. Linear Low-Density Polyethylene (LLDPE) is significantly consumed in applications such as liners, covers, packaging films, and other products. Consumption in these applications is anticipated to witness a significant rise owing to the properties of LLDPE, such as strength, durability, easy to handle, and inexpensive.

Ethylene and crude oil are among the key raw materials used to manufacture plastics. Ethylene and co-monomers such as butane, hexane, and octene are the main raw materials utilized in the production of LLDPE. Fluctuating raw material costs associated with plastics is expected to pose hindrances in terms of profitability. Major companies, such as BASF and Exxon Mobil, are actively investing in R&D to improve their production processes by adopting strategic initiatives in an attempt to reduce costs and improve efficiency.

Ethylene has witnessed a significant demand in North America with increased consumption in automobile and packaging applications. Moreover, the production cost is also relatively lower due to the region's high availability of low-carbon feedstock. Canada and Mexico are anticipated to witness an exponential rise in manufacturing activities, which is driven by economic growth, favorable credit landscape, and increased spending capacities. Plastics and the related raw materials, which are consumed in the manufacturing of tangible goods, are likely to gain traction in terms of demand in the coming years, thereby positively affecting plastics industry, including the LLDPE industry.

Product Insights

Films dominated the market with the largest revenue share of 68.6% in 2024. The growth of segment is driven by the extensive use of LLDPE films in various applications, such as packaging, agriculture, and industrial products. The superior properties of LLDPE films, including high tensile strength, flexibility, and puncture resistance, make them ideal for packaging materials like stretch wrap, shrink films, and grocery bags. Additionally, the growing demand for flexible packaging solutions in the food and beverage, pharmaceuticals, and consumer goods industries contributes to the high revenue share of LLDPE films. The agricultural sector also relies on LLDPE films for applications such as greenhouse covers and mulch films, further supporting their market dominance.

The covers segment is expected to grow at the fastest CAGR of 5.5% over the forecast period. Due to their excellent durability, flexibility, and resistance to environmental stress, covers made from LLDPE are widely used in agricultural applications, such as greenhouse covers, mulch films, and silage covers. The increasing demand for efficient agricultural practices and the need to enhance crop yield and protection contribute to the growth of this segment. Additionally, LLDPE covers are used in industrial applications, such as construction site coverings and equipment protection, where their strength and resistance to punctures and tears are highly valued. The rising emphasis on sustainable and cost-effective solutions in these sectors further supports the robust expansion of the covers segment in the North America LLDPE market.

Process Insights

Rotomoding dominated the market with the largest revenue share in 2024. The segment growth is driven by the unique advantages of the roto-molding process, which allows the production of large, hollow plastic products with uniform wall thickness and excellent durability. Industries such as automotive, construction, and consumer goods extensively utilize rotomolded products due to their lightweight nature, cost-effectiveness, and design flexibility. The ability to produce complex shapes and sizes with consistent quality makes rotomolding a preferred manufacturing method in these sectors.

Injection molding is expected to grow at the fastest CAGR over the forecast period. Injection molding is a versatile and efficient manufacturing process that allows the production of complex and high-precision plastic parts. The increasing demand for lightweight and durable components in industries such as automotive, healthcare, and consumer goods fuels the growth of this segment. Additionally, advancements in injection molding technology, such as the development of new LLDPE grades with enhanced properties, further support the expansion of this segment. The ability to produce high-quality products with reduced material waste and shorter production cycles makes injection molding an attractive option for manufacturers.

Layer Insights

Multilayer dominated the market with the largest revenue share in 2024. Multilayer films offer superior barrier properties, strength, and flexibility, making them ideal for packaging food, beverages, and pharmaceuticals. These films help preserve product freshness, extend shelf life, and protect against moisture and contaminants. The rising demand for high-performance packaging solutions that ensure product safety and quality drives the growth of the multilayer segment. Additionally, advancements in film extrusion technologies and the development of innovative multilayer structures further enhance the segment's market presence.

The mono layers segment is expected to grow at the fastest CAGR over the forecast period. Mono layer films are widely used in various applications due to their cost-effectiveness, ease of production, and versatility. These films are particularly popular in the packaging industry, where they are used for products like stretch wraps, shrink films, and grocery bags. The increasing demand for sustainable and lightweight packaging solutions that reduce material usage and environmental impact also supports the growth of the mono layers segment. Additionally, advancements in film extrusion technologies and the development of high-quality mono layer films with improved properties further enhance their appeal.

End-use Insights

Packaging dominated the market with the largest revenue share in 2024. This dominance is driven by the extensive use of LLDPE in various packaging applications due to its excellent mechanical properties, flexibility, and durability. LLDPE is widely used in the production of films, bags, and wraps, which are essential for packaging food, beverages, pharmaceuticals, and consumer goods. The increasing demand for flexible packaging solutions that enhance product shelf life and ensure safety further supports the growth of this segment. Additionally, the growing trend of e-commerce and online shopping drives the need for durable and reliable packaging materials, boosting the demand for LLDPE.

The building and construction segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for durable and lightweight construction materials that offer high-impact resistance and flexibility supports the expansion of this segment. LLDPE is widely used in applications such as roofing membranes, insulation, and piping systems due to its excellent properties. Additionally, the growing focus on sustainable construction practices and the development of eco-friendly LLDPE products further drive market growth. The construction industry's recovery and expansion in North America, coupled with the rising need for infrastructure development, contribute to the robust growth of the building and construction segment.

Country Insights

The U.S. linear low-density polyethylene industry dominated the North American Market with the largest revenue share of 88.9% in 2024. The U.S. has a well-established petrochemical industry and abundant availability of raw materials, such as ethylene and natural gas, which support the large-scale production of LLDPE. Additionally, the presence of major LLDPE manufacturers and advanced production facilities in the U.S. ensures a steady supply of high-quality LLDPE products. The extensive use of LLDPE in various end-use industries, including packaging, automotive, construction, and agriculture, further drives the demand. The growing focus on sustainability and the development of advanced LLDPE grades with enhanced properties also contribute to the market's strong presence in the U.S.

Mexico Linear Low-Density Polyethylene Market Trends

Mexico linear low-density polyethylene industry is expected to grow significantly over the forecast period owing to the increasing demand for LDPE in various end-use industries such as packaging, automotive, construction, and healthcare. The packaging industry is a major consumer of LDPE due to its properties such as flexibility, durability, and cost-effectiveness. Additionally, the growing focus on sustainable packaging solutions and the expansion of the automotive and construction sectors in Mexico contribute to the rising demand for LDPE.

Canada Linear Low-Density Polyethylene Market Trends

Canada linear low-density polyethylene industry is expected to witness the fastest CAGR of 4.5% over the forecast period. The increasing demand for LLDPE in various end-use industries, such as packaging, construction, and automotive, supports the expansion of the market. Additionally, the Canadian government's focus on sustainable development and the adoption of eco-friendly materials further drives the demand for LLDPE. The growing construction sector and the need for durable and flexible materials also contribute to the robust growth of the LLDPE industry in Canada.

Key North Ameirca Linear Low-Density Polyethylene Company Insights

Some key companies in the North America linear low-density polyethylene market include Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS MOLDS PVT. LTD, Dow, and others.

-

Exxon Mobil Corporation is a major player in the low-density polyethylene (LDPE) industry. The company’s LDPE resins are known for their high melt strength, excellent optical properties, and outstanding shrink performance. These resins are used in a variety of applications, including blown and cast film, extrusion and coating, and rotational and injection molding.

Key North America Linear Low-Density Polyethylene Companies:

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS MOLDS PVT. LTD

- Dow

- LyondellBasell Industries Holdings B.V.

- Westlake Corporation

- Chevron Phillips Chemical Company LLC.

- Arkema

- Borealis AG

- LOTTE Chemical Corporation

Recent Developments

-

In December 2024, ECI Group announced the launch of its Consultancy Services, targeting the polyolefins sector. The new division will deliver specialist consultancy, technology support, and plant optimization services to enhance clients' profitability, safety, and sustainability objectives.

North America Linear Low-Density Polyethylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.1 billion

Revenue forecast in 2030

USD 24.8 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, layer, end-use, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Exxon Mobil Corporation; Formosa Plastics Corporation; INEOS MOLDS PVT. LTD; Dow; LyondellBasell Industries Holdings B.V.; Westlake Corporation; Chevron Phillips Chemical Company LLC.; Arkema; Borealis AG; LOTTE Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Linear Low-Density Polyethylene Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America linear low-density polyethylene market report based on product, process, end-use, layer, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Films

-

Liners

-

Bags & Pouches

-

Covers

-

Others

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Rotomolding

-

Extrusion

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Pharmaceutical Packaging

-

Food & Beverage Packaging

-

-

Building & Construction

-

Automotive

-

Electrical & Electronics

-

Others

-

-

Layer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Monolayer

-

Multilayer

-

3 Layer

-

5 Layer

-

Others

-

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.