- Home

- »

- Communication Services

- »

-

North America Customer Experience Management Market, Report 2030GVR Report cover

![North America Customer Experience Management Market Size, Share & Trends Report]()

North America Customer Experience Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Analytical Tools, By Touch Point, By Deployment (Hosted, On-premise), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-914-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

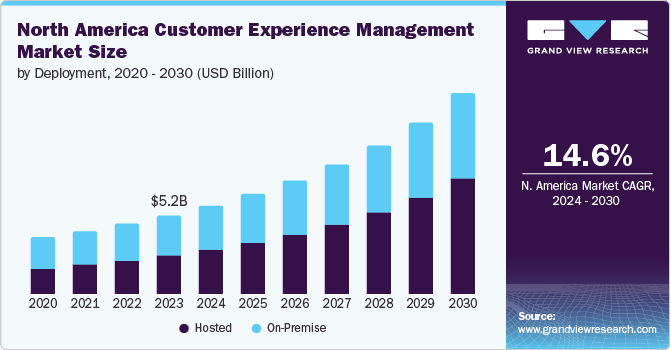

The North America customer experience management market size was valued at USD 5.20 billion in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. The digital transformation across industries has elevated customer expectations. With the proliferation of digital channels and platforms, customers have more ways to interact with brands and expect consistent, high-quality experiences across all touchpoints. This shift has made businesses need to actively manage and enhance the customer journey.

Additionally, the rise of data analytics and artificial intelligence (AI) has empowered companies to better understand customer behavior and preferences. Businesses can now gather and analyze vast amounts of customer data from various sources, enabling them to personalize interactions and tailor services to individual needs. This personalization is crucial as customers increasingly expect brands to understand and anticipate their needs. By leveraging customer experience management (CEM) tools and strategies, companies can foster stronger customer loyalty and drive repeat business, essential for long-term success.

Moreover, the competitive landscape has intensified, making customer experience a key differentiator. In many industries, products and services have become commoditized, leading companies to seek differentiation through exceptional customer experiences. A positive customer experience can significantly enhance brand reputation, customer retention, and word-of-mouth referrals. As a result, businesses are investing more in CEM to build lasting relationships with customers, reduce churn rates, and increase lifetime customer value.

Analytical Tools Insights

Text analytics held the largest market share of 38.8% in 2023. Businesses' increasing need to understand customer feedback and sentiments more comprehensively drives segment growth. As customers share their experiences through various channels like social media, emails, and reviews, the volume of unstructured text data has surged. Text analytics tools enable companies to process and analyze this data, uncovering insights into customer sentiments, preferences, and pain points. This capability allows businesses to enhance their customer service, personalize marketing efforts, and improve overall customer satisfaction, driving the adoption of text analytics in CEM strategies.

Speech analytics is expected to register the fastest CAGR of 17.2% over the forecast period. Speech analytics helps businesses better understand customer sentiments, requirements, and challenges. By examining call recordings, companies can pinpoint common topics and opportunities for enhancement. This allows them to customize their offerings to match customer requirements more effectively. Speech analytics assesses agent performance and pinpoint coaching and development opportunities. By analyzing call recordings, companies can pinpoint strengths and weaknesses in communication, product knowledge, and problem-solving skills. This information assists in assuring that agents are prepared to provide customer service.

Touch Point Insights

The call centers segment held the largest market revenue share in 2023. The growing complexity of products and services requires more personalized and immediate customer support, which call centers are well-equipped to provide. Customers value the ability to speak with a representative who can quickly resolve issues and provide detailed information, enhancing overall satisfaction. Additionally, integrating advanced technologies like AI and analytics in call centers has improved the efficiency and quality of customer interactions, making them a crucial touchpoint for managing customer experiences. This trend is also fueled by businesses' recognition that maintaining high-quality, responsive customer service is essential for building loyalty and retaining customers in a competitive market.

Web service segment is expected to grow at the fastest CAGR over the forecast period. The growing reliance on digital interactions between businesses and consumers drives the segment growth. As more customers seek convenience and efficiency, they increasingly engage with companies through online platforms, including websites, mobile apps, and social media. This shift has prompted businesses to enhance their digital presence and ensure a seamless, personalized experience across all web-based touchpoints. Gathering and analyzing customer data through these channels allows companies to understand consumer preferences and behaviors better, leading to more targeted and effective engagement strategies. Consequently, businesses are investing more in web services to optimize customer interactions, driving the demand in this segment.

Deployment Outlook

The on-premise segment held the largest market revenue share in 2023. On-premise solutions offer greater control over data, reducing the risk of breaches and ensuring compliance with stringent regulatory requirements. Additionally, businesses with complex IT infrastructures often prefer on-premise deployments for their ability to integrate seamlessly with existing systems. This control over customization and scalability, coupled with concerns over data sovereignty, makes on-premise solutions a preferred choice for many enterprises seeking to enhance their customer experience strategies.

Hosted segment is expected to grow at the fastest CAGR over the forecast period. Businesses are attracted to the lower initial investment and reduced maintenance costs associated with hosted services, which do not require significant upfront capital for hardware and infrastructure. Additionally, hosted solutions allow for easier integration with existing systems and provide the capability to quickly adapt to changing customer needs and market conditions. Accessing real-time data and analytics from any location supports more effective decision-making and personalized customer interactions.

Enterprise Size Insights

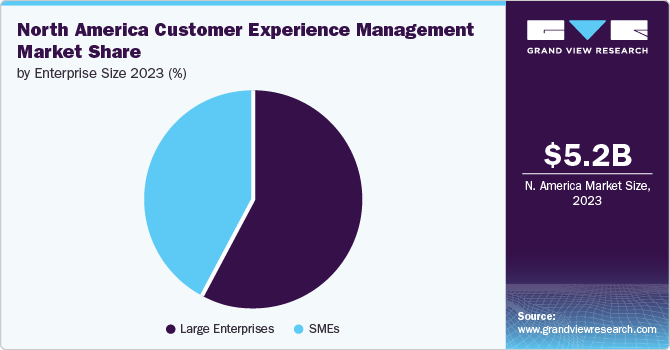

The large enterprise segment held the largest market revenue share in 2023. The complexity and scale of these businesses require comprehensive CEM systems that can integrate across various departments and channels, providing a unified view of customer data. Additionally, large enterprises face intense competition, driving the need for differentiated customer experiences to retain and attract customers. As such, they are investing heavily in advanced analytics, AI-driven insights, and personalized customer engagement strategies, all facilitated by robust CEM platforms. This trend is further bolstered by the increasing focus on digital transformation, where large enterprises seek to leverage cutting-edge technologies to enhance customer satisfaction and loyalty.

The SMEs segment is expected to grow at the fastest CAGR over the forecast period. SMEs are increasingly recognizing the importance of delivering distinctive customer experiences to differentiate themselves in a competitive market. They leverage digital tools and analytics to gain insights into customer behavior and preferences, which helps them tailor services and enhance customer satisfaction. Moreover, technological advancements have made sophisticated CEM solutions more accessible and affordable for SMEs.

End-use Insights

The retail segment held the largest market revenue share in 2023. The growing emphasis on personalized shopping experiences and the digital transformation of retail operations. Retailers increasingly leverage customer experience management technologies to gain insights into customer behavior, preferences, and feedback, enabling them to offer tailored services and promotions. Additionally, the rise of e-commerce and omnichannel shopping has heightened the need for consistent and seamless customer experiences across various platforms. As competition intensifies, retailers invest more in customer experience management to differentiate themselves, enhance customer loyalty, and drive sales growth.

The BFSI segment is projected to grow at the fastest CAGR of over the forecast period. As financial services become increasingly digital, customers expect seamless, personalized interactions across multiple channels. The BFSI sector leverages CEM to enhance customer satisfaction and loyalty by providing more tailored and efficient services. Additionally, regulatory requirements and the need for robust risk management make it crucial for financial institutions to understand better and respond to customer needs.

Key North America Customer Experience Management Company Insights

Some of the key companies in the market include Adobe Inc., Avaya Inc., Clarabridge, Freshworks Inc., Genesys and International Business Machines Corp. The key participants are undertaking strategic initiatives such as collaboration, partnerships, expansion, and product launches to gain competitive advantage in the market.

-

Adobe provides a collection of tools designed for managing customer experiences. It provides tools for generating customized content (AEM), analyzing consumer actions (Analytics), managing consumer information (Audience Manager), and automating marketing initiatives, all collaborating to provide unified and favorable customer experience across various touchpoints.

-

Avaya places focus on enhancing customer experience (CX) with their Avaya Experience Platform. This platform, based on cloud technology, combines contact center solutions with AI and automation to provide a seamless experience for customers. It offers customers with various channels to interact and provides agents with advanced tools and analysis, ultimately aiming to enhance customer satisfaction and business expansion.

Key North America Customer Experience Management Companies:

- Adobe Inc.

- Avaya Inc.

- Clarabridge

- Freshworks Inc.

- Genesys

- International Business Machines Corp.

- Medallia Inc.

- Open Text Corp.

- Oracle Corporation

- SAP SE

Recent Developments

-

In September 2023, Genesys collaborated with Salesforce to announce the launch of a unified AI-powered solution called CX Cloud, integrating Genesys Cloud CX and Salesforce Service Cloud. This new offering enhances customer experience and relationship management by enabling seamless data sharing and deeper customer insights. The collaboration aims to streamline customer journeys and enhance agent efficiency, focusing on comprehensive data utilization and employee empowerment.

North America Customer Experience Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.85 billion

Revenue forecast in 2030

USD 13.22 billion

Growth Rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Analytical tools, touch point, deployment, enterprise size, end-use, region

Key companies profiled

Adobe Inc.; Avaya Inc.; Clarabridge; Freshworks Inc.; Genesys; International Business Machines Corp; Medallia Inc.; Open Text Corp.; Oracle Corporation; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Customer Experience Management Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America customer experience market report based on analytical tools, touch point, deployment, enterprise size, end-use and region.

-

Analytical Tools Outlook (Revenue, USD Billion, 2018 - 2030)

-

EFM Software

-

Speech Analytics

-

Text Analytics

-

Web Analytics & Content Management

-

Others

-

-

Touch Point Outlook (Revenue, USD Million, 2018 - 2030)

-

Stores/Branches

-

Call Centers

-

Social Media Platform

-

Email

-

Mobile

-

Web Services

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Government, Energy & Utilities

-

Construction, Real Estate & Property Management

-

Service Business

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.