- Home

- »

- Advanced Interior Materials

- »

-

North America Ceiling Tiles Market, Industry Report, 2033GVR Report cover

![North America Ceiling Tiles Market Size, Share & Trends Report]()

North America Ceiling Tiles Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mineral Wool, Metal, Gypsum, Wood, Plastic), By End-use (Residential, Non-residential), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-995-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Ceiling Tiles Market Summary

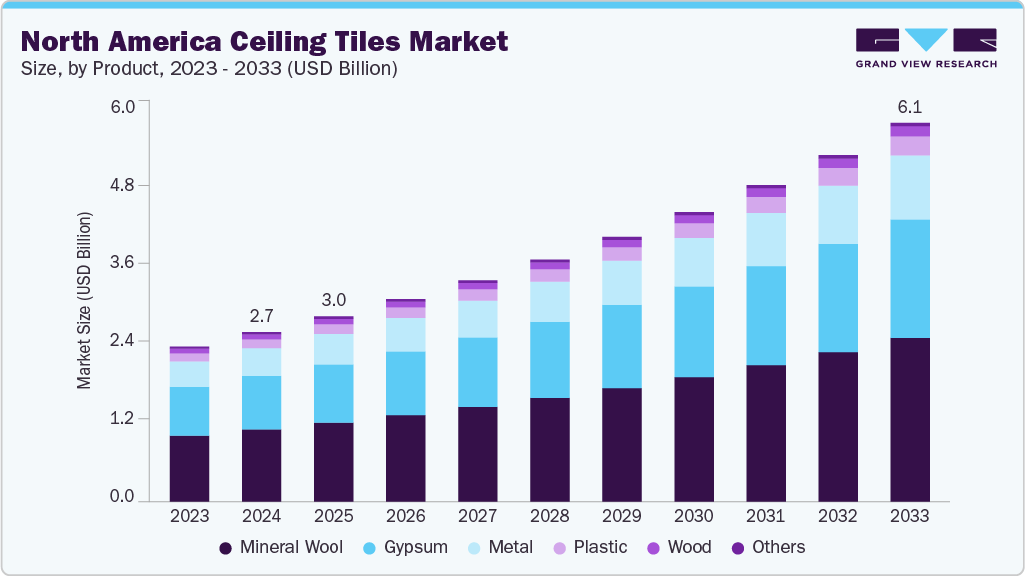

North America ceiling tiles market size was estimated at USD 2.74 billion in 2024 and is projected to reach USD 6.14 billion by 2033, growing at a CAGR of 9.4% from 2025 to 2033. The expansion of office buildings, healthcare facilities, educational institutions, and retail centers has led to increased demand for ceiling tiles that offer both functional and aesthetic benefits.

Key Market Trends & Insights

- U.S. dominated the North America ceiling tiles market with the largest revenue share of 82.75% in 2024.

- Based on product, the mineral wool segment dominated the market, accounting for a revenue share of 42.6% in 2024.

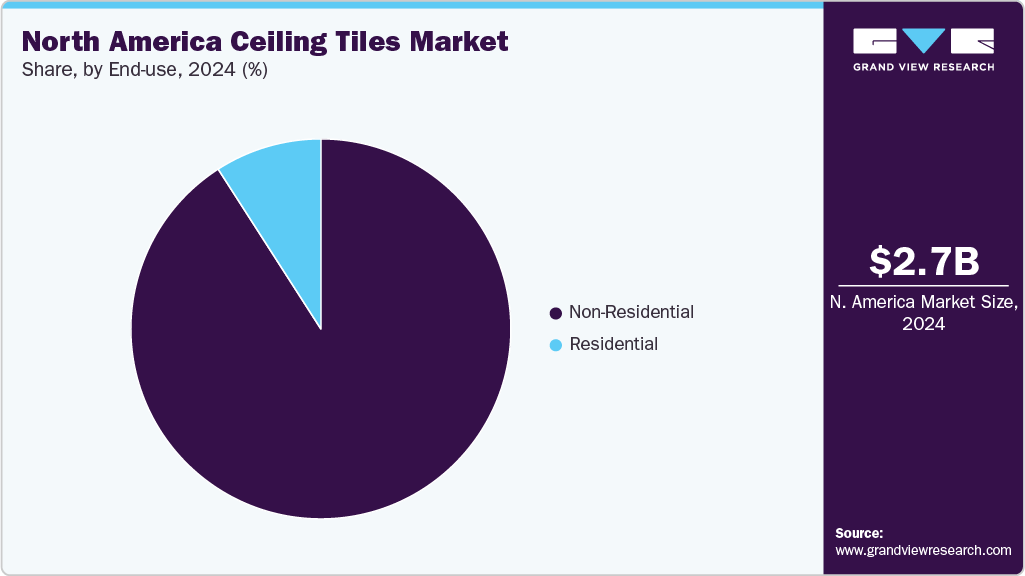

- Based on end-use, the non-residential segment held the largest revenue share of 91.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.74 Billion

- 2033 Projected Market Size: USD 6.14 Billion

- CAGR (2025-2033): 9.4%

These tiles are widely used for concealing structural components, improving indoor air quality, and meeting fire safety regulations. As public and private investments in non-residential construction continue to grow, the market benefits directly from the rising material requirements.Sustainability has also become a critical factor influencing the ceiling tiles market in North America. With the rise of environmentally conscious building practices, there is increasing demand for ceiling products made from recycled, low-emission, and bio-based materials. Regulatory frameworks and voluntary green building standards such as LEED (Leadership in Energy and Environmental Design) are encouraging developers to adopt eco-friendly materials. As a result, manufacturers are innovating their product lines to align with these sustainability goals, further strengthening market growth.

Technological innovation and evolving interior design preferences have also played a crucial role in expanding the market. Advanced manufacturing techniques now allow for the production of ceiling tiles with customizable textures, finishes, and integrated functionalities such as lighting and acoustic control. These developments have broadened the application scope of ceiling tiles beyond traditional settings, making them an integral part of modern architectural and interior design solutions. As buildings increasingly adopt multi-functional components, ceiling tiles with enhanced performance characteristics are witnessing growing demand.

Market Concentration & Characteristics

The North America ceiling tiles industry exhibits a moderate to high level of market concentration, with a few prominent players such as Armstrong World Industries, CertainTeed (Saint-Gobain) and USG Corporation accounting for a significant share of total production and distribution. The degree of innovation in the market is considerable, as manufacturers continually invest in developing ceiling systems with enhanced acoustic properties, fire resistance, moisture control, and design flexibility. Product differentiation is driven by material composition-ranging from mineral fiber to metal and gypsum-and by specialized features such as antimicrobial coatings and integrated lighting systems. Mergers and acquisitions are relatively common, enabling leading companies to expand their product portfolios, enhance geographic reach, and consolidate supply chain capabilities.

Regulations and building codes play a critical role in shaping product development and market dynamics, particularly in relation to fire safety, indoor air quality, and sustainability standards. Compliance with certifications such as LEED, GREENGUARD, and ASTM standards influences both product design and purchasing decisions. While substitute materials such as exposed ceilings or drywall alternatives exist, ceiling tiles remain preferred in commercial applications due to their performance benefits and design versatility. End use concentration is highest in sectors such as commercial real estate, education, and healthcare, where acoustic and environmental performance are essential. These institutional buyers often drive large-volume procurement, thereby influencing pricing strategies and product specifications across the market.

Product Insights

Based on product, the mineral wool segment dominated the market, accounting for a revenue share of 42.6% in 2024, driven by its superior acoustic and thermal insulation properties. Mineral wool ceiling tiles are widely adopted in commercial, educational, and healthcare settings where noise control, energy efficiency, and occupant comfort are essential. Their dense composition allows for effective sound absorption, making them ideal for spaces that require enhanced acoustic performance. As demand for noise mitigation in open-plan offices, classrooms, and hospitals continues to grow, mineral wool tiles have become a preferred solution among architects and facility managers.

The metal segment is anticipated to experience the fastest CAGR of 9.7% during the forecast period, driven by increasing demand for durable, low-maintenance, and aesthetically versatile ceiling solutions across commercial and institutional settings. Metal ceiling tiles, typically made from aluminum or steel, offer excellent resistance to moisture, mold, and fir, making them particularly suitable for environments such as hospitals, airports, and industrial facilities. Their long lifespan and structural stability reduce the need for frequent replacements, which appeals to facility managers seeking cost-effective and sustainable building materials.

End-use Insights

The non-residential segment held the largest revenue share of 91.0% in 2024, due to the ongoing expansion and modernization of commercial, institutional, and industrial buildings. Office spaces, healthcare facilities, educational institutions, airports, and retail centers rely heavily on ceiling tiles for their functional benefits, such as acoustics, fire resistance, and ease of maintenance. The increasing number of corporate buildings and co-working spaces, driven by urbanization and economic development, has fueled the demand for modular and aesthetically appealing ceiling solutions that support both employee comfort and regulatory compliance.

The residential segment is anticipated to experience the fastest CAGR of 9.5% during the forecast period, driven by the rising demand for enhanced interior aesthetics and functional home design solutions. Homeowners are opting for ceiling tiles not only for their decorative value but also for their ability to conceal structural elements such as ductwork, pipes, and wiring. As interior design trends evolve toward more refined and modern finishes, ceiling tiles made from materialssuch as PVC, gypsum, and metal are gaining popularity in living rooms, basements, and kitchens. This aesthetic appeal, coupled with the availability of customizable textures and patterns, is propelling demand within the residential sector.

Country Insights

U.S. Ceiling Tiles Market Trends

The U.S. ceiling tiles industry dominated the North America region with a revenue share of 82.75% in 2024, driven by large-scale commercial and institutional construction, particularly in sectors such as healthcare, education, and corporate offices. The growing emphasis on workplace acoustics, fire safety, and green building certifications like LEED is pushing demand for high-performance ceiling systems. In addition, the rise in renovation projects across aging public infrastructure and office interiors is contributing to sustained market activity. Technological innovation, including smart ceilings with integrated lighting and HVAC controls, further supports market expansion in urban and metropolitan areas.

The ceiling tiles industry in Canada is influenced by strict building regulations, energy efficiency standards, and a growing focus on sustainable construction practices. Developers are increasingly adopting ceiling tiles with thermal insulation and sound absorption properties to meet national building codes and environmental targets. The rise in mixed-use developments and urban revitalization projects in cities like Toronto and Vancouver is also boosting demand for modern and aesthetically versatile ceiling systems. Furthermore, the seasonal need for temperature and moisture control in residential and commercial buildings enhances the utility of ceiling tiles across diverse applications.

Mexico Ceiling Tiles Market Trends

The Mexican ceiling tiles industry is largely driven by rapid urbanization and growth in commercial real estate, including retail centers, hospitality, and office buildings. As more international companies invest in Mexico’s industrial and business infrastructure, demand for cost-effective and functional interior solutions is on the rise. Ceiling tiles are favored for their affordability, ease of installation, and ability to improve acoustics and aesthetics in modern commercial settings. In addition, increasing awareness of fire safety and interior comfort standards is leading to the gradual adoption of performance-based ceiling systems, especially in newly constructed buildings across urban centers.

Key North America Ceiling Tiles Company Insights

Some key companies involved in the North America market include Armstrong World Industries Inc., USG Corporation, CertainTeed (a subsidiary of Saint-Gobain), Rockfon (a part of ROCKWOOL Group), OWA Ceiling Systems Inc., Hunter Douglas, Gordon Incorporated, SAS International, and Ceilume. Companies are expanding their business to achieve a competitive edge in the marketplace. Major companies are implementing mergers and acquisitions and establishing alliances with other leading companies to achieve this goal.

-

Armstrong World Industries is a leading U.S.-based manufacturer specializing in ceiling and wall solutions. The company offers a wide range of mineral fiber and fiberglass ceiling tiles, metal ceiling systems, and acoustical panels designed for commercial and institutional applications. Its portfolio includes high-performance acoustic solutions like the "Ultima" and "Optima" series, as well as sustainable tiles aligned with LEED certification standards.

-

USG Corporation, headquartered in Illinois, is a major player in the building materials space, with a strong presence in ceiling tile manufacturing. The company’s product line includes acoustical ceiling panels, specialty ceilings, and grid systems under the "USG Ceilings" brand. USG is known for innovation in performance-based ceiling systems, including fire-resistant and sound-absorbing solutions.

Some emerging players in the North America ceiling tiles industry include:

-

CertainTeed, a North American subsidiary of global materials leader Saint-Gobain, offers a wide range of ceiling tiles for commercial and residential projects. The company’s product offerings include acoustical ceiling systems, gypsum ceilings, and suspension systems. CertainTeed emphasizes sustainability, offering low-VOC, recyclable materials under collections such as "Symphony" and "Ecophon."

-

Rockfon is a subsidiary of the ROCKWOOL Group and is recognized for its stone wool-based ceiling tiles, known for superior acoustics, fire resistance, and moisture performance. Its product lines, such as "Rockfon Sonar" and "Rockfon Artic" serve educational, healthcare, and office environments. The company emphasizes green building compliance and indoor air quality.

Key North America Ceiling Tiles Companies:

- Armstrong World Industries Inc.

- USG Corporation

- CertainTeed (Saint-Gobain)

- Rockfon (ROCKWOOL Group)

- OWA Ceiling Systems Inc.

- Hunter Douglas

- Gordon Incorporated

- SAS International

- Ceilume

Recent Developments

- In October 2024, Rockfon, a U.S.-based manufacturer, launched its Rockcycle program-an innovative ceiling tile take-back initiative aimed at promoting environmental sustainability. Through this program, customers can return used mineral wool ceiling tiles to Rockfon’s production facilities located in West Virginia and Mississippi. This initiative supports clients in meeting their sustainability goals by facilitating the responsible disposal and recycling of ceiling materials, thereby reducing construction waste and encouraging circular practices within the built environment.

North America Ceiling Tiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.0 billion

Revenue forecast in 2033

USD 6.14 billion

Growth Rate

CAGR of 9.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Armstrong World Industries Inc.; USG Corporation; CertainTeed (a subsidiary of Saint-Gobain); Rockfon (a part of ROCKWOOL Group); OWA Ceiling Systems Inc.; Hunter Douglas; Gordon Incorporated; SAS International; Ceilume

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Ceiling Tiles Market Report Segmentation

This report forecasts revenue & volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America ceiling tiles market report based on product, end-use, and country.

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Metal

-

Mineral Wool

-

Gypsum

-

Wood

-

Plastic

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-Residential

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.