- Home

- »

- Organic Chemicals

- »

-

Nitrous Oxide Market Size, Share And Growth Report, 2030GVR Report cover

![Nitrous Oxide Market Size, Share & Trends Report]()

Nitrous Oxide Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Automotive, Medical, Electronics, Food & Beverages, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-344-7

- Number of Report Pages: 77

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nitrous Oxide Market Summary

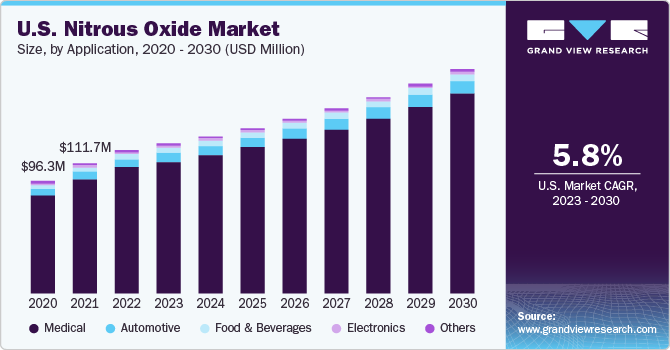

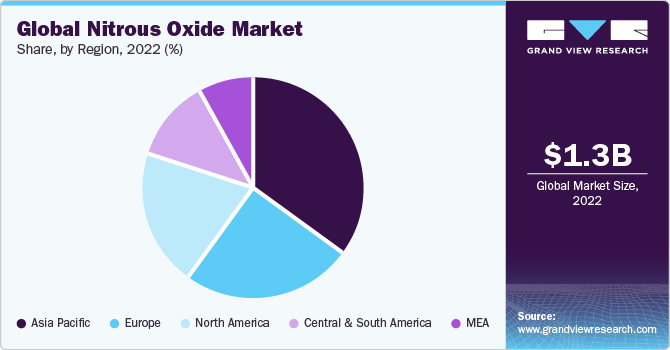

The global nitrous oxide market size was estimated at USD 1.3 billion in 2022 and is projected to reach USD 2.30 billion by 2030, growing at a CAGR of 7.9% from 2023 to 2030. Increasing application of nitrous oxide in various industries such as automotive, electronics, medical, and food & beverages is expected to be the key trend stimulating market growth.

Key Market Trends & Insights

- Asia Pacific dominated the global market and accounted for the largest revenue share of 35.0% in 2022.

- North America is expected to grow at a CAGR of 5.4% during the forecast period.

- Based on application, the medical segment held the largest revenue share of 87.6% in 2022.

- In terms of application, the automotive segment is expected to grow at a CAGR of 7.3% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 1.3 billion

- 2030 Projected Market Size: USD 2.30 billion

- CAGR (2023-2030): 7.9%

- Asia Pacific: Largest market in 2022

In addition, significant demand from Asia Pacific, owing to the high prevalence of chronic diseases and the widening base of the geriatric population in major countries such as China and India, is benefiting the overall market.

Nitrous oxide, commonly known as laughing gas, is a colorless and non-flammable gas with a slightly sweet smell, finding extensive applications in both medical and non-medical fields. In non-medical settings, it is utilized for activities such as racing cars, in the semiconductor industry, and during food processing. Within the medical industry, nitrous oxide serves as an analgesic and anesthetic, finding widespread use in surgical and dental procedures. When inhaled, it induces euphoric effects, making it attractive for recreational use as a dissociative anesthetic.

In the U.S., nitrous oxide is extensively used in the automotive, medical, and food & beverage sectors. Possession of nitrous oxide is legal in various states under federal law. However, the Food & Drug Administration regulates it under the Food Drug and Cosmetics Act, which prohibits the sale and distribution of human consumption.

The use of nitrous oxide in the medical sector has a minimal impact on the environment. Nitrous oxide accounts for 5% of the total greenhouse effects, with only 1% of nitrogen oxide released into the atmosphere coming from medicinal use. Medical nitrous oxide accounts for 0.05% of the total gas emissions affecting the environment globally.

However, stringent rules and regulations over the possession, transportation, and usage are posing a challenge to the growth of the market. The use of medical gases and their associated equipment are regulated by the Center for Drug Evaluation and Research and the U.S. Food and Drug Administration. These guidelines explain practices and procedures for compressed medical gas fillers, including home respiratory services. Manufacturers are obliged to comply with rules and guidelines laid down for the manufacturing and marketing of medical gases.

Application Insights

The medical segment held the largest revenue share of 87.6% in 2022. Nitrous oxide is extensively used in the medical sector as an anesthetic and analgesic agent in surgical and dentistry procedures. It is commonly used as a single agent for partial sedation in dentistry, mostly in pediatric dental applications. Increasing aging population across the world and the growing prevalence of dental problems are anticipated to contribute to the growth of the segment.

The automotive segment is expected to grow at a CAGR of 7.3% over the forecast period. In modern automobiles, nitrous oxide is used to significantly boost engine power by increasing the oxygen content of the fuel mixture, thus enabling the engine to burn more fuel. The majority of nitrous oxide systems are installed on trucks, motorcycles, snowmobiles, all-terrain vehicle, and cars. However, legislation pertaining to the use of nitrous oxide in road vehicles varies from country to country, even within Europe.

Regional Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of 35.0% in 2022. The Asia Pacific region includes a wide variety of countries with differing levels of economic development and healthcare infrastructure. Several factors contribute to the demand for nitrous oxide in this region. Notably, the growing population and increasing urbanization play a significant role, leading to a higher need for medical and dental procedures where nitrous oxide is commonly employed as an analgesic and anesthetic. Moreover, the expanding middle-class population with increased disposable incomes is driving the demand for various medical treatments and surgeries, thereby further propelling the consumption of nitrous oxide in the healthcare sector.

North America is expected to grow at a CAGR of 5.4% during the forecast period. The region is poised to offer huge opportunities over the forecast period. The increasing prevalence of chronic diseases such as cancer, type 2 diabetes, stroke, heart disease, obesity, and arthritis is supplementing the growth of the regional market. It is used as a carrier gas for producing powerful general anesthesia. Airgas, a key manufacturer, and supplier, has a strong reach in North America with production facilities in Pensacola and Maitland in Florida, Ontario, Canada, and Mississippi.

Key Companies & Market Share Insights

The market is highly competitive and fragmented in nature with the presence of several key players in the global arena. Consumption of nitrous oxide is highly affected by regulations related to nitrous oxide in various countries. They vary from country to country for various application sectors. It is not illegal to sell or possess nitrous oxide; however, there are several laws pertaining to distribution to minors and to recreational inhalation. Some prominent players in the global nitrous oxide market:

-

Praxair Technology, Inc.

-

Chart Industries, Inc.

-

Linde plc

-

MATHESON TRI-GAS, INC.

-

SOL GROUP

-

Merck KGaA

-

Air Liquide

-

Airgas, Inc.

-

Ellenbarrie Industrial Gases

Recent Developments

-

In July 2022, BPR Medical, a prominent expert in gas control, joined forces with Medclair, a Swedish specialist in safe nitrous oxide utilization. This collaboration led to the establishment of a strategic agreement aimed at achieving mutual goals. Within this framework, BPR secured exclusive distribution rights for Medclair's innovative mobile nitrous oxide conversion technology across the regions of the UK and Ireland. This partnership capitalizes on BPR's esteemed standing in the realm of inhaled analgesia items, enabling Medclair to not only benefit from BPR's reputation but also to play a supportive role for the NHS in fulfilling its environmental objectives.

-

In November 2022, Chart Industries, Inc. made a significant announcement regarding its plan to acquire Howden Group for a substantial sum of USD 4.4 billion. Howden Group, a reputable company headquartered in the UK, specializes in offering air and gas handling products and services. Their product line includes compressors, steam turbines, and various gas handling solutions. The acquisition agreement is anticipated to bring about a range of advantages for Chart Industries. These benefits encompass cost efficiencies, synergies in the commercial sphere, and increased business exposure in terms of service and repair capabilities.

Nitrous Oxide Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.34 billion

Revenue forecast in 2030

USD 2.30 billion

Growth Rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Praxair Technology, Inc.; Chart Industries, Inc.; Linde plc; MATHESON TRI-GAS, INC.; SOL GROUP; Merck KGaA; Air Liquide; Airgas, Inc.; Ellenbarrie Industrial Gases

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrous Oxide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nitrous oxide market report on the basis of application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Electronics

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nitrous oxide market size was estimated at USD 1.3 billion in 2022 and is expected to reach USD 1.34 billion in 2023.

b. The global nitrous oxide market is expected to grow at a compounded annual growth rate of 7.9% from 2023 to 2030 to reach USD 2.3 billion by 2030.

b. Asia Pacific dominated the nitrous oxide market with a share of 35% in 2022. This is attributable to the high prevalence of chronic diseases and widening base of the geriatric population in major countries such as China and India

b. Some key players operating in the nitrous oxide market include Praxair Technology, Inc.; Oxygen & Argon Works Ltd.; The Linde Group; Matheson Tri-Gas, Inc.; SOL Spa; Merck KGaA; Air Liquide; Airgas, Inc.; and Ellenbarrie Industrial Gases Ltd.

b. Key factors driving the nitrous oxide market growth include increasing demand from various industries such as automotive, electronics, medical, and food & beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.