- Home

- »

- Medical Devices

- »

-

Neuroscience Market Size, Share & Trends Report, 2030GVR Report cover

![Neuroscience Market Size, Share & Trends Report]()

Neuroscience Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Instruments, Consumables), By Technology (Neuro-Microscopy, Brain Imaging), By End-user (Hospitals, Diagnostic Laboratories), And Segment Forecasts

- Report ID: 978-1-68038-562-5

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neuroscience Market Summary

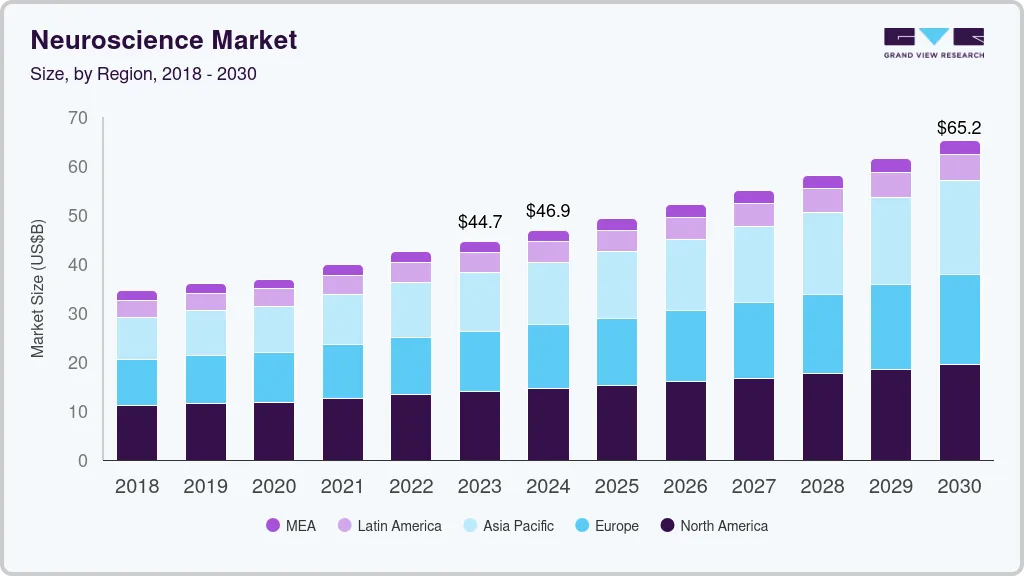

The global neuroscience market size was estimated at USD 44.65 billion in 2023 and is projected to reach USD 65.22 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. This can be attributed to the increasing prevalence of neurological diseases, such as Alzheimer’s, brain cancer, epilepsy, and traumatic brain injuries.

Key Market Trends & Insights

- North America accounted for the largest market share of 31.42% in 2022.

- Based on components, the instrument segment accounted for the largest share of 64.71% in 2022.

- Based on technology, the brain imaging segment accounted for the largest share of 25.19% in 2022.

- Based on end-user, the diagnostic laboratories segment accounted for the largest revenue share of 42.04% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 44.65 Billion

- 2030 Projected Market Size: USD 65.22 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2022

According to Alzheimer's Association, approximately 6 million American individuals suffer from Alzheimer's, which is anticipated to rise to 13 million by 2050. Furthermore, the progression of the neuroscience field has been driven by the emergence of advanced technological abilities, and the speed at which these R&D capabilities are being developed has accelerated significantly in recent years.

For instance, the U.S. launched the Brain Research through Advancing Innovative Neurotechnologies (BRAIN) program for research and development of novel investigational methods that will enhance the understanding of the brain. Such initiatives will channel the knowledge into innovative solutions for diagnosing and treating neurological patients. In addition, increasing healthcare digitalization improves the management of neurological disorders, which, in turn, is expected to propel the adoption of advanced neuroscience devices over the forecast period. For instance, in May 2023, Australian researchers Dr. Thomas Oxley and Nicholas Opie developed a human-brain-computer interface system that conveys data from the patient’s brain remotely to control external digital devices helping severely paralyzed patients in communicating using their thoughts.

Such inventions help open new opportunities in the neuroscience field. Moreover, the rising awareness among the global population about neurological disease diagnosis and their treatment options is expected to positively contribute to market growth. For instance, the American Academy of Neurology runs Neuroscience Is. initiatives to build public awareness about neurological disorders and demonstrate the importance of neuroscience research in treating neurology patients and developing a treatment for brain-associated diseases. The COVID-19 pandemic had a high impact on the market. Many neurological device manufacturing companies witnessed a decline in sales revenue during the COVID-19 pandemic. This was driven by declines in neurosurgery, partially offset by strength in neurovascular. In addition, strict regulations undertaken by the government, such as nationwide lockdowns and supply chain breakdown, led to a shortage of neurological devices and consumables globally.

Component Insights

Based on components, the market has been segmented into instruments, consumables, and software & services. The instrument segment accounted for the largest share of 64.71% in 2022. This can be attributed to the launch of new instrument devices for diagnosing and treating neurological disorders. In May 2023, Koninklijke Philips N.V. launched an AI-powered CT system, the Philips CT 3500, to perform routine radiology and high-volume screening programs. This device can deliver high-quality images required by radiologists to make precise diagnoses.

The consumables segment is also expected to witness significant growth during the forecast period. Key players, such as B. Braun SE and GE HealthCare, offer strong, durable, easy-to-handle consumables of neurological instruments. These consumables include ScalpFix Clips, Flat Table Tops, patient monitors, injectors, head holder inserts, cradle pads, and others. The development and introduction of new consumables further contribute to segment growth.

Technology Insights

Based on technology, the neuroscience industry has been segmented into brain imaging, neuro-microscopy, stereotaxic surgeries, neuro-proteomic analysis, neuro-cellular manipulation, and others. The brain imaging segment accounted for the largest share of 25.19% in 2022. This can be attributed to the increased use of brain imaging devices, such as MRI, EEG, and CT scans, in hospitals, diagnostic centers, and ambulatory surgical centers (ASCs) to diagnose neurological diseases. As per NHS England and NHS Improvement Report 2022, approximately 67,215 people were referred for brain MRI scans by physicians in March 2022 for diagnosing cancer.

Thus, the increasing adoption of brain imaging has spurred the demand for imaging devices in the coming years. The neuro-microscopy segment is also expected to witness significant growth during the forecast period owing to advancements in neuro-microscopy. In May 2023, Deblina Sarkar, a nanotechnologist and assistant professor at MIT, announced the development of ultra-tiny electronic microscopic miniature machines, which can enter the brain, and detect and reverse neurological disorders. Furthermore, the presence of key companies, such as Danaher Corporation and Carl Zeiss AG, and their wide neuro-microscopy offerings are projected to propel segment growth during the forecast period.

End-user Insights

Based on end-user, the market has been segmented into hospitals, diagnostic laboratories, and research & academic institutes. The diagnostic laboratories segment accounted for the largest revenue share of 42.04% in 2022. This can be attributed to the wide application scope of neurological devices in diagnostic laboratories and increased awareness among the population about early disease diagnosis benefits. According to Parkinson's Foundation, more than 90,000 people have been diagnosed with Parkinson’s disease each year. Some of the widely used neurological devices in diagnostic centers for diagnosis purposes are CT scans, MRIs, electroencephalograms (EEG), electromyograms (EMG), and others.

Thus, introducing safe, durable, and effective neurological devices is anticipated to drive the industry's growth. The hospital segment is expected to witness the fastest growth rate during the forecast period owing to the increasing hospitalization of patients with neurological disease conditions. According to the National Center for Biotechnology Information (NCBI), each year, 22.6 million people suffer from neurological injuries or disorders, of whom 13.8 million require surgical treatment. Thus, the increasing number of neurological hospital admissions boosts the demand for devices required for surgery, thereby driving segment growth.

Regional Insights

Based on region, North America accounted for the largest market share of 31.42% in 2022. This can be attributed to the strong presence of companies engaged in developing, manufacturing, and commercializing devices used for diagnosing and treating neurological patients in the region. For instance, in February 2022, CERENOVUS launched an advanced balloon guide catheter, EMBOGUARD, to be used in endovascular procedures, especially in patients with acute ischemic stroke. The Asia Pacific region is expected to witness the fastest growth during the forecast period.

This can be attributed to growing investments in healthcare logistic infrastructure, with high healthcare spending contributing to the growth of the neuroscience industry. In September 2022, the Government of China introduced its “China Brain Project (CBP)” with a starting investment of USD 746 million, intending to focus on areas of the neural basis of cognitive functions, brain-inspired computing, and diagnosing and treating brain disorders. Such initiatives from public bodies are anticipated to boost R&D in neuroscience, thereby driving market growth.

Key Companies & Market Share Insights

Strategic partnerships, major R&D investments, and the development of new products or product modifications are among the key strategies adopted by companies to gain a competitive edge in the market. In May 2023, the U.S. Food and Drug Administration (FDA) granted clearance to an artificial intelligence (AI) software, Neurophet AQUA, to improve the assessment of brain atrophy on the MRI. This launch will help physicians in providing the right treatment course to patients and improve brain monitoring. Some of the prominent players in the global neuroscience market include:

-

Carl Zeiss AG

-

Danaher Corporation

-

GE Healthcare

-

Siemens Healthcare Private Limited

-

Koninklijke Philips N.V.

-

Canon Inc.

-

B. Braun SE

-

Medtronic

-

Stryker

-

Boston Scientific Corporation

-

ABBOTT

-

Terumo Corporation

Neuroscience Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.91 billion

Revenue forecast in 2030

USD 65.22 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carl Zeiss AG; Danaher Corp.; GE Healthcare; Siemens Healthcare Private Limited; Koninklijke Philips N.V.; Canon Inc.; B. Braun SE; Medtronic; Stryker; Boston Scientific Corp.; ABBOTT; Terumo Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neuroscience Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the neuroscience market report on the basis of component, technology, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Software & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Brain Imaging

-

Neuro-Microscopy

-

Stereotaxic Surgeries

-

Neuro-Proteomic Analysis

-

Neuro-Cellular Manipulation

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic laboratories

-

Research and Academic Institute

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neuroscience market size was estimated at USD 42.5 billion in 2022 and is expected to reach USD 44.6 billion in 2023.

b. The global neuroscience market is expected to grow at a compound annual growth rate of 5.56% from 2023 to 2030 to reach USD 65.2 billion by 2030.

b. Brain imaging dominated the neuroscience market with a share of 25.1% in 2022. This is attributable to a substantial number of applications in neuroscience-based research wherein imaging techniques are employed.

b. Some key players operating in the neuroscience market include Carl Zeiss AG; Danaher Corporation; GE Healthcare ; Siemens Healthcare Private Limited; Koninklijke Philips N.V.; Canon Inc.; B. Braun SE; Medtronic; Stryker ; Boston Scientific Corporation ; ABBOTT; Terumo Corporation

b. Key factors that are driving the market growth include ongoing brain mapping research & investigation projects; neuroscience-based initiatives by government bodies; and technological advances in tools & algorithms that are implemented in neuroscience space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.