- Home

- »

- Next Generation Technologies

- »

-

Network Transformation Market Size, Industry Report, 2030GVR Report cover

![Network Transformation Market Size, Share & Trends Report]()

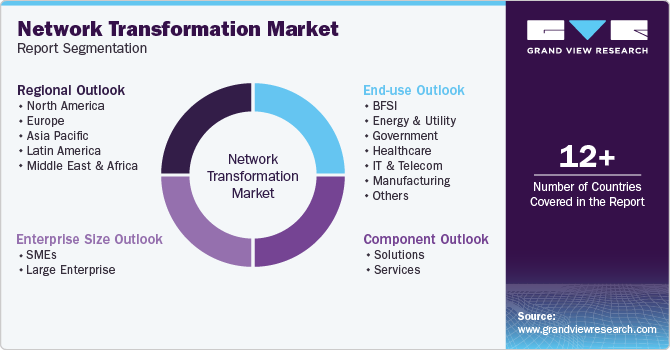

Network Transformation Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size (SMEs, Large Enterprises), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-576-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Network Transformation Market Summary

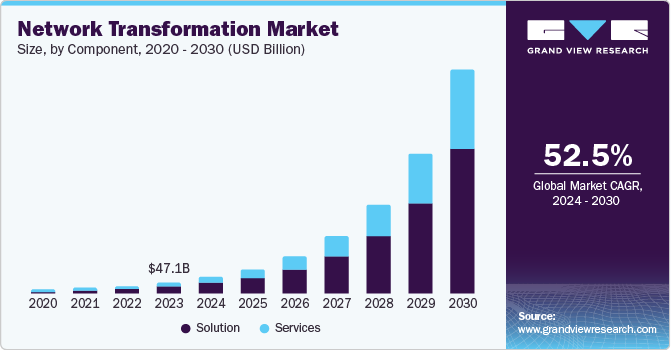

The global network transformation market size was valued at USD 47.06 billion in 2023 and is expected to reach USD 854.69 billion by 2030, growing at a CAGR of 52.5% from 2024 to 2030. The market is likely to witness traction, owing to the collaboration among market players to promote and develop next-generation networking solutions.

Key Market Trends & Insights

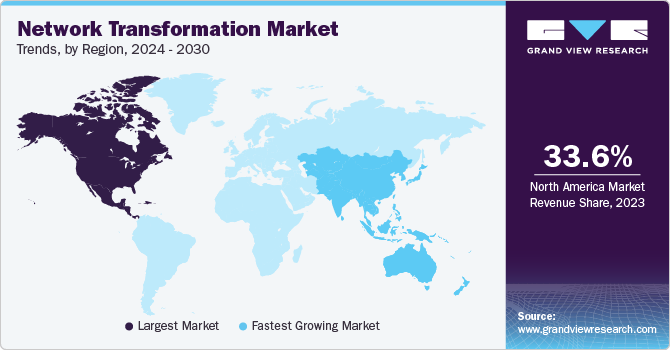

- North America dominated the global market and accounted for revenue share of 33.6% in 2023.

- By components, the solutions segment held the largest revenue share of the global market and accounted for 67.9% in 2023.

- By enterprise size, the large enterprises segment dominated the market in 2023.

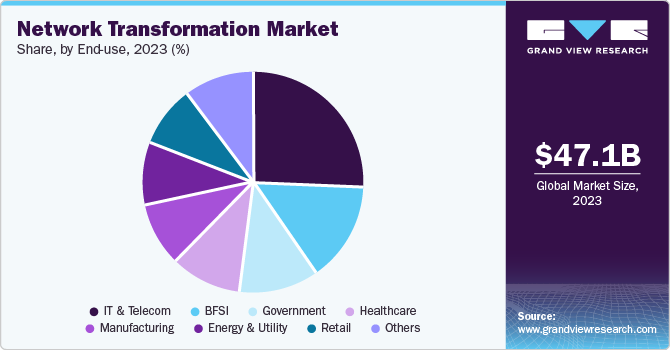

- By end-use, the IT & Telecom segment accounted for the largest revenue share of the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 47.06 Billion

- 2030 Projected Market Size: USD 854.69 Billion

- CAGR (2024-2030): 52.5%

- North American: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, the increasing adoption of IT as a Service (ITaaS), Bring Your Own Device (BYOD) policy, and network virtualization will contribute to the growth. Moreover, the increasing bandwidth requirement and the rising need to enhance present networking solutions are further anticipated to propel growth.The network transformation rebuilds the architecture based on data centre-centric Information and Communication Technology (ICT) infrastructure, where information is stored, managed, and exchanged. Business transactions and service processing are done in data centres. It offers a platform for businesses to modernize their infrastructure regarding information technology. It allows users to support a cloud-controlled environment and helps carry huge amounts of data in a more effective and cost-efficient manner than traditional processes. Such data transformation allows users to exchange information using small amounts of energy and provides faster data processing.

Furthermore, integrating advanced technologies such as machine learning, Artificial Intelligence (AI), and big data with network transformation solutions is expected to provide lucrative growth opportunities. The solution providers are concentrating more on current technological trends to enhance their software designs per client requirements. Several companies are investing in R&D activities to provide solutions that are easy to deploy, understand, and offer improved client efficiency. Furthermore, government initiatives to augment the implementation of digital technologies, internet connectivity, and mobile applications to lower manual efforts to enhance the productivity of organizations are likely to fuel market growth.

Network transformation solutions provide affluence when operating a communication network. It enables a telecom operator to decrease network complexity and reduce overall management costs. Cloud service providers, telecommunication service providers, and enterprises are the biggest beneficiaries of this. In the telecommunication sector, there is huge margin pressure on service providers, owing to the varying needs of consumers, such as usages of OTT services and data consumption. Conventional networks of service providers cannot handle this demand from consumers. Hence, they are reconfiguring their network with the help of network transformation solutions to manage the challenges of increasing the Average Revenue Per User (ARPU) and traffic explosion. All these factors contribute remarkably to market growth.

In addition, collaborations and partnerships among key companies in the technology and innovation industry are also contributing to the growth of the network transformation market. The collective R&D effort, joint product deployments, enhanced customer assistance, and combined expertise are expected to help multiple organizations and regions grow. For instance, in June 2024, Tencent Cloud, a cloud business entity of Tencent, an internet and technology organization, collaborated with Nokia, a major market participant in the technology, consumer electronics, and IT industry. The partnership aims to support businesses in Singapore and other parts of Asia Pacific during cloud and network infrastructure upgrades for the next step of digital transformation.

Component Insights

Based on components, the solutions segment held the largest revenue share of the global market and accounted for 67.9% in 2023. Growth of this segment is primarily influenced by factors such as enhanced control, scope for automation, ability to ensure data security and protection, and availability of SDN (software-defined networking) and NFV (Network functions virtualization) solutions. In addition, the rapid expansion of 5G networks has also had a significant influence on the growth of this segment. Increasing use of internet-powered devices by individuals and enterprises, unceasing growth in demand for high-speed network connections, and a rising number of industries adopting AI-driven solutions are expected to generate an upsurge in demand for this segment during the forecast period.

The services segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to multiple factors, including rising demand for professional services characterized by consulting, assistance in transformation and performance enhancement processes, increasing adoption of managed services driven by a lack of skilled professionals, and constraints related to resources to deploy full-fledged solutions. Long-term collaborations, growing partnerships, and demand for managed services from SMEs are projected to influence this segment's growth.

Enterprise Size Insights

The large enterprises segment dominated the network transformation market in 2023. This segment is mainly influenced by factors such as the availability of resources to deploy, capacity to accommodate changes such as transformations and automation, sophisticated existing infrastructures, presence of in-house experts and professionals, and increased need for network transformation to match the rapid changes in customer behavior and business cycles. Network transformation activities necessitate full-scale deployments requiring funds, teams, and infrastructural capabilities. Accessibility and availability of these aspects for large enterprises are expected to drive growth for this segment. For instance, Associated British Foods plc (ABF), one of the key large enterprises in the food & retail industry with highly diversified portfolios, selected AT&T to deploy and manage its network transformation with a target of accomplishing six business objectives. AT&T has deployed next-generation SDN-based transformation solutions within the ABF structure.

The SME segment is expected to experience the fastest CAGR during the forecast period. Growth of this segment is primarily driven by factors such as the increasing need for effective data protection and storage, the inability to prevent data breaches and theft with existing networks and legacy systems in some cases, the rising availability of services dedicated to SMEs, and more. The SMEs, with comparatively lesser funds at hand, are empowered by innovations and technological excellence provided by key IT industry companies, which offer affordable professional services.

End-use Insights

Based on end-use, the IT & Telecom segment accounted for the largest revenue share of the global market in 2023. This segment is primarily driven by the rapid changes in technologies utilized by businesses, the emergence of innovation-based technologies such as AI, machine learning, cloud computing, and the Internet of Things, rising infrastructural changes driven by 5G network expansions, and demands for high-performance broadband connections and effective IT solutions influenced by changing landscapes of multiple businesses. Multiple companies in the IT & telecom industry have initiated processes related to network transformation to ensure improved performance and enhanced business outcomes. For instance, in July 2024, Brightspeed, one of the key internet service providers in the U.S., was awarded multiple investments to ensure the availability of high-speed networks in various states, investing in next-generation network transformation solution provided by Ribbon Communications Operating Company, Inc. This process is expected to help Brightspeed in establishing deployment transparency for customers and regulatory bodies while ensuring replacement of decade-old legacy equipment.

The retail segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to multiple factors such as a modern mix of online and offline distribution managed through technology-based systems, increasing demand for cost reductions and operational efficiency enhancement, the emergence of technologies such as sensors, trackers, virtual payments, voice picking, and more. The growth in data collection, increased data-driven strategic decision making, rising dependency on data for strategy implementation and service delivery, involvement of data in customer experience, and customer retention have developed an alarming need for effective data storage, data protection and recovery, data management, and data security solutions.

Regional Insights

North America dominated the global network transformation market and accounted for revenue share of 33.6% in 2023. Growth of this market is primarily driven by the focus of multiple businesses in numerous industries to replace legacy networks and systems while accomplishing a reduction in operational costs and enhancements in productivity through the implementation of technology excellence strategies. Businesses in the region, such as IT & telecom, retail, banking, financial services, and others, continuously invest funds and resources in network transformation activities. Rapidly expanding 5G networks, changing processes and customer experiences in various industries, and rising demand for extra-ordinary data storage and data protection solutions are expected to generate an upsurge in demand for this market during the forecast period.

U.S. Network Transformation Market Trends

The U.S. network transformation market is mainly influenced by rapid changes in business processes associated with multiple industries. For instance, the retail industry, currently operating with a combined offline and online presence, majorly monitored through technology-driven systems, has been experiencing the emergence of new technologies, integration of advanced solutions driven by AI or the Internet of Things, increasing dependability on data and data protection, and major changes in customer preferences and behavior. This has developed requirements for digital transformation and intelligence upgrades for retail businesses. In the U.S., the network transformation market is expected to experience a rapid rate of growth owing to factors such as increasing demand for operational excellence, cost reduction, replacement of legacy systems, deployment of solutions powered by emerging technologies, the establishment of unified control network for large-scale businesses, and more.

Europe Network Transformation Market Trends

Europe was identified as one of the key regions for the network transformation market in 2023. This market is primarily driven by businesses' rising adoption of cloud computing technology to ensure remote monitoring and flexibility, the integration of modern technologies such as AI and machine learning with existing operational systems, and the rapid rate of digital transformations in the industry. The 5G deployments and growing demand for high bandwidth and low latency are also contributing to the growth of this market.

Germany network transformation market held significant revenue share of the regional industry in 2023. This market is primarily driven by the large investments by multiple companies and authorities in establishing and expanding 5G networks in the country. For instance, in January 2024, Nokia announced that it is conducting a four-year long project of European IPCEI (Important Projects of Common European Interest), which is funded by the company German Federal Ministry of Economics and Climate Protection (BMWK) and states of Baden-Württemberg and Bavaria. Nokia revealed its plan to invest nearly USD 400 million in software, hardware, and chip design through its sites in Ulm and Nuremberg. These developments are associated with future communications systems driven by 5G-advanced.

Asia Pacific Network Transformation Market Trends

Asia Pacific network transformation market is expected to experience the fastest CAGR from 2024 to 2030. This regional industry is mainly influenced by factors such as rising digital transformation activities in the region, growth of data-driven business processes in multiple industries leading to the need for effective data storage and data protection, the requirement for enhanced operational efficiencies, promotion of technology adoption by governments and rising use of cloud computing technology. Changes in the retail industry, telecom services businesses, customer experiences in different sectors, and the rapid rate of digital transformation are expected to generate growth for this market in the approaching years.

India network transformation market is projected to grow with a noteworthy CAGR during forecast period. Growth of this market is mainly driven by the unceasing demand for high-speed network connections and reliable networks, an unprecedented surge in the use of e-commerce websites and subscription-based on-demand video entertainment, and growing requirements of businesses with rising dependency on data storage and data protection.

Key Network Transformation Company Insights

Some of the key companies operating in network transformation market are NEC Corporation, Juniper Networks Inc., IBM, Fujitsu, Cisco Systems, Inc., Ciena and others, To address growing competition in the industry, the major market participants are adopting strategies such as innovation, collaborations with other organizations and governments worldwide, enhanced portfolios, and more.

-

NEC Corporation, one of the prominent organizations in the IT and network technology integration industry, offers multiple network-related solutions, including network planning, rollout, optimization, operation, energy efficiency, research and development, private networks, and consulting services.

-

Cisco Systems, Inc., a key company in the technology and innovation industry, offers a diverse portfolio of network transformation solutions driven by innovation in cloud technology, enhanced security features, and the adoption of modern technologies. It focuses on establishing secured connections among businesses, users, devices, and applications while ensuring flexibility and user-friendly experiences.

Key Network Transformation Companies:

The following are the leading companies in the network transformation market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- IBM

- Juniper Networks Inc.

- Fujitsu

- Cisco Systems, Inc.

- Dell

- Telefonaktiebolaget LM Ericsson

- Ciena Corporation

- Intel Corporation

- Hewlett Packard Enterprise Development LP

Recent Developments

- In February 2024, Huawei Technologies Co., Ltd., a major market participant in innovation and technology excellence, introduced a series of products and solutions for commercial and distribution market SMEs at MWC Barcelona 2024. Huawei presented 24 products and solutions and 12 eKit products designed and developed to assist SMEs in digital transformation activities and intelligence upgrades.

Network Transformation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.00 billion

Revenue forecast in 2030

USD 854.69 billion

Growth Rate

CAGR of 52.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

NEC Corporation; IBM; Juniper Networks Inc.; Fujitsu; Cisco Systems, Inc.; Dell; Telefonaktiebolaget LM Ericsson; Ciena Corporation; Intel Corporation; Hewlett Packard Enterprise Development LP

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Transformation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the network transformation market report based on component, enterprise size, end-use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Energy & Utility

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.